We look at the Canadian Dividend Aristocrats for 2023, what they are, who they are, and why they matter to dividend growth investors. See some of our favorite aristocrats and why we like them, and learn a 3-step process for finding and choosing stocks that are right for you.

What’s a Canadian Dividend Aristocrat?

It’s a Canadian company showing 5 consecutive years with a dividend increase. Aristocrats are solid companies with a robust balance sheet.

Why do they matter to you?

Dividend growers tend to outperform the market over a long period of time, and with less volatility. Dividend growers = more money, less stress. Investing in Canadian dividend growers should lead to recurrent investment income and help you achieve your retirement goals.

Can you invest in any Canadian Dividend Aristocrat and make money?

NO. This guide to Canadian Dividend Aristocrats not only provides you with a list of stocks, but also with a methodology to select the right companies for your portfolio. We also share what are our favorite Canadian aristocrats.

Canadian Aristocrats and U.S. Aristocrats

The Canadian Dividend Aristocrats list is the little brother of a much larger and world-known dividend growers list. The popular U.S. Dividend Aristocrats List includes companies with over 25 consecutive years of dividend increases. What about Canadians? Do we have companies showing 25+ years of consecutive dividend increases?

While Canada does have a few companies that achieved that feat, the Canadian Dividend Aristocrats list would be too short if we were to include them using the US requirement. Canadian aristocrats are companies that increased their dividends for at least 5 consecutive years.

While many investors might think 5 years is not enough to give such an elite title to a company, I tend to disagree. I love picking stocks that have just started increasing their dividends on their way to a great future. It’s a unique opportunity to select high-quality companies and still enjoy stock price appreciation going forward. We all wish we had bought shares of Coca-Cola (KO) 50 years ago when it was a young dividend grower. You have a similar opportunity with the Canadian dividend aristocrats.

Skip directly to the good stuff, download our Canadian Rock Stars list here:

What it Takes to Become a Canadian Dividend Aristocrat?

Unlike U.S. aristocrats, Canadian companies don’t have to show 25 years of consecutive dividend increases. In fact, even the 5 year minimum requirement isn’t as strict as you might think. The requirements Canadian companies must meet to earn the title are:

- The company’s common stock is listed on the Toronto Stock Exchange and is a constituent of the S&P BMI Canada. Stocks listed on the TSX venture, aren’t eligible.

- The company’s market capitalization (Float-adjusted) is at least $300M. We want companies of a minimal size. Yet $300M is quite permissive.

- The company increased its regular cash dividends for 5 consecutive years, but companies can pause their dividend growth policy for a maximum of 2 years within a said 5-year period. In other words; as long as the company intends to share the wealth, it has a good chance of being included among the elite dividend growers.

Needless to say, it’s easier to become a Canadian aristocrat than a U.S. aristocrat! To do that, U.S. companies must:

- Be a member of the S&P 500

- Show 25+ consecutive years of dividend increases

- Meet certain minimum size & liquidity requirements

It would be foolish to think that any aristocrats out of the list makes a good investment. On both sides of the border, we regularly see companies added or withdrawn for the list. The list you see in 2023 shows only those only who survived the test of time.

Canadian Dividend Aristocrats for 2023

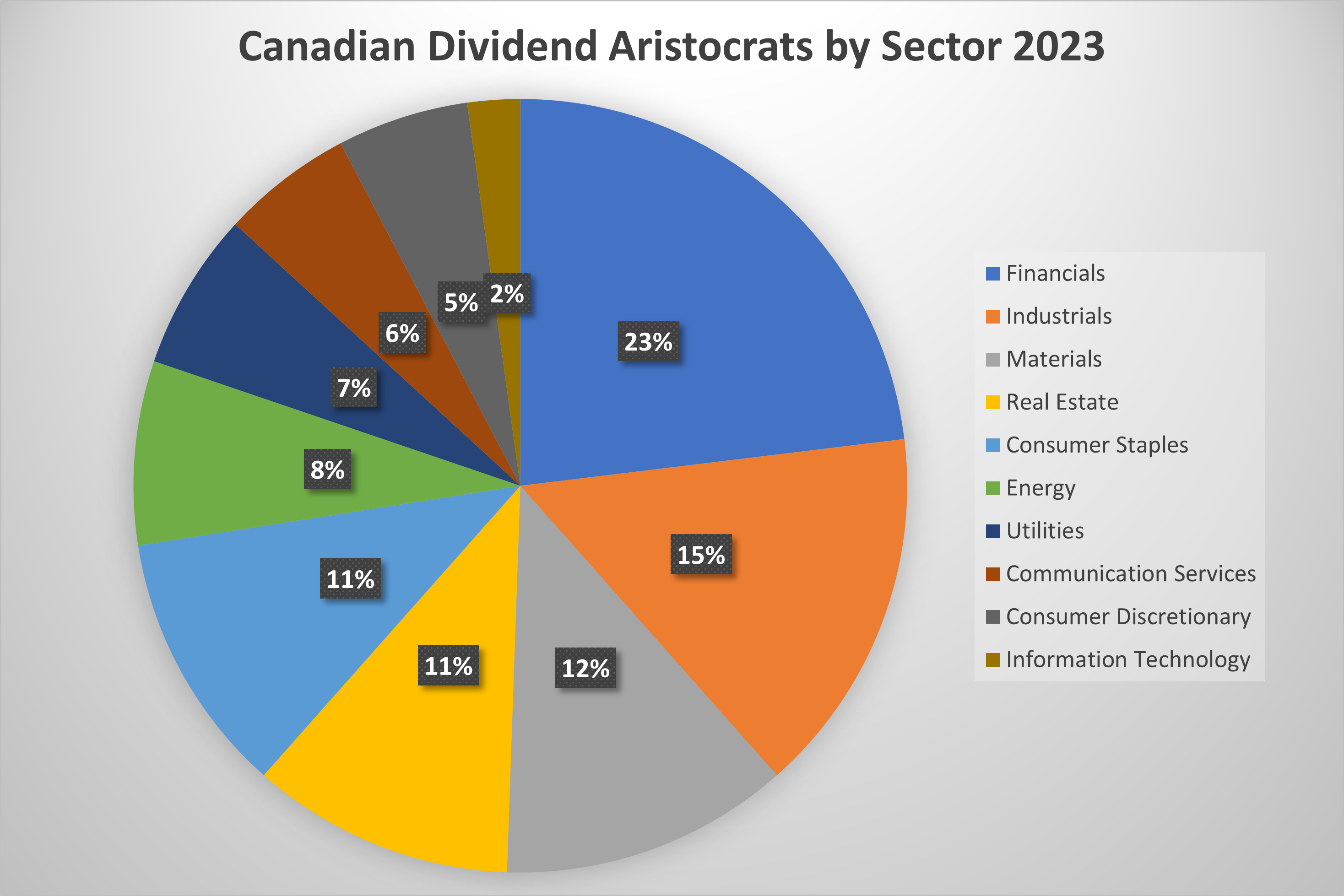

There are 91 Canadian dividend aristocrats in 2023. You’ll find very few Technology sector companies on the list as that sector is not known for steady cash payments to shareholders. What you will find, however, are many Financial Services companies along with some Industrials. Those two sectors have been and continue to be well-established dividend payers.

As you can see below, half the Canadian dividend aristocrats are in the Financials, Industrials, and Materials sectors and 22% are in the Real Estate and Consumer Staples sectors. Energy, Utilities, Communication Services and consumer discretionary sectors each represent 8% to 5% of aristocrats. There are none in healthcare.

Here are the Canadian dividend aristocrats as of 2023, grouped by sector.

Core Sectors

Financials

| Bank of Montreal (BMO.TO) | Industrial Alliance (IAG.TO) |

| Brookfield Asset Management (BAM.TO) | Intact Financial (IFC.TO) |

| Brookfield Corp (BN.TO) | Manulife (MFC.TO) |

| Canaccord Genuity Group (CF.TO) | National Bank (NA.TO) |

| Canadian Western Bank (CWB.TO) | Power Corporation (POW.TO) |

| CIBC (CM.TO) | Royal Bank (RY.TO) |

| Equitable Group (EQB.TO) | Scotia Bank (BNS.TO) |

| Fiera Capital Corp (FSZ.TO) | Sun Life Financial (SLF.TO) |

| First National Financial (FN.TO) | TD Bank (TD.TO) |

| goeasy (GSY.TO) | TMX Group (X.TO) |

| Great West Life (GWO.TO) |

Consumer staples

| Alimentation Couche-Tard (ATD.TO) | Maple Leaf Foods (MFI.TO) |

| Empire Co (EMP.A.TO) | Metro (MRU.TO) |

| George Weston (WN.TO) | Premium Brands (PBH.TO) |

| Jamieson Wellness (JWEL.TO) | Saputo (SAP.TO) |

| Loblaw (L.TO) | The North West Company (NWC.TO) |

Information technology

| Enghouse Systems (ENGH.TO) |

| Open Text Corporation (OTEX.TO) |

Growth Sectors

Industrials

| ADENTRA (ADEN.TO) | Finning Intl (FTT.TO) |

| Aecon Group (ARE.TO) | Savaria Corporation (SIS.TO) |

| Badger Daylighting (BDGI.TO) | Stantec (STN.TO) |

| Canadian National Railway (CNR.TO) | TFI International (TFII.TO) |

| Canadian Pacific Railway (CP.TO) | Thompson Reuters (TRI.TO) |

| Cargojet (CJT.TO) | Toromont Industries (TIH.TO) |

| Exchange Income Fund (EIF.TO) | Waste Connections (WCN.TO) |

Consumer discretionary

| Boyd Group Services (BYD.TO) | Magna International (MG.TO) |

| Canadian Tire Corporation (CTC.A.TO) | Restaurant Brands International (QSR.TO) |

| Dollarama Inc (DOL.TO) |

Income sectors

Real estate

| Allied Properties REIT (AP.UN.TO) | Granite REIT (GRT.UN.TO) |

| Canadian Apartment Properties REIT (CAR.UN.TO) | InterRent REIT (IIP.UN.TO) |

| Chartwell Retirement Residences (CSH.UN.TO) | Killam Apartment REIT (KMP.UN.TO) |

| CT REIT (CRT.UN.TO) | Minto Apartment REIT (MI.UN.TO) |

| FirstService Corp (FSV.TO) | SmartCentres REIT (SRU.UN.TO) |

Utilities

| Atco (ACO.X.TO) | Emera (EMA.TO) |

| Canadian Utilities (CU.TO) | Fortis (FTS.TO) |

| Capital Power Corporation (CPX.TO) | Hydro One (H.TO) |

Communications services

| BCE (BCE.TO) | Quebecor (QBR.B.TO) |

| Cogeco (CGO.TO) | Telus (T.TO) |

| Cogeco Cable (CCA.TO) |

Volatile Sectors

Materials

| Agnico Eagle Mines (AEM.TO) | Pan American Silver Corp (PAAS.TO) |

| Altius Minerals (ALS.TO) | Stella-Jones (SJ.TO) |

| Barrick Gold (ABX.TO) | Transcontinental (TCL.A.TO) |

| CCL Industries (CCL.B.TO) | West Fraser Timber (WFG.TO) |

| Franco-Nevada Corp (FNV.TO) | Wheaton Precious Metals Corp (WPM.TO) |

| Nutrien (NTR.TO) |

Energy

| Canadian Natural Resources (CNQ.TO) | Pembina Pipeline (PPL.TO) |

| Enbridge (ENB.TO) | TC Energy (TRP.TO) |

| Imperial Oil (IMO.TO) | Tourmaline Oil (TOU.TO) |

| Parkland Corporation (PKI.TO) |

They made it through the pandemic without cutting their dividend and they are among the best Canadian dividend stocks. However, this list can and probably will change as higher interest rates and a possible recession are changing the economic landscape, and as new dividend payers reach the 5-year milestone and other requirements. A very useful list to find great stocks.

Even Better than an Aristocrat?

At DSR, we go further with our Canadian Rock Stars list, which we update and publish monthly. That’s an even stronger list than the Canadian Dividend Aristocraft list because we look beyond dividend growth. It is based on the combination of three metrics that make what I call the Dividend Triangle (more on that later). In a nutshell, to be on the Rock Stars list, companies must show not only dividend growth, but also revenue and EPS growth over 5 years. Growing revenue and profits fuel future dividend increases.

Many of the aristocrats are on the Rock Star list, but not all. Also, the list includes many additional metrics and filters to help you narrow down your search.

Download the Canadian Rock Stars list, we update it monthly!

3 Steps to Select the Right Stocks for Your Portfolio

As previously mentioned, going “all-in” with Canadian aristocrats may not make your portfolio any better. After reviewing the Canadian Dividend Aristocrat list and the Rock Stars list, follow these steps to ensure you pick only the best stocks possible.

#1 Focus on the sector(s) you need

Whenever you isolate certain metrics, you notice most companies in some sectors to be generally strong, but not in other sectors. This is because each sector thrives or faces tailwinds at different times. The timing of your research determines which sectors offer the best opportunities. Sadly, you can’t buy all your stocks from the same sector.

I’d rather buy the best of breed for each sector than buy 4 stocks from the same industry. Why? Because it helps my diversification and smooths out my total returns over time. For example, having many tech stocks in my portfolio in March 2020 protected me to some extent from the crash. Tech, utilities and consumer defensive stocks held the fort while my financials, industrials and consumer cyclicals were getting killed. Even more importantly, that diversification helped my portfolio bounce back relatively quickly.

#2 Start with the dividend triangle

If you’ve been following me for a while, you know I’m a big fan of the Dividend Triangle. This simple focus on three metrics reduces your research time and helps you find companies with more robust financials. I start all my searches with a look at companies showing strong revenue growth, earnings growth and dividend growth over the past 5 years.

First, download the Canadian Rock Star list. Then, with a few simple clicks, set the filters you want and start hunting for the best stocks for you.

By selecting only companies that show strong numbers in the Rev 5yr Growth, EPS 5yr Growth and Div 5yr Growth columns, you’ll find those companies with a positive and strong dividend triangle.

This methodology covers all “regular companies”, but not REITs and other businesses for which earning per share (EPS) is misleading and that use non-conventional metrics instead of EPS.

#3 Prioritise dividend growth, not yield

You’ve narrowed down the number of stocks. It’s time to trim it even further. Over the years, I found most of my best stock picks amongst the strongest dividend growers. When you think about it, it totally makes sense. Such companies must earn increasing cash flows and show several growth vectors to be confident enough to increase their dividend by 5%+ year after year.

Past dividend growth is a result of several good metrics simultaneously: usually stronger revenue, consistent earnings growth, increasing cash flow, and debt that is under control. A strong dividend grower likely comes with other robust metrics. For details about other metrics I used for selecting stocks, see stock buy checklist.

While not all my holdings show such strong dividend growth, I always look for the strongest dividend growers when I want to add a new stock to my portfolio.

Using this simple 3-step methodology narrows down your search to a few stocks per sector. It’s then easier to make your final selections and your portfolio will likely perform better over the long run.

See also Building an Income Portfolio – Made Easy.

How to Calculate a Fair Value

Valuation does play a major role in the buying process, but it shouldn’t be the single factor that determines whether you buy a stock. It’s one factor among many. To be honest, I would rather buy an “overvalued stock” with a strong dividend triangle, great growth vectors and lots of potential for the next 10 years than buying an “undervalued stock” that has nothing else but a good yield and a poor valuation.

When I find a company I really like, but the valuation seems ridiculous, I put it on a watch list that I keep on the side and wait. When I’m done with one of my current holdings (e.g. the company doesn’t meet my investment thesis anymore), I take out watch list and check if valuations have changed. Once again, I’ll pick any “Alimentation Couche-Tard” (overvalued, strong growth) over any “Suncor” (undervalued, modest growth) of this world.

At DSR, we focus on two methodologies to determine a stock’s valuation.

PE Ratio

The first thing we do consider the past 10 years of price-earnings (PE) ratios. This tells you how the stock is valued by the market over a full economic cycle. You can then determine if the company shares enjoyed PE expansion (price grows faster than earnings) or if the company has a similar ratio year after year.

Dividend Discount Model

When you look at stocks offering a yield of over 3% with a stable business model, the dividend discount model (DDM) can be of great use. Keep in mind the DDM gives you the value of a stock based solely on the company’s ability to pay (and grow) dividends. Therefore, you will find strange valuations when you look at fast-growing companies with low yields (e.g. Alimentation Couche-Tard!). Find out more about the DDM model and its limitations here.

While the idea of receiving dividends each month is appealing, it’s not what makes dividend growth investing magical. It’s the combination of capital growth and dividend growth, called total return, that truly generates the magic in your portfolio.

Our Rock Stars list included additional metrics such as PE ratio and DDM valuation, payout ratio, and more. You can download it here.

Favorite Canadian Dividend Aristocrats 2023

Searching through almost 100 stocks could become tiresome. Using the DSR investing methodology, I’ve selected my favorite Canadian aristocrats, who also happen to be DSR Canadian Rock Stars.

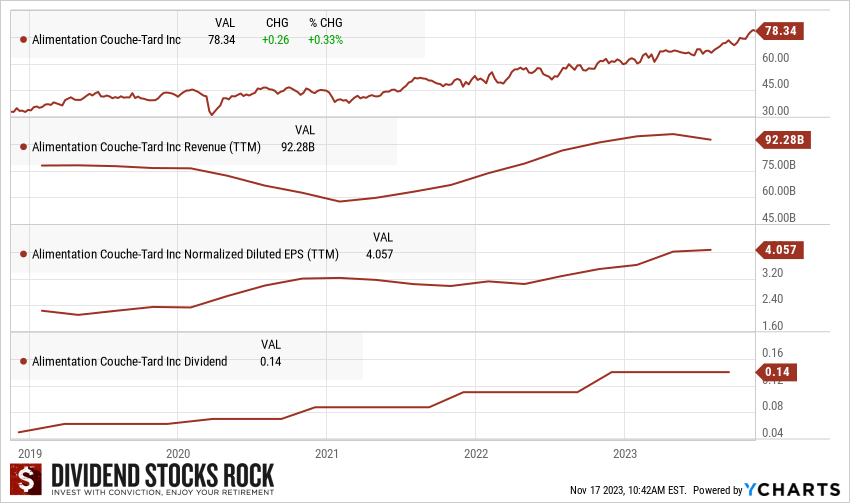

Alimentation Couche-Tard (ATD.TO)

Business Outlook

In the long-term, dividend payouts should grow in the double digits, and investors should see strong stock price growth. ATD’s potential is directly linked to its capacity to acquire and integrate additional convenience stores. Management has proven its ability to pay the right price and generate synergies for each acquisition. ATD exhibits a solid combination of the dividend triangle: revenue, EPS, and strong dividend growth. The company counts on multiple organic growth vectors such as Fresh Food Fast, pricing & promotion, assortment, cost optimization, and network development.

In 2023, ATD also confirmed the acquisition of 2,193 stores from TotalEnergies for €3.1B (100% of retail assets in Germany and the Netherlands as well as a 60% controlling interest in the Belgium and Luxembourg entities). This will significantly expand its exposure to the European market and grow its total number of stores to surpass 16,000 across the world.

The mediocre 0.90% dividend yield is so low that ATD shouldn’t even be considered a dividend grower. However, the dividend payout has surged in the past 5 years (+211%) and the stock price jumped by over 90% (taking into account the stock price drop in early 2020). The only reason the dividend yield is so low is that ATD is on a fast track to growth. ATD will continue steadily increasing its payout while providing stock value appreciation to shareholders.

Potential Risks

Growers by acquisition are all vulnerable to occasionally making a bad purchase. While ATD’s method of acquiring and integrating more convenience stores has proven successful, it is important for them to not grow too fast or become too eager, leading them to possibly overpay in the name of growth. The company acted in this way when they tried to acquire French grocery store Carrefour. Still, we don’t think the next acquisition should be a source of concern with the current management team. ATD announced its firm offer to acquire more than 2,000 retail stores from TotalEnergies for €3.1B. This will be interesting to see how the deal goes. Investors are also worried about the potential impact of electric vehicles on fuel sales, but we believe ATD will overcome this challenge by installing superchargers.

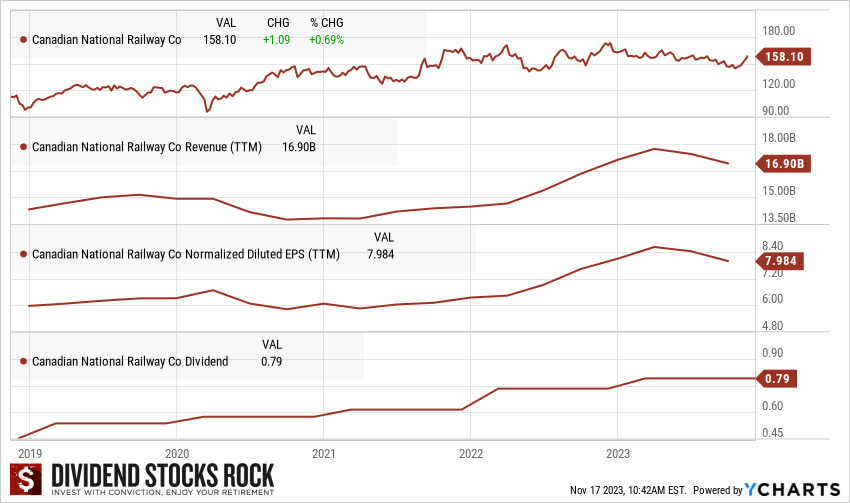

Canadian National Railway (CNR.TO)

Business Outlook

CNR has been known for being the “best-in-class” for operating ratios for many years. CNR has continuously worked on improving its margins and was among the first to do so. Today, peers have caught up and all railroads are managed in the same way. CNR also owns unmatched quality railroad assets. It has a very strong economic moat as railways are virtually impossible to replicate, so we can therefore count on increasing cash flows each year. Plus, there isn’t any more efficient way to transport commodities than by train. The good thing about CNR is that an investor can always wait for a down cycle to make an investment. We can often spot a good occasion around the corner since we see railroads as attractive investments. Finally, the cancellation of the Keystone XL pipeline should drive demand for oil transport via railroads and CNR will benefit. Management is being challenged and we should see more growth emerging from this challenging period.

CNR has successfully increased its dividend yearly since 1996. The management team makes sure to use a good part of its cash flow to maintain and improve railways while rewarding shareholders with generous dividend payments. CNR exhibits impressive dividend records with very low payout ratios. While the business could face headwinds from time to time, its dividend payment will not be affected. Shareholders can expect more high single-digit dividend increases. The railroad company kicked off 2023 with an impressive dividend increase of 8%. If you can grab CNR with a yield of approximately 2%, you’re in for a good deal!

Potential Risks

Railroad maintenance is capital intensive and could adversely affect CNR in the future. It is a difficult balance to obtain an efficient operating ratio and well-maintained railroads. Continuous (and substantial) reinvestments are required to maintain its network. However, CNR continues to boast one of the best operating ratios in the industry. CNR’s growth could also be negatively impacted from time to time as it depends on Canadian resource markets. When the demand is low for oil, forest, or grain products, demand for CNR’s services will obviously slow accordingly. For example, the pandemic caused a slowdown in weekly rail traffic of about 10% over the summer of 2020. When the oil price is low, trucking steers some business away from railroads. CNR is a captive of its best assets since you can’t move railroads!

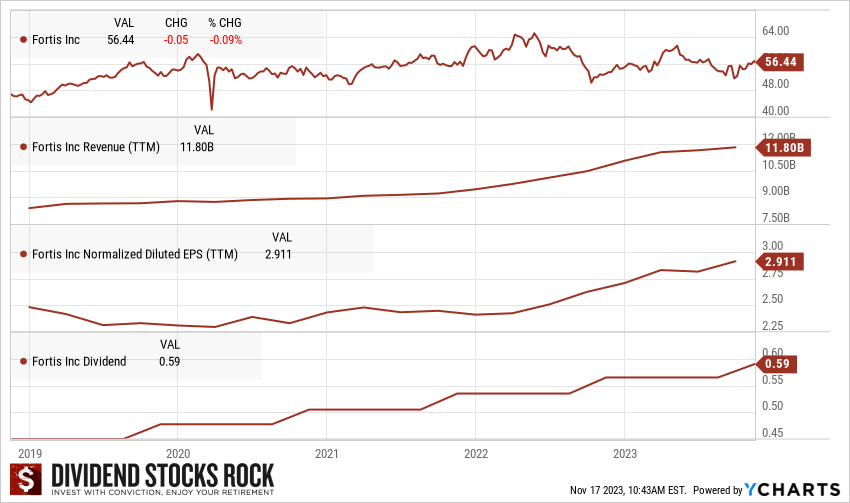

Fortis (FTS.TO)

Business Outlook

Fortis invested aggressively over the past few years, resulting in strong and solid growth from its core business. An investor can expect FTS’ revenues to continue to grow as it continues to expand. Bolstered by its Canadian based businesses, the company has generated sustainable cash flows leading to 4 decades of dividend payments.

The company has a five-year capital investment plan of approximately $20 billion to be invested beginning in 2022, through to 2026. Only 33% of its CAPEX plan will be financed through debt, while 61% will come from cash from operations. Chances are that most of its acquisitions will happen in the US. We also like the company’s goal of increasing its exposure to renewable energy from 2% of its assets in 2019 to 7% in 2035.

Management increased its dividend by 6% like clockwork for the past 5 years and has declared that it expects to increase dividends by 6% annually until 2025. We like it when companies show motivation for growth through acquisitions and reward shareholders at the same time. After all, Fortis is among the rare Canadian companies who can claim to have increased their dividend for 50 consecutive years. The company announced its 50th consecutive increased in September of 2023. The dividend was increased by 4.4% to $0.59/share. Fortis is a great example of a “sleep well at night (SWAN)” stock.

Potential Risks

Fortis remains a utility company; in other words, don’t expect astronomical growth. However, Fortis’ current investment plan is enough to make investors smile. Fortis made two acquisitions in the U.S. to perpetuate its growth by opening the door to a growing market. However, it may be difficult for the company to grow to a level where economies of scale would be comparable to that of other U.S. utilities. The risk of paying a high price for other U.S. utilities is also present. Fortis runs capital intensive operations which makes its business model sensitive to interest rate.

Finally, as most of its assets are regulated, each increase is subject to regulatory approval. While FTS has a long history of negotiating with regulators, it’s possible to see rate increase demands being revised. Please also note that Fortis’ revenue is subject to currency fluctuations between the CAD and USD currencies.

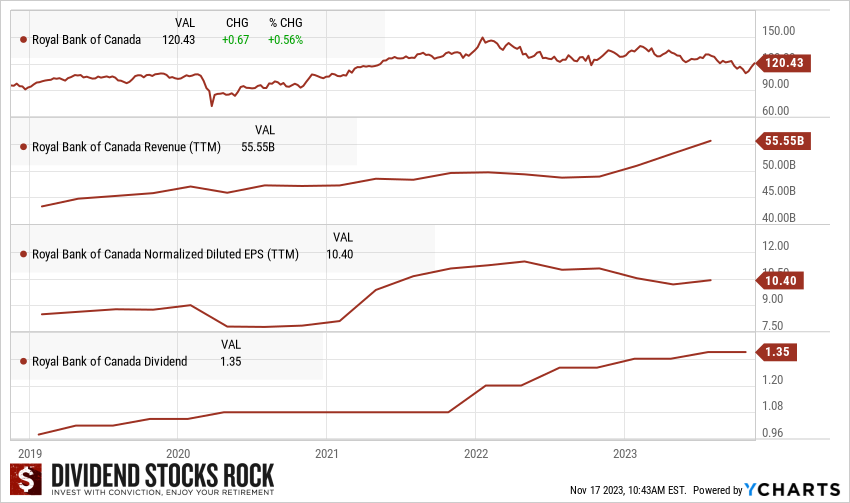

Royal Bank of Canada (RY.TO)

Business Outlook

Royal Bank counts on many growth vectors: its insurance, wealth management, and capital markets divisions. These sectors combined now represent over 50% of its revenue. These are also the same segments that helped Royal Bank stay the course during the pandemic. The company has made significant efforts in diversifying its activities outside of Canada and has a highly diversified revenue stream to offset interest rate headwinds. Canadian banks are protected by federal regulations, but this also limits their growth. Having some operations outside of the country helps RY to reduce risk and improve its growth potential. The bank posted impressive results for the latest quarters driven by strong volume growth and market share gains, which offset the impact of higher provisions for credit losses. As interest rates rose in 2023, RY is in a good position.

Royal Bank has traditionally increased its dividend twice per year. Under normal circumstances, an investor can count on two low-single-digit dividend increases each year. The bank paused its dividend growth policy between 2008 and 2010, but returned with double-digit dividend growth increases in 2012. Regulators put a hold on dividend increases for all banks in 2020 and lifted it in late 2021. Royal Bank went with a generous dividend increase of $0.12/share, or 11%. In 2022, the company returned to its habit of raising its dividend twice per year. We expect mid single-digit dividend increases going forward (e.g. between 2% and 3% increases, twice a year). Royal Bank increased its dividend by 2.3% in Q2 of 2023.

Potential Risks

After the 2008 financial market crash, the bank focused on growing its smaller sectors. While wealth management should continue to post stable income, the insurance and capital markets divisions are more inclined to variable returns. Royal Bank is highly exposed to the Canadian housing market and higher interest rates may affect this market. We have seen a slowdown in the housing market already, but we have yet to see defaults going up significantly. Royal Bank increased its provisions for credit losses (PCLs) as it expects a tougher market. We are still unclear about whether a looming recession will occur. This will have an impact on both personal and commercial banking.

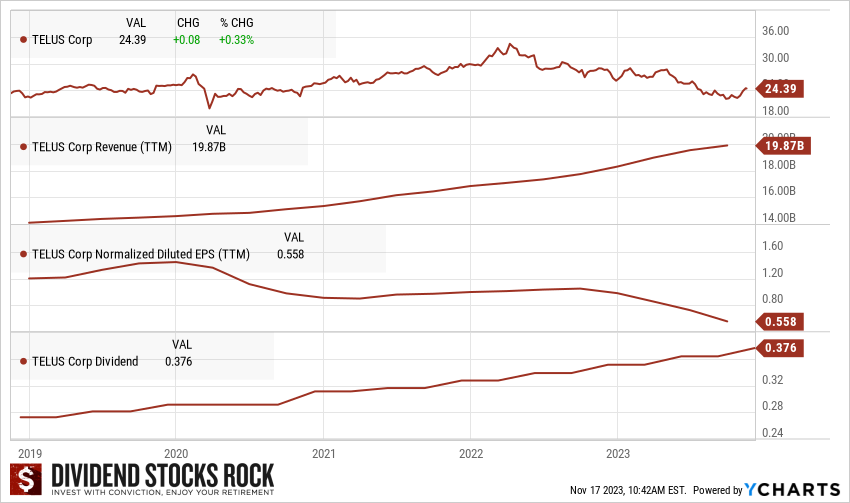

Telus (T.TO)

Business Outlook

Telus has grown its revenues, earnings, and dividend payouts on a very consistent basis. Telus is very strong in the wireless industry and is now tackling other growth vectors such as internet and television services. The company has the best customer service in the wireless industry as defined by their low churn rate. It uses its core business to cross-sell its wireline services. The company is particularly strong in Western Canada. Telus is well-positioned to surf the 5G technology tailwind.

Finally, Telus looks to original and profitable ways to diversify its business. Telus Health, Telus Agriculture, and Telus International (artificial intelligence) (TIXT.TO) are small, but emerging divisions that should lead to more growth going forward. In 2022, Telus also acquired Lifeworks for $2.3B to boost its health business segment. For 2023, CAPEX is slowing down ($2.6B) and will be mostly financed by free cash flow ($2B). This explains why the company keeps its generous dividend growth streak alive.

This Canadian Aristocrat is by far the industry’s best dividend payer. Telus has a high cash payout ratio as it puts more cash into investments and capital expenditures. Capital expenditures are regularly taking away significant amounts of cash due to their massive investment in broadband infrastructure and network enhancement. Such investments are crucial in this business. Telus fills the cash flow gap with financing for now. At the same time, Telus continues to increase its dividend twice a year, exhibiting strong confidence from management. You can expect a mid single-digit increase year after year. Telus kicked off 2023 with a first increase (it usually increases twice per year) of 3.6%, in line with our expectations. The company ended 2023 with the second increase (as usual) to bring the dividend at $0.3761 for a total increase of 7% for the year.

Potential Risks

As competition increases among the Big 3 (including the merger of Rogers and Shaw) and the coming of a new player (Quebecor acquired Freedom Mobile) in the wireless market, future margins could be under pressure. Plus, the Federal Government would like to see more competition for the “Big 3” and will likely open the door to new competitors going forward. You can bet that Quebecor will get a lot of support to expand its wireless business. Telus will eventually have to consider other growth vectors once the wireless market becomes fully mature. TV & internet will not be enough to avoid Telus becoming another Verizon (VZ) 10 years from now. We are not convinced by the acquisition of Lifeworks (particularly its cost). We will see how Telus integrates this business into its Health division. Finally, Telus’s debt has increased substantially, from $12B in 2015, to $27B in 2023. As interest rates are rising faster than expected, this may affect future profitability. The company is facing several headwinds explaining its stock performance in 2023.

Disclaimer: I hold shares of all five of these favorites!