Canadian investors buy Canadian Depositary Receipts (CDRs) to get shares of U.S. companies in $CAD, enjoy lower nominal stock prices, and protect their investment from currency fluctuations. Sounds like a pretty sweet deal. Are they really worth it?

For years, we’ve seen the term ADRs (American Depositary Receipts); stocks issued by companies based outside of North America, but that want to trade on U.S. markets. We cover only a few of them at DSR, because we prefer investing in North American companies. Why? Companies based outside North America often don’t report their earnings quarterly as is customary here, and they report them in a different currency; also, for most of them, there is usually a better (or as good) option to invest in on North American soil.

CDRs are different because they are shares of U.S.-based companies trading on the Canadian market. CDRs are offered by CIBC, the Depositary, on the Cboe stock exchange, but you can buy them through any online broker.

CIBC, sweetens the deal by offering investors a hedge against currency fluctuations. Also, CDRs are fractional shares that usually trade at lower prices than the underlying U.S. stock; this makes it easier for Canadians to participate in the growth of big U.S. companies. Instead of buying one share of Costco at $703 USD, you buy one fractional share of Amazon for $33 CAD!

How does currency hedging work? Are fractional shares as good as they sound? For answers for these questions and much more, download our Canadian Depositary Receipts (CDRs) guide here!

What’s the catch?

Honestly, there is no catch to CDRs, but they won’t change your life either.

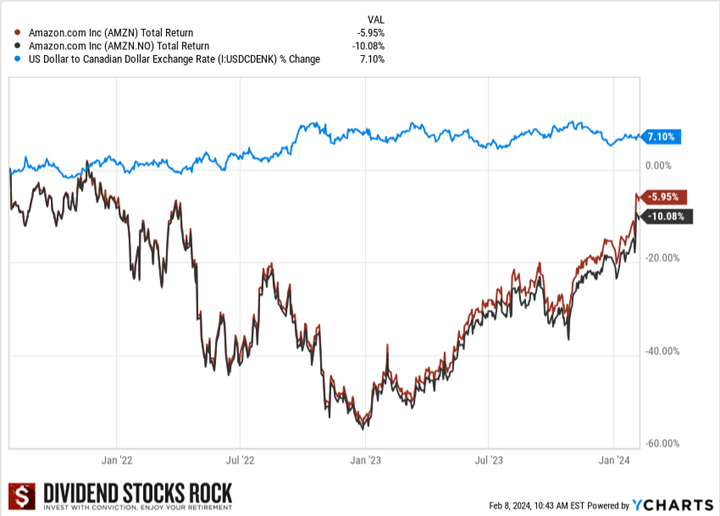

CIBC doesn’t charge any management fees on CDRs, but there’s a currency hedge fee capped at 0.60%. It’s not much, but it’s something to consider. As you can see, since the Amazon CDR was introduced in 2021, there is a small difference in total returns between the CDR (AMZN.NO) and the underlying U.S. stock (AMZN) :

However, the biggest difference lies with the currency fluctuation. Since 2021, the U.S. dollar gained 7.1% in value versus the Canadian dollar; it’s true that, due to the CDR currency hedge, you didn’t lose any value on an AMZN.NO investment. However, you failed to gain that 7.1%, which you’d have if you had invested in the U.S. stock. So the CDRs’ currency protection works well one way but not the other…

What about the dividend?

Yes, if you purchase CDRs, you are entitled to the dividend paid by the company. Since you hold fractional shares, you receive the dividend % (yield) on the value of your investment, not the dividend “per share” declared by the company. For example, if Microsoft (MSFT) declares a dividend of $0.62/share for a 0.85% yield, you will receive the equivalent of 0.85% of your investment, not $0.62 per fractional share.

Why am I less than enthusiastic about CDRs?

Remember when I said that there is no catch to CDRs, but that they wouldn’t change your life either? Here’s why…

We’ve already seen that the currency protection doesn’t always work in favor of CDR investors. Next is that only a limited subset of U.S. companies are available as Canadian Depositary Receipts, and that many dividend paying U.S. companies aren’t on the list! See the full list of CDRs here.

CDRs are also touted for their convenience and because they are cheaper than the underlying U.S. stocks. I find these so-called advantages unconvincing:

- Buying U.S. stocks isn’t nearly as inconvenient as many people make it out to be, on top of offering worthwhile advantages to Canadian investors that they don’t get with CDRs. Also, there’s a way to avoid currency conversion fee when buying U.S. dollars.

- Since a CDRF is a fraction of a U.S. share, it is indeed cheaper. That said, you own but a fraction of a share and receive a fraction of the declared dividend. Who wants only a slice of pizza when you can have the whole thing! There are strategies new investors and those with modest amounts available to invest can adopt to build up a portfolio that includes U.S. stocks.

Want more details about why I favor buying U.S. stocks? About how to buy $USD without paying a conversion fee? About how to go about including U.S. stocks in your portfolio? Download our CDR guide for all that and more!