Most of the best Canadian stocks pay a dividend. Known for their stability when markets are rough, they also provide income to investors quarterly. Companies in sectors such as telecoms, utilities, REITs, and banks can protect you against market fluctuations and severe losses.

Yet, not all dividend-paying companies are good investments. Investing in dividend stocks can lead to painful losses and income cuts. The risk of falling for dividend traps or seeing your retirement income plummet due to the wrong stock selection is too frequent.

The market creates bubbles and hurts your portfolio. You worked hard to invest money, and you shouldn’t lose it to the wolves of Bay Street. There is a way you can invest safely in Canadian dividend stocks.

See part of our best dividend stocks selection for 2024, download our booklet now!

Best Canadian Dividend Stocks for 2024

When I built my retirement portfolio, I focused on companies showing a combination of safe income and steady growth. Many of my choices are Canadian Dividend Aristocrats (companies showing several years of consecutive dividend increases). I added a few more metrics and used the DSR stock screener to refine my research.

Here are some the best Canadian Dividend Stocks for 2024:

#11 Canadian National Resources

How to Buy in Canadian dividend stocks

#11 Canadian National Resources (CNQ.TO)

You can never be too cautious when dealing with the energy sector. CNQ is a rare beast that has increased dividends for 23 consecutive years. Yes, it even increased its payouts while everybody was on hold or cutting distributions in 2020. It brings a question: why is CNQ oil price resistant?

It sits on a large reserve of cheap oil. According to management, CNQ is profitable with an oil price around $35-$40 per barrel . This lets the company manage production and CAPEX with greater flexibility. It can slow down CAPEX when the oil price is low and produce less. When we are back in “full oil bull mode”, CNQ bolsters CAPEX and boosts production generating maximum cash flow.

I don’t see CNQ as a super powered growth stock for the future. However, with a yield above 4% and a resilient business model, that’s the type of business that will either excel in your portfolio, or go back into hibernation while paying a secure dividend. In both scenarios, you can be a winner over the long run.

See part of our best dividend stocks selection for 2024, download our booklet now!

#10 Brookfield Corporation (BN.TO)

BN.TO is among my top picks for a second year in a row. Last year was filled with confusion and uncertainties around Brookfield’s business. Meanwhile, the company kept on doing what it does best: grow! Brookfield is an alternative asset manager. Over the past 10 years, the interest toward alternative assets (assets I that aren’t traded on the publish stock market) has grown significantly. This is a long-term trend that is not about to stop. BN is part of a small and selective group of major players which have enough liquidity to manage large infrastructure projects. We know many countries will invest massively in such projects in the coming decades. Finally, holding Brookfield Corporation will be like holding a little bit of all the Brookfield family members.

#9 Toromont Industries (TIH.TO)

Toromont Industries keeps showing a very strong dividend triangle (5-yr double-digit growth for revenue, EPS and dividends) and yet, the stock price isn’t following the same growth trend. Last year, you had the chance to buy TIH.TO at a PE of 20. Today, the forward PE is 18.35!

Toromont Industries keeps showing a very strong dividend triangle (5-yr double-digit growth for revenue, EPS and dividends) and yet, the stock price isn’t following the same growth trend. Last year, you had the chance to buy TIH.TO at a PE of 20. Today, the forward PE is 18.35!

In addition to relying on the mining (20%) and construction (38%) industries to grow organically, the company also buys smaller dealerships, such as Hewitt (acquired in 2017). Considering the massive infrastructure spending needs in Canada for the coming years, Toromont is surely a player that could do well going forward.

TIH.TO shows an interesting diversification with CIMCO representing 13% of its sales. The CIMCO segment is involved in the designing, engineering, fabrication, and installation of industrial and recreational refrigeration systems.

#8 Capital Power (CPX.TO)

Capital Power has hurt like most other utilities in the past two years. However, the company reported solid revenue growth, decent EPS increase, and mid-single digit dividend growth rate during that period. It invested heavily in new projects each year since 2012. This constant investment has enabled CPX.TO to grow its AFFO consistently.

CPX.TO relied on Alberta for 38% of its revenue and it made real effort to diversify with multiple acquisitions. After its recent transaction, CPX.TO’s reliability on Alberta’s economy will drop to 31% and it’ll show a 50%-50% Canada-U.S. exposure. The company will expand its renewable energy activities while counting on a solid natural gas business.

#7 Canadian Tire (CTC.A.TO)

In attempting to beat the market, I have to take my chances with another iconic brand currently showing price weakness. Canadian Tire currently trades at a forward PE ratio of about 10. For the record, the past 5-year PE average is nearly 12. EPS has been on a downtrend as margins are under pressure and the company faces fierce competition. However, its focus on “home brands” should help to expand margins. Canadian Tire invested massively in its e-commerce platform and uses its store network for pick-ups increasing its digital sales. Again, it’s really an “educated guess”. I expect a choppy year for CTC.A.TO, but we never know when the rebound will happen.

#6 Dollarama (DOL.TO)

I believe in Dollarama potential. It’s a low yield, high growth stock that has proven its ability to grow by opening new stores. Its focus on selling “home brands” provides better margins. DOL.TO has built a strong brand, and its business model aimed at low-value items is an excellent defensive play against the threat of e-commerce over the retail business and a possible recession. Through the acquisition of 51% of Dollarcity, DOL.TO has demonstrated international growth potential in Latin America.

As consumers’ budgets are tight, DOL.TO appears to be an amazing alternative to buy many goods. There are concerns surrounding its ability to maintain its margins going forward. DOL.TO introduced a new price point of $5 for many items, which lends additional flexibility and pricing power.

#5 Telus (T.TO)

Telus is a regular on my yearly buy list edition. I believe Telus shows very strong growth potential going forward. Telus chose to expand its business model using technology. That hurt the company in 2023, but I believe it was more related to the downtrend of the investment cycle in technology than a long-term trend.

BCE.TO is a great deluxe bond, but the wireless and media business has a growth ceiling. The debt level will become a burden as well.

Telus makes the bulk of its revenue from its wireless business. The wireless industry is 90% controlled by three companies: BCE, Rogers, and Telus. We see constant growth and strong profitability due to the under penetration of the wireless Canadian market and the oligopoly status.

What impresses me about Telus is its ability to develop new technologies and offer cross-selling opportunities amongst its corporate customers. The company has massively invested in artificial intelligence and has developed three new businesses (Telus International, Telus Health, and Telus Agriculture). Its goal is to spin-off the Health and Agriculture segments as it successfully has done with Telus International.

If we hear just a rumor that interest rates might get cut some time in 2024, I think Telus stock price will be on the rise.

See part of our best dividend stocks selection for 2024, download our booklet now!

#4 Granite REIT (GRT.UN.TO)

My number one criterion to select a REIT is distribution growth. If the REIT can’t keep up with the economy and fails to increase its distribution yearly, there’s no point in discussing it. Since a REIT’s goal is to distribute as much money as possible to unitholders, don’t expect huge price appreciation. So, if the dividend doesn’t grow, inflation is nibbling away at your income. There aren’t many REITs in Canada that kept their distribution increase alive in 2023. One is Granite! This is a rare REIT exhibiting AFFO per unit growth while issuing more units to finance growth.

GRT’s growth is mostly driven by new acquisitions and contractual rent adjustments. It announced another dividend increase of 3.125% and reported an AFFO payout ratio of 73% for its latest quarter (reported on November 8th). While many investors are worried about the future of industrial properties now that interest rates are increasing, Granite keeps reporting stellar occupation rates (95.6%) and a solid pipeline. The demand remains strong in this sector.

Granite units price has been on a roller coaster in 2023 but ended on a positive note. As the REIT keeps reporting strong numbers quarters after quarters, it should get more love from the market.

#3 Stella-Jones (SJ.TO)

Stella-Jones is a special beast in the materials sector. While its business model revolves around lumber price, 65% of its revenue comes from utility poles (40%) and 25% from railway ties. For both goods, buyers will pay the price because they’re are essential to their projects. Therefore, SJ’s business is less affected by price fluctuations than if it was all about residential lumber.

In 2023, the company reported impressive numbers as demand for infrastructure products surged. Management recently announced they were looking for more acquisition targets. SJ.TO has a lot of growth vectors on its dashboard. While residential construction may slow down due to higher interest rates, the need for more infrastructure and major projects continues to drive sales higher.

The stock price surged in 2023 but the company still trades an attractive forward PE of 14.

#2 National Bank (NA.TO)

After seeing NA.TO out of the top 10 most popular stocks at DSR for two years in a row, I had to highlight it as one of the best stock for 2024! National Bank is the second most generous bank in terms of dividend increases over the past 10 years, right behind TD, and the most generous in the past 5- and 3-year periods. It also shows one of the lowest payout ratios of the group. What does this tell me? More generous dividend increases to come. Once again in 2023, National Bank ended the year with the largest dividend increase and the lowest payout ratio.

NA has targeted capital markets and wealth management to support its growth. It’s Private Banking 1859 has become a serious player in that arena. The bank even opened private banking branches in Western Canada to capture additional growth.

National Bank has been more flexible and proactive in many growth areas such as capital markets and wealth management than other banks. NA is seeking additional growth vectors by investing in emerging markets such as Cambodia (ABA bank) and in the U.S. through Credigy. We wonder if it can it have more success than BNS on international grounds. It seems they may have found the right formula to do so! This is one of the rare Canadian stocks having a near-perfect dividend triangle.

#1 Alimentation Couche-Tard (ATD.TO)

I really tried to find something else than ATD, but seriously, which company match up? I can’t stress enough my admiration for the world’s second-largest convenience store chain. Many ask how Couche-Tard will make money once we all drive electric vehicles.

- First, we are very far from this scenario. It will take at least 10 years if not more to reach a point where there are more EV’s on the road than ICE (Internal combustion engine) vehicles.

- Second, ATD.TO is already thriving in Norway where 14% of the vehicle fleet is electric. It succeeds in this market by having chargers in strategic locations and even by installing its own chargers at consumers’ homes.

- Third, 65% of Couche-Tard transactions don’t include gas sales. Therefore, 2/3 of Couche-Tard’s business is 100% sheltered from the energy transition.

- Fourth, the bulk of its profit comes from convenience store sales. ATD.TO focuses on improving its customers’ experiences by adding products such as fresh food fast (their version of healthy fast food!), automating cashiers, and building a loyalty program.

Five years ago, it had a plan to double its EPS and succeeded. Now, it introduced “10 for the win” strategy which is adding another 5 years target of $10B in EBITDA in 2028 (from $5.8B in 2023).

On top of organic growth vectors, Couche-Tard also enjoys a robust balance sheet. It means it can pull the trigger on any acquisitions coming its way. The management team remains disciplined and won’t waste a penny on a bad deal for the sake of growth.

How to Buy in Canadian Dividend Stocks

2023 can be summed up in four words: Different Investors, Different Returns. Some investors had a great year while others saw their portfolio value decline. Those invested in technology stocks and consumer discretionary did better than those invested in utilities, real estate, and energy.

Inflation hurts consumers’ budgets forcing them to tighten their belt with high interest rates putting even more pressure on them. During the latter half 2023, we saw the higher interest rates finally catching up with the economy and slowing it down. Inflation has lowered, Canada reported a negative GDP late in 2023, and the unemployment rate, while low, is inching up a bit.

It’s been frustrating for investors and predicting what’s coming seems impossible. You don’t want to lose more money and you’re afraid your retirement dream could slip away. No investor should roll the dice for their retirement.

Know that I’m invested 100% in equities all the time. I have been since I first bought my first shares in 2003. I didn’t change my approach in 2008, 2018 or 2020 and I certainly won’t today.

I know how it feels to lose money day after day. It’s painful, but there’s a solution. I’m helping over 3,000 people like you to invest with more conviction and stick to their plan through any current market crisis or uncertainty.

See part of our best dividend stocks selection for 2024, download our booklet now!

Stop Losing Money for Nothing

Don’t you hate not knowing when to buy or sell stocks? Market fluctuations create confusion and leave you with the impression you’ll lose all your savings. It doesn’t have to be this way.

Since 2018, DSR PRO offers a customized quarterly report tracking each company’s earnings. Receive a portfolio summary along with crucial information about your holdings. You tell us what to follow, and we keep you in the loop. I’ve attached an example of what the report looks like (it’s an example, so numbers don’t add up).

Our PRO ratings have been proven highly efficient during the bear market of 2018 and the market crash of 2020.

Four things to do right after signing-up with DSR PRO:

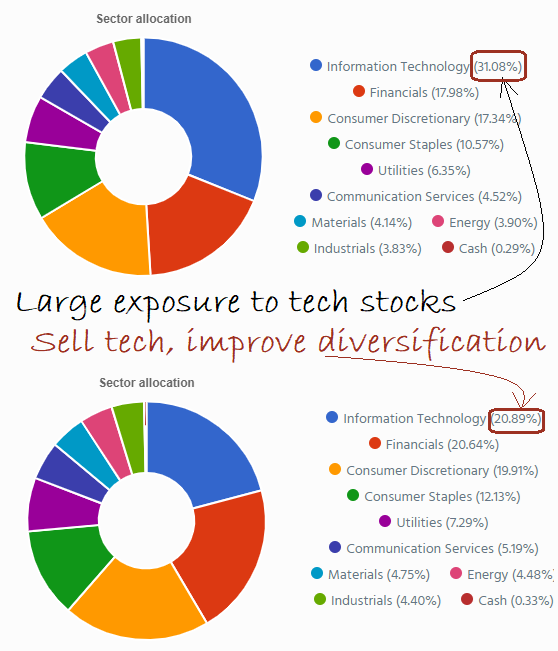

#1 Build your portfolio online and optimize your sector allocation. The DSR portfolio builder is a great tool you use to create as many portfolios as you want and review your sector allocation instantly.

Psst! You can build as many portfolios and generate as many reports as you want!

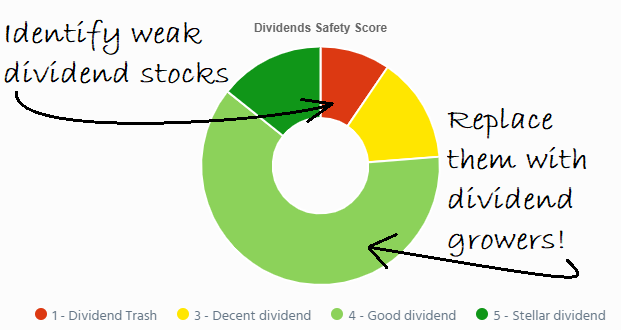

#2 Identify weak ratings, take action before it’s too late. Difficult economic conditions will push companies to cut their dividend. There could be more dividend cuts in these uncertain times. You have the chance to avoid a loss of income and capital.

Make changes to your portfolio and run your report again! You can run another report 24 hours after you updated your portfolio!

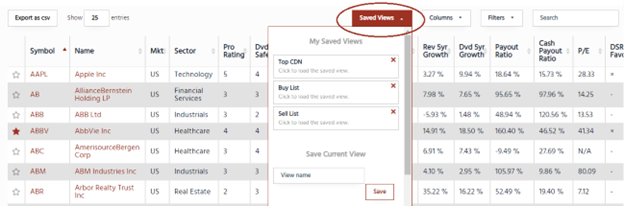

#3 Add stocks that will thrive. At DSR, we scout the entire market to find companies that have a proven business model and that will keep increasing their distributions. Use the DSR screener to instantly filter for DSR favourite stocks or those with PRO ratings of 4 or 5. Did you know that as a PRO member, you’re also able to save your filter views and reuse them at will?

We offer more than 40 metrics including an ESG score, valuation and credit score on top of the Chowder rule and the 5-year average dividend yield.

#4 Talk with other DSR PRO members! Visit the exclusive channel on Discord for DSR PRO members. The forum has rapidly grown into a community of 700+ experienced investors sharing their point of view on stocks, strategies and helping each other. You’re not alone in your journey, share your thoughts with other investors like you!

Subscribe to DSR PRO with a 33% lifetime discount

I’m excited for you to get your DSR PRO report, take appropriate actions, and secure your portfolio. Making sure you keep only good companies in your portfolio is crucial during volatile markets.