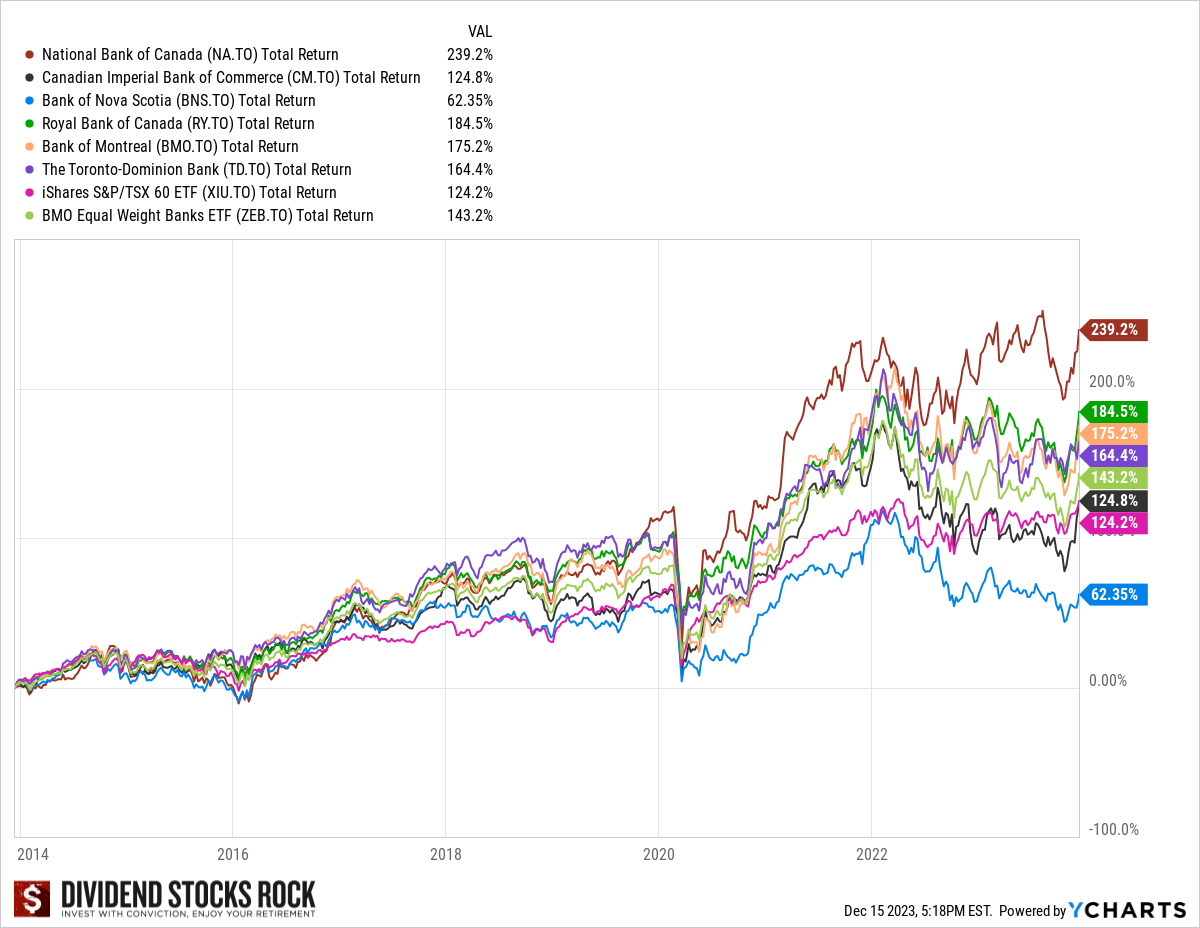

It’s that time: Canadian Banks Ranking 2024! Canadian banks are amazing; most have outperformed the Canadian stock market for the past 5, 10, 15, probably 25 years. We see below that at the end of 2023, five of six had outperformed the market, and four of six also outperformed the ZEB.TO equal weight banks ETF over 10 years.

Many investors think they’re all the same; just pick of of them in your portfolio and you’ll be fine. That’s a myth. So, which is the best?

Since the 2008 financial crisis, each member of the big six (Royal Bank, TD Bank, ScotiaBank, Bank of Montreal, Canadian Imperial Bank of Commerce and National Bank), took different paths. They all benefited from the banking oligopoly in Canada to fund new growth vectors. Fifteen years later, if you pick the wrong bank, you’ll be leaving a lot of money on the table.

Here is our Canadian Banks Ranking 2024 from position 6 to 1. But first, watch this video to review their latest quarterly earnings:

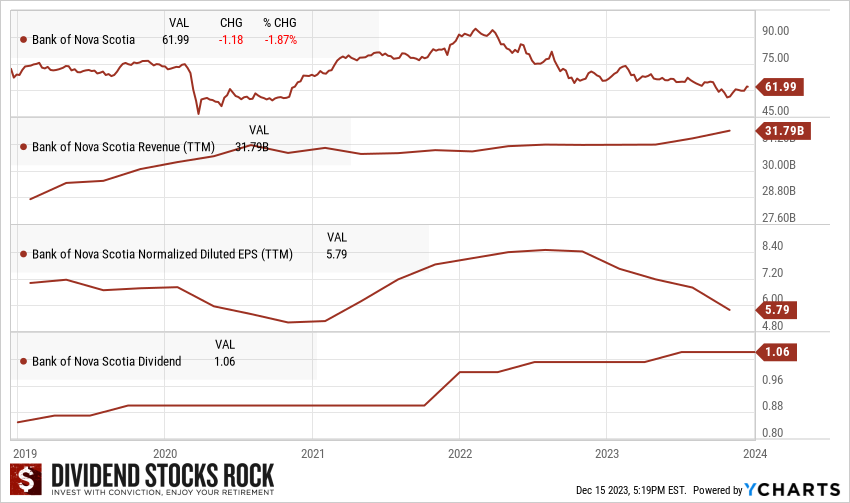

#6 ScotiaBank (BNS.TO)

The most international of the Canadian banks, BNS has significantly expanded outside of Canada with 40% of its assets outside the Canadian border. This hasn’t always been an advantage as BNS ran into its share of problems with South American economic struggles. The bank reduced its international footprint, limiting it to 30 countries down from 54 in 2013. Expected gross domestic product (GDP) growth for these countries is attractive, higher than Canada and the U.S., but comes with much uncertainty and volatility. BNS is a dominant player in Chile after acquiring BBVA Chile in 2018. The bank has a strong track record of acquiring and integrating businesses.

Unfortunately, this wasn’t enough to keep pace in 2023. Scotiabank ended the year with poor results, mostly driven by higher provision for credit losses (PCLs) across all segments. The pace at which PCLs increase is concerning. We were disappointed by the small dividend increase (3%) in 2022, compared to BNS’ peers; it did it again with another small increase in 2023.

Pros:

- Best diversified, most international: For over a decade, BNS focused on growing outside Canada, especially in Central and South America, where GDP growth rate is better there than in the U.S. and Canada. Moving it should grow at 3%-4% while it’ll be hard to reach over 1%-2% in Canada and the U.S.

Cons:

- International exposure brings uncertainties: Before the pandemic, BNS had a great story, but never capitalized on it and never outperformed other banks. Why? It’s complicated to do business in Central and South America! It took years and several failures for Canadian banks to enter the U.S. They made bad acquisitions and failed several times. Looking at South and Central America, you realize it’s a lot more complicated than making loans in the U.S.

- Worst performing stock from the top 6 over the past 10 years. With all the difficulties mentioned, I’m not expecting BNS to reverse the current trend in the upcoming months or years.

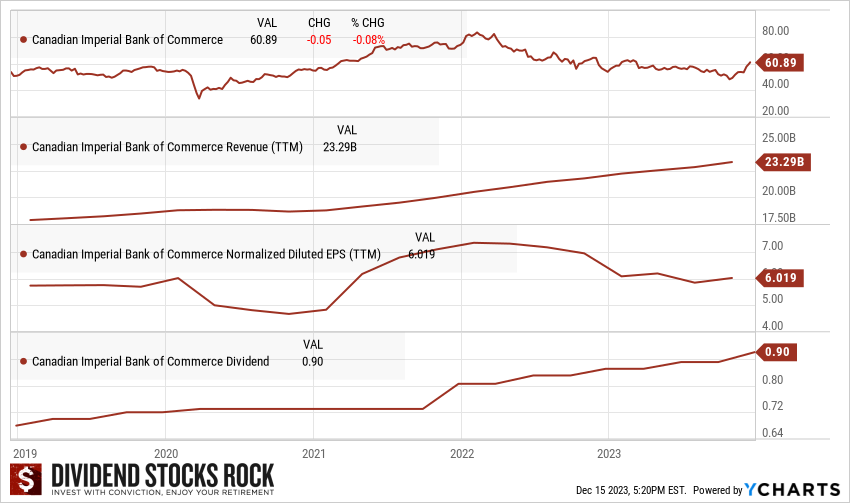

#5 Canadian Imperial Bank – CIBC (CM.TO)

While CIBC lags behind the other banks on the stock market (along with ScotiaBank), it gives investors the chance to get a generous yield without significant risk. We like that they want to grow their wealth management division, but the integration of Private Bank represents a crucial step. For investors looking for additional income, CM is probably one of the best picks on the Canadian stock market; just don’t expect it to outperform the banking industry over the long run. CIBC is trading at a low PE ratio versus some of its peers since it has lower growth expectations. On the bright side, the dividend is not at risk, and an investor will enjoy consistent increases. CIBC will likely be a good fit for a retirement portfolio since it offers the stability of a top 5 Canadian bank with a decent yield and the security of future dividend growth.

Pros:

- High yield with a relatively low payout ratio: When you do the math, a low stock price brings a higher yield. A low PE ratio also brings a high yield and so the stock price is low…

- Mortgage loans: A classic and easy activity for banks, but when your biggest growth vector is mortgages right now, I don’t think it will result in outperforming the other banks.

- Private banking and wealth management: Smart move, but a little late. CIBC is a small player in this ground compared to the others.

Cons:

- Lack of growth vectors: Lack of clarity about their strategy, or a lack of strategy, it tries to do a bit of everything. There isn’t a business segment that’s clearly leading the growth.

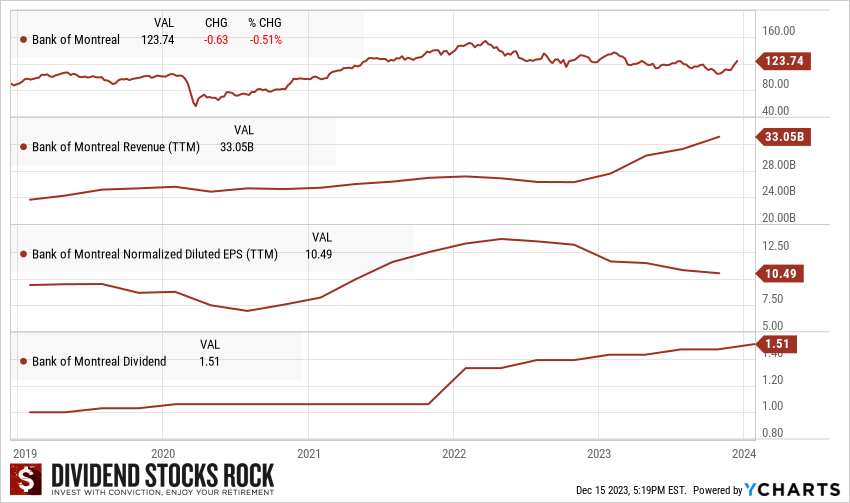

#4 Bank of Montreal – BMO (BMO.TO)

BMO chose the stock market path to ensure its growth. It was the first Canadian bank with its own ETF on the market. Competition is fierce but being among the first Canadian issuers surely helped to build momentum in a growing market. The bank remains active in the M&A world with its acquisition of Bank of the West. BMO also made innovative moves such as the introduction of a robo-advisor. Over the years, BMO concentrated on developing expertise in capital markets, wealth management, and the U.S. market. Since growth will occur in these markets in the coming years, BMO is well-positioned to surf this tailwind. Take note that BMO’s results are often more volatile compared to those of its peers due to its capital market business segment. The bank has been less generous regarding dividend growth between 2010 and 2020. However, it came back strong with its most generous dividend increases since 2021.

Pros:

- Focus on capital markets and wealth management: They were the first in the country to have their own ETF suites. They saw where the market was going, and they took advantage of it. They were also among the first Canadian banks to make a move towards private banking with the acquisition of Harris Bank in Chicago. They’re well established in wealth management and in capital markets, which I like.

- Well established in the U.S.

Cons:

- Revenue and earnings are more volatile: Because of their focus, their revenue and earnings are more volatile, riskier. Investors should expect two increases per year going forward.

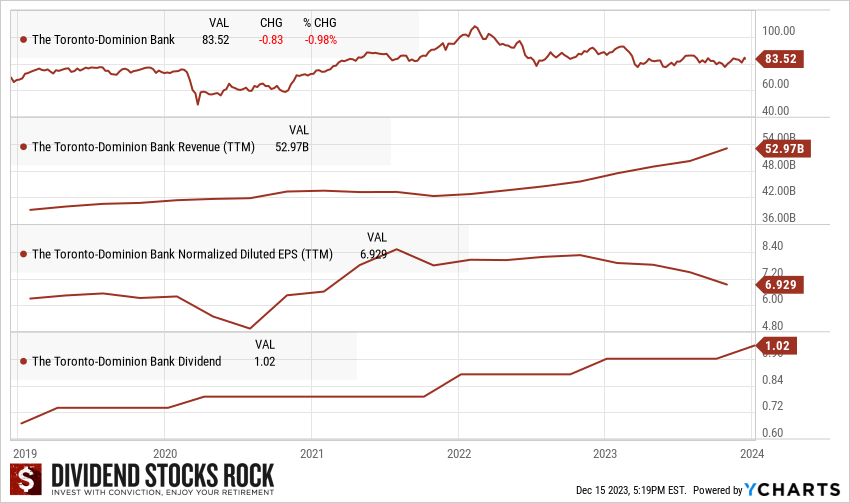

#3 TD Bank (TD.TO)

Over the years, the bank has been increasing its retail focus, driven by lower-risk businesses with stable, consistent earnings. The bank enjoys number one or two market share for most key products in the Canadian retail segment. TD keeps things clean and simple; the bulk of its income comes from personal and commercial banking. It has substantial exposure in major cities like Toronto, Vancouver, Edmonton, and Calgary, and a strong presence in the US. With about a third of its business coming from the U.S., TD is the most “American” bank you’ll find in Canada. If you’re looking for a straightforward bank, TD should be your pick as increasing retail focus, large market share in Canadian banking, and U.S. expansion are key growth enablers for TD Bank. The 13% stake in Charles Schwab (SCHW) is another interesting growth vector.

Pros:

- Revenues (a third) coming from the US: They really caught up that game from their southern neighbors; they know how they want to deal; they have a great exposure over there.

- Largest amount of assets in Canada.

- Doing things simple but doing them the right way: They have been doing very well for the past 10 years.

- Strong wealth management: Their segment from Ameritrade did very well, and now they’re selling to Charles Schwab.

Cons:

- High exposure to mortgages: Showing resilience, the hot housing markets such as Vancouver and Toronto have only slightly cooled down over the last year. If we get into a housing bubble though, it’s going to be harder for TD.

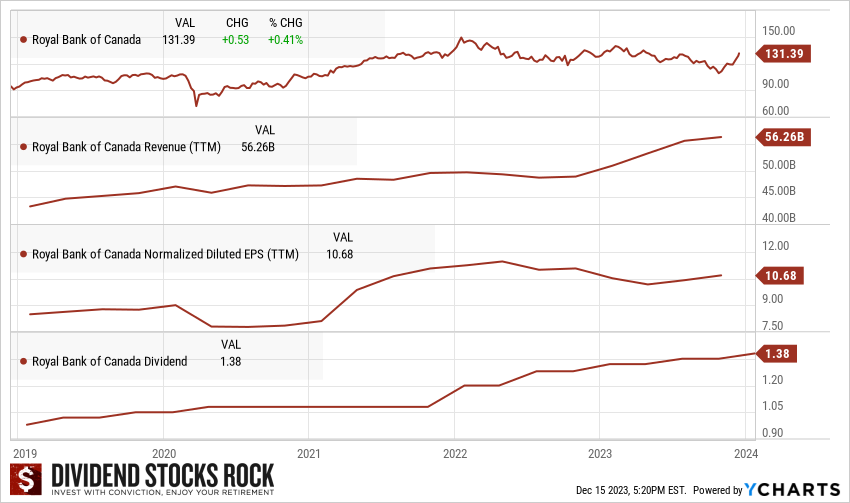

#2 Royal Bank – RBC (RY.TO)

Royal Bank counts on many growth vectors: its insurance, wealth management, and capital markets divisions, which combine to represent over 50% of its revenue. They’re also the segments that helped Royal Bank stay the course during the pandemic. The company has made significant efforts in diversifying its activities outside of Canada and has a highly diversified revenue stream to offset interest rate headwinds. Canadian banks are protected by federal regulations, but this also limits their growth. Having some operations outside of the country helps RY to reduce risk and improve its growth potential. The bank posted impressive results for the latest quarters driven by strong volume growth and market share gains, which offset the impact of higher provisions for credit losses. As interest rates rose in 2023, RY is in a good position.

Pros:

- Battling TD to be the largest bank in assets: They’re well established across all of Canada.

- Roughly 50% of revenue come from classic banking activities: Which means only 50% is subject to the interest rate squeeze.

- Other half comes from wealth management, capital market, and insurance: They have been able to do lots of cross-selling across those segments, they are maximizing their presence in the wealth management, and they had a huge deal with BlackRock for ETFs.

- Strong dividend growth policy in place: You can count on two low-single-digit dividend increases each year. Royal Bank increased its dividend by 2.3% in Q2 of 2023 and by another 2.2% in Q4 of 2023. The dividend is safe.

Cons:

- Royal Bank can get hurt by a bearish housing market: A rather small downside considering RY’s strength and ability to face headwinds.

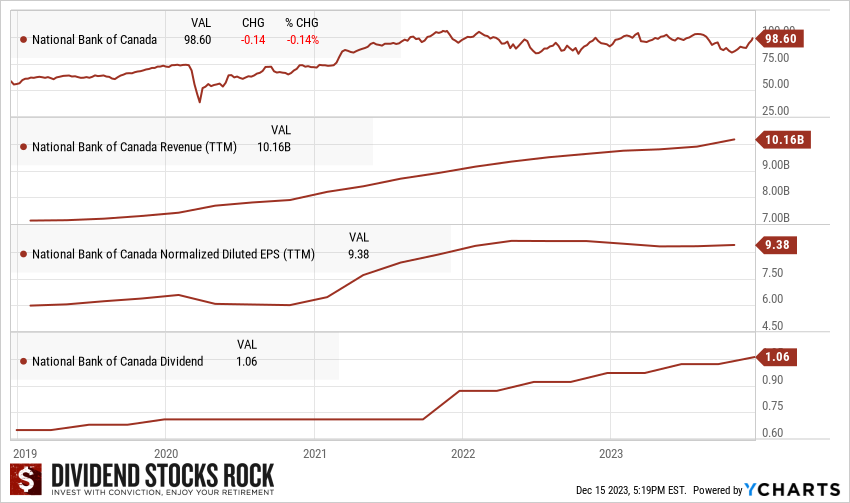

#1 National Bank (NA.TO)

Again, NA holds the top position in our Canadian banks ranking 2024. NA has targeted capital markets and wealth management to support its growth. Private Banking 1859 has become a serious player in that arena. The bank even opened private banking branches in Western Canada for additional growth. It now shows great diversification across its business segments (with 50% of revenue from outside classic savings & loans activities).

Since NA is heavily concentrated in Quebec, it concluded deals to provide credit to investment and insurance firms under Power Corp. (POW). NA has shown strong results, and its stock outperformed the other Big 5 for the last decade. National Bank has been more flexible and proactive in growth areas such as capital markets and wealth management. NA is seeking additional growth by investing in emerging markets; in Cambodia through ABA bank and in the U.S. through Credigy. We wonder if it can achieve more success than BNS internationally. It seems like it might have found the winning formula! It’s one of the rare Canadian stocks with a near-perfect dividend triangle.

Pros:

- Among the fastest growing wealth management businesses in the country: NA has very strong brand recognition there. Since it was doing a lot of loans in Western Canada, it opened private banking branches there. Not regular branches where everybody can go, but selling points where private consultants and private bankers serve their clients.

- Strong in capital markets: NA’s very active on the market. This creates more volatility, as is the case with BMO, but overall, it’s been doing well, and making more money.

- International branch and US segment: Internationally, it focuses on Cambodia by purchasing ABA Bank. NA’s trying to create growth outside of Canada, selecting emerging markets in Asia rather than South America.

- Heavily based in Quebec: In the past, this was a reason for NA to be a little behind, but over the past 10 years, Quebec has proven its resiliency. It’s not dependent on energy to grow its economy; Quebec has a Canadian economy similar to Ontario. It’s doing well. During the pandemic, Quebec was hit with a lot of cases, but its economy seems to be on the way to recovery faster than elsewhere as is the case with National Bank.

Cons:

- International branch and US segment: We’re going to see how this goes. Not my favorite part of the business model, but I like that it tries to diversify.

Final Thoughts

Canadian banks could be compared to the salt you use in your hearty fall soup. Some salt in it is making it tasty and great. Add too much salt and it is totally ruined. Act with the same caution for Canadian banks. Pick one or two, but don’t add too much in your portfolio!

I know how hard it is to invest when stocks don’t seem to trade at their fair value

Don’t you hate not knowing when to buy or sell stocks? So many investing articles contradict one another. This creates confusion and leaves you with the impression you may not reach financial independence. It doesn’t have to be this way. We have created a free, recession-proof portfolio workbook that gives you the actionable tools you need to invest with confidence and reach financial freedom.

This workbook is a guide to help you achieve three things:

- Invest with conviction and address directly your buy/sell questions.

- Build and manage your portfolio through difficult times.

- Enjoy your retirement.