Retirement’s knocking — but can your income keep up? If you’re dreaming of monthly paychecks without the headaches of tenants or property repairs, Canadian REITs could be your answer.

Most dividends come quarterly. But some REITs? They pay monthly, giving you that steady stream of income retirees love.

What makes REITs great monthly payers?

While most companies pay dividends quarterly, many Canadian REITs opt for monthly distributions. That’s because their rental income arrives monthly — and they’re happy to share it.

Think of REITs like owning a rental empire — without the late-night repair calls. These trusts collect rent monthly from dozens (or hundreds) of properties and pass that income straight to you.

Monthly distribution REITs list

At DividendStocksRock, we track over 1,200 dividend-paying stocks. Only 65 Canadian companies pay a monthly dividend from this list, and over half (34) are REITs.

Want to explore all your monthly income options? Here’s our complete list of Canadian REITs that pay monthly dividends, including their yields and dividend growth history.

Retirees: Not All Income Is Created Equal

Monthly distributions can feel safe — until they’re not. High-yield funds often cut payouts when you need them most.

Dividend Income for Life shows you a better way:

✅ Reliable, growing income from quality dividend stocks

✅ A strategy built to outlast market dips and inflation

✅ How to retire with income you won’t outlive

💡 If you’re retired (or close to it), this guide is your roadmap to income that grows with you.

Download it free and build the income your retirement deserves.

Our Top 3 Monthly REITs

Some of the best Canadian REITs are paying a monthly distribution. We picked three standouts from over 30 monthly-paying REITs based on yield stability, tenant diversification, debt or payout ratios, and long-term growth.

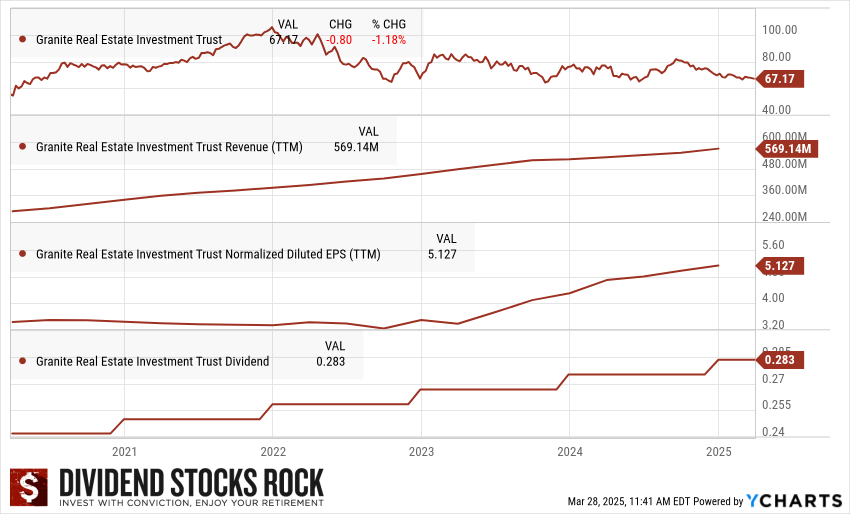

Granite REIT (GRT.UN.TO)

Investment Thesis: Diversified, Disciplined, and Growing

Granite REIT has transformed from a single-tenant industrial landlord into a diversified, growth-oriented real estate investment trust.

Once dependent on Magna International for 98% of its revenue, that figure has dropped to 26.7% as of August 2024. The trust now owns 143 properties across seven countries, with a growing tenant base including Amazon. Backed by a BBB/BAA2 investment-grade rating and a low FFO payout ratio (~70%), Granite offers a 4–5% dividend yield with inflation-beating growth potential.

Strategic acquisitions and developments aligned with e-commerce and supply chain trends continue to fuel expansion and de-risk the portfolio.

Potential Risks: Magna Still Matters

Despite Granite REIT’s successful diversification, key risks remain—most notably its ongoing dependence on Magna, which still accounts for over a quarter of its revenue. Any disruption in Magna’s business could impact Granite’s financial stability.

Broader economic downturns could also reduce demand for industrial space, leading to lower occupancy and rent collections. Rising interest rates present a further challenge, potentially increasing borrowing costs and pressuring profit margins.

The industrial REIT space is also becoming increasingly competitive, with rivals like Dream Industrial and Stag REIT actively pursuing premium tenants and properties, requiring Granite to enhance its value proposition continuously.

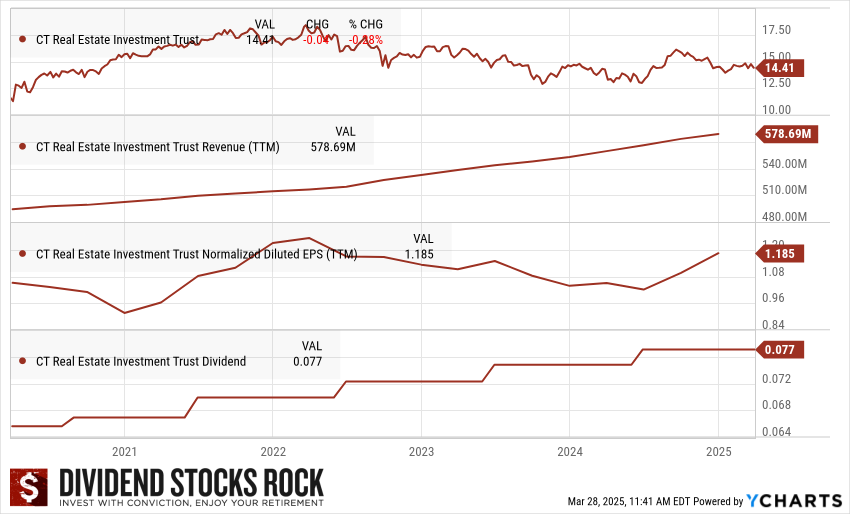

CT REIT (CRT.UN.TO)

Investment Thesis: High Yield, Low Risk, and Long Leases

CT REIT is a stable, income-focused real estate investment trust that derives 92% of its rental income from Canadian Tire and its associated brands.

With a robust 6.3% dividend yield and a conservative AFFO payout ratio (~74–75%), it offers reliable monthly income backed by long-term, triple-net leases. The REIT owns 375 properties across Canada and continues to grow through acquisitions, intensifications, and development projects.

While its fortunes are tied closely to Canadian Tire’s performance, the trust benefits from high occupancy, mission-critical assets, and strong pricing power on renewals—making it an appealing choice for conservative, yield-seeking investors.

Potential Risks: When Your REIT Depends on One Retailer

CT REIT’s stability comes with concentrated risk—over 90% of its leasable area is tied to Canadian Tire.

This tight dependency means the REIT’s fortunes rise and fall with its anchor tenant. While Canadian Tire has been resilient, any strategic shift or decline in its performance could have ripple effects on CT REIT.

The trust also faces exposure to interest rate risk due to its $3B+ in debt and operates many properties in secondary markets, which are more vulnerable during economic downturns.

Despite solid management and stable cash flows, CT REIT lacks diversification, making it a high-conviction bet on a single retailer.

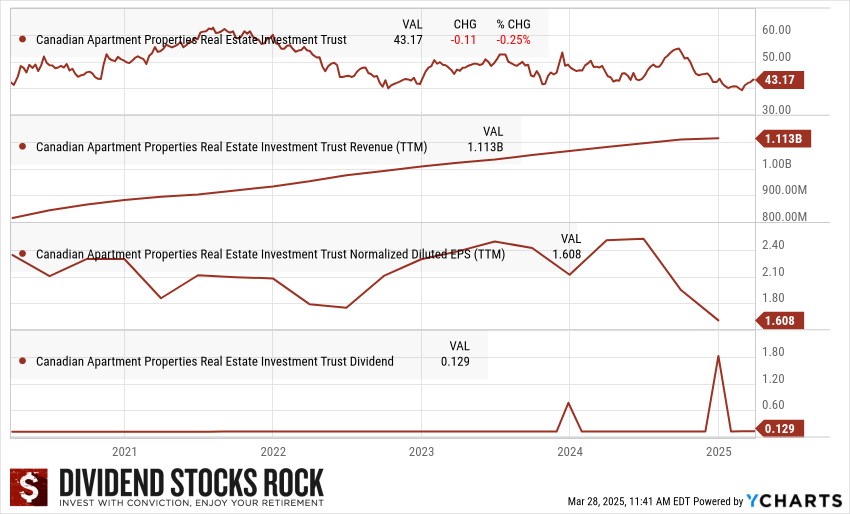

Canadian Apartment Properties REIT (CAR.UN.TO)

Investment Thesis: Stable Income with Rental Growth Upside

Canadian Apartment Properties REIT (CAPREIT) is a leading residential REIT with over 48,000 rental suites across Canada and the Netherlands.

Known for its inflation-resistant cash flows and strong occupancy (97.5% in Q4 2024), CAPREIT offers steady income and long-term growth potential. It has delivered high single-digit organic rent growth while engaging in capital recycling—selling nearly $1 billion in Canadian assets in 2024 to optimize its portfolio.

With strategic property acquisitions, strong demand in rental housing, and exposure to international markets, CAPREIT is well-positioned for continued performance amid a tight housing market and rising rental rates.

Potential Risks: From Strong Rents to Squeezed Margins

While CAPREIT remains a top residential REIT, it faces mounting headwinds from rising costs, regulatory risk, and economic uncertainty.

Same-property NOI growth slowed to 3.4% in Q4 2024, as maintenance and repair expenses climbed. A potential shift in Canadian immigration policy could weaken rental demand, while high interest rates continue to pressure REIT valuations and acquisition strategies.

CAPREIT also competes with other major residential REITs and faces new risks through its European exposure, including currency volatility and unfamiliar regulatory landscapes.

Future performance will depend on its ability to maintain occupancy, control costs, and adapt to a changing macro environment.

Each REIT has strengths — whether it’s Granite’s industrial edge, CT’s retail consistency, or CAPREIT’s rental growth. Consider what fits your income goals and risk comfort.

Those REITs are great, but there’s more!

Monthly REITs are a powerful tool — but they’re not the whole picture. Relying solely on high yields can be risky, especially if payouts get slashed.

That’s why we built ‘Dividend Income for Life’ — a strategy that balances immediate income with long-term stability.

Discover the Dividend Strategy Built for Real, Long-Term Income

If you’re counting on monthly distributions to fund your retirement, there’s something you need to know: many of them aren’t sustainable. High yields can vanish overnight with a dividend cut — leaving your income and peace of mind at risk.

That’s where Dividend Income for Life comes in.

This free guide reveals a disciplined, proven strategy to build income from dividend stocks that grow over time — not just pay today.

Inside, you’ll learn:

✅ Why monthly income funds can be misleading (and what to use instead)

✅ The secret power of low-yield, high-growth stocks to protect your income

✅ How to build a portfolio that grows your cash flow and preserves your capital

✅ Real data: how dividend growers crushed high-yield stocks over the last decade

✅ A smarter withdrawal approach to make your money last

🛡️ Don’t trade short-term comfort for long-term risk.

Build a dividend income stream designed to last – and grow – for life.

👉 Download your free copy now and take control of your retirement income.