Canoe EIT Income Fund is a Canadian closed-end investment trust. The investment objective of the Fund is to maximize monthly distributions relative to risk and maximize net asset value while maintaining and expanding a diversified portfolio. In other words, EIT has been created to take your money, manage it, and distribute juicy monthly dividends to help you manage your retirement budget.

Learn how to create a recession-proof portfolio. Download our free workbook now!

What Canoe Income Fund looks like

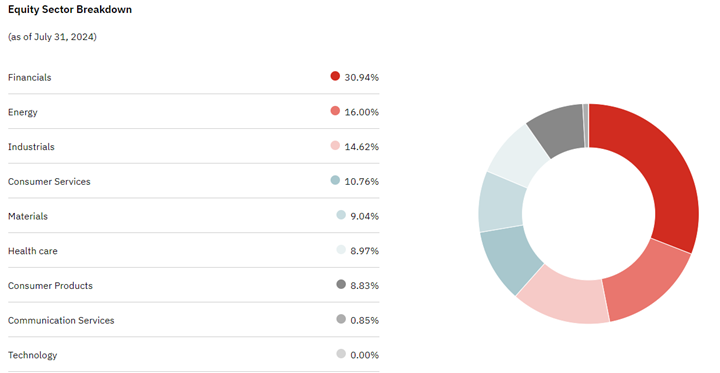

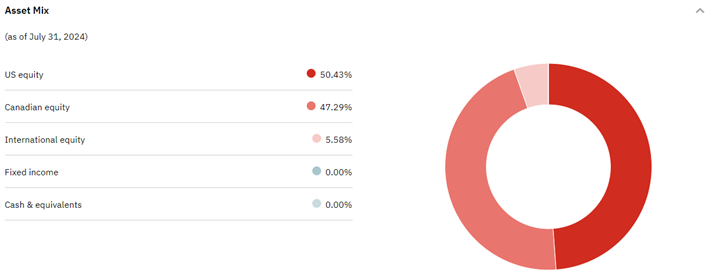

The Canadian fund includes 47.3% (7% less than last year) of Canadian equity stocks, 50.4% (+7%) of U.S. stocks, 5.58% (you read that right, the website shows 103% of the money invested…that’s probably linked to leverage.) of international equity, and 0% (in line with last year) cash. Despite having less than 50% of its assets invested in Canadian firms, its sector breakdown is heavily concentrated in financials, energy, and materials (55.98%).

Source: EIT website

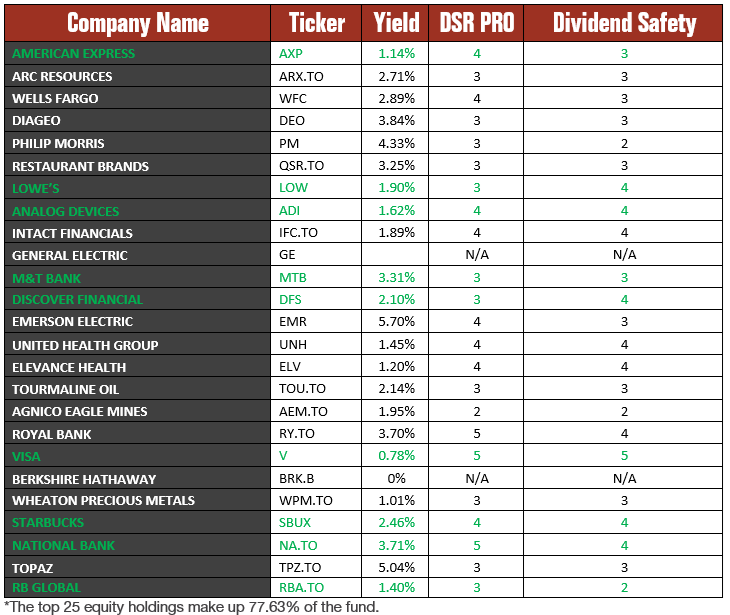

Top-25 Holdings

They have an impressive diversification of stocks from low yield to high yield with various safe stocks and other quite speculative securities. The fund has greatly diminished its exposure to the energy sector, as they have made the smart move of cashing in on many of their gains in that sector.

Another interesting point is the amount of turnover in the fund when we compare their top holdings from August 2023. I have highlighted (in green) 9 positions out of 25 (36%) that are not in the top 25 this year. Last year, it was 12 positions for a 48% turnover rate.

But my opinion does not really matter if the fund helps you retire happily. Let’s look at what does really matter though and that is how the fund’s money has been managed over time and how much you profit (or not) from the management team led by Rob Taylor, CPA, CA, CFA (yes, he needs 2 business cards to include all his titles!).

Secure your retirement. Download our Recession-Proof Portfolio Workbook.

Performance & Distributions

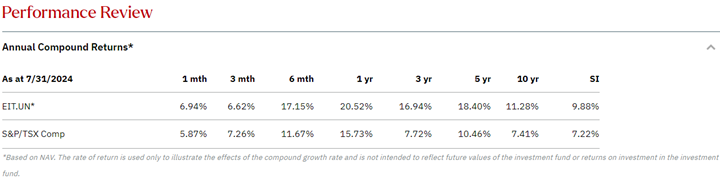

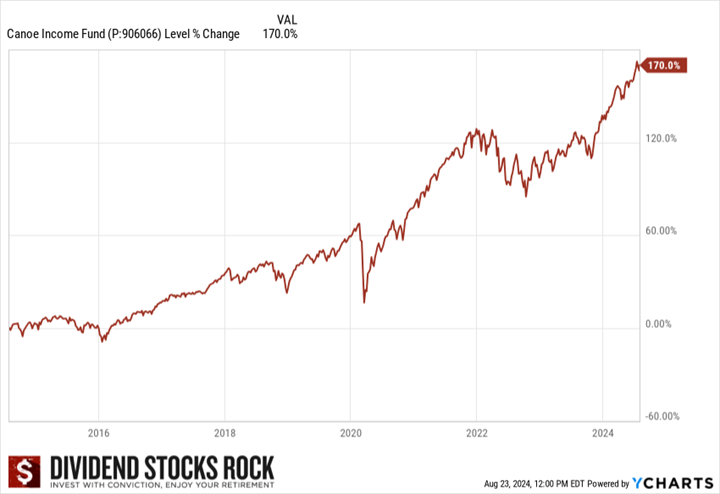

From their website, we can see that EIT has outperformed the TSX on a consistent basis (which was not the case prior to 2020). Their focus on the energy and basic materials sectors clearly paid off after the pandemic and now the fund has moved to other sectors.

However, I don’t particularly appreciate that they only use the TSX as their benchmark and ignore the S&P 500. With 50% of their portfolio invested in the U.S., it seems only fair to include U.S. and international components to their benchmark measures.

Just for fun, I ran the calculations using a portfolio with 47% XIU.TO, 50% SPY and 3% XEF.TO (for international equity) for the past 10 years, 5 and 3 years. Results include dividends and are as of 7/31/2024 to match their website.

CAGR: 10yr: 10.44%, 5yr: 12.72%, 3yr: 8.6%.

This is quite interesting, as our conclusions in 2021 and 2020 were not the same. The first two times we analyzed the fund, it had underperformed the index portfolios we created. This time, it is quite the opposite. You can see that change occurred around mid-2021 where Canoe started to surge while indexes reached a plateau and eventually decreased in 2022.

The idea of having a high-yield investment (EIT.UN.TO pays 8.5% yield at the time of writing) where distributions are paid monthly is quite interesting. If you reinvest the distribution, you could beat the market, which is quite impressive! Strangely enough, EIT.UN.TO returns are now quite similar to my personal portfolio.

The lesson here is that conclusions and returns can vary from one year to another. We will review Canoe again next year. The Canoe fund could be an interesting way to generate a high income from your investments. However, if you cash this distribution, make sure you realize two things:

#1 Your capital will not likely grow over time

#2 Your dividend will not likely grow over time

Therefore, it’s an interesting investment vehicle for income, but that income is not inflation-proof. In fact, you receive a lot less today than 10 years ago. If you reinvest the dividend in the fund, then, you get a good total return. However, you don’t get to cash the dividend to fund your retirement.

Do you see how we run into circles?

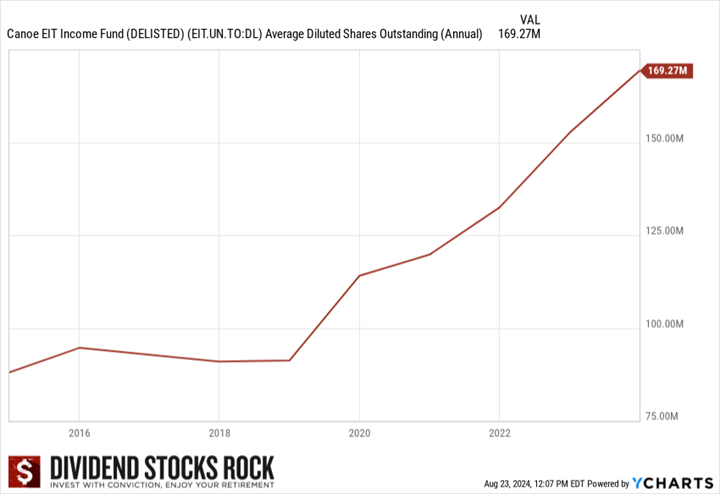

Canoe and the habit of issuing more shares

Another interesting point is that Canoe has continuously issued more units year after year since 2018. This is great for raising money to invest and capture opportunities. However, it’s not that great when you consider that it increases the amount to be paid in dividends each year.

With this kind of structure, it looks like Canoe will do well as long as we are in a bull market. If units start to tumble, Canoe will have difficulty issuing more shares to invest and pay the current dividend. This could put serious pressure on Canoe’s ability to maintain its generous distribution.

Final Thoughts

Canoe EIT income fund is not the worst investment in the world. In fact, it generated decent returns considering its dividend. While recent performance has been impressive, the fund is not perfect. First, ownership of this fund does not avoid value fluctuations when the market is shaky. If you looked at your portfolio value during corrections Canoe did not save you from headaches.

The only thing that is “guaranteed” is the dividend payment… until it isn’t. Does any Canadian remember Financial Split Corp (FTN.TO) or Dividend 15 Split Corp (DF.TO)? They were both famous for their high yields and super solid investment strategy. I will leave it to you to research them today if you are curious. Did I ever tell you there is no free lunch in the world of finance and investments?

Canoe looks good today, but it was not the same story three years ago. Can it show more consistency going forward? Only time will tell.