Our 2023 year-end review in four words: Different Investors, Different Returns. Some investors had a great year and are happy that the market is “finally back”. Others saw their portfolio value decline. What explains these discrepancies in returns in 2023?

Asset and Sector Allocation

Asset and sector allocation is what made the difference between happy and disappointed investors in 2023.

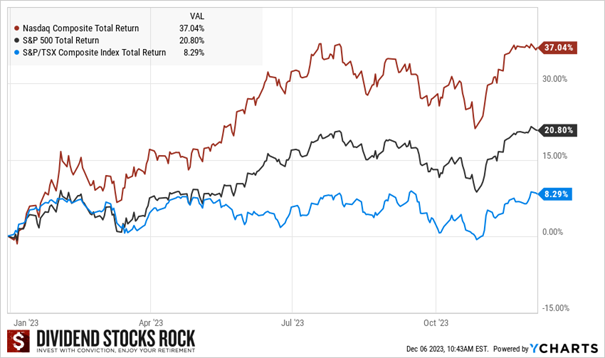

As you can see in this graph, the year was quite different depending on whether you were invested in Canada, the U.S., or heavily in the technology sector…

Excluding the latest mini bull run provoked by hints that interest rate hikes are over, the Canadian market was heading toward a flat year or worse. Across sectors, the performance in Canada and the U.S. was quite different for 2023. Next, we look at the total returns for each sector in 2023.

Learn how to create your own paycheck with our Dividend Income for Life guide!

Total Returns by Sector

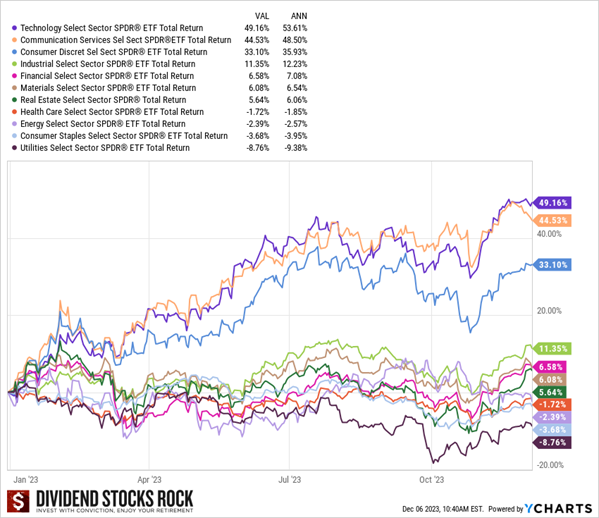

Below are the year’s total returns per sector in the U.S.

We see the surging technology sector leading the way, followed by the communication services sector. It wasn’t the AT&T’s and Verizon’s of this sector that pushed it to such heights but rather tech-focused communications stocks such as Meta (META), Alphabet (GOOG) and Netflix (NFLX). I must add the communication services ETF in the graph is a isn’t really a good representation; it skews the results favorable because it’s 47% invested in Meta and Alphabet.

While the energy sector was the savior in 2022, it was flat in 2023. The utility sector is the biggest loser, hurt by higher interest rates and poor performance from all renewable energy stocks. For more on that, see What’s Happening with Renewables?

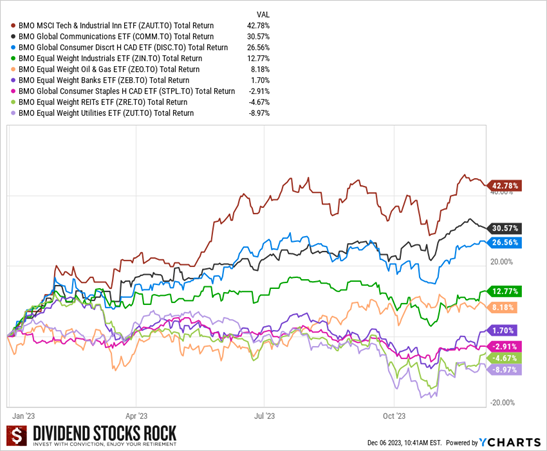

On the Canadian side, shown in the next graph, we see similar trends, but with a stronger performance from the energy sector than in the U.S. Take the BMO’s technology, communications, and consumer discretionary ETFs with a grain of salt because each includes several U.S. stocks. Banks and telecommunications companies disappointed in 2023 as did utilities and REITs.

The investment year 2023 could be summarized as follows:

- If you focused on low-yield, high dividend growth stocks, it was a success.

- If you focused on income and high yield, it was a bad year.

What’s next?

We have been spoiled over the past twelve years. In general, an economic cycle lasts about 5 to 8 years. That includes a bear market and a bull market and everything in between. The last real bear market we had began in 2008 and ended in 2009. That was 14 years ago.

Currently, we live in a strange world: inflation hurts consumers’ budgets forcing them to tighten their belt with high interest rates putting even more pressure on them and yet, the unemployment rate remains low. Why? Demographics: as our population ages, many retire, and we don’t have enough babies to take those jobs.

During the second part of 2023, we saw signs that higher interest rates were finally catching up with the economy and slowing it down. Inflation has lowered, GDP isn’t as strong (Canada even reported a negative GDP late in 2023), and unemployment rates on both sides of the border are going up by a bit.

Learn how to create your own paycheck with our Dividend Income for Life guide!

If you focus on your portfolio yield, you were unhappy with your results in 2023 and my guess is that it won’t be easy in 2024 either.

New inflation data hints at a pause in interest rates. We might even talk about rate decreases later in 2024. However, as the steak price won’t get back to 2021 levels, we are not going to see 2% mortgages or debentures in 2024. Companies will have to deal with higher interest rates when refinancing.

I said it over and over; we will continue to feel the lagging impact of those interest rate increases for many years.

Different Year, Same Plan

Studies show that most individual investors like you and me lag the market… big time. Think of famous investor Peter Lynch who managed the Fidelity Magellan Fund from 1977 to 1990 generating an annualized return of 29%. Fidelity later revealed that the average Magellan Fund investor lost money during this period. How is that possible? Investors were simply not investing with conviction, and they didn’t stick to their plan, especially at times when the market dropped.

Studies show that most individual investors like you and me lag the market… big time. Think of famous investor Peter Lynch who managed the Fidelity Magellan Fund from 1977 to 1990 generating an annualized return of 29%. Fidelity later revealed that the average Magellan Fund investor lost money during this period. How is that possible? Investors were simply not investing with conviction, and they didn’t stick to their plan, especially at times when the market dropped.

In 2022, I was overconfident, and I drifted away from my investment rules and process. As a result, I suffered from three bad investment decisions, Algonquin (AQN.TO), Sylogist (SYZ.TO), and VF Corp (VFC), in a brief period of time, which is never good for the investor’s ego.

In early 2023, I quickly got back into the driver’s seat and acted. I sold the three dividend cutters, took the loss of roughly 50% on each stock, and moved on by focusing on dividend growers with strong dividend triangle.

I could have prevented part of those losses by following my own rules, but I didn’t. Fortunately, my investment structure protects me from major negative impacts from bad investments as they are limited in size in my portfolio. Again, this highlights the importance of following your plan and sticking to your investment strategy.

For 2024, I intend to follow the same plan. My investment strategy stays the same: have a strong investment thesis backed with numbers and select companies with minimal downside.

Wishing you a successful investing year in 2024!