CNR and CNQ are two companies that hold cost advantages over their competition. Canadian National Railway (CNR.TO) is a transportation and logistics company while Canadian Natural Resources (CNQ.TO) is in oil & gas exploration and production.

They have a cost advantage because they can produce goods or services at a cheaper price than their competitors. A cost advantage can be used in two ways:

1) Crush the competition with low price

Often, the easiest way to gain market share is to sell at a cheaper price than their competitors. When they produce the same goods or services at a lower cost, they can undercut competition. This is what Canadian National Railway (CNR.TO) does.

2) Sell at the same price, but make a lot more profit

When the business model permits, some companies will sell at the same price as their competitors. Their advantage is in the higher margin they enjoy thanks to their lower operations cost. They then become money-making machines. Canadian Natural Resources (CNQ.TO) often does this.

Learn how to build and manage a portfolio that give you retirement income. Download our Dividend Income for Life Guide!

Canadian National Railway – Offering lower prices

Railroads are known to be one of, if not the cheapest way to transport goods across land. With Canada and the U.S. amongst the largest countries in the world, CNR (and Canadian Pacific Kansas City CP.TO for that matter) are quite popular. Railroads are less flexible than truck transport, but they are surely the lowest-cost transport.

But CNR is more than railway transport! Its services also include intermodal, trucking, and supply chain services. CNR’s rail services offer equipment, customs brokerage services, transloading and distribution, private car storage, and more. Intermodal container services help shippers expand their door-to-door market reach with ~23 strategically placed intermodal terminals. These services include temperature-controlled cargo, port partnerships, logistics parks, moving grain in containers, custom brokerage, transloading and distribution, and others. Trucking services include door-to-door service, import and export dray, interline services, and specialized services.

But CNR is more than railway transport! Its services also include intermodal, trucking, and supply chain services. CNR’s rail services offer equipment, customs brokerage services, transloading and distribution, private car storage, and more. Intermodal container services help shippers expand their door-to-door market reach with ~23 strategically placed intermodal terminals. These services include temperature-controlled cargo, port partnerships, logistics parks, moving grain in containers, custom brokerage, transloading and distribution, and others. Trucking services include door-to-door service, import and export dray, interline services, and specialized services.

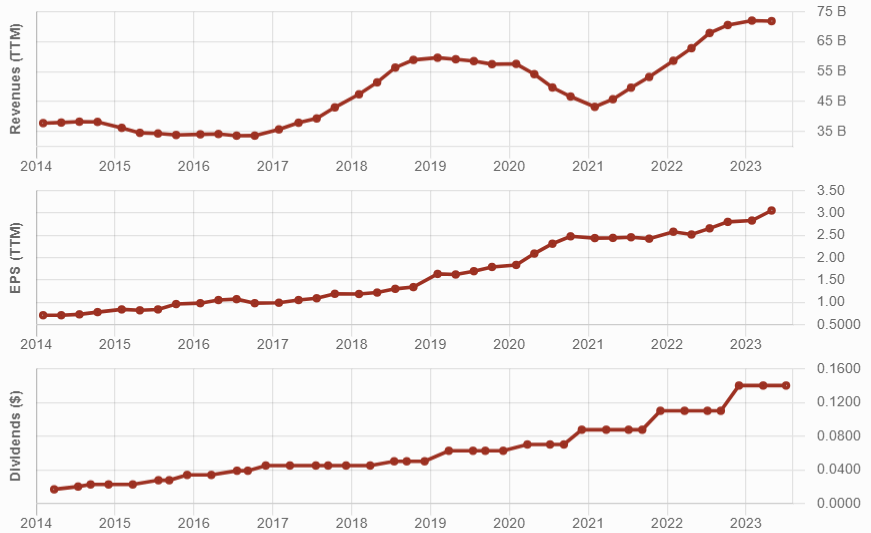

Known as “best-in-class” for operating ratios for years, CNR boasts strong operational performance, with velocity and speed staying solid metrics quarter after quarter. CNR has tirelessly improved its margins and was among the first railroad companies to do so. Today, its peers have caught up and are managed in the same way.

CNR profits from cost advantages over trucking and other transportation methods, and from the scale of its operations which is virtually impossible to replicate. These advantages give it what is called a wide economic moat, meaning that it will enjoy these benefits for 20 years or more. Therefore, it can count on increasing cash flows each year.

The good thing about CNR is that investors can always wait for a down cycle in the economy to invest in it. You can bank on it going back on a roll when things pick up and consumers and businesses buy more goods.

Canadian Natural Resources – Raking in the profits

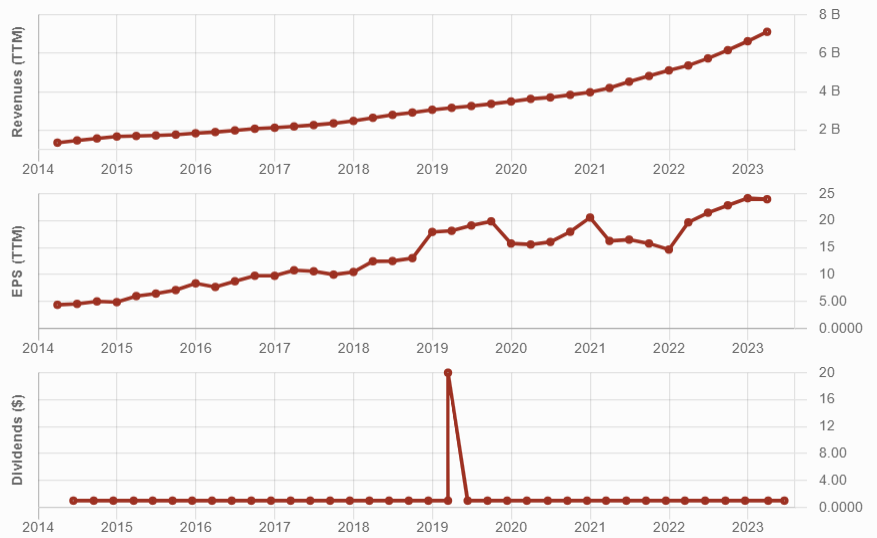

A play in the energy sector is Canadian Natural Resources, an oil and gas exploration and production company. CNQ enjoys long-life assets with low declines in its reserves. The company can produce oil and natural gas at an extremely low cost. This enables CNQ to ramp up production when prices are up and boost their margins. During down cycles, it can slow down production and still be highly profitable. In other words, its cost advantage makes CNQ a cash flow-making machine.

CNQ sits on a large asset of non-exploited oilsands and its break-even price for the WTI grade of crude is $35. However, the fact that oilsands are not exactly environmentally friendly and that more and more countries look to produce greener energy and electric cars does cool our enthusiasm a bit.

Despite this, CNQ is very well positioned to surf any oil boom. It invested heavily, and it is now generating higher free cash flow because of that capital spending. CNQ appears at the top of my list for a long-term play in the oil & gas industry. I also appreciate CNQ’s shareholder-friendly approach, as it will return 100% of free cash flow to shareholders after hitting $10B in net debt.

Ready to learn how to create retirement income? Download our Dividend Income for Life Guide!

Cost-advantaged companies in other industries

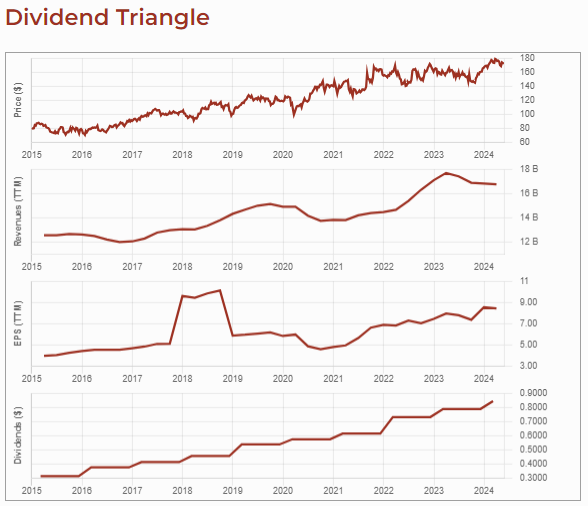

There are companies in other industries that also enjoy cost advantages over the competition. Think of Costco which positions itself as the largest customer of its suppliers to gain negotiating power and offer the lowest prices to its customers.

Walmart is another great example of a cost-advantaged business. As a dominant retailer and among the largest grocers in the U.S., WMT built its entire business model around offering “low prices every day”. Walmart “squeezes” every penny from its suppliers to 1) offer the cheapest price possible to customers and 2) crush most competitors. You don’t go to Walmart for its exceptional customer service, but rather to pay as low a price as possible for everyday goods.

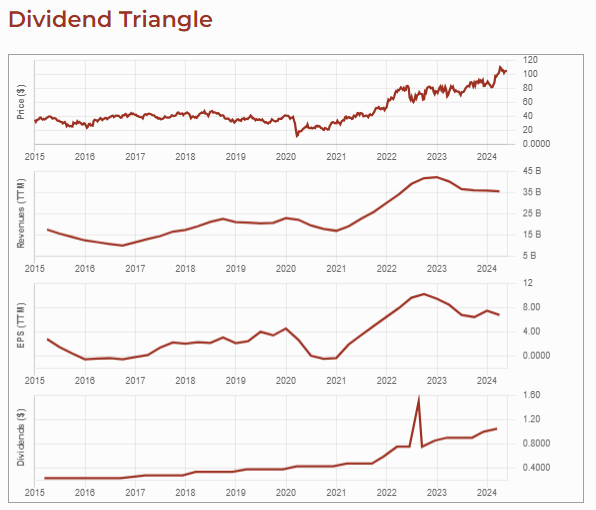

The cost advantage can be deadly. Amazon founder, Jeff Bezos, once said “Your margin is my opportunity”. Companies, such as Barnes & Noble, thought they were doing well, and that no competition could kill them. Along came Amazon with a different business model focused on building a strong cost advantage. Barnes & Noble survived, barely, but it’s not a flourishing business anymore.

Ah, forever stocks! I love them. Here I present nine stocks I include in my Canadian Forever Stock Selection and briefly explain why. A forever stock is one I’d buy for the long haul, 10+ years. It offers reliable growth and is so solid and resilient that I can forget about it and sleep soundly.

Ah, forever stocks! I love them. Here I present nine stocks I include in my Canadian Forever Stock Selection and briefly explain why. A forever stock is one I’d buy for the long haul, 10+ years. It offers reliable growth and is so solid and resilient that I can forget about it and sleep soundly.