High yield Canadian stocks that beat the market? Yes, here are some examples. After writing so much about the virtues of low-yield, high-growth stocks, it’s time to talk a bit about high-yield stocks. To be fair, they’re not all bad investments. Some provide a fairly sustainable source of high income for investors, and some even manage to beat the market!

High yield Canadian stocks that keep giving

I searched for high yield companies that also matched the overall stock market performance of late. On October 7, the iShares S&P/TSX 60 ETF (XIU.TO) 5-year total return (capital + dividends) was about 52% and the SPDR S&P 500 ETF Trust (SPY) was about 74%. So, I search for all companies generating a total 5-year return of at least 50% and a yield of at least 6%; this returned 101 stocks.

Here are three of the Canadian stocks that provided high yields while matching or outperforming the market for total return over the last 5 years. Caution: there’s no guarantee that they will keep performing that well in the future, especially with a long-predicted recession looming. As always, do your due diligence when considering any investment.

Want a portfolio that provides enough income in retirement? Download our Dividend Income for Life Guide!

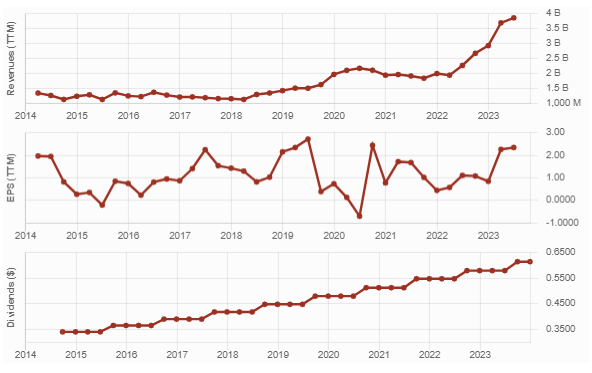

Capital Power (CPX.TO) 6.03%, +89.62%

Not long ago, Capital Power was a darling as its stock price defied gravity while other utilities were doing down. While the market has some reservations about utilities due to their sensitivity to interest rates, CPX continues to show a relatively strong dividend triangle. Management increased the dividend from $0.58/share to $0.615/share. A 6% increase in the middle of an “interest rate crisis” is bold and shows strong confidence.

CPX is dependent on Alberta’s economy, where it generates 56% of its electricity and 62% of its revenues. That is a concern. It means its share price tends to move up and down with the oil market. As a capital-intensive business, CPX must invest heavily and continually to generate cash flow. The market might not like additional debt to fund projects in the coming years. With interest rates rising, this debt could become a burden and obtaining liquidity from capital markets might get more difficult. Finally, weather variations can affect results as seen recently when a warm winter reduced AFFO.

Considering its wind energy projects and the robust economy in Alberta, CPX expects to increase its dividend by 6% through to 2025, welcomed news for income seeking investors. Through its successful transformation into a more diversified utility company, CPX is earning its place among robust Canadian utilities such as Fortis, Emera, and the Brookfield family.

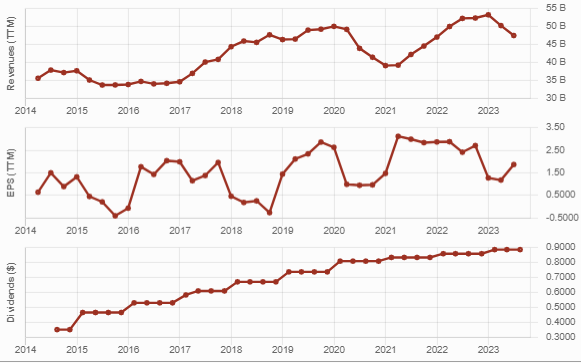

Enbridge (ENB.TO), 7.90% yield, +50.20%

I smiled at the 50% total return for Enbridge as I remembered buying it in 2017 and selling at the beginning of 2023 with a good profit. ENB is a good example of a deluxe bond that could eventually evolve into a dividend trap!

With inflation and higher interest expenses, Enbridge faces higher operating costs. This could seriously jeopardize growth because ENB can’t find any growth vectors without getting into more debt. In September 2023 ENB announced it was taking on more debt and issuing shares to acquire a gas transmission business for $19B CAD. I like the predictable cash flow it’ll bring, but I’m concerned about the ever-increasing debt level.

Total long-term debt stands at around $80B, up from $67B in 2017; it’s time to see some debt repayments. ENB’s interest expenses are continuing to increase, and it won’t end any time soon. Since building and maintaining pipelines requires significant amounts of capital, ENB may find itself in a position where cash is short.

Enbridge operates high-quality assets, with almost impenetrable barriers to entry. There’s no doubt the business model is solid. The problem is the rising debt level. ENB won’t be able to rely on its pipelines forever; many projects were revised or paused by regulators over the past few years. TRP’s latest Keystone pipeline spills remind us of the environmental risks of this industry.

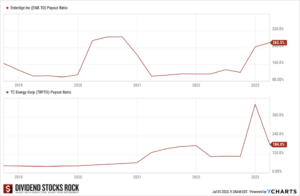

ENB has paid dividends for 65 years, with 28 consecutive years with a dividend increase. Further dividend growth is expected at around 3%. Management aims to distribute 65% of its distributable cash flow, keeping enough for CAPEX. Consult their latest quarterly presentation for their payout ratio calculation.

See how Mike’s dividend growth investment strategy can secure your retirement. Download our Dividend Income for Life Guide!

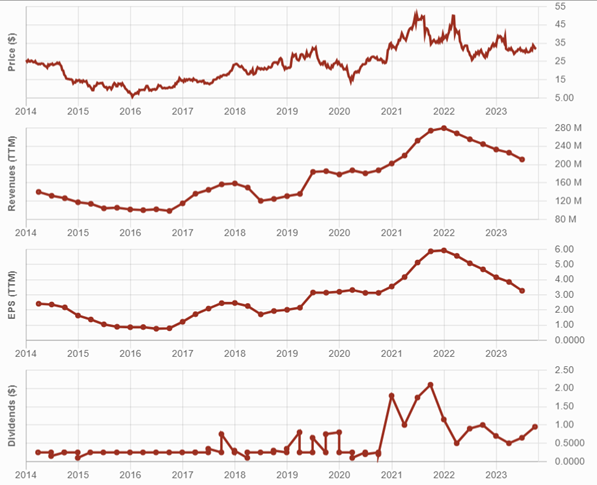

Labrador Iron Ore Royalty Corp (LIF.TO) 8.89% yield, +101.4%

LIF receives a 7% gross overriding royalty on iron ore products sold by Iron Ore Company of Canada, a producer and exporter of iron ore pellets and high-grade concentrate. The mine enjoys a high-quality source of products with sufficient inventory to support future expansion. IOC is well-positioned strategically due to the high quality of the iron ore and its ability to produce higher margin pellets.

LIF’s business model depends on factors that are barely in its control; commodity prices, unions, and demand that can affect production of the underlying business. Since we only have data from 2010, we have yet to see how LIF will navigate a recession. However, we can see the effect of an iron spot price decline, and how quickly it happens, as it did in 2022.

The company must keep a large cash reserve for additional CAPEX. After all, the royalty-based business is only good if you have high-quality assets. The narrative has been quite enticing as LIF surfed on the highest iron prices in its history, and demand seemed stable. Things took a turn, and both the stock price and dividend dropped.

LIF pays a variable dividend: base payment of $0.25/share quarterly + special dividend based on royalties received. You can’t expect a stable dividend, but a yield usually in the high single-digit to double-digit! The generous yield is inflated by the royalty payments.

When iron ore trades at a high price, LIF seems the most generous stock in town. The opposite is also true. Demand for iron ore will come and go, affecting its price, and, therefore, your dividends. It’s not a bad investment if you’re able to stomach the price and dividend fluctuations.

Last thoughts about high yield Canadian stocks

As you know, I prefer higher total return over high yield. Overall, low yield high growth stocks provide higher total return, so I favor them for my dividend growth investment strategy. However, a few solid higher yield companies that match or exceed the market can be good assets to have in a portfolio. Be sure to monitor them quarterly though, to ensure they don’t become dividend traps!