If you’re looking for a strong Canadian stock in the materials sector to add to your buy list, take a look at CCL Industries. The world’s largest producer of pressure-sensitive and specialty extruded film materials, CCL offers products and solutions to address decorative, packaging and labelling, security, loss prevention, and inventory management needs.

A global presence, CCL employs over 25,000 people in 200 production facilities in 43 countries. Its revenues come from North America (41%), Europe (32%), and Emerging Markets (27%).

CCL Business Model

Operating through four segments, CCL Industries sells its solutions to global corporations, government institutions, small businesses, and consumers.

Operating through four segments, CCL Industries sells its solutions to global corporations, government institutions, small businesses, and consumers.

- The CCL segment converts pressure sensitive and specialty extruded film materials for a range of decorative, instructional, functional and security applications.

- The Avery segment supplies labels, specialty converted media and software solutions.

- The Checkpoint segment develops radio frequency (RF) and radio frequency identification (RFID) based technology systems for loss prevention and inventory management applications, and labeling and tagging solutions, for the retail and apparel industries.

- The Innovia segment produces specialty and layered surface engineered films for label, packaging, and security applications.

Investment Thesis

An international leader with a well-diversified business that is based in Canada is a rare find. With its 2013 major acquisition of business units from Avery, the world’s largest label producer, the company set the tone for several years of growth. Bolstered by its earlier success, CCL also bought Checkpoint and Innovia, and it keeps making more acquisitions.

CCL is still able to generate organic growth (roughly 4-5%) on top of its growth through acquisitions. You can rest assured that management’s interests are aligned with yours since the Lang family still owns 95% of CCL’s A shares with voting rights. We appreciate CCL’s capital allocation that includes a mix of dividend, share buybacks, acquisitions, and CAPEX. With its attractive PE ratio, CCL can generate more growth through acquisitions.

CCL’s Last Quarter and Recent Activities

CCL reported a strong first quarter in 2023; revenue up 9% and EPS up 12%, with organic growth of 1.4%, acquisition-related growth of 3% and a 4.2% positive impact from foreign currency translation. Sometimes, doing business across the world works out! By segment, CCL sales were up 7.5%, Avery was up 44%, Checkpoint was up 3.6%, and Innovia was down 14%. In constant currency, the company saw high single-digit growth for revenue and earnings. It is looking good for the rest of the year!

In less than 30 days, in June and July 2023, CCL made three small acquisitions:

- It bought Pouch Partners for $44M in an all-cash deal. Pouch Partners supplies highly specialized, gravure printed & laminated, flexible film materials for pouch forming, including recyclable solutions, with sales of $104M in 2022.

- It announced the acquisition of Oomph Made for $7.1M. CCL said Oomph had sales of C$6.7M in 2022. This adds to Avery’s growing portfolio of access control, badging and credentials technologies, products, and brands focused on the retail, hospitality, live events, and conferencing markets.

- It bought privately held Creaprint S.L., a specialist producer of In Mould Labelling (IML) with sales of $17M in 2022, for a debt and cash-free purchase consideration of $38.1M. This acquisition brings IML technology and expertise to global CCL Label operations.

Want other stock ideas for your watch list? Download our Dividend Rock Stars list!

DOWNLOAD THE LIST HERE

Potential Risks for CCL.B.TO

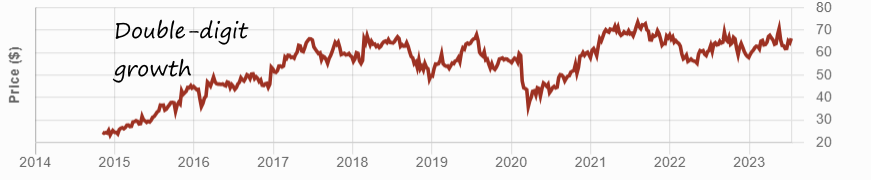

We often see rising stars such as CCL yielding a high return over a short period. In 2014, the stock traded at approximately $15, steadily rising to $62 in 2017, peaking at $72 in 2021, and now around the $66 mark. CCL is a leader in many sectors, but double-digit growth will be hard to achieve going forward.

The possibility of a recession is affecting investor interest for this stock. CCL used leverage for its acquisitions many times in the past few years. Further acquisitions to support growth might be riskier as many expect a global economic slowdown. CCL also faces inflation headwinds as the cost of raw materials continues to rise.

CCL.B.TO Dividend Growth Perspective

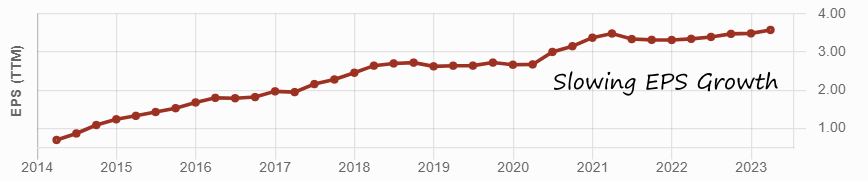

CCL shows a nearly perfect dividend triangle over the past 5 years, with strong revenue and dividend growth. However, earnings are beginning to slow down.

CCL’s business model is built on repeat orders generating consistent cash flows. With their low payout ratios, investors can expect dividend growth for many years. After a smaller increase in 2020, CCL roared back with yearly dividend increases of 17%, 14%, and 10.4% from 2021 to 2023. It will be interesting to see how CCL will grow its payouts going forward with EPS not growing as fast. With a payout ratio of 25% and a cash payout ratio of 35%, there is nothing to worry about.

Final Thoughts on CCL.B.TO

I look at CCL.B.TO as an educated guess; it’s almost perfect but I expect price fluctuations and I know the risks. As it operates in the cyclical materials sector, CCL faces potential headwinds from a looming recession and increased raw material prices. That being said, the dividend is safe, and the company can sustain dividend growth for several years.

If you are looking for a company focused on growth by acquisition, and you can live with fluctuations in this uncertain economic environment, CCL might be for you. Or you can keep CCL on your watch list while you wait to see how the economy evolves over the next months and quarters.