The Smith Manoeuvre is a Canadian strategy that is designed to structure your mortgage so that it is tax deductible.

Since the Real Estate market has gone up in value significantly over the past few years, I’ve decided to use some of that equity sleeping in my house to invest in the stock market.

For Canadians, this means I’m doing the Smith Maneuver (transforming the interest paid on my mortgage into a tax-deductible expense). For all other investors, this article will talk about leverage in general. Should you borrow to invest? What’s the possible outcome? What are the risks? How to start investing with borrowed money? These are the subjects we will discuss today!

Why do a Smith Manoeuvre?

First things first, the Smith Manoeuvre includes leverage. This means borrowing money to invest. This is not for everyone (more on that later), please do your due diligence and make sure you have the right risk profile before using leverage.

All right, now that we have the disclaimer out of the way, here’s some background information from yours truly. In 2003, I completed my bachelor’s degree with a double major (finance & marketing). I started a job at National bank in the credit department for partnerships with Power Corporation. My goal was to help financial advisors build credit applications for their clients who wished to use leverage to provide capital for investments. In other words, I was the architect behind millions of dollars of investment loans.

I also used the Smith Manoeuvre for several years back then with great success. I saw the best and the worst of this strategy throughout those five years. I’ve seen investors build enormous wealth and others have burned down tens of thousands of dollars on a margin call. I can’t stress this enough; leverage can bring the best out of the stock market and can also destroy your wealth. Please use this strategy with caution.

Wealth generation

Why did I decide to use such a “dangerous” strategy? Because I have time, knowledge and an incredibly high-risk tolerance on my side. The math behind leverage is quite simple. If you can borrow money at a 3-4% interest rate and then invest it at a 6-7% return, you can create wealth out of thin air.

With conservative numbers and $333.33 per month ($4,000 / 12), you can create more than half a million dollars in 30 years.

Imagine borrowing $100K at 4% for the next 30 years. The cost out of pocket would be $4,000 per year, or $120,000 for the entire duration of this loan. Keep in mind that the $4,000 doesn’t move (unless your interest rate changes). This means that $4,000 in 20-30 years from now isn’t that much if you factor inflation.

Now if you take that $100K loan and you invest it at a 6.5% average annual return, 30 years later your investment would have grown to $661K. You could then pay off your loan and end-up with more than half a million dollars. Over 30 years, you turned $120K into $561K (more than 4.5 times your investment). With leverage, the advantage is that you turned a 6.5% return into 9.1% (you must achieve a 9.1% investment return on a yearly investment of $4,000 to reach $566K in 30 years.

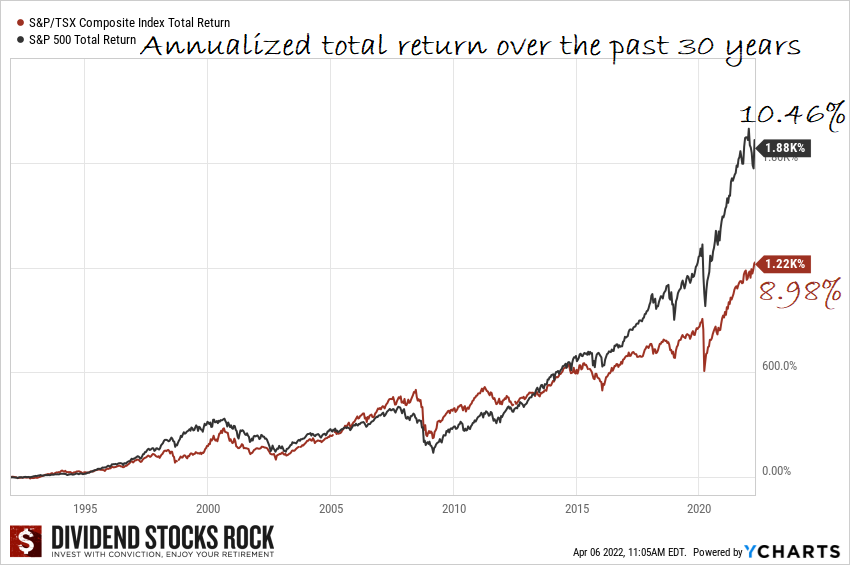

Using a 6.5% expected return is quite conservative (see the chart of the S&P 500 and the TSX on the following page). I could potentially talk about 8.5% return and how you could transform the same $120K in interest payment into more than $1M net of debt.

But that’s daydreaming and you must also consider taxes applicable to this strategy. Now that you understand the wealth generation ability, let’s talk a little bit more about the dangers inherent in this strategy.

The danger of leverage – This is not for everyone

While I used conservative numbers (a 100% equity position should generate an annualized return of 6.5% over a 30-year period), this is still a positive scenario. If you borrow $100K today and your investment goes down by 30%, you then have $70K invested and you are still paying interest on a debt of $100K. You could also get sick or need additional money for many reasons. These perspectives are enough to make a lot of investors sick. At best, leverage should be a complement, not a “all-in” strategy. It could turn even worse if you have a margin call.

If you use your investment as collateral, there is a good chance that the bank will set a minimum value for your portfolio to maintain the loan. When your portfolio goes down too low too fast, the bank will “call you” and ask you to put more money in the portfolio. If you don’t have liquid assets, the bank would simply sell your investments and use the proceeds to cover the loan (or a part of it).

Because I want to slowly build my leveraged portfolio and I don’t want to get squeezed by a margin call, I’ve decided to use my house as collateral for my leverage strategy. Here comes the Smith Manoeuvre!

What’s the Smith Manoeuvre?

The Smith Manoeuvre is a Canadian strategy that is designed to structure your mortgage so that it is tax deductible. A financial planner named Fraser Smith introduced this concept where you borrow money against the equity in your home, invest it in income-producing entities (dividend paying stocks), and use the tax return to further pay down the mortgage. It’s not that impressive for our fellow Americans since their mortgage interest is already tax deductible. But it’s a big thing for Canadians since we don’t have this advantage!

To set this strategy up, you need a home equity line of credit (a source of revolving credit). Then, each month, you pay off a part of your mortgage (imagine $500 in capital). Right after you pay off that capital on your debt, you use the home equity line of credit (HELOC) and borrow that same $500 and invest it.

| Month | Mortgage | HELOC | Interest paid | Investment Account | Net Wealth Creation |

| 0 (start) | -$200,000 | $0 | $0 | $0 | 0 |

| 1 | -$199,500 | -$500 | $1.66 | $502.70 | $1.04 |

| 12 | -$194,000 | -$6,000 | $130.04 | $6,215.50 | $85.46 |

| 360 | -$20,000 | $180,000 | $108,300 | $556,084 | $267,784 |

Following this chart, I could transform $180K of debt into a tax-deductible mortgage by simply using $500 a month for my leverage strategy. You could go a lot faster by increasing the amounts. Obviously, if you boost the amount invested or increase the percentage of expected return, the strategy looks even more attractive.

The largest advantage of leverage (on top of the tax deductibility) is the power of compounding interest. While the interest you pay monthly doesn’t compound, the amount invested is compounding. Throughout time, a small difference of 2.5% (4% interest vs 6.5% investment return) creates thousands of dollars even if you start small.

All about long-term

The point here isn’t to make you dream about riches, but rather to show you how even a conservative leverage strategy could create incremental wealth. The plan I’m about to discuss applies to the start of my Smith Manoeuvre (with $500 a month) but could be applied to a larger leverage amount either using a monthly investment or a lump sum payment.

Keep in mind that the basic rules of leverage will apply on a $500 or a $500,000 loan. The way you build your portfolio and how you should approach this strategy remains the same. Numbers are just growing with zeroes, but they react the same to the power of compounding interest.

In the next two parts of this article, I’ll share with you my plan and the portfolio model I wish to build in the coming years. I will show you how to use DSR tools to build your own leverage strategy.

The Smith Manoeuvre Plan

The purpose of this exercise isn’t to make you follow my plan and invest the same way. I want to provide you with a guideline as I am building this wealth creation strategy. As I successfully built my pension portfolio using exclusively Dividend Stocks Rock tools, I’m doing the same thing for the Smith Manoeuvre portfolio. Numbers and details could change depending on your financial situation, your age, and your risk tolerance. Again, do your own due diligence.

Opening a margin account allows options

First things first, which type of account should you use to invest using leverage? Since I’m a bit crazy, I’ll be opening a non-registered margin account. To make your leverage strategy successful, having a non-registered (meaning a taxable account) is mandatory. One of the perks of leveraging is to be able to use the interest you paid on your loan against the investment income you generated. Therefore, using the 4% interest rate and the 6.5% expected returns numbers, the first 4% return of the portfolio is “tax free”.

Margin account

Opening a margin account instead of a regular non-registered account is to give me additional flexibility. My goal isn’t to use margin on top of borrowing money. That’s what we could call a “double-dip”. However, if the market drops drastically, I’d like to have additional liquidity ready to be deployed. Imagine if my pension plan was in a margin account during March of 2020. I could have easily borrowed $50K and boosted my positions into amazing companies like Canadian Banks, Telcos, Utilities and Tech stocks.

My margin account also allows me to trade options. Since the goal of this portfolio is to generate investment income, I would also leave the door open to writing covered calls in the future. This would obviously not happen right away, but I would rather be set with the most flexible investment account upfront. Then, I don’t have to worry about any other paperwork.

Setting a budget

Once I decided to open a margin account allowing option trading, it was time to determine how much money I wanted to borrow each month (or a lumpsum amount if you have lots of equity sleeping in your house). Keep in mind that leveraging should be a complement to your wealth generation plan. Your financial plan should not rely solely on leverage.

The reality of a business owner is that there are always a thousand things going on in my financial life. Therefore, I don’t want to go “all-in” with my Smith Manoeuvre for now. For this reason, I thought of starting with $500 per month. This enables me to keep my financial flexibility (and continue to support my children as they go to college!). I will revisit this amount separately each year.

If you intend to use a larger amount for your leverage strategy, I’d suggest you consider two things. First, the amount of interest that must be paid monthly on that loan. It’s fun to imagine the compounding interest on a $250,000 investment over the next 20 years, but this requires cash flow in the meantime. At $250K, we are talking about a very nice car payment $833.33/month at 4%. To make sure the leverage strategy works, the most important thing is to have time. Therefore, you must ask yourself if you can afford a “BMW payment” for the next 20 years or so.

Investment rules

As you know already, I like to keep things simple. There is no need to have a complex investing strategy because you have borrowed money to invest. However, there are a few more rules to observe for this specific approach.

#1 Follow the DividendStocksRock methodology

When you borrow to invest, you want to reach a balance between generating an interesting total return and making sure you don’t put your portfolio at risk. Taking “bets” would end-up badly in a leveraged portfolio while focusing on dividend growers will achieve this balance. The DSR methodology to pick stocks will apply perfectly to this strategy (but I’ll add rule #4 in my stock selection process).

#2 Invest for the long term (minimum 20 years)

I’m currently 40 and I plan to use this strategy for the next 30-40 years. Since it’s a compliment to my wealth generation plan, I will be able to keep my leverage strategy above 70. The idea with leverage is to use compounding interest to your advantage. You can only do that over a long period of time.

#3 Invest 100% in Canadian stocks

I’m not your tax guy, but if you are Canadian and you want to play around taxes, it would be a good thing to invest in Canadian stocks to benefit from the preferential Canadian dividend tax treatment. Only Canadian corporations will pay eligible dividends. Therefore, I’ll keep my love for U.S. dividend growers in my tax-sheltered pension (LIRA) and retirement (RRSP) accounts exclusively.

#4 Generate a minimum yield of 5.5%

Right now, my HELOC interest rate is set at 5.4%. Therefore, my portfolio must generate at least 5.5% in dividend income. Again, I’m not your tax guy, but if you are Canadian and you wish to deduct the interest you pay against your investment income, it can’t be used against capital gains (e.g., it must be interest or dividend income). Then again, it doesn’t mean that all stocks in your portfolio will offer a 5% yield and above, but the total generated by the portfolio must be in that range.

Smith Manoeuvre Execution – Portfolio Model

To select the companies “worthy” of my leveraged portfolio, I will get inspiration from the Canadian Retirement portfolio and the 100% Canadian portfolio models. I’m looking at stocks offering a decent yield (minimum of 3%) but with some growth opportunities as well. I used the DSR stock screener, the watch list (PRO feature) and the portfolio builder (PRO feature) to build my portfolio model. If you can’t use the DSR stock screener, you can look at the Dividend Rock Stars List here.

Stock selection using DSR stock screener

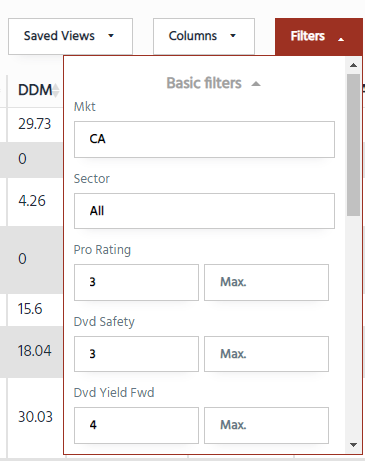

The first step in finding interesting stocks is to go to the Canadian Retirement portfolio and the 100% Canadian portfolio models’ pages and select companies with a minimum rating of 3 for both the DSR PRO rating and the Dividend Safety Score. I also added a minimum dividend yield of 4% as I want to make sure I can use the full 5%+ interest rate that will be charged on my loan by the end of the year. Right now, I’m at 5.4% on a variable rate. That helped me to select a few stocks, but it wasn’t enough to build a complete portfolio. I wanted to double-check across our entire stock library.

The first step in finding interesting stocks is to go to the Canadian Retirement portfolio and the 100% Canadian portfolio models’ pages and select companies with a minimum rating of 3 for both the DSR PRO rating and the Dividend Safety Score. I also added a minimum dividend yield of 4% as I want to make sure I can use the full 5%+ interest rate that will be charged on my loan by the end of the year. Right now, I’m at 5.4% on a variable rate. That helped me to select a few stocks, but it wasn’t enough to build a complete portfolio. I wanted to double-check across our entire stock library.

Then I used the same filter with the stock screener. I don’t want to start too narrow. This simple set of filters gave me a list of 75 companies. To build a diversified portfolio, I’d like to have about 20 stocks. The plan is to buy one position each month over the course of almost two years. Having to investigate 75 stocks upfront seems a bit overwhelming.

So, here’s my trick: I kept the filters in place and looked at each sector one by one. After all, there is no point in looking into 10 stocks in the same sector. If this happens, I can always add more minimum metrics or select stocks with a rating of 4 for the PRO rating or the Dividend Safety Score.

I then selected my favorite 3-4 companies per sector to see how many companies I could rack up. Between both techniques, I got to a short list of 22 stocks that might make a good fit for my portfolio.

Deep dive with the watch list

Before I started my research with the stock screener, I emptied my watch list. The watch list enables you to see only the stocks you have selected in the screener. This is great to create a group of companies you like and want to follow going forward.

I selected each stock that looks interesting by clicking on the star button on the left side of the stock screener. Those selections are then automatically reported to the watch list.

Why would I bother to add all those stocks to a watch list? For two reasons:

#1 I will invest in new companies each month for a long time. I want to keep a close eye on my prospects.

#2 I can then look at my favorite stocks and download the excel spreadsheet with all data

While I love our stock screener, when you look at 30 financial metrics, it’s not that easy to see them and sort them as you want. Excel is a better software to use to make an additional triage among the list of your potential stocks. Then, I can read each stock card and start building my portfolio! Will I go ahead and buy the 22 stocks? Let’s build a fake portfolio to see what it looks like, shall we?

While I love our stock screener, when you look at 30 financial metrics, it’s not that easy to see them and sort them as you want. Excel is a better software to use to make an additional triage among the list of your potential stocks. Then, I can read each stock card and start building my portfolio! Will I go ahead and buy the 22 stocks? Let’s build a fake portfolio to see what it looks like, shall we?

Sector allocation verification with the portfolio builder

The last thing to do before pressing the buy button is to check to see if the portfolio makes sense. I won’t have to make ~20 buy decisions today, but it helps to have an idea of where I’m going with my purchases. Therefore, I’ve built a fake portfolio using the portfolio builder. Good news: in a few months, you’ll be able to select which portfolio you want in your consolidated reports. You will select which portfolio(s) you want and generate as many reports as you wish!

Here’s the list of all the potential stocks after the review:

| Symbol | Name | Sector | Pro Rating | Dvd Safety | Dvd Yield Fwd |

| AP.UN.TO | Allied Properties REIT | Real Estate | 4 | 3 | 6.74% |

| AQN.TO | Algonquin Power & Utilities | Utilities | 4 | 4 | 6.81% |

| ARE.TO | Aecon Group | Industrials | 4 | 3 | 7.72% |

| AW.UN.TO | A and W Revenue Royalties Income Fund | Consumer Discretionary | 4 | 3 | 5.63% |

| BEP.UN.TO | Brookfield Renewable | Utilities | 4 | 4 | 4.34% |

| BEPC.TO | Brookfield Renewable | Utilities | 4 | 4 | 4.14% |

| BIP.UN.TO | Brookfield Infrastructure | Utilities | 4 | 4 | 4.04% |

| BMO.TO | bmo | Financials | 4 | 4 | 4.35% |

| BNS.TO | ScotiaBank | Financials | 4 | 4 | 6.22% |

| CM.TO | CIBC | Financials | 4 | 4 | 5.31% |

| CNQ.TO | Canadian Natural Resources | Energy | 4 | 4 | 4.12% |

| CRT.UN.TO | CT REIT | Real Estate | 4 | 3 | 5.44% |

| EIF.TO | Exchange Income | Industrials | 4 | 3 | 5.47% |

| EMA.TO | Emera Inc | Utilities | 4 | 3 | 5.63% |

| ENB.TO | Enbridge Inc | Energy | 4 | 3 | 6.39% |

| FTS.TO | Fortis Inc | Utilities | 4 | 4 | 4.30% |

| GRT.UN.TO | Granite REIT | Real Estate | 4 | 4 | 4.13% |

| GWO.TO | Great-West Lifeco | Financials | 4 | 4 | 6.48% |

| KMP.UN.TO | Killam Apartment REIT | Real Estate | 4 | 3 | 4.28% |

| NET.UN.V | Canadian Net REIT | Real Estate | 4 | 4 | 5.50% |

| PKI.TO | Parkland Corp | Energy | 4 | 3 | 5.12% |

| POW.TO | Power Corp. | Financials | 4 | 4 | 5.98% |

| SYZ.TO | Sylogist | Information Technology | 4 | 3 | 8.74% |

| T.TO | Telus | Communication Services | 4 | 4 | 4.92% |

| TD.TO | TD Bank | Financials | 5 | 4 | 4.03% |

| TPZ.TO | Topaz Energy | Energy | 4 | 4 | 5.13% |

| TRP.TO | TC Energy | Energy | 4 | 3 | 5.99% |

I’m not saying this will be my final portfolio. However, it’s a great start and it gives me a very strong buying list to look at. Each month, I’ll go deeper in a specific stock and adjust along the way. Remember, investing is like hiking, you don’t get to the summit or get a great view during the first 100 meters.

Why Using Leverage? Should You Do It At Any Age?

I’d like to end this article on a very important topic; at what age leverage becomes irrelevant? I’ve highlighted the point of risk tolerance several times. If you can’t sleep when your portfolio is down 10%+ or because interest rates are rising, leverage isn’t for you. Not now, not at any age. Period.

As a banker, we used a few rules to qualify investors for an investment loan (on top of having a very high-risk tolerance). I’ve modified them a little:

Smith Manoeuvre Rules

#1 Don’t borrow too much. I believe the rule back then was to not borrow more than 50% of your liquid net worth (liquid = investments, no houses or rental property)

#2 Make sure you can afford to make the loan payment. The investment and growth parts are fun, but if you can’t pay the loan from your regular income, don’t go there. You don’t want to squeeze your budget with another loan.

#3 Invest for 20 years or go home. The rule was more to do it at least for 10 years, but it seems a bit short to my taste. The idea is to go through a full economic cycle (recession + expansion). If you can let your investments ride through several economic cycles, you will realize the full power of compounding interest. In other words, it comes down to: Don’t borrow what you cannot afford and let your investment run for a long time.

If you can withstand fluctuations (and you keep your eyes on the long-term horizon), using leverage before 50 is a very smart move. I’ve used leverage several times in the past and it paid off nicely. Using leverage for 20-40 years seems like a no brainer. But is it the case when you are 50 or even 65?

Should you use leverage at 50? Over 65?

Assuming your life expectancy is somewhere between 85 and 95, if you start a leverage operation at 50, this means you have a good 35 to 45 years to make it bloom. This should be enough to generate wealth for the next generation (and hopefully for your grandchildren too!). Therefore, it would make sense (assuming, again, that you have a high-risk tolerance).

Finally, The “last chance” to do a leverage operation is probably when you get close to 65-70. I really focus on that 20-year period to make sure the investment grows and blooms. I don’t think it would be useful to start leverage in your 70’s as it would likely bring on more stress than anything else. Again, some people want to generate additional wealth for generations to come and this strategy provides a vehicle for that incremental growth.

I hope this article has given you some food for thought. I’ll be covering my Smith Manoeuvre in my portfolio newsletter update going forward. You’ll be able to follow my progress.