Back in February 2023, as part of my quarterly review of the DSR portfolios and my personal portfolio, I sold all shares of Enbridge (ENB) and TC Energy (TRP).

Many wonder why on earth I would do such a thing. After all, they are much beloved pipeline stocks with impressive dividend profiles; generous yields, 28 years of consecutive dividend increases for Enbridge, TC Energy not far behind with 23 years, and both are part of the 15 Canadian stocks with the longest dividend growth streaks.

Are they unsafe investments? Are their dividends at risk? Should you sell them too? The answers are 1) no, 2) no, and 3) you have to decide for yourself by doing your due diligence; review these companies quarterly to see if they are still a good fit for your investment thesis. Just because I sold them does not mean you should too.

Are Enbridge & TC Energy still safe investments?

Both companies will continue supplying an essential service and they will keep generating substantial cash flow. Like railroads, they are not going anywhere. The world needs energy and pipelines are the ones providing it. They enjoy robust contracts with their customers that, usually, are shielded against inflation and include a minimum fee that ensures the customers pay even if the pipeline is not used.

Are ENB & TRP dividends safe?

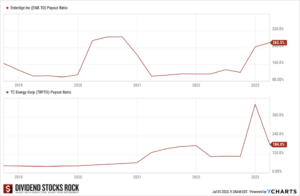

Despite their triple-digit dividend payout ratio, show in the graph below, ENB and TRP dividends are safe for now.

Let me explain. At the time of writing, the dividend payout ratio for ENB is over 200% and close to 200% for TRP, which says that they are paying more than, or close to, twice what they earn as dividends. Not good, right? Well, that’s not the complete picture here.

- The payout ratio is based on earnings, and the calculation of earnings includes non-cash items such as depreciation and impairments. Non-cash items do not affect the amount of cash a company has to pay dividends.

- Capital expenditures (CAPEX) are also included when calculating the earnings and payout ratio. Pipelines are capital-intensive businesses. CAPEX fund infrastructure projects, including investments that the company expects will be profitable and generate new revenue in the future.

To get a clearer picture of ENB and TRP’s ability to pay their dividends, we looked at the Distributable Cash per Share (DCF), which does not include non-cash items or CAPEX. The payout ratio, when calculated using the DCF rather than earnings, is well below 100% for both ENB and TRP. So yes, both pipelines can afford to pay their dividends based on the cash they generate. That doesn’t mean everything is perfect and rosy in pipeline land.

Reasons for selling Pipelines

While both ENB and TRP have done relatively well in our different DSR portfolios and I believe their dividend is safe for now, the dividend growth has slowed down and I don’t see much potential for capital appreciation going forward.

Slowing dividend growth for both ENB.TO and TRP.TO

ENB was increasing its dividend by 10% yearly before slowing down to 3% per year starting in 2021. TRP had 7% to 8% dividend increases until it lowered the targeted rate to 3% to 5% increases, although the last two increases were closer to 3%.

What is slowing down the dividend growth? Quite simply, it is getting more difficult for Enbridge and TC Energy to make money; inflation is pushing their costs up, and higher interest rates are making their debt more expensive.

It costs of lot money to maintain and expand pipeline infrastructure, so both ENB and TRP rely on borrowing. The rise in interest rates, started in 2022, has already increased ENB and TRP’s interest expenses. With both the U.S. Federal Reserve and the Central Bank of Canada clearly not expecting interest rates to go down in 2023, it will only get worse for ENB and TRP as they pay back their older debt, at the lower pre-2022 rates, and add new debt at the higher rates.

Inflation and increasing interest rates are hurting ENB and TRP. This will go on for a while, limiting their ability to increase their dividends. While their yields are generous, as a dividend investor, I look for robust dividend growth.

ENB & TRP shares price won’t go anywhere

In the current landscape, I do not see a lot of room for capital appreciation for ENB and TRP.

They lack growth vectors. New pipelines are difficult to build; they are subject to substantial regulations and are expensive to build. There are often delays in construction, for a variety of reasons including supply shortages, labor shortages, and regulatory complexities, which translate into higher costs, even more so now that inflation has kicked in.

ENB and TRP will also have to deal with Canadian carbon emissions taxes that are expected to increase to $170 a ton by 2030 from $40 today. Enbridge is already on board to reduce its emissions to offset this increase but doing so requires considerable capital investments.

These obstacles to growth are only made worse by the higher interest rates that make borrowing more expensive.

In closing: Why I sold Enbridge and TC Energy

While both ENB and TRP have done relatively well in our different DSR portfolios and I believe their dividend is safe for now, the dividend growth has slowed down and I don’t see much potential for stock appreciation going forward.

Besides enjoying a generous dividend, I don’t see how ENB and TRP will make me richer over the coming years. Since my strategy is focused on total returns by selecting dividend growers, they do not meet my investing strategy. Both pipelines will either end up as deluxe bonds or dividend traps.

Having said that, I think it’s fair to say both END and TRP will continue to pay their dues for a while. There is a case for holding on to them for stability and income; however, it is essential to follow them with great attention quarterly. If you see more references in their quarterly reports to higher cost of debt, high debt ratio, impairments and charge due to delays and inflation, you’ll know that the dividend safety is under pressure.