I’m sorry to say there is no foolproof method to avoid loser stocks in your portfolio. It’s impossible to not make occasional mistakes as investors. If you can’t bear the thought of losing 30%, 40%, 50% of your investment in a stock, you should probably not invest in equities.

However, you can minimize the risks. In fact, you can reduce the number of times it happens, and you can also reduce the impact of those rotten apples in your portfolio. This starts by acknowledging our mistakes.

Recognizing our mistakes

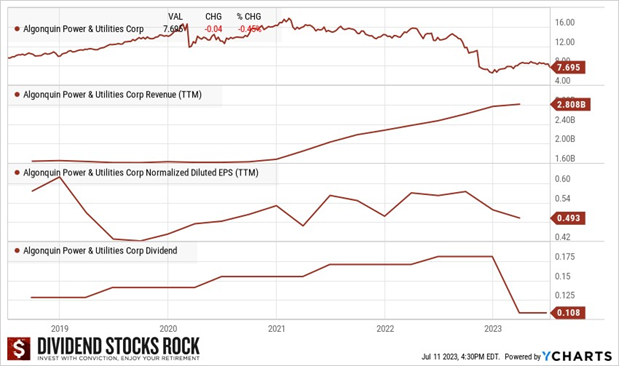

I’ve made mistakes in my investment journey. For example, with Algonquin (AQN):

- I let the company narrative take too much importance in my analysis and ignored the financial numbers. Who doesn’t like a good story, right? Always rely on company fundamentals and metrics; they either back the narrative or reveal it as fiction.

- Wearing pinked-colored glasses, I hoped for the best outcome and minimized the impact of the worst-case scenario.

- I put too much faith in company management, thinking it would keep paying the dividend. Obviously, the dividend wasn’t a priority for AQN’s management team.

Other common investing mistakes are:

- Being seduced by a high yield: investors often concentrate too much on the generous dividend yield in their decision to buy or keep a stock. Appealing as a high yield might be, it is often a warning sign.

- Underestimating the potential downside of a company. No company is invincible. Being aware of the risks is a good defense; knowing about a company’s dependency on the housing market will alert you to watch its results when interest rates rise. Just as risk awareness helps to spot a problem stock, it can also prevent bad buying decisions.

Another mistake that adds to the pain of having a loser stock is investing heavily in a single stock, thus granting it too much weight in your portfolio, without considering the effect a dropping stock price will have on your portfolio.

An ounce of prevention: portfolio review to detect loser stocks

Always review of all your holdings quarterly so that you can detect when you have overweight sectors or stocks, verify that growth is still in the cards by consulting the dividend triangle, identify red flags, and investigate them properly.

During your quarterly review:

- Identify your core holdings, educated guesses, and falling knives

- Make sure your core holdings represent most of your portfolio; rebalance if needed.

- If you see a dividend yield above 5%, consider it a red flag and investigate that stock further; does it still fit your investment thesis? Does the company have growth vectors? Are the revenue and EPS growing consistently? Is the dividend growing, has its growth slowed down?

- Be more demanding about the stocks you keep, for example, look for stronger dividend triangle, a low payout ratio, companies meeting expectations and not lowering their outlook.

- Do not hesitate to sell a loser stock, even if it hurts.

- Resist the appeal of exciting, sexy, growth stories. Go for boring, yet consistent and recession-resilient investment narratives.

Have a replacement list ready

When a $10,000 investment is now worth $6,500, I try to get the $10K figure out of my head and focus on how I can most efficiently invest what is left.

Make a list of stocks you’d like to have but don’t have money to invest in yet. Choose companies that have good growth potential and a strong dividend triangle in different sectors. Not sure where to start? Download our Dividend Rock Stars list!

DOWNLOAD THE LIST HERE

Comparing two stocks

Equipped with my replacement list, I look for a decent replacement in the same industry as the loser stock I’m considering selling. Then, I compare both stocks, analyzing six factors:

- The business models

Review the business models to understand how each company can make money and to find similarities and differences between them.

- The dividend triangle

The dividend triangle is an overview of a company’s metrics and the trend of its revenue, EPS, and dividends. Two companies in similar environments would have similar growth metrics.

- Dividend safety & growth potential

How of the dividend going to evolve? Double-digit or mid-single digit growth? Low growth, no growth, or cut? Dividend safety and growth potential is assessed by analysing the dividend triangle, the company’s payout ratios, and potential risks.

- Growth vectors

Growth vectors point to how a company should grow in the coming years. Reviewing a company’s business model and studying revenue and earnings trends can give you a good idea. Two companies in the same industry can show similar growth vectors.

- Potential risks

Review the risks the companies face; are they particularly vulnerable to interest rates, commodity prices, increased regulation? Do they carry a high debt load? Are they in an expanding market? Companies in the same industries might face similar risks.

- Valuation

To compare two companies, assess the value of each one’s stock value. Valuation methods include the P/E ratio trend over several years and the Dividend Discount Model (DDM).

Dividend Stocks Rock (DSR) members can find all of the information needed on the stock cards and compare two of them side-by-side. Other sources of information are the investor relations section of each company’s website, and stock reports by third-party financial analysts.