How is Old Age Security (OAS) different from the Canada Pension Plan (CPP)? Who is eligible for OAS and what is the benefit amount? How does one apply for OAS benefits? What is this OAS claw back you’ve been hearing about? So many questions, so little time. Look no further, here are the answers, in a nutshell.

What is Old Age Security (OAS)?

Old Age Security (OAS) is a taxable monthly payment the federal government gives Canadian residents and/or citizens who meet the eligibility criteria, once they are 65 years old or older.

How is OAS different from the Canada Pension Plan (CPP)?

Unlike the Canada Pension Plan (CPP) and the Quebec Pension Plan (QPP/RRQ), the OAS is not a pension to which you and your employer(s) contribute over the years. OAS payments come from the taxes the federal government collects each year.

Unlike the Canada Pension Plan (CPP) and the Quebec Pension Plan (QPP/RRQ), the OAS is not a pension to which you and your employer(s) contribute over the years. OAS payments come from the taxes the federal government collects each year.

Another key difference is that OAS payments are not based on how long people have worked or how much money they earned. OAS benefits are paid to every eligible citizen or legal resident, even if they never received employment income.

Want to know more about the CPP/QPP? See Explaining the Canada Pension Plan (CPP).

Who is eligible to receive OAS?

You are eligible to receive OAS payments if:

- You are a Canadian citizen or legal resident.

- You are 65 years of age or older.

- You currently live in Canada and have resided in Canada for at least 10 years since the age of 18, or you don’t currently live in Canada but have done so for at least 20 years since the age of 18.

There are rules for other situations; for example, if you lived outside Canada while working for Canadian employers, or if you have contributed to other countries’ social security programs.

How much will I receive in OAS payments?

The amount of the OAS payment depends on how long you have lived in Canada since the age of 18, and the age when you start receiving the payment. Your OAS monthly payment increases by 10% when you turn 75 years old.

The amount of the OAS payment depends on how long you have lived in Canada since the age of 18, and the age when you start receiving the payment. Your OAS monthly payment increases by 10% when you turn 75 years old.

The amount of the OAS benefit is reviewed and updated four times a year to adjust it for the cost of living.

Surely there is a maximum OAS payment…

Right you are! As of June 2023, the maximum OAS payment is $691 per month ($760.10 per month for people 75 and older).

The maximum payment is paid to people who lived 40 years in Canada after the age of 18, and who have a net income that is below a specific threshold for the calendar year prior to the payment. More about that later.

Find out how to get an estimate of your OAS benefits, download our guide now.

How do I apply for OAS?

Most eligible Canadians do not have to apply to start receiving OAS payments; when you get close to the age of 65, you’ll receive a letter from the government indicating when you will start to receive OAS payments. However, if you decide to delay receiving your payments, you must notify the government.

Delay the start OAS payments! Whatever for?

You can delay receiving OAS payments until the age of 70. For every month after your 65th birthday that you delay receiving your first OAS payment, the government increases the amount you will receive by 0.6%, or 7.2% per year.

You can delay receiving OAS payments until the age of 70. For every month after your 65th birthday that you delay receiving your first OAS payment, the government increases the amount you will receive by 0.6%, or 7.2% per year.

Once you start receiving OAS payments, you cannot change your mind; in other words, you cannot pause the payments to delay to a later age and receive a higher payment.

What is the OAS claw back?

The purpose of the OAS is to provide some financial protection and reduce poverty in old age. OAS recipients who have enough income from other sources to live comfortably must pay back some or all of the OAS payments they receive. This is often called the OAS claw back; the government calls it a recovery tax.

What is the income level at which

I have to pay back some of my OAS?

As of July 1st, 2023, if your net income is below $81,761, you do not have to pay back any of the OAS benefits you receive in 2024. For incomes above that threshold, the amount to pay back is 15% of the difference between your net income and $81,761. The income threshold is updated yearly.

What is considered income for the OAS claw back?

Income includes work income, pensions, CPP payments, withdrawals from RRSPs, and dividends, capital gains, and interest earned from non-registered investments.

Download our guide to get tips for choosing when to start receiving OAS payments, and more information.

What do I need to do about OAS?

- Decide at what age you want to start receiving OAS payments.

- Before you turn 65, you will receive a letter from the government letting you know when to expect your OAS benefits, and the amount you will receive.

- If you want to start receiving OAS at 65, and all the information in the letter is correct, you don’t have to do anything. If there are errors in the letter, you will have to contact the government.

- If you want to delay the start of the OAS payment, you will have to notify the government before you turn 65.

Why does the Government of Canada pay OAS benefits?

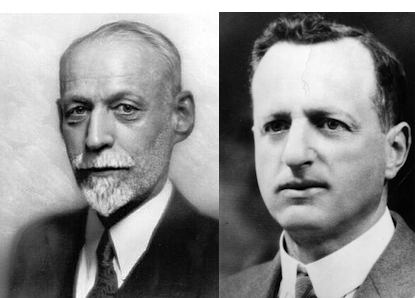

We can thank two labour party MPs, James S. Woodsworth and Abraham A. Heaps, both from Winnipeg. In 1925, they accepted to support prime minister Mackenzie King’s minority government in exchange for his promise to, among other things, create old age benefits.

At the time, many seniors were living in poverty. The jobs they had relied on to earn a living were disappearing as industrialization profoundly changed how goods were produced. Younger workers who were supporting their aging parents struggled to save money for their own old age.

Although Mackenzie King resigned before creating the old age benefit, he was re-elected in 1926, this time with a majority. He kept his word. The Old Age Pensions Act came into effect in 1927.