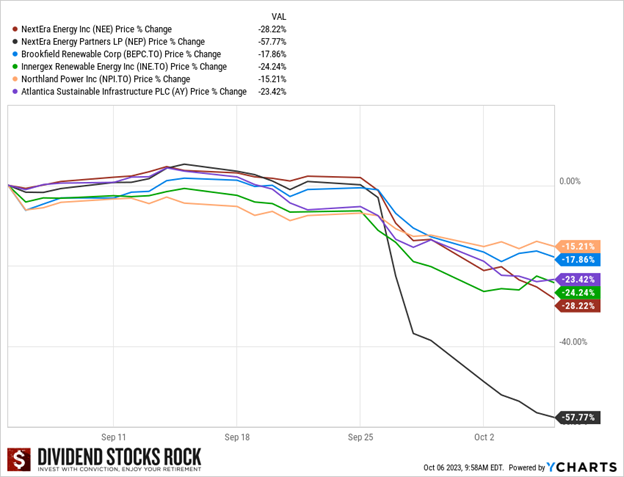

What’s happening with renewables? Renewable stock prices dropped spectacularly in the last few weeks, as shown here. If you have renewable energy stock in your portfolio, you might be in shock.

What caused that chaos?

It’s not a dividend cut or an absence of dividend growth. On September 27, NextEra Partners (NEP) lowered its guidance for the growth of its distribution per unit from 12%-15% per year down to 5%-8%, with a target growth rate of 6% per year. The CEO explained the reasons in this press release. NEP’s distribution rose 89.78% over the past 5 years with an annualized growth rate of 13.67%.

Earlier in May, NEP had announced a strategic shift by confirming its intention to sell its natural gas pipelines.

The goal of selling assets and lowering the dividend growth policy is to give NEP more financial flexibility and maintain its ability to invest in new projects to pursue growth. It’s also to pay off debts that are coming due.

NEP’s debt

Companies can use debt or issue more stocks/units to finance projects. Convertible Equity Financing Portfolio (CEFP) is a way to get financing where you pay the debt either in cash or in units when it comes to maturity.

NEP uses a mix including convertible equity financing; it gets money “today”, betting that its unit price goes up before the debt comes to maturity, thus getting a good deal by issuing units at a higher price to pay it off. NEP has roughly $1.5B of convertible equity financing debt to pay off through 2025. With the stock dropping nearly 60% recently, you can count on them not issuing additional units for near term financing.

This highlights how sensitive most renewable utilities are to rising interest rates. NEP is stuck between a rock and a hard place. Future debt will carry interest rates of 7%-8% while issuing units with such a depreciated stock price would only drive the price lower by diluting shareholders’ investments.

Want a portfolio that can withstand all this economic turmoil and provide you with enough income? Download our Dividend Income for Life Guide!

What’s next for NEP?

NEP is walking is on the edge, but that doesn’t mean it’ll fall. Numbers seem to work until 2025, assuming no further major interest rate hikes. However, it’s not out of the woods.

The pessimistic scenario has NEP facing higher interest rates while its unit price doesn’t bounce back. NEP would eventually face a possible dividend cut or see NextEra Energy (NEE) buy all its units. A leader in renewable energy with a market cap of $97B, NEE owns 51% of NEP, whose market cap is $2B. NEP shareholders wouldn’t be happy with this outcome because they wouldn’t get much for their units.

The optimistic scenario sees NEP on the edge for a few years, with interest rates decreasing before 2026, when more debt (including CEFP) comes to maturity. We’d see NEP’s unit price slowly but surely go up, the dividend paid, and growth back on the table. At this point, however, NEP would be a high-risk, high-reward investment.

What about other renewable utilities?

Now’s the time to make sure you have a solid portfolio. This implies digging deeper to ensure companies you hold show strong financial metrics. Unfortunately, utilities aren’t easy to analyze; they use both GAAP (generally accepted accounting principles) and non-GAAP (like homemade calculations), and often use Funds from operations (FFO) per unit, found in press releases and quarterly earnings reports.

Look for investors’ presentations and quarterly earnings reports on the company website. Doing that reveals that another renewable, Brookfield Renewable (BEPC/BEPC.TO), hosted its investors day in September. Contrary to NEP, BEPC reaffirmed its growth expectations and distribution growth targets…business as usual for BEPC.

Look for investors’ presentations and quarterly earnings reports on the company website. Doing that reveals that another renewable, Brookfield Renewable (BEPC/BEPC.TO), hosted its investors day in September. Contrary to NEP, BEPC reaffirmed its growth expectations and distribution growth targets…business as usual for BEPC.

Different companies, different business models, different debt structures. When a NEP-like situation happens, solid companies are also punished, unfairly, because the market puts them in the same basket as the one with the problem.

It’s clear that all utilities will suffer for a while. Higher interest charges hurt their balance sheet and cash flow, while simultaneously drawing retirees to bonds and GICs and away from utilities. In fairness, when 10-year government bonds offer over 4.5%, income-seeking investors would be fools to go for stocks paying the same yield.

How to look at renewable utilities

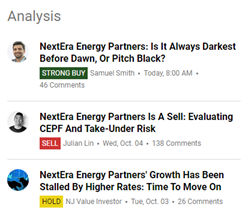

First, ignore the noise, or you’ll get lost in a myriad of conflicting information. Here are three articles on Seeking Alpha for October 6 (Strong Buy, Sell, and Hold ratings).

First, ignore the noise, or you’ll get lost in a myriad of conflicting information. Here are three articles on Seeking Alpha for October 6 (Strong Buy, Sell, and Hold ratings).

I read all three; each makes solid points. If I rely on their opinion, I have no clarity.

Best to develop your own opinion. How? Follow the same process as always: make sure your investment thesis (the narrative) is backed by the numbers.

1 – Start with the dividend triangle.

The EPS won’t be of much use for utilities; review the revenue and dividend growth trends.

Weak dividend growth, or none, raises a huge red flag. If you’re choosing between two stocks and one shows no or weak dividend growth, eliminate it as a candidate.

2 – Look at the FFO/unit (common replacement for EPS for utilities) on the company’s website.

3 – Look at the company’s debt structure and maturity in its investor presentation.

There’s a big difference between fixed-rate debt over a long period of time vs. floating rates or short-term maturities that will push interest expenses higher.

4 – Look at the company’s past track record to see how it performed in other difficult periods. You’ll have to go back to the 2008 crisis to see how they fared, but it’s time well spent if you’re unsure of some stocks.

Create yourself a large enough paycheck. To learn how…download our Dividend Income for Life Guide!

Renewables aren’t dead, just facing substantial headwinds

Renewables are facing stronger headwinds than classic utilities due to their business model. Many classic utilities—Fortis, Canadian Utilities, Xcel, and WEC Energy—operate regulated assets. They’re granted a monopoly over an area to ensure quality, stable service. In exchange for that monopoly, utilities cannot raise their rates as they see fit. They must present a case for increasing rates to the regulator, who assesses whether the increase makes sense for both the utility and its customers. When interest costs increase, regulated utilities have more pricing power because it’s easier to justify rate increases.

Renewables don’t enjoy a monopoly because their energy source is less stable and complements other sources. They can raise prices freely, but they face more competition. In the current economic environment, I bet they’d love to negotiate rate increases with a regulator!

Renewables and other capital-intensive businesses (Telcos, REITs, pipelines, etc.) will have a rough ride until we know that interest rate increases are over and that we’re heading toward reductions. We’re not there yet; you must decide if you want to “walk in the desert”. Again, focusing on dividend growers helps.