Electricity, gas, and water are essential in our modern world. It’s hard to imagine a house without power or running water in North America. Companies in the utilities sector offer indispensable services to their customers, and they reward their shareholders with generous dividends.

Utilities include electric, gas, water, renewable energy, diversified, or independent power producer companies. They provide the public with necessities. Since we depend on electricity and water, utility companies hold a great deal of power over the population; it would be catastrophic to see our utility bill rising by 75% overnight!

Don’t miss anything! Subscribe to our newsletter here.

Regulating utilities

To mitigate the risk of utilities having too much power, some countries, provinces, or states nationalized these resources to provide them at a lower price. Often, in Canada and the U.S., governments allow private companies to manage and distribute electricity, gas, and water. Granting such power to private entities couldn’t be done without strict rules. Hence, utilities usually operate in a highly regulated environment. Governments decide the price of power and water that is charged to customers.

To mitigate the risk of utilities having too much power, some countries, provinces, or states nationalized these resources to provide them at a lower price. Often, in Canada and the U.S., governments allow private companies to manage and distribute electricity, gas, and water. Granting such power to private entities couldn’t be done without strict rules. Hence, utilities usually operate in a highly regulated environment. Governments decide the price of power and water that is charged to customers.

While this seemingly puts brakes on future growth, it does provide utilities with the benefit of a stable and predictable source of income over long periods. Consequently, don’t invest in utilities to make a quick buck. On the positive side, utilities tend to grow at a steady pace, not unlike the turtle winning the race against the rabbit.

Utilities sector strengths

Historically, utilities are regarded as generous with their dividends. They’re inclined to distribute over 50% of their available cash flow to their shareholders. The perfect type of business for dividend investors.

Utility companies need large infrastructures and most of their capital projects amount to billions of dollars. This limits the number of competitors who can enter the sector. In most cases, we describe the sector as a collection of natural monopolies. It doesn’t make sense for three electricity companies to spend billions on power generators and power lines to serve the same geographic area. Therefore, utility markets are normally well protected, and companies have nothing to fear but themselves. We had a great example of that with the poor management at Algonquin (more on that later).

If you’re looking to invest in renewable energy, know that those companies are in the utilities sector. Renewable energy companies aren’t getting much love in the market of late. While wind and solar energy are getting cheaper to generate and governments offer generous subsidies, most of the “energy money” went back to the oil & gas industry. This is probably an opportune time to buy undervalued renewable stocks in this crazy market!

Utilities sector weaknesses

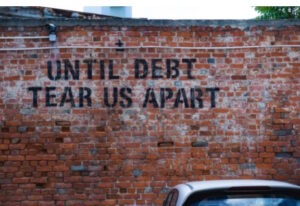

Be mindful of the volume of debt these companies carry. You can bet any new utility project will cost at least several hundred million, or even a few billion dollars.  Most often, those projects are financed by issuing additional shares of stock or taking on more long-term debt. When interest rates rise, the cost of new financing increases, reducing the projected profitability of the project. In short, there will be less cash left to increase the dividend.

Most often, those projects are financed by issuing additional shares of stock or taking on more long-term debt. When interest rates rise, the cost of new financing increases, reducing the projected profitability of the project. In short, there will be less cash left to increase the dividend.

Keep in mind that some projects fail. The Atlantic Pipeline, a joint venture project between Duke Energy (DUK) and Dominion (D), was canceled recently. Result? Billions in write-offs, Dominion even reduced its dividend because of the cancellation.

With high interest rates, capital-intensive utilities face another challenge. Some income-seeking investors left the boat and went back to their first love—bonds, GICs, and preferred shares. Fixed-income products pay a better interest rate and are more stable than renewable utilities! This explains part of the general stock decline since 2021. It could be a solid opportunity, however, if you’re a patient investor.

The demand for power follows the economy. During lockdowns in 2020, we saw industrial and commercial demand for power decline. In general, recessions also have an impact for a few years. To increase the rates they charge customers, regulated utilities must get approval from regulators. During challenging times, regulators might not agree to increase the rates, preferring to give consumers a break. A good example was Arizona regulators lowering the rate increase inquiry submitted by Pinnacle West Capital (PNW) in 2021.

Looking for growth and diversification in your portfolio? Explore the industrials sector.

The Algonquin story

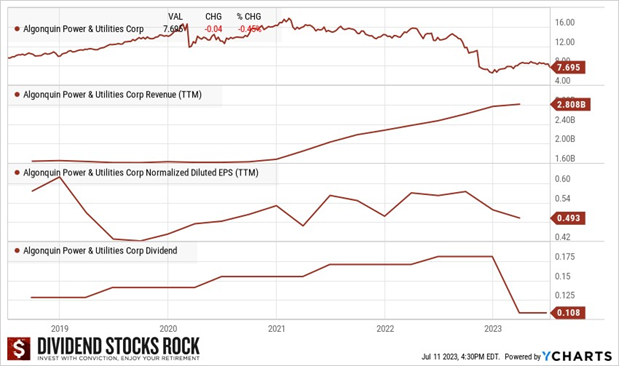

When Algonquin reported its earnings in November 2022, management shared plenty of bad news: negative EPS revision, uncertainty around the financing for Kentucky Power acquisition, the impact of variable rates on their business model, etc. The result was catastrophic on the market. The stock dropped 35%, from $11.51 to $7.49, in 7 days.

In a conference call with investors in early 2023, Algonquin announced a 40% dividend cut and more asset sales, worth another $1B. This call revealed a company that had lost its magic touch, and whose business model—aggressive growth by acquisition—had blown up in its face. Now, AQN wants to strengthen its balance sheet which was greatly affected by variable rate increases. When the tide went down, we all discovered that management was swimming naked in the ocean.

Getting the best of this sector

Utilities became the popular kids after the 2008 financial crisis. With bottom-low interest rates, income-seeking investors ignored bonds and certificates of deposit, turning to equities that provided better yields, like utilities. This has changed and could change more with the higher interest rates.

Also, the renewable energy industry has taken some serious hits. This could be the opportunity you were waiting for. Since utilities can’t expand their business in another state or province without an acquisition, keep track of which regions have the best economic growth opportunities.

At DSR, we prefer utilities using clean energy. They’re not too expensive right now and offer great potential for the next 10 years.

We also favor companies that have been around for a while, like Fortis which shows 50 consecutive years with a dividend increase. It has proven that it can reward shareholders even during challenging times.

Like what you read? Don’t miss anything. Subscribe to our newsletter here.

Should you invest in utilities?

The utilities sector is best suited for income-seeking investors. Income investors can invest between 10% and 20% of their portfolio in utilities without any worries. For growth investors, something between 5% and 10% should be enough.

My favorites are:

- U.S.: NextEra Energy (NEE), Sempra (SRE), and Xcel (XEL).

- Canada: Fortis (FTS.TO / FTS), Emera (EMA.TO), Brookfield Infrastructure (BIPC.TO / BIPC), Brookfield Renewable (BEPC.TO / BEPC).