In investing, some businesses deliver growth by chasing trends, while others quietly fill the essentials basket, year after year. Food and health products may not sound flashy, but they are non-negotiables in every household budget. That’s where this company shines—anchoring its model in grocery and pharmacy sales to create dependable, recession-resistant cash flows. It’s a model that doesn’t promise fireworks, but instead builds a basket of stability that dividend investors can count on.

A Focused Regional Player

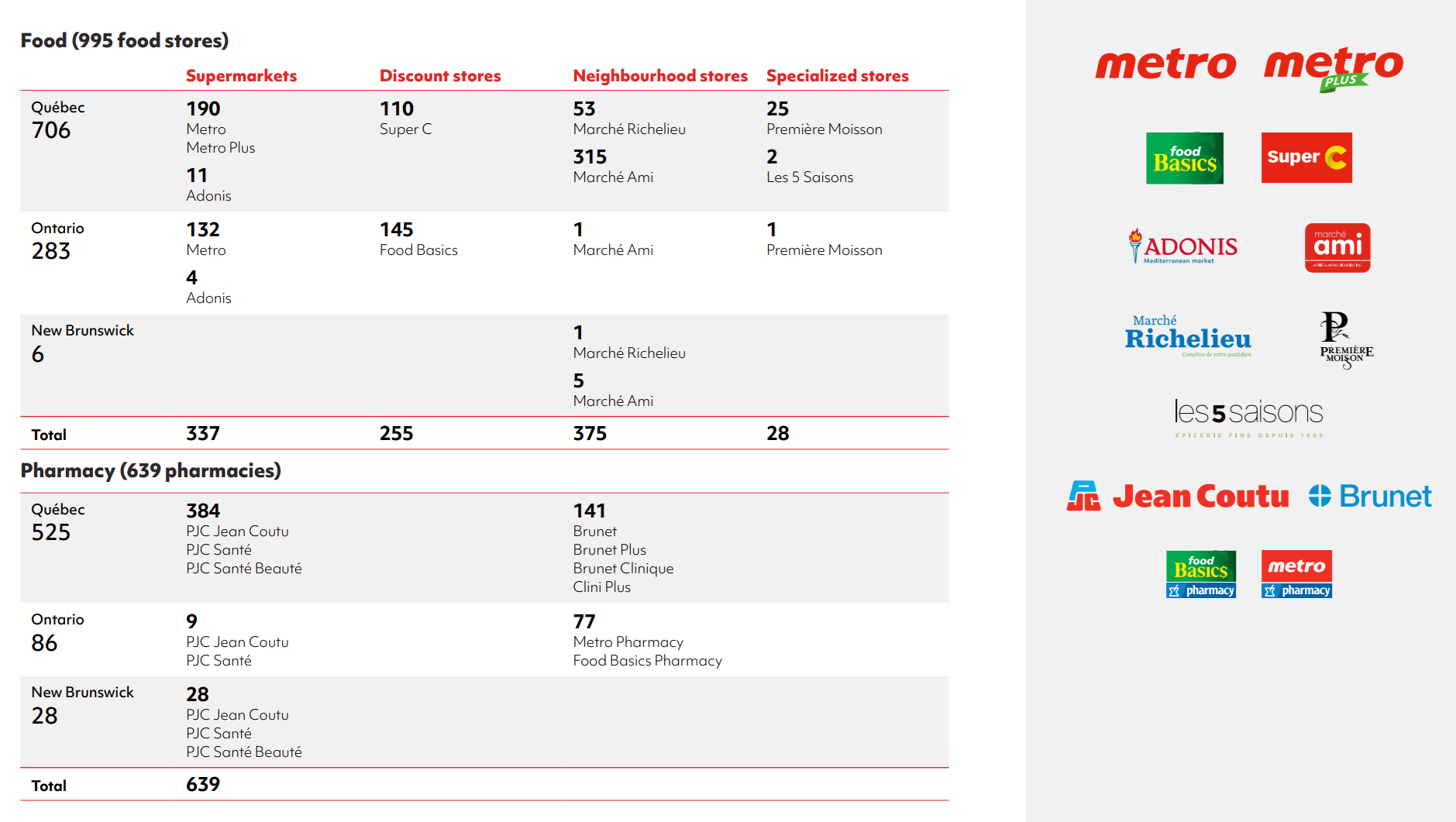

Metro Inc. (MRU.TO) operates one of Canada’s largest networks of grocery and pharmacy stores, with nearly 1,000 food locations under banners such as Metro, Super C, Food Basics, and Adonis, and about 640 pharmacies under Jean Coutu, Brunet, and Metro Pharmacy. The company serves multiple consumer segments, from full-service supermarkets to value-driven discount banners.

Its strategy centers on regional dominance rather than national expansion, giving it a stronghold in Quebec and Ontario. This localized approach has provided stability, but it also caps growth potential relative to larger rivals like Loblaw and Sobeys.

Why Dividend Investors Like It

Bull Case: Steady Growth in a Defensive Sector

Metro offers stability in an industry where consumers must shop regardless of economic conditions. Food retail is a defensive sector, and Metro complements it with pharmacy operations—adding resilience and margin strength.

-

Revenue Mix: The balance between food and pharmacy sales ensures diversification. Pharmacy growth, particularly through Jean Coutu, strengthens overall margins.

-

Playbook: The company runs both corporate and franchised stores while also distributing to independents. This hybrid model reduces risks tied to single revenue streams.

-

Growth Vectors: Expansion is supported by new automated distribution centers, pharmacy growth, and selective acquisitions. Metro is also leaning into private label and digital loyalty programs. Its Moi loyalty platform aims to deepen customer engagement, while private-label offerings expand margins.

-

Economic Moat: Metro lacks a true moat, but entrenched brand recognition in Quebec and operational discipline give it staying power. Consumers in its core markets often view Metro as a trusted, local brand, which helps offset its lack of national clout.

Beyond the numbers, Metro benefits from demographic and lifestyle shifts. Canada’s aging population supports pharmacy demand, while consumers’ search for affordability keeps discount formats like Food Basics relevant. The combination of grocery and pharmacy under one roof also increases customer traffic and convenience.

The Other Side of the Coin

Bear Case: Limited Scale and Competitive Pressure

Metro’s strengths in execution are offset by structural disadvantages that make it less competitive against larger rivals.

-

Business Vulnerabilities: Operating margins are inherently slim in food retail, and Metro’s smaller size limits its purchasing power compared to Loblaw or Walmart. Unionized labor adds cost rigidity, especially as wage pressures increase.

-

Industry & Market Threats: Canadian food retail is saturated and cutthroat, with consumers highly price-sensitive. Shoppers often divide their purchases across multiple banners, weakening brand loyalty. Pharmacy operations also face regulatory risks, particularly around prescription drug pricing in Quebec, which limits profitability.

-

Competitive Landscape: Metro lags peers in key differentiators. Private-label penetration is only ~11%, far behind Loblaw’s 44%. Its Moi loyalty program, while promising, is still young compared to PC Optimum. U.S. discounters like Costco and Walmart continue to grow in Canada, squeezing both price and volume.

Taken together, these challenges create a ceiling on Metro’s long-term growth. It can continue to execute well, but it cannot easily match the scale-driven advantages enjoyed by its largest competitors.

Want More Stocks Like This One?

The Dividend Rock Star List is our hand-picked collection of quality dividend stocks.

Here’s what you’ll find inside:

-

🔍 Over 300 U.S. and Canadian dividend-paying stocks

-

✅ Screened using our Dividend Triangle: Revenue growth, EPS growth, and dividend growth

-

🚨 Updated monthly with the latest data

-

📊 Filter by yield, sector, payout ratio, dividend growth rate, and more

-

💡 Discover reliable growers that can power your portfolio through bull and bear markets

Start browsing the Dividend Rock Star List now and find your next winner before everyone else does.

What’s New: Navigating Inflationary Pressure

On August 26, 2025, Metro reported a solid quarter:

-

Revenue up 3%.

-

EPS up 12%.

-

Food same-store sales +1.9%.

-

Pharmacy same-store sales +5.5% (prescriptions +6.2%, front-store +4%).

Management credited strong pharmacy growth and disciplined pricing in grocery for the performance. Priorities moving forward include network upgrades, supply-chain automation, and using digital and loyalty platforms to boost customer retention.

While Metro’s results lack the excitement of a growth stock, they underscore its consistency in navigating inflationary pressure and consumer price sensitivity.

The Dividend Triangle in Action: Consistent Uptrends

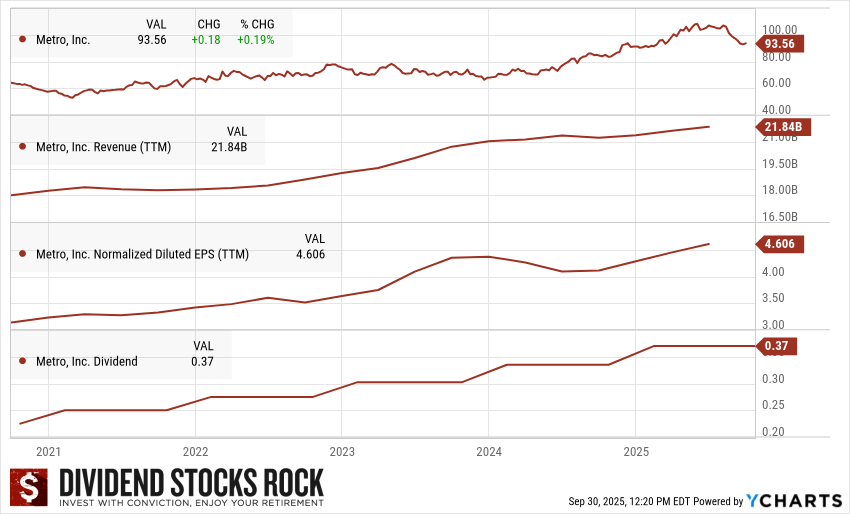

Dividend investors know that a reliable payout is only as good as the fundamentals behind it. Metro’s Dividend Triangle—revenue, earnings, and dividend growth—shows measured but dependable progress:

-

Revenue: Now at $21.8B, with growth coming from both food sales and pharmacies. While volume growth in food has softened, pricing discipline and steady pharmacy gains have supported topline expansion.

-

Earnings per Share (EPS): Up to $4.61, showing resilience even in a high-cost environment. Earnings volatility is low, reinforcing Metro’s defensive profile.

-

Dividend: At $0.37 per share, with steady increases over the years. Yield may look modest, but payout discipline ensures sustainability.

For investors, the story is one of slow-and-steady compounding. Metro won’t deliver rapid dividend hikes, but its consistent earnings base supports dependable growth that can anchor a dividend portfolio.

Final Thoughts: A Defensive Anchor, not a Growth Star

Metro occupies a unique space in the Canadian retail landscape. It doesn’t have the size or brand power of Loblaw or Walmart, but it knows how to execute in its chosen markets. Its regional dominance, hybrid grocery-pharmacy model, and disciplined operations provide stability, while pharmacy growth offers modest upside.

For dividend investors, the trade-off is straightforward: Metro is a slow grower with limited upside, but it offers reliability in an industry where consistency is often hard to come by. It is not the stock that will lead your portfolio higher, but it can keep your income stream safe and predictable through cycles.

Don’t leave without your freebie! Download the ONLY list focusing on the Dividend Triangle.

The Dividend Rock Star List is updated monthly with over 350 screened dividend stocks, complete with safety scores and valuations.