“What if your dividend income was more than just a yield?”

We all dream of the same thing: freedom.

Whether that’s retiring comfortably, spending more time with family, or finally ticking off that epic trip to Tuscany — the goal is simple: build income that works for you, not the other way around.

But here’s the problem: Most people start their income journey with the wrong question:

“How much yield can I get?”

While it sounds like a smart starting point, this approach is more of a napkin calculation than a real investment plan. It sets you up to chase yield, walk into value traps, and — worst of all — risk your retirement income.

So let me walk you through a better way to build an income portfolio that’s built to last.

The Shift: From Yield Chasing to Dividend Growth Conviction

Let’s kill a myth right now: High yield does not equal high income security.

Just because a stock pays 7% doesn’t mean it deserves a place in your portfolio. High-yield stocks are often the market’s way of warning you — not rewarding you.

We’ve seen this movie before: A company offers a juicy dividend, everyone piles in… then the earnings drop, the dividend gets slashed, and suddenly you’ve lost both your income and your capital. That’s not income investing — that’s gambling dressed up as a paycheck.

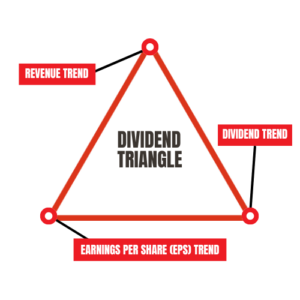

Instead, I focus on dividend growers. These are companies that:

- Grow their revenue (top-line strength)

- Grow their earnings (bottom-line power)

- And grow their dividend (shareholder commitment)

This is what we call the Dividend Triangle — and it’s the first thing I look for when building an income portfolio.

But let’s go one step deeper:

For retirees, dividend growth is what protects their lifestyle.

Here’s why:

- 🔒 It protects you from inflation.

Prices rise every year — groceries, gas, healthcare. A company that increases its dividend annually ensures your income keeps pace. - ⏳ It guards against longevity risk.

You may live 25–30 years in retirement. If your income stays flat, your purchasing power will fall dramatically. - 🛡️ It reflects a strong business model.

Companies that grow their dividend can only do so by increasing their profits and cash flow — year after year. This is your best defense against surprises.

“A 3% yield growing at 8% per year will beat a 6% yield that never grows — and do it with less risk.”

Imagine this:

You retire with a $1 million portfolio. You choose stable dividend growers paying an average of 3.5%, with a dividend growth rate of 7%. In 10 years, your income will nearly double — without you lifting a finger.

Now compare that to locking in a 6% yield with no growth. Ten years later, your income hasn’t changed — but your costs have. You’re forced to sell shares to keep up, and that’s where the retirement stress kicks in.

Dividend growth isn’t just about returns — it’s about peace of mind.

If this approach resonates with you — focusing on dividend growth instead of just chasing yield — you’ll want to dig deeper into the system I use to build reliable, inflation-resistant income streams.

From Theory to Action

That’s exactly why I created the Dividend Income for Life Guide. It breaks down the step-by-step process for building your dividend pension plan — no guesswork, no spreadsheets required.

Inside the guide, you’ll learn how to:

- ✅ Build a portfolio that generates growing income in retirement

- ✅ Apply the Dividend Triangle to select stronger companies

- ✅ Avoid common traps like over-diversification and yield chasing

📘 Ready to go from theory to action? Download the guide and start designing the income stream you’ll rely on for decades:

Start With This Core Strategy

If you’re new to building a dividend portfolio, here’s a simple formula I’d suggest using as your foundation:

1. Define Your Target Yield

- Aim for a total portfolio yield of ~3–4%

- This lets you combine lower-yielding growers with stable income generators

🔥 Pro Tip: It’s not about finding one perfect stock — it’s about building a team that works together.

2. Mix Yield with Growth

Create a blend like this:

- Low yield, high growth: Apple, Visa, Couche-Tard

- Moderate yield, consistent growth: Johnson & Johnson, BIP

- High yield, low growth (if safe!): Selected REITs or utilities

If you can access a Stock Screener, use the Chowder Rule (Yield + 5yr Dividend Growth ≥ 9%) to screen your picks.

Sector Allocation: Balance for All Seasons

No single sector is recession-proof, but some bend instead of breaking.

There are 11 sectors that we can sort into three categories:

- Income/stability: Sectors where you find many mature businesses that are recession-resistant.

- Growth: Sectors where you find companies with multiple growth vectors, able to surge during economic booms.

- Both: Sectors where you find companies balancing growth and stability.

| Income/Stability Sectors | Growth Sectors | Sectors Balancing Both |

| Consumer Staples | Consumer Discretionary | Financials |

| REITs | Information Technology | Communication Services |

| Healthcare | Energy | Industrials |

| Utilities | Materials |

Do I need to invest in all 11 sectors?

Not at all. You must invest in sectors that fit with your goals, i.e., stability vs growth, and that you understand.

Not at all. You must invest in sectors that fit with your goals, i.e., stability vs growth, and that you understand.

There’s no point in investing in tech stocks if you have no clue how the semiconductor industry cycles work. You won’t be happy when investments are down, but if you understand the industry’s characteristics, you won’t panic.

How much to put in each sector?

⚠️ Pro Tip: Keep any one sector below 20–25% to reduce risk.

Again, there are no hard rules here. I like to have a maximum of 20% invested in my favorite sectors and around 10% in others. However, I sometimes go above 20% due to the great performance of a few companies.

I invest in various industries within the same sector to avoid being impacted by a single market event.

For example, there is a big difference between:

- Having 25% invested in financial services spread across five Canadian Banks, with 5% in each one.

- Having 5% in each of the following: Royal Bank (Canadian bank), BlackRock (asset management), Visa (payment processor), Great-West Life (life insurance), and Brookfield Corp (alternative asset management).

Number of stocks per sector?

That depends on how many stocks you want to hold and how many sectors you want to invest in.

You can select the best 2, 3, or 4 companies in each sector you want exposure to. That would likely lead to a portfolio of 20 to 40 stocks. Purely by chance, that’s very close to what I think is the ideal number of stocks.

Number of stocks in my portfolio?

Holding fewer than 20 stocks means the room for error is thin. This strategy could be great for high-conviction investors, but I prefer securing a bit more diversification.

Conversely, if you go above 40, you’re getting closer to building your own ETF. Monitoring 70 companies quarterly will prove daunting, and you’ll eventually miss information.

Also, if a stock represents 0.32% of your portfolio, even if it doubles in value or crashes by 80%, you will never feel it.

Dividend Income = Your Personal Pension Plan

If you’re retired — or planning to be — think of your dividend portfolio as a self-built pension plan.

Each dividend-paying stock you own is like a brick in your retirement income wall. And just like any wall, some bricks are stronger than others.

Companies that grow their dividends year after year are the reinforced bricks. They strengthen your income over time and help it keep up with inflation. On the other hand, high-yield stocks that don’t grow — or worse, cut their dividends — are like hollow bricks. They may look solid, but when pressure builds (like inflation or a market downturn), they crack.

This is why dividend growth matters more than yield. It’s not just about getting paid today — it’s about getting more income every year, without selling shares.

Think of dividend growth stocks as inflation-adjusted paycheques — just like a pension, but one you control.

Again, if your portfolio yields 3.5% today, and your holdings grow their dividends by 6–8% annually, your income will double roughly every 9–12 years. That’s the income security most traditional pensions can’t even match.

Bottom line: A strong dividend portfolio is built one solid, growing company at a time. Focus on quality. Focus on growth. And watch your income become as reliable — and rising — as a pension.

The Traps to Avoid

Now that you’ve got the building blocks of a strong dividend income portfolio, it’s just as important to know what not to do. Even the best strategy can fall apart if you let fear, noise, or impatience take the wheel.

Here are three common traps I see investors fall into — and how to avoid them:

- Chasing High Yield

If it looks too good to be true… it probably is. Many of the worst dividend cuts started with “safe” 6%+ yields. Always check the dividend triangle before reaching for yield. - Over-diversification

Owning 50+ stocks doesn’t make you diversified — it just makes you tired. Stick to 20–40 quality holdings across sectors you understand and can monitor. - Waiting for a Pullback

Time in the market > timing the market. Invest when the company’s fundamentals support your thesis — not when CNBC says “buy.”

Final Thoughts: Income That Grows With You

Instead of asking:

“How much income can I generate today?”

Start asking:

“How much income can I grow over the next 10, 20, or 30 years?”

That’s the mindset that builds wealth and protects your retirement.

Start with dividend growers. Build a balanced portfolio. Stay consistent. Let time do its thing.

Ready to Begin?

If you’re not sure where to start, here’s your mini checklist:

- ✅ Review your current holdings: strong dividend triangle?

- ✅ Identify your sector gaps

- ✅ Set a yield-growth blend target

And remember — you’re not alone. We’re building dividend income for life, one stock at a time.

Want a complete roadmap to get started? Download the Dividend Income for Life Guide — it’s packed with real-world insights, simple strategies, and the exact framework we use to help thousands of investors retire with confidence.

This guide will help you:

- ✅ Build a reliable income stream — even during market volatility

- ✅ Avoid costly mistakes (like chasing yield or holding forever)

- ✅ Invest with clarity, not guesswork

Start building your retirement income plan today:

And remember — you’re not alone. We’re building dividend income for life, one stock at a time.