Still number one buy list stock on the Canadian market for December is Brookfield Corporation (BN.TO / BN). The engine behind the Brookfield family of businesses, BN is a core holding, one that investors can hold for a long time. Have a look.

You can have a look at my buy list stock pick of the month on the U.S. market.

BN.TO Business Model

Brookfield Corporation is an alternative asset manager, meaning that its assets are not liquid like conventional assets such as stocks, bonds, cash, ETFs. It owns and operates these real assets with a focus on compounding capital over the long term to earn attractive total returns for its shareholders. Managing alternative assets requires a high level of expertise and patience.

BN is the parent company of the other Brookfield companies; through them BN focuses on long-life, high-quality assets including: Renewable Power & Transition assets in hydro, wind, solar, distributed energy and sustainable solutions; Infrastructure assets in transport, data, utilities and midstream sector; Asset Management, managing funds coming from pension plans and other investors; Private Equity, businesses that provide essential industrial, infrastructure, and business services; Real Estate with a diversified portfolio across many industries and spread across five continents; Credit, through its majority interest in Oaktree; and Insurance Solutions across the life, annuity, and property and casualty industries.

BN is the parent company of the other Brookfield companies; through them BN focuses on long-life, high-quality assets including: Renewable Power & Transition assets in hydro, wind, solar, distributed energy and sustainable solutions; Infrastructure assets in transport, data, utilities and midstream sector; Asset Management, managing funds coming from pension plans and other investors; Private Equity, businesses that provide essential industrial, infrastructure, and business services; Real Estate with a diversified portfolio across many industries and spread across five continents; Credit, through its majority interest in Oaktree; and Insurance Solutions across the life, annuity, and property and casualty industries.

Investment Thesis for Brookfield Corporation

The company has access to billions of dollars in liquidity to finance its projects and has built impressive expertise in various industries. BN is present in countries that show potential for high growth for years to come. Its diversified businesses are a solid source of permanent capital. Over the last few years, BN has seen an increase in both the number and size of average client commitments. BN is well-positioned to expand its private fund investor base in Europe and parts of Asia.

Brookfield Corporation doesn’t only do the asset-light manager’s job consisting of strategy and earning fees on assets under management (AUM); it also contributes with its own assets. Therefore, it benefits from its own strategies to recycle its assets; in other words, it can sell assets it considers to be at a high value and reallocate the proceeds into new projects or undervalued assets. It’s the classic “buy low, sell high” concept.

For more great stock ideas, download our Rock Stars list, updated monthly.

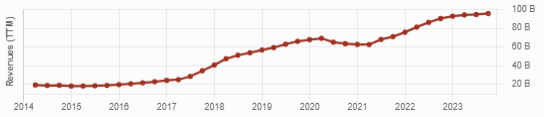

BN.TO Last Quarter and Recent Activities

Brookfield Corporation reported decent results for its most recent quarter with revenue increasing 5%, but distributable earnings per share remained flat. Insurance solutions distributable earnings were up 14% as insurance assets increased to ~$50B. The average investment portfolio yield was 5.5%, about 200 basis points higher than the average cost of capital. It continues to track towards reaching $800M of annualized earnings by the end of 2023.

Operating businesses earnings declined by 8% but funds from operations were supported by a stronger performance from the renewables and infrastructure segments. The asset management segment was up 13% and BN ended the quarter with $120B to invest.

The bigger news about Brookfield of late was its offer to BN shareholders to exchange their shares for shares of Brookfield Reinsurance (BNRE), one for one. There was no share dilution, and the company did it to improve equity base and market capitalization of BNRE.

Potential Risks for BN.TO

BN’s growth depends on investors’ confidence in long-term projects. When panic arises, it becomes difficult for companies like BN to increase their AUM. We had another example of this phenomenon in 2022, when the stock price dropped along with the market.

BN is well-managed and has the ability to navigate the current crisis. Investors must simply remain patient. Its operational complexity can leave many investors wondering how money is managed within the business; it’s easy to get lost in the pile of financial statements throughout the multiple companies and the many stock classes.

Contrary to BAM, which is asset-light, BN’s success relies on management’s ability to manage its assets; in short, making money selling at the right time, and reallocating capital into the right assets at the right time. This adds to the complexity of its business model and requires a larger cash reserve.

Want to find more great stock ideas? Download our Rock Stars list, updated monthly.

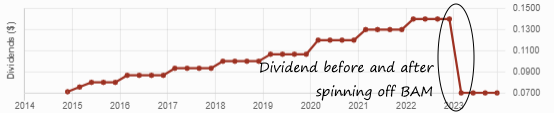

BN.TO Dividend Growth Perspective

Following the spin-off of BAM, it’s clear that BN is a low-yield, high-growth stock. The company kept a low yield by paying a $0.07/share dividend. We expect this dividend to increase each year. However, if you’re looking for a more generous yield, BAM is the better option.

BN has the advantage of owning a stake in various assets across the Brookfield family, while BAM has the advantage of simply managing the money and earning revenue on a fee charged on the assets under management.

Final Thoughts on Brookfield Corporation

It’s virtually impossible to buy a piece of a bridge or a railroad. This is where Brookfield comes into play as investing in Brookfield Corp is like investing in your own “alternative asset fund”.

As an asset manager, you can expect BN.TO to go through some difficult times with the higher interest rates and possible recession. However, its depth of assets, expertise, and geographic distribution make it a worthwhile buy list stock for investors seeking long-term dividend growth.

Investing in alternative assets is a great way to diversify a portfolio. Usually, the investment returns on such investments are decided by what’s happening on the stock market. You can expect them to generate about 5-7% above inflation over long periods of time. Interest in alternative assets is increasing, especially for institutional investors.

See also the list of Canadian Dividend Aristocrats for other great stock pick ideas.