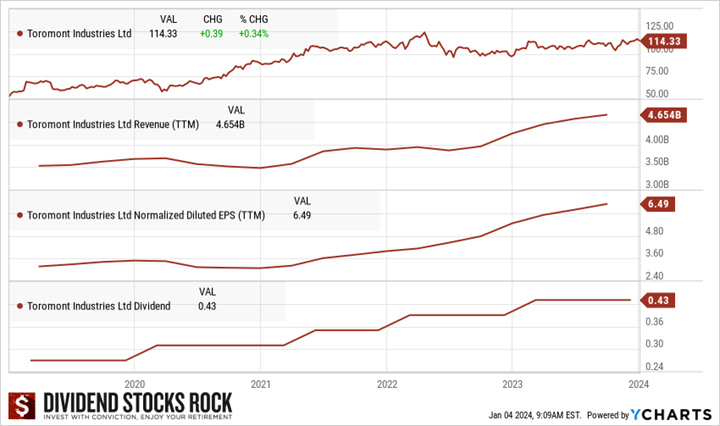

My Canadian buy list stock for February 2024 is Toromont Industries (TIH.TO). It shows a very strong dividend triangle with double-digit 5-yr annualized growth for revenue, EPS, and dividends. Considering the massive infrastructure spending needs in Canada for the coming years, TIH should keep doing well.

We included Toromont in our Best Canadian Stocks to Buy in 2024, but it’s now a buy list stock because we feel it deserves a bit more attention and we wanted to provide more detail about it.

See our U.S. buy list stock pick for the month here.

Toromont Industries Business Model

Toromont Industries is a Canada-based company serving the specialized equipment and lifetime product support needs of thousands of customers in diverse industries from roadbuilding to mining, and telecommunications to food and beverage processing. It operates the Equipment Group and CIMCO segments.

Toromont Industries is a Canada-based company serving the specialized equipment and lifetime product support needs of thousands of customers in diverse industries from roadbuilding to mining, and telecommunications to food and beverage processing. It operates the Equipment Group and CIMCO segments.

Within the Equipment Group segment, TIH is the exclusive Caterpillar dealer for a contiguous geographical territory in Canada that covers Manitoba, Ontario, Quebec, Newfoundland, New Brunswick, Nova Scotia, Prince Edward Island, and most of Nunavut. Additionally, the Company is the MaK engine dealer for the Eastern Seaboard of the United States, from Maine to Virginia. The segment includes rental operations and a complementary material handling business. CIMCO segment is engaged in the design, engineering, fabrication, and installation of industrial and recreational refrigeration systems. Both segments offer comprehensive product support capabilities.

Want more stock ideas? Download out Top Stocks for 2024 booklet!

Investment Thesis for TIH.TO

TIH has over 50 years of history and has built a solid sales network with roughly 140 locations across Canada and the US. Combining this large distribution network with a well-known brand that is Caterpillar secures success that will last for decades. In addition to counting on the mining (20%) and construction (38%) sectors to grow organically, the company also buys smaller dealerships, such as Hewitt, acquired in 2017.

Considering the massive infrastructure spending needs in Canada in the coming years, Toromont is surely a player that could do well going forward. On top of this, the mining industry continues to bolster TIH’s order book given that commodity prices remain strong. It’s a shame that TIH exhibits such a low yield. The company has navigated the current uncertain economic conditions well by remaining committed to operating discipline. Now that governments want to invest in more infrastructure, TIH possesses a stronger dividend triangle showing robust growth.

TIH.TO Last Quarter and Recent Activities

Toromont Industries reported a total revenue increase of 9% for Q4’23 with Equipment Group revenue up 9% and CIMCO up +2%. EPS dropped 3.6% in the quarter as operating income fell due to property gain included in the prior year Q4 results. Excluding these gains, Toromont’s operating income grew 5% due to higher revenue but affected by lower gross margins. Bookings rose 49% compared to the same period in 2022. For the full year, revenue grew 12%, increasing in both groups and across all product and service categories compared to full year 2022 .EPS for 2023 increased 18% compared to 2022. The company also just announced an 11.6% dividend increase!

Potential Risks for Toromont Industries

When we think of the mining and construction sectors, there are two characteristics that come to mind: capital-intense and cyclical. While TIH enjoys a strong reputation and a steady source of income coming from its business model, the company still has to deal with economic cycles. The market expects TIH to showcase great performance in the coming years due to massive infrastructure investments from Canadian provinces. Let’s hope that the company doesn’t disappoint investors.

Revenue growth wasn’t impressive since the pandemic, but now it seems to be picking up in the latest quarters. TIH continues to face construction delays and inflationary pressure. What would happen if we entered a recession? We can see that backlog is now slowing down, signaling weaker results ahead. But so far, the dividend triangle stays incredibly strong.

Want more stock ideas? Download out Top Stocks for 2024 booklet!

TIH.TO Dividend Growth Perspective

Toromont has been a pioneer among the Canadian dividend growers with a dividend growth streak that has been around since 1989. It’s too bad that TIH exhibits such a low dividend yield even after management more than doubled its payouts over the past 5 years. Since TIH has a low payout ratio, shareholders can expect higher single digit increases over the long run. It followed up on a generous dividend increase of +11.4% in 2022 with another one of +10% in 2023 (from $0.39/share to $0.43/share), and yet another one, this time +11.6% in early 2024 (from $0.43/share to $0.48/share).

Final Thoughts on Toromont Industries

TIH’s yield of 1.5% won’t pay your bills, but it is growing by double-digit annually for one (+10.25%), three (+13.05%), and five years (15.45%).

Despite its very strong dividend triangle (5yr double-digit growth for revenue, EPS and dividends) and revenue growth improving of late, the stock price isn’t following the same growth trend. Last year, you had the chance to buy TIH at a PE of 20. Today, the forward PE is 18.80! Could be a good entry point if you want to add industrials stock to your portfolio.