A new Canadian buy list stock on my list for January 2024 is Stella-Jones (SJ.TO), a special beast in the materials sector. While its business model revolves around lumber prices, most of its revenue comes from products essential to infrastructure projects: utility poles and railway ties. SJ.TO’s business is less affected by price fluctuations than if it was all about residential lumber. Find out more about why I bought shares of SJ.TO in December 2023.

See my U.S. buy list stock pick for this month here.

Stella-Jones Business Model

Stella-Jones Inc. is a Canada-based producer of pressure-treated wood products. It supplies various electrical utilities and telecommunication companies with wood utility poles and North America’s short line and commercial railroad operators with railway ties and timbers. SJ.TO also provides industrial products including wood for railway bridges and crossings, marine and foundation pilings, construction timbers, and coal tar-based products.

Additionally, the Company manufactures and distributes premium treated residential lumber and accessories to Canadian and American retailers for outdoor applications, with a significant portion of the business devoted to servicing Canadian customers through its national manufacturing and distribution network. The Company operates 45 wood treating plants and a coal tar distillery across Canada and the United States, complemented by a procurement and distribution network.

Discover other great picks in our 2024 Top Stocks booklet. Download it now.

Investment Thesis for SJ.TO

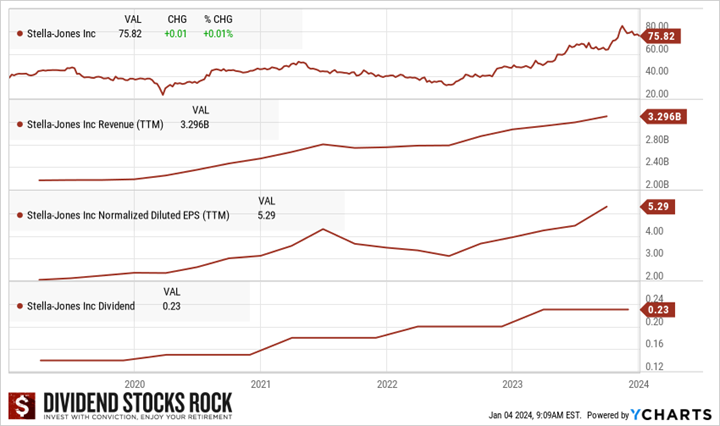

With utilities and railroads as its main customers, Stella-Jones will keep getting sizable orders and getting paid. SJ.TO’s revenue surged between 2017 and 2021 because demand for its products was strong from both sides of the border. Business has slowed since the second half of 2021, but SJ.TO continues to grow. In 2023, it reported impressive numbers as demand for infrastructure products is surging. With 15 facilities in Canada and 25 on U.S. soil, Stella-Jones can deliver its products promptly.

The company has proven to be a defensive pick during the pandemic. The “lumber COVID-hype” is over, but SJ.TO remains a solid business benefiting from multiple growth vectors. While residential construction may slow down due to higher interest rates, the need for more infrastructure and major projects continue to drive sales higher.

A portion of the company’s growth in recent quarters was fueled by recent acquisitions and margin expansion. Management mentioned it was seeking acquisition targets – we like that!

SJ.TO Last Quarter and Recent Activities

Recently, Stella-Jones impressed the market and analysts with a killer quarter; revenue up 13%, and EPS up 79%! Excluding the acquisition of utility pole manufacturer Texas Electric and the positive currency impact, sales were still up 7%. Despite understandable lower sales for residential lumber, the company saw an organic growth of 17% from its infrastructure-related businesses. Utility sales were up 32.3%, Railway ties +15.6%. Earnings jumped on expanding margins in SJ.TO infrastructure-related businesses, helped by businesses acquired in late 2022 and 2023.

Potential Risks for Stella-Jones

SJ.TO is highly dependent on macroeconomic factors. Although the company enjoys a stable replacement business for railway ties and utility poles, those segments do not always grow at a fast pace. The residential lumber division depends on the health of the housing market. Fueled by strong results, SJ.TO’s stock price skyrocketed in 2023. It’s always an additional risk to buy when a stock almost doubles in value.

Going forward, Stella-Jones will remain dependent on lumber pricing. If demand is strong, it will seem to be a robust business. Like any commodity producer, it experiences uptrends and downtrends. This seems to be a good deal with a forward PE ratio below 14.

Discover other great picks in our 2024 Top Stocks booklet. Download it now.

SJ.TO Dividend Growth Perspective

Another reason I chose SJ.TO as a buy list stock is that it’s dividend has almost doubled over the past 5 years, yet the company exhibits a very low payout ratio. Unfortunately, as is the case with many low-yielding stocks, the combination of a low payout ratio and low yield makes the DDM calculation inadequate. Going forward, shareholders can expect mid single-digit dividend growth. The latest dividend increases were more than generous (going from $0.15/share to $0.18/share in 2021 and then to $0.20/share in 2022, and now to $0.23/share in 2023), but for planning and valuation purposes, we would rather stick with a more conservative scenario.

Final Thoughts on Stella-Jones

In 2023, the company reported impressive numbers with demand for infrastructure products surging; despite a surging stock price in 2023, it still trades at an attractive forward PE of 14; infrastructure and major projects should continue to drive sales higher; the company is on the lookout for more acquisition targets. So, lots of growth vectors on its dashboard.

What’s not to like? Stella-Jones is fully deserving of a spot as a buy list stock for many dividend growth investors.