A stock that remains on my buy list for November is Toronto-Dominion Bank (TD.TO/TD). I look at TD as a core holding, because it meets all my investment requirements and it’s a stock that I would hold for a long time, while reviewing it quarterly for good measure. Here’ why.

TD has a very lean structure that plays a significant role in its expansion. It also has a solid dividend growth history, and management recently rewarded shareholders with several dividend increases. Plus, it has a significant presence in the US compared to other Canadian banks.

TD has a very lean structure that plays a significant role in its expansion. It also has a solid dividend growth history, and management recently rewarded shareholders with several dividend increases. Plus, it has a significant presence in the US compared to other Canadian banks.

TD.TO Business Model

Toronto-Dominion Bank operates as a bank in North America. TD’s segments include Canadian Personal and Commercial Banking; U.S. Retail; Wealth Management and Insurance; and Wholesale Banking.

- Canadian Personal and Commercial Banking offers a full range of financial products and services to approximately 15 million customers in Canada.

- S. Retail offers a range of financial products and services under the brand TD Bank, America’s Most Convenient Bank. It also TD Auto Finance U.S., TD Wealth (U.S.) business.

- Wealth Management and Insurance provides wealth solutions and insurance protection to approximately six million customers in Canada.

- Wholesale Banking operates under the brand name TD Securities and offers a range of capital markets and corporate and investment banking services to corporate, government, and institutional clients.

Want more great stock ideas? Download our Rock Star list, updated monthly!

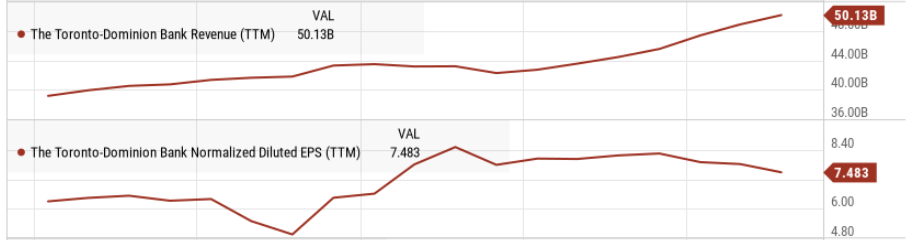

TD Investment Thesis

Over the years, TD has increased its retail focus, driven by lower-risk businesses with stable, consistent earnings. The bank enjoys the largest or second largest market share for most key products in the Canadian retail segment. TD keeps things clean and simple as the bulk of its income comes from personal and commercial banking. It has sizeable exposure in major cities like Toronto, Vancouver, Edmonton, and Calgary, combined with a strong presence in the US.

Over the years, TD has increased its retail focus, driven by lower-risk businesses with stable, consistent earnings. The bank enjoys the largest or second largest market share for most key products in the Canadian retail segment. TD keeps things clean and simple as the bulk of its income comes from personal and commercial banking. It has sizeable exposure in major cities like Toronto, Vancouver, Edmonton, and Calgary, combined with a strong presence in the US.

With about a third of its business coming from the U.S., TD is the most “American” bank you’ll find in Canada. If you are looking for an investment in a straightforward bank, TD should be your pick as increasing retail focus, large market share in Canadian banking, and U.S. expansion are key growth enablers for TD Bank. The 13% stake in Charles Schwab (SCHW) is another interesting growth vector.

TD.TO Last Quarter and Recent Activities

In August, TD reported a disappointing quarter with net income down 2% and EPS down 5%, but it could have been worse. TD’s results were affected by amortization charges, acquisition & integration costs, the termination fee of the acquisition of First Horizon, and strategy costs to reduce the interest rate impact on their balance sheet.

We do like a proactive bank that takes steps now instead of doing what US regional banks did a few months ago, which was nothing! Canadian Personal and Commercial Banking net income was down 1%, mainly due to higher provisions for credit losses (PCLs). US retail was down 9%, hurt by higher PCLs and termination fees on the acquisition. Wealth Management & Insurance was down 12% while Wholesale was flat. TD also announced a 5% share buyback program.

There weren’t any news about TD in October, so we are patiently waiting for the end of November to look at their earnings!

Potential Risks for TD Bank

The housing market has been a concern since 2012. However, TD seems to be managing its loan book wisely and the Canadian economy has been remarkably resilient as well. A higher insured mortgage level in the prairies seems adequate while TD continues to ride the ever-growing downtown Toronto housing market tailwind. As interest rates rise, TD’s loan book will profitably generate stronger income. However, this also comes with increased risk of defaults and slow volume growth.

TD must identify other growth vectors because consumers can’t borrow continuously, even more so with higher interest rates slowing down the economy. It is important to follow the bank’s provision for credit losses, which have risen in the latest quarters. So far, everything is under control, but a recession still looms. In early 2023, TD paid $1.6B in a settlement related to a Ponzi scheme (Stanford Litigation Settlement). While this is treated as a one-time event, it still affected their quarterly earnings report.

Get other stock ideas for all sectors. Download our Rock Star list, updated monthly!

TD.TO Dividend Growth Perspective

TD is a Canadian dividend aristocrat (which allows them a “pause” in their dividend increase streak). TD shareholders were lucky enough to enjoy a dividend increase in early 2020 (+6.8%), right before regulators forced a break in dividend growth. In 2021, the bank rewarded investors with a 12.7% dividend increase. It returned with a more regular increase in 2022 (+7.8%). Going forward, you can expect a mid-single-digit dividend increase as payout ratios are quite low and TD is well capitalized.

For more about dividend aristocrats and the paused dividend growth for Canadian banks, listen to my podcast.

Final Thoughts on this Buy List Stock

Its legal settlement early this year and the general economic landscape may have seemingly taken some of lustre away from TD, but it has a lot on offer for dividend-growth investors. A lean structure conducive to expansion; growth potential through its focus on Canadian retail banking, its US exposure, and its stake in Charles Schwab (SCHW); and dividend growth.

We have TD in the DSR retirement and 500K portfolio models, for both Canada and the US. A stock to consider if you’re looking for holdings in the financial sector.