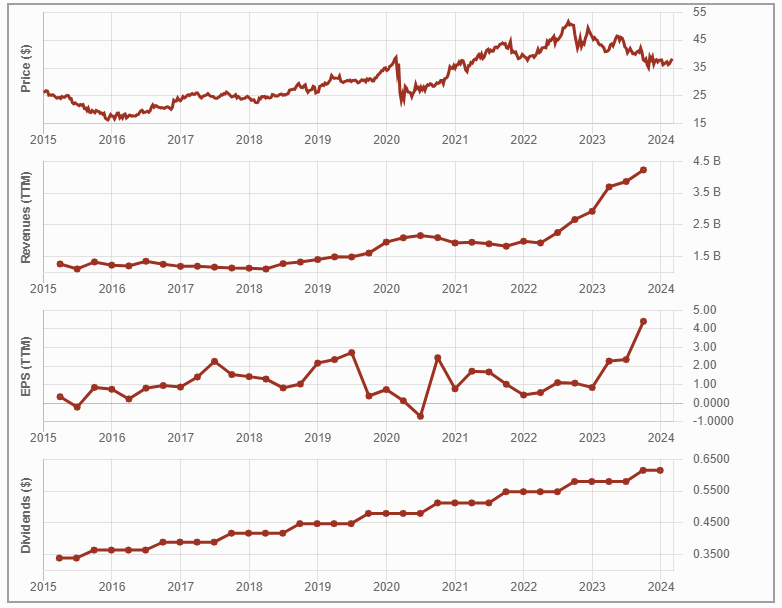

Our buy list stock for March 2024 is Capital Power Corp. (CPX.TO). This is an educated guess. The company is almost perfect, showing a strong business model and good metrics. However, it might come with price fluctuations because of the risks surrounding debt for such a capital-intensive business in the current landscape of high interest rates.

Want to see our U.S. buy list stock of the month? Click here.

Capital Power Business Model

Capital Power Corp. is a growth-oriented power producer company. It develops, acquires, owns, and runs renewable and thermal power generation facilities and manages its related electricity and natural gas portfolios. It runs electrical generation facilities in Canada and the United States. The Company has approximately 9,300 megawatts (MW) of power generation capacity at 32 facilities across North America.

Its projects under construction include over 140 MW of renewable generation capacity and 512 MW of incremental natural gas combined cycle capacity from the repowering of Genesee 1 and 2 in Alberta. It has over 350 MW of natural gas and battery energy storage systems in Ontario and approximately 70 MW of solar capacity in North Carolina in advanced development. Its La Paloma facility is in Kern County, California. The Company also has a natural gas generation facility in the Harquahala region of Arizona.

Its projects under construction include over 140 MW of renewable generation capacity and 512 MW of incremental natural gas combined cycle capacity from the repowering of Genesee 1 and 2 in Alberta. It has over 350 MW of natural gas and battery energy storage systems in Ontario and approximately 70 MW of solar capacity in North Carolina in advanced development. Its La Paloma facility is in Kern County, California. The Company also has a natural gas generation facility in the Harquahala region of Arizona.

Don’t miss anything! Subscribe to our free newsletter here!

CPX.TO Investment Thesis

Capital Power has invested heavily in new projects each year since 2012. This has enabled it to grow its AFFO consistently. Contrary to Algonquin Power (AQN), CPX currently shows funds from operation per share growth year after year despite higher interest rates.

After announcing the acquisition of Midland Cogeneration (a 1,633 MW natural gas combined-cycle cogen facility), it did it again in late 2023, acquiring a 50.15% interest in the 265 megawatts (MW) Frederickson 1 Generating Station in Pierce County, Washington. This will bring CPX’s revenue diversification to 50% U.S. and 50% Canada.

The acquisitions add another 1,608 MW of net capacity to CPX’s U.S. WECC portfolio, boosting run-rate U.S. EBITDA to ~40% of total contributions. Acquisitions are expected to bring an 8% AFFO growth per share. CPX is now the 5th largest natural gas IPP in North America.

We like CPX’s strategy of investing in renewable energy and its goal to abandon coal in 2024 and show zero net production by 2045, but profitability might be hard to achieve with these projects in this market. 22% of adjusted EBITDA was generated from renewable assets in 2021. An investor can expect continued profitability going forward as CPX keeps investing in renewables.

CPX.TO Last Quarter and Recent Activities

In 2023, Capital Power continued to transform its Genesee generating station to move away from coal. It completed the work needed for Unit 3, now 100% natural gas-fuelled, and progressed the repowering of Units 1 and 2, with completion expected in 2024. CPX made its largest transaction ever with the acquisition of the La Paloma and Harquahala natural gas facilities, as well as the addition of the Frederickson 1 facility.

Capital Power reported a good quarter with revenue growth of 6% and funds from operation per share up 15%. AFFO increased due to lower overall sustaining capital expenditures resulting from fewer outage activities, and higher adjusted EBITDA.

Potential Risks for Capital Power Corp.

For several years, Capital Power’s had too much of its revenue coming from Alberta making it dependent on the state of the province’s economy. Through its multiple acquisitions, CPX brought its exposure to this province down to 31%.

As with all other utilities, CPX.TO is a capital-intensive business. It must invest heavily continually to generate more cash flow. The market might not be so eager to see additional debt to fund projects in the coming years. With higher interest rates, debt could become a burden. There’s no guarantee that liquidity will continue to be easy to get from capital markets. While CPX shows a healthier balance sheet than Algonquin, let’s not forget how aggressive growth by acquisition strategies can end when they’re not managed properly. Finally, weather variation could affect results as we’ve seen already, where warm winters reduce AFFO occasionally.

Don’t miss anything! Subscribe to our free newsletter here!

CPX.TO Dividend Growth Perspective

Considering its various wind energy projects and the robust Alberta economy, CPX’s management expects to increase its dividend by 6% through 2025. Such a promise is always welcomed by income-seeking investors. Through its successful transformation into a diversified utility, CPX is earning its place among other robust Canadian utilities such as Fortis, Emera, and the Brookfield family.

Final Thoughts on Capital Power (CPX.TO)

CPX.TO intends to invest heavily in the wind energy business and to get many U.S. projects. Its diversification plan is paying off; it reduced Alberta’s contribution to its revenue to less than one-third and has managed to show sustained growth. The company now expects a dividend growth rate of 6% through 2025.

With its vigorous growth by acquisition strategy, Capital Power could face headwinds from high interest rates on significant debt. Investors aware of these potential risks and willing to live with them while the investment thesis stands might find it an attractive play.