Imagine being able to invest in Amazon, Apple, or Microsoft in Canadian dollars—without opening a U.S. account or worrying about exchange rates.

Welcome to the world of Canadian Depositary Receipts (CDRs), a unique financial product tailored for Canadian investors who want access to big-name U.S. companies without the hassle of the U.S. dollar.

But before you jump in thinking CDRs are the ultimate shortcut, let’s take a closer look.

- Are they the perfect solution?

- Or are there limitations you need to know before clicking “Buy”?

Let’s explore what CDRs are, how they work, and whether they belong in your portfolio.

What Are CDRs and Why Are Canadians Interested?

CDRs are like the Canadian cousin of ADRs (American Depositary Receipts).

But instead of giving U.S. investors access to foreign companies, CDRs let Canadian investors buy fractional shares of U.S. companies—right on the Canadian market and in Canadian dollars.

They’re issued by CIBC and traded on Cboe Canada (formerly the NEO Exchange). You don’t need a U.S. brokerage account, and there’s no need to convert your CAD to USD. You log in to your brokerage, search for the CDR ticker (like AAPL.NE for Apple), and buy in Canadian dollars.

CDRs are especially appealing for two reasons:

-

Currency hedging: CDRs protect you from USD/CAD fluctuations—your returns aren’t affected if the loonie drops in value.

-

Fractional investing: Since you’re buying a slice of a U.S. share, you can invest in companies like Amazon or Microsoft for just $30–$40 CAD per share.

Sounds convenient, right? It is—but there’s more to the story.

What You Gain and What You Might Miss

Pros of CDRs

-

Invest in U.S. giants without buying USD

-

Lower share price makes big names accessible

-

Currency fluctuations are mostly neutralized

-

Dividends are paid in Canadian dollars

-

No special tax rules if held in an RRSP

But, of course, there are a few limitations you should know about.

The Not-So-Obvious Downsides

-

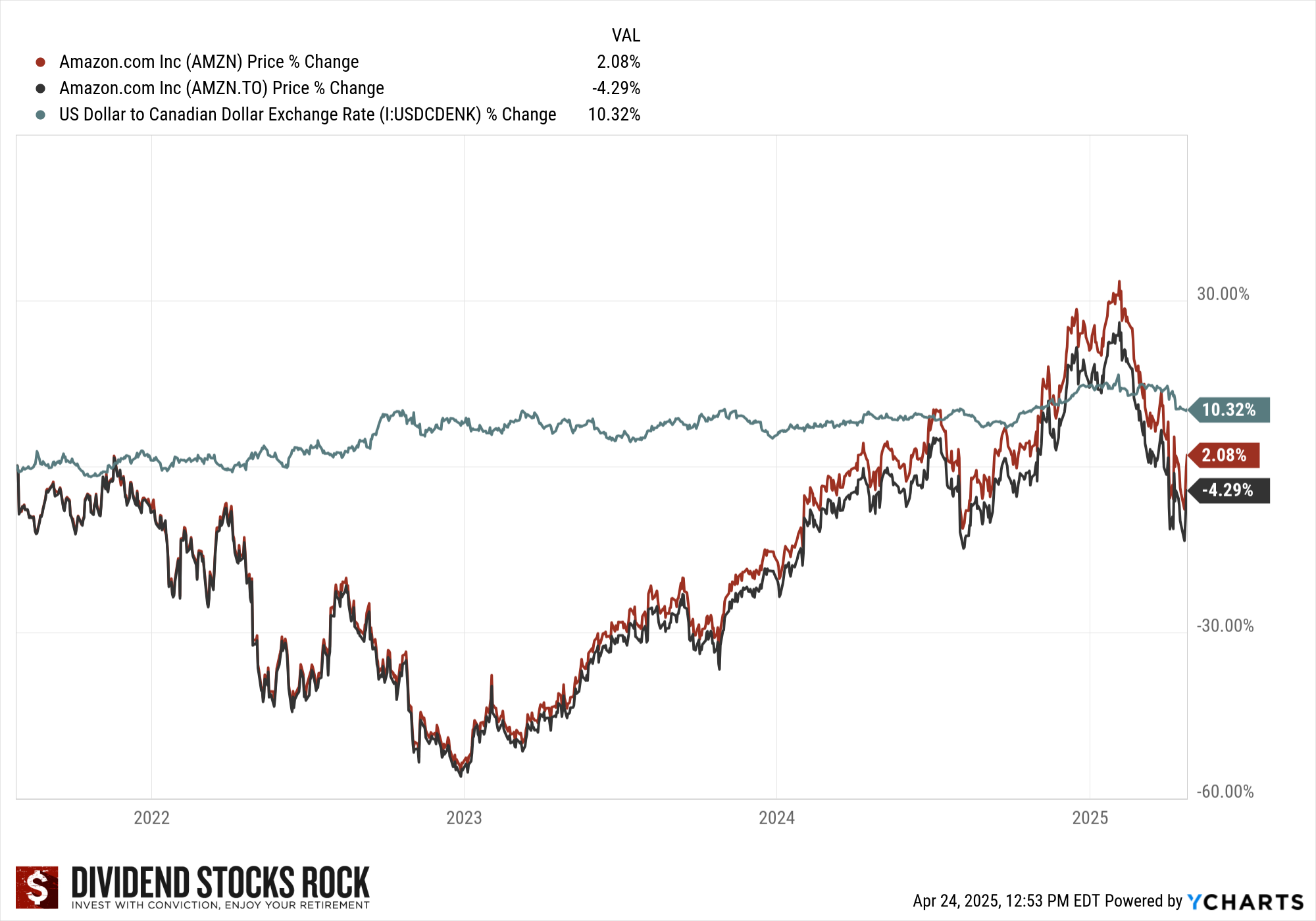

You miss out when the U.S. dollar gains value. Since 2021, the USD has appreciated by about 10% against the CAD. If you had held Amazon’s U.S. stock instead of the AMZN CDR, you’d have seen a 10% boost in your returns just from currency alone.

-

Only a subset of U.S. companies are available as CDRs. Many strong dividend-paying U.S. stocks—especially those favored by income investors—aren’t included.

-

They’re just fractions. Buying a CDR is like buying a slice of pizza when you want the whole pie. Sure, you can buy more over time, but you’re still tied to fractional dividend payouts and limited voting rights.

Do You Get the Dividend?

Yes! If the company pays a dividend, CDR holders receive it proportionally.

Instead of receiving the full dividend per share (like $0.62/share from Microsoft), you get the same yield (e.g., 0.85%) on the CAD value of your investment. It’s all paid out in Canadian dollars—no conversion or withholding tax if held in an RRSP.

One note of caution: If you hold your CDRs in a TFSA, the dividend is still subject to a U.S. withholding tax, even though the shares are bought in CAD.

Is it Really that Hard to Buy US Stocks?

This is where I push back on the “CDRs are more convenient” argument.

These days, most Canadian brokers offer dual-currency accounts, so you can hold CAD and USD side-by-side. And if you’re worried about conversion fees, there’s a great workaround known as Norbert’s Gambit, which lets you convert CAD to USD for a fraction of what banks charge. It takes a bit of setup, but for long-term investors, it’s well worth it.

Want to learn how Norbert’s Gambit works and when it makes sense to use it?

Get the full explanation in the CDR Guide (yes, it includes a step-by-step example and diagram).

My Personal Take: I Don’t Use CDRs-Here’s Why

Despite all their benefits, I don’t invest in CDRs myself, and here’s why:

-

I like the long-term upside of holding U.S. dollars. Over decades, the CAD/USD fluctuations tend to even out, but when the USD rises, I want to benefit from it.

-

I prefer direct ownership of U.S. stocks. More options, full shares, full dividends.

-

I already have a USD account. Once you’re set up, buying U.S. shares directly isn’t any more complicated, and I keep the dividends in USD for reinvestment.

That said, CDRs aren’t bad. They’re actually good for newer investors, those starting with small amounts, or anyone uncomfortable dealing in U.S. currency. But they’re not revolutionary. And they’re not for everyone.

Want to Dive Deeper?

In the CDR Guide, you’ll learn:

-

How fractional investing works in practice

-

The complete list of all 86 CDRs available as of April 2025

-

How currency hedging affects your long-term returns

-

Why most high-quality dividend stocks aren’t available as CDRs

-

My complete breakdown on Norbert’s Gambit for CAD/USD conversion

Subscribe now to get your copy of the Canadian Depositary Receipts (CDRs) Guide.