Canadian stocks paying USD dividends or trading on an U.S. market (either the NYSE or NASDAQ), or both. Why? Canadian dividend stocks are fascinating. Many of them operate in small niches and pay handsome dividends.

Canadian stocks paying USD dividends or trading on an U.S. market (either the NYSE or NASDAQ), or both. Why? Canadian dividend stocks are fascinating. Many of them operate in small niches and pay handsome dividends.

Should you invest in a Canadian stock on the U.S. market? What is the advantage of having a dividend paid in USD by a Canadian company? Are there withholding taxes on USD dividends?

Let’s answer these questions. We’ll also cover Canadian companies paying a dividend in USD for my fellow Canadians who want to enjoy a sunny retirement down south without worrying about currency fluctuations.

Create income for life. Download our guide!

That darned exchange rate

One question that keeps coming up since the creation of Dividend Stocks Rock in 2013 is:

“As a Canadian, should I invest in the U.S. stock market?”

This is usually followed by…

“I’m asking because the currency rate isn’t good right now”

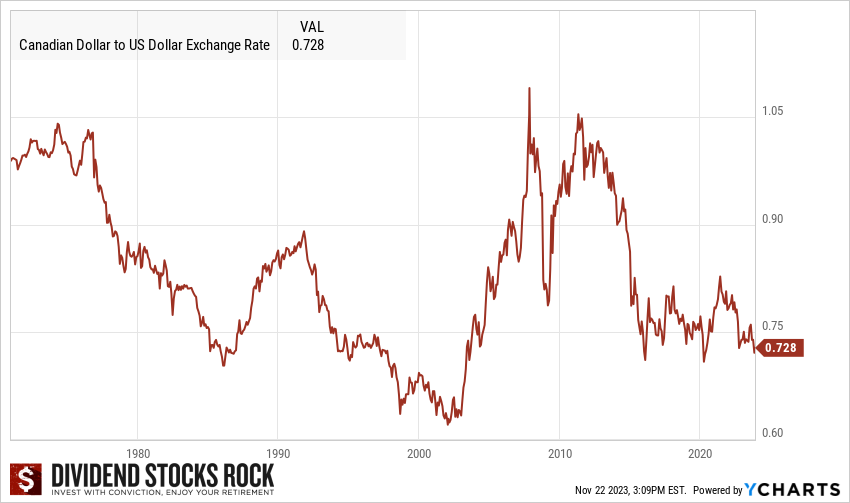

Is it really? Let’s look at the Canadian Dollar vs. the US dollar since the 70’s:

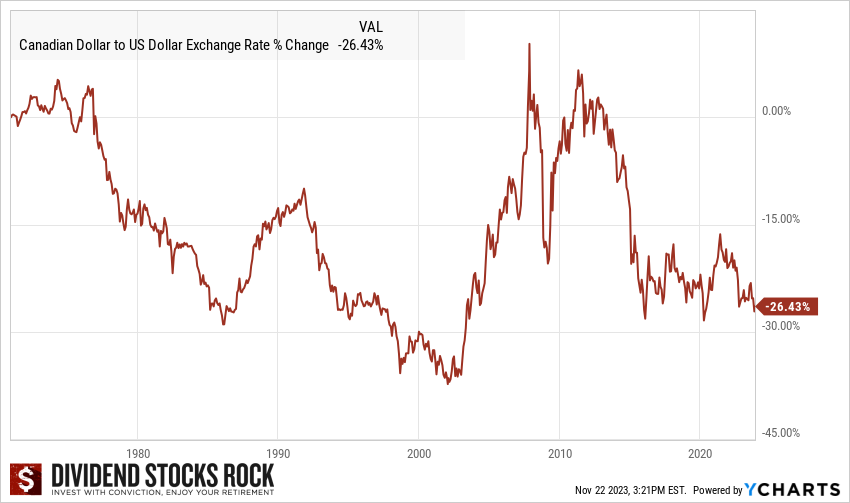

What we see is that we used to trade close to par in the 70’s (remember, it wasn’t a glorious decade for our southern neighbors). Then, it’s a rollercoaster ride between $0.65 to $1.05 depending on the decade. Now, let me work some magic with this graph and present another perspective:

Over the past 50 years, the dollar moved by 26%. In annualized return, we’re talking about the equivalent of an “expensive” ETF fee (0.456). The largest movement was from 2002 to 2007 (remember the oil boom with oil income trusts?) where our dollar surged by 71%. The difference between the bottom in 2002 and today is a 16% upside fluctuation.

Here’s the range of risk regarding CAD vs USD: over a short period of time, one investment in “bad” currency could make you lose a lot (71% between 2002 and 2007). However, if your investment horizon is over five years (seriously, if you’ll need your capital in 5 years or less, stop investing in equities right now), chances are the impact of currency fluctuations will be less than 1% per year.

Right now, we are not close to a historical high or a historical low. Therefore, your risk of losing massively in investing in USD for Canadians or in CAD for Americans isn’t that important all things considered.

Cross-border investing: is it worth it?

However, the risk of not investing in those unique opportunities for each country is great. Americans, you won’t find better banks, telcos, pipelines and utilities outside of Canada. Canadians, you won’t find better exposure to international markets, new technology and the world’s most popular brands outside of the U.S.

If you can combine both markets to your advantage, you’ll build the most powerful and stable dividend growth portfolio. You’ll be well on your way to achieving your retirement dreams.

I’ve discussed at length my interest in U.S. dividend growers. I’m pretty sure I’ve convinced most of my fellow Canadians to consider U.S. exposure in their portfolios. However, I haven’t fully covered the advantage for Americans to invest in Canadian Stocks.

Since we are talking about currencies, let’s look at these topics:

- Canadian dividend stocks trading on U.S. markets for Americans to benefit from our best sectors.

- Canadian dividend stocks paying dividends in USD for Canadians to retire in Florida or Arizona.

Learn about how Canadians can obtain a currency hedge and buy US stocks at a lower price, by reading Canadian Depositary Receipts (CDRs).

Create income for life. Download our guide!

Canadian Dividend Stocks trading on the NYSE

Good news, the list of Canadian dividend stocks trading on U.S. markets isn’t exhaustive. I’ve compiled a complete list to the best of my knowledge.

You can download the list here.

Fortunately for you, there are several great options on this short list.

Canadian banks

(RY, TD, BMO, CM, BNS): Canadian banks are highly regulated, but also highly protected. They are comfortably doing business in a small oligopoly. If you haven’t considered Canadian banks yet, now’s your chance. The big 5 are trading at 9.5-11.5 times their earnings. RY and TD are my favorite from this group (more on National Bank later). A special mention to Brookfield Assets Management (BAM) which is an asset manager, not a bank. Still, it’s a company you should consider. You can view our complete Canadian banks ranking.

Life insurance companies

(MFC, SLF): Canadian Life Insurance companies could be interesting now that interest rates appear to be increasing. My favorite is Great-West Lifeco, but sadly it’s not part of this list. SLF would be my pick instead.

Telecoms

(BCE, TU, RCI, ): Like Canadian banks, telecoms operate in a small oligopoly where 90% of the wireless market is controlled by BCE, TU and RCI. BCE and TU are long-time dividend growers. The former will offer you a stable yield while the latter will offer you a great combination of growth and yield.

(BCE, TU, RCI, ): Like Canadian banks, telecoms operate in a small oligopoly where 90% of the wireless market is controlled by BCE, TU and RCI. BCE and TU are long-time dividend growers. The former will offer you a stable yield while the latter will offer you a great combination of growth and yield.

Utilities

(FTS, BEP, BIP, TA): If you look them up at DSR you will notice they all have strong ratings, but TA. BEP and BIP also pay their dividends in USD. Therefore, there is no reason to not consider those great dividend growers!

Energy

(ENB, CNQ, TRP, SU, IMO, PBA, CPG, ERF, OVV): While there is a wide range of choices in this category, I would cut the selection to only include dividend growers. ENB and TRP are probably the most reliable pipelines in North America while CNQ and IMO (which is partially owned by XOM) are two other great dividend growers. They have proven (especially in 2020), that they can weather any storms and keep their promises to shareholders.

Industrials

(TFII, CNI, CP, STN, WCN, TRI): This is clearly a widely diversified group, but all of them merit a look nonetheless. CNI and CP are among the strongest railroad companies in North America. WCN pays a small yield and is a very stable business. Thomson Reuters shows 28 years of consecutive dividend increases. TFI International is one of the fastest growing trucking companies in North America.

(TFII, CNI, CP, STN, WCN, TRI): This is clearly a widely diversified group, but all of them merit a look nonetheless. CNI and CP are among the strongest railroad companies in North America. WCN pays a small yield and is a very stable business. Thomson Reuters shows 28 years of consecutive dividend increases. TFI International is one of the fastest growing trucking companies in North America.

Materials

(FNV, NTR, GOLD, AEM, WPM, PAAS, MEOH, TECK, CCJ): You know I’m not a big fan of materials, but FNV is in another class. This is a rare gold-related company showing several years with dividend increases. NTR is also an interesting pick if the demand for potash remains strong.

Others

(MGA and OTEX): Magna International (MGA) is an amazing company. You can surf on the car industry along with the EV trend through Magna without having to take the risk of another automotive crash. The company is one of the largest auto parts sellers in the world. It’s a cash flow machine! As for Open Text, this is a SAAS business with over 100,000 customers around the world. However, I must admit that you have better choices on the US market if you are looking for a solid tech stock!

If you are American, I’d say that investing in Canadian banks, telecoms and utilities would add a lot of value to your portfolio. We have many choices in the energy & materials sectors as well, but I’m not a fan of those sectors.

What about pink sheets?

Pink sheets are listings for stocks that trade over the counter (OTC) rather than on a major U.S. stock exchange. They’re usually companies that can’t meet the requirements for listing on the major markets. They often have a “bad reputation” as many of them are penny stocks with limited liquidity. As a dividend investor, this isn’t exactly what you want to add to your portfolio.

However, you will also find amazing Canadian stocks are listed as pink sheets, such as National Bank (NTIOF), Emera (EMRAF), Power Corporation (PWCDF) and Alimentation Couche-Tard (ANCTF). Those are far from being penny stocks. Emera is the smallest company among this list with a market cap over $15B. While there is less volume for those companies, you can add them to your portfolio if you have a long-term horizon. If you’re a DSR member, I invite you to read our analyses of these stocks on the Canadian side if you have doubt about a pink sheet stock.

Create income for life. Download our guide!

Canadian Dividend Stocks Paying USD dividends

Some Canadian companies pay their dividend in USD. They choose to this usually after a business analysis shows most of the company’s revenues are made in the United States. By paying their dividend in the same currency as they generate their revenues, they reduce the risk of currency fluctuation. An example is TFI International (TFII) that changed its CAD dividend to USD after the integration of a massive acquisition in the U.S. (UPS freight was purchased for $800M in 2021).

Is there a tax implication?

In most cases, dividends paid in U.S. dollars by Canadian companies are eligible for the dividend tax credit (source). It’s always a good practice to verify this in the dividend section of the company’s investors’ website. The dividend may also be deposited in your account automatically in CAD. Again, it depends on the company. Those are questions you can ask your broker to ensure you receive the right dividend in the right currency!

Advantage of Canadian stocks paying USD dividends

In general, the advantage of Canadian stocks paying a USD dividend is more for the company, because it generates most of its revenues in USD as explained earlier. For investors, it could be a source of headaches or frustrations (you don’t want your broker making a sweet 2% conversion rate fee on your dividend, right?). However, if you plan a vacation or retirement in the U.S., having Canadian stocks paying their dividend in Uncle Sam’s dollar is a natural hedge against currency fluctuation. You can build a part of your portfolio with those Canadian stocks along with other US stocks and you’ll be set to never have to worry about converting your money “at a bad rate” in the future.

In general, the advantage of Canadian stocks paying a USD dividend is more for the company, because it generates most of its revenues in USD as explained earlier. For investors, it could be a source of headaches or frustrations (you don’t want your broker making a sweet 2% conversion rate fee on your dividend, right?). However, if you plan a vacation or retirement in the U.S., having Canadian stocks paying their dividend in Uncle Sam’s dollar is a natural hedge against currency fluctuation. You can build a part of your portfolio with those Canadian stocks along with other US stocks and you’ll be set to never have to worry about converting your money “at a bad rate” in the future.

The list of Canadian stocks trading on the NYSE counts 75 companies and the Canadian stocks paying USD dividends is relatively small (35 companies), but you will find some common names.