Some companies chase growth; others define stability. Fortis falls squarely in the latter camp — a true Dividend King with over 50 consecutive years of dividend increases, making it one of the most reliable income plays in North America.

While it may not grab headlines with flashy innovation, this utility powerhouse has quietly powered millions of homes — and countless portfolios — with the same steady rhythm for half a century.

If you’re building a portfolio to last, Fortis earns a spot on your shortlist right alongside the names featured in our Canadian Forever Stock Selection.

Business Model: Regulated Power, Predictable Growth

Fortis (FTS.TO) is one of North America’s largest regulated utility companies, serving over 3.5 million customers across Canada, the U.S., and the Caribbean. Its operations span electricity and natural gas distribution, transmission infrastructure, and renewable energy projects.

Roughly 99% of its earnings come from regulated operations, giving the company one of the most stable revenue bases in the market. Major subsidiaries such as ITC Holdings (U.S.), UNS Energy (Arizona), and FortisBC provide geographic and regulatory diversification.

This structure provides reliable cash flows, allowing Fortis to fund steady dividend growth and a robust C$26 billion capital plan through 2028.

Investment Thesis: Powering Ahead with Predictability

Bull Case: A Model of Consistency

Fortis has mastered the art of slow, steady, and sustainable growth. Its regulated revenue model offers unmatched visibility into future earnings, while its ongoing capital investments fuel long-term expansion. The utility plans to grow its rate base by 6.5% annually through 2028, driven largely by investments in its U.S. transmission network (ITC) and renewable energy initiatives.

The company’s ability to deliver 4–6% annual dividend growth through 2029 underscores its commitment to shareholders. Fortis has raised its dividend for 51 consecutive years, placing it in the rare category of Canadian Dividend Kings.

Growth drivers include:

- Large-scale grid and transmission expansion in the U.S. Midwest and Canada

- Transition of coal assets to natural gas and renewable generation

- Strategic investments in offshore wind and renewable natural gas

- Inflation-linked rate base adjustments ensure cash flow protection

Fortis remains one of the few utilities offering steady earnings growth, inflation resilience, and reliable dividend compounding — all wrapped in a conservative, defensive package.

Bear Case: Regulated Stability Comes with Limits

While Fortis provides safety and predictability, it isn’t immune to headwinds. The company’s heavy reliance on debt-funded capital projects makes it sensitive to rising interest rates and financing costs. Approximately one-third of its current capital plan is funded through debt, a structure that works best in stable-rate environments.

Additionally, currency risk is real — with roughly 60% of earnings generated in the U.S., fluctuations in the CAD/USD exchange rate can impact results.

The regulated nature of its business also means limited upside: returns are capped by rate decisions from regulators. While this reduces volatility, it also constrains potential outperformance compared to faster-growing peers like Hydro One or Emera.

Finally, environmental and policy shifts — particularly around carbon reduction — could pressure Fortis to accelerate its transition spending faster than planned, straining capital budgets.

Latest News: Staying on Plan and On Track

On August 8, 2025, Fortis reported a solid quarter with EPS up 13% year-over-year, driven by continued execution of its capital plan and strong regulatory outcomes.

The company reaffirmed its C$26 billion five-year capital plan, including:

- Converting 793 MW of coal generation at TEP’s Springerville station to natural gas by 2030

- Achieving a coal-free portfolio by 2032

- Growing its regulated rate base from US$39B (2024) to US$53B (2029) — a 6.5% CAGR

With $2.9 billion in capex deployed in the first half of 2025, Fortis remains firmly on schedule and continues to target annual dividend growth of 4–6% through 2029.

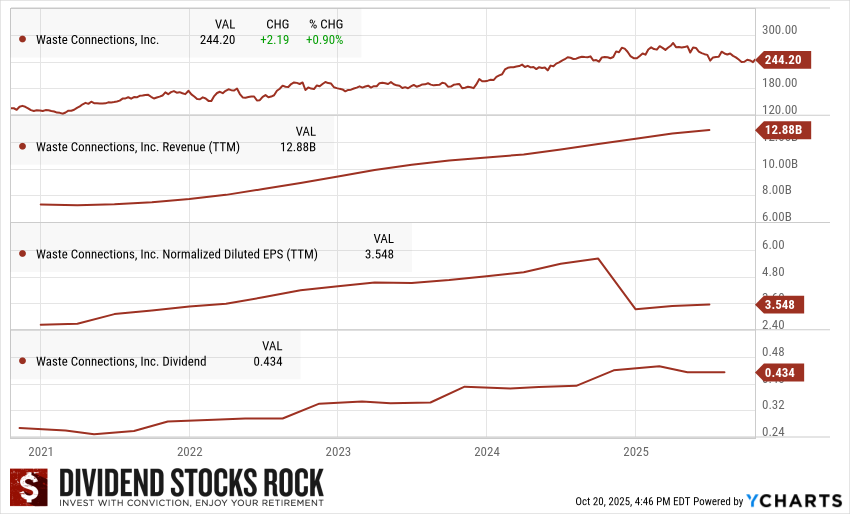

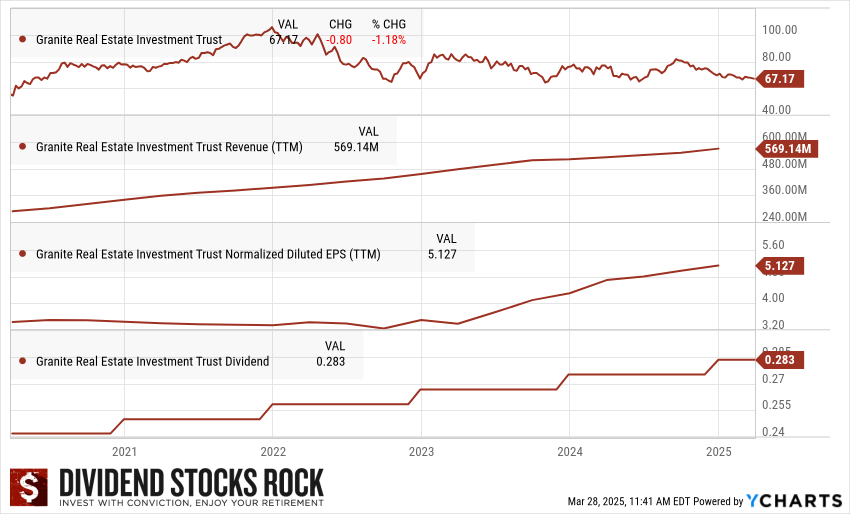

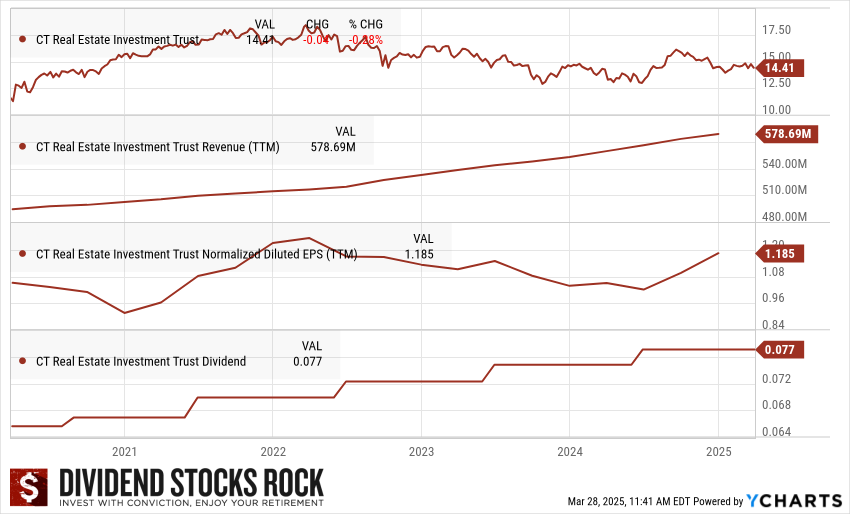

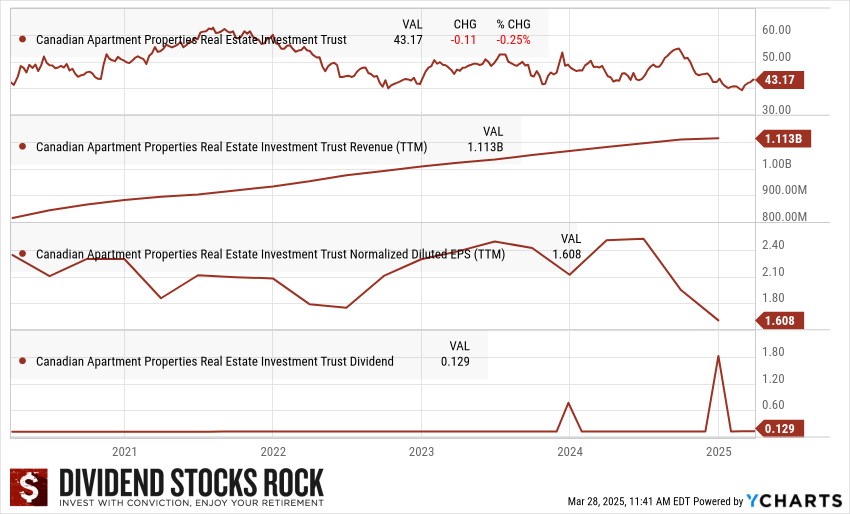

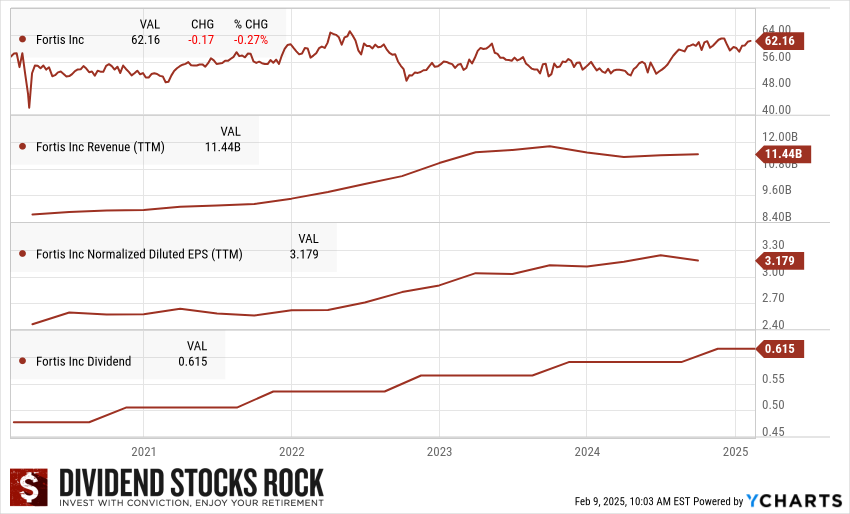

The Dividend Triangle in Action: Stability You Can Count On

Fortis’s Dividend Triangle — the combination of revenue, earnings, and dividend growth — demonstrates remarkable consistency over the past decade.

- Revenue: Steady growth driven by rate base expansion

- Earnings per Share: Reliable increases supported by predictable cash flows

- Dividend: A 51-year streak of increases — the gold standard of dependability

Final Words: The Dividend King of Consistency

Fortis doesn’t aim to surprise the market — it aims to outlast it. With a proven management team, strong regulatory relationships, and an unbroken dividend growth record stretching over five decades, this utility remains a cornerstone holding for dividend investors seeking peace of mind.

It’s the kind of stock that may never dominate headlines, but it will quietly power your portfolio through any market cycle.

Want More Dividend Rock Stars?

If you like dependable names like Fortis, don’t miss our Dividend Rock Star List — your guide to the best Canadian companies combining growth, stability, and reliable income for the long haul.