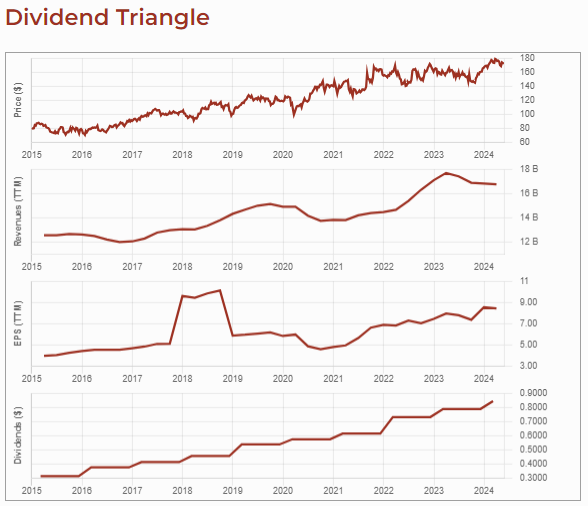

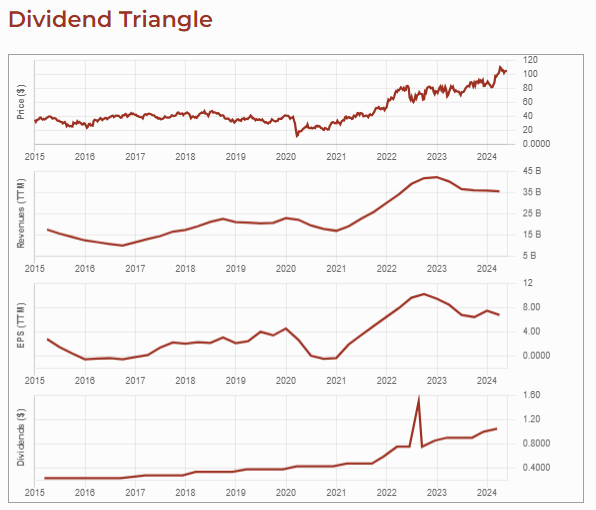

Thomson-Reuters (TRI.TO) seems pretty boring. After all, software and services for lawyers, accountants, and corporations don’t make us jump to our feet excitedly. However, with a market cap of $110B CAD, 31 consecutive years of dividend increases, and 5-year total returns of 200%, Thomson-Reuters is an industrial stock that is anything but boring.

You can also listen to Mike’s podcast.

Formed in 2008 with the merger of Thomson and Reuters, TRI.TO is mostly known to the general public for its news service and media, but this only represents a few percentage points of its total revenue. Thomson-Reuters’s largest business is selling complex software and services for the legal profession (42% of its revenue), accounting profession (20-25%), and corporations (20-25%). The company was also in the financial data service, with Refinitiv, which it sold to the London Stock Exchange in 2019.

TRI’s Legal Professionals segment sells research and workflow products to law firms and governments. The Tax & Accounting Professionals segment does the same, but for tax, accounting and audit professionals in accounting firms. Its Corporates segment sells a full suite of content-driven technology solutions for small businesses all the way to multinational organizations, including the seven global accounting firms.

Create your own income. Learn how in our Dividend Income for Life Guide!

What’s to like about Thomson-Reuters?

TRI’s generates 80% of its revenue from subscription-based services; this predictable revenue and cash flow is great, as long as the customers stick around. This brings us another strength of Thomson-Reuters: its sticky business model. It sells products and services for complex and regulated domains such as law and accounting.

Through its WestLaw business unit, TRI offers an important service to lawyers. Law firms don’t have the time to jump from one provider to another. With WestLaw and Checkpoint, the tax & accounting software, Thomson-Reuters offers top-of-the-line software to two stable industries. Implementing and learning these services required a high degree if involvement from both TRI and the customers, which tends to cement the relationship between them.

This large customer base to offer cross-selling opportunities. Corporate clients have legal and accounting departments, law firms have accounting departments, etc.

The company generates steady organic growth throughout all segments. The pivot towards cloud-based software should allow it to lower acquisition costs while keeping its existing customer base. The complexity of its fields of business provides a strong barrier to entry against competitors. TRI is well-diversified geographically and enjoys a strong brand name.

The company is heavily investing in innovation, particularly in generative AI, to capitalize on the rising complexity of regulatory compliance and the demand for AI-driven solutions. It made notable progress with products like Westlaw Precision and CoCounsel, and the integration of Pagero to enhance corporate tax and audit capabilities.

Last quarter, Thomson Reuters reported solid results with revenue up 8.5% and EPS up 36%. Total organic revenue growth was 9%, with the “Big 3” segments growing by 10%, driven by strong transactional revenue and seasonal offerings. By segment, growth was as follows: Legal +7%, Corporate +12%, and Tax & Accounting +14%.

Potential Risks for TRI.TO

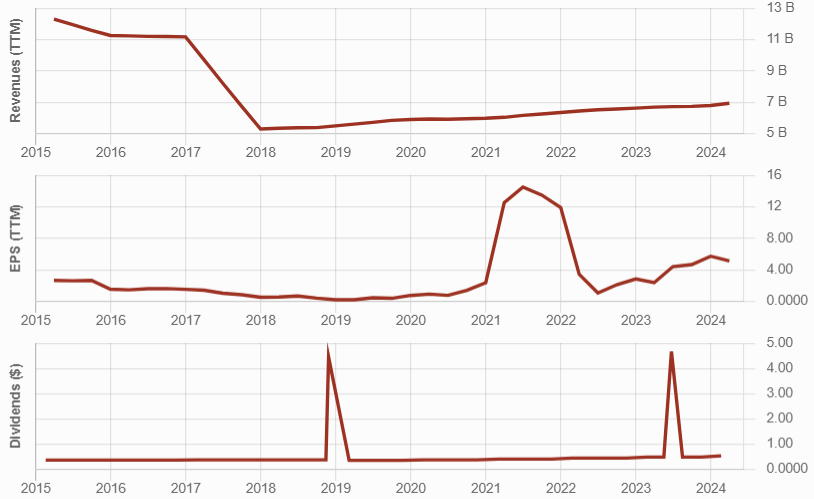

Selling its Financial and Risk (FR) segment brought in a good amount of cash, but reduced TRI’s business diversification. Following the transaction, TRI’s legal services now represent close to half of their revenues. While this segment is quite stable, it does not show rapid growth. A new technology emerging disrupting TRI’s financial legal services isn’t impossible either. TRI is an important shareholder of the London Stock Exchange (LSE) with a 15% stake. This participation is subject to market fluctuations and highly cyclical volumes.

While TRI counts on its Big 3 segments, the rest of its businesses (news and print) could adversely affect margins and slow overall growth. Finally, we saw TRI’S margin being affected by higher inflation in recent quarters. Multiyear contracts take time to reflect price increases.

TRI.TO Dividend Growth Perspective

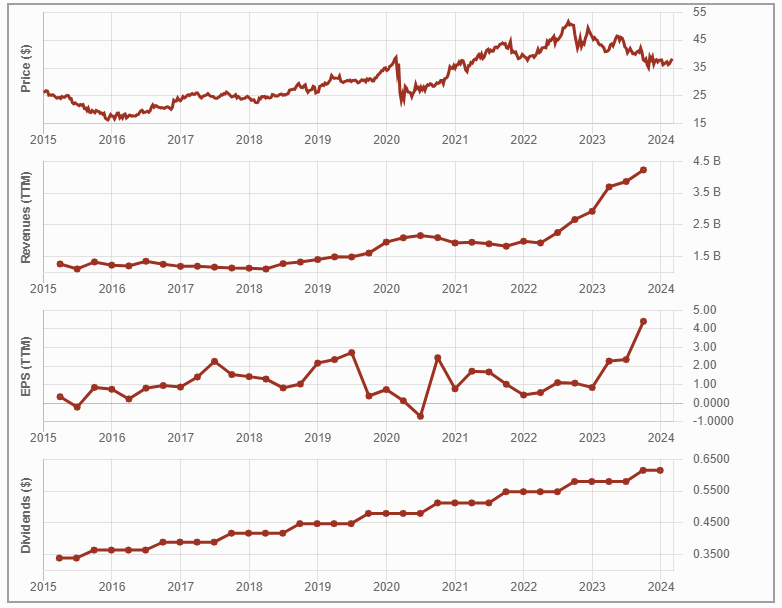

Thomson Reuters has increased its dividend every year since 1993, but its dividend growth rate is not very impressive.

Selling Refinitiv in 2019 brought in a healthy infusion of cash into the business. Management bought back shares and authorized another 5M in share buybacks. An investor can expect a low single-digit dividend growth rate from now on, perhaps with nice surprises along the way as we were in 2022 with the 10% dividend increase, followed by another one in 2023. TRI did not disappoint in 2024 with another 10% increase.

Thomson-Reuters pays its dividend in USD.

Create your own income. Download our Dividend Income for Life Guide!

Final Thoughts on Thomson-Reuters

At 1.25% dividend yield, Thomson-Reuters is a low yield stock. It is also high growth. Total returns over 5 years were 200%! TRI has a stable business model that generates consistent cash flow. With its yearly dividend increased, TRI management is showing its confidence for the future.

Management increased the dividend by 10% in early 2024 and expects to buy back for $1B worth of share. Full-year 2024 outlook expects organic revenue growth of approximately 6%.

TRI.TO stock is trading at a high valuation. It’s trading at a lower P/E ratio than its five-year average, but a P/E ratio of 33 and a Fwd P/E ratio of 44 might give you reason to pause. With market expectations high, will Thomson-Reuter be able to innovate to keep high-single digit revenue growth going? It’s certainly worth a look.

Package and Courier picks up, transports, and delivers items across North America. Less-Than-Truckload picks up small loads, consolidates, transports, and delivers them. The Truckload segment offers conventional and specialized truckload services, including flatbed trucks, tanks, dumps, and oversized. It offers specialized trailers and a million-plus square feet of industrial warehousing space. Logistics provides asset-light logistical services, including brokerage, freight forwarding, transportation management, and small package parcel delivery. TFII hauls compostable and recyclable materials and offers residential waste management services.

Package and Courier picks up, transports, and delivers items across North America. Less-Than-Truckload picks up small loads, consolidates, transports, and delivers them. The Truckload segment offers conventional and specialized truckload services, including flatbed trucks, tanks, dumps, and oversized. It offers specialized trailers and a million-plus square feet of industrial warehousing space. Logistics provides asset-light logistical services, including brokerage, freight forwarding, transportation management, and small package parcel delivery. TFII hauls compostable and recyclable materials and offers residential waste management services.

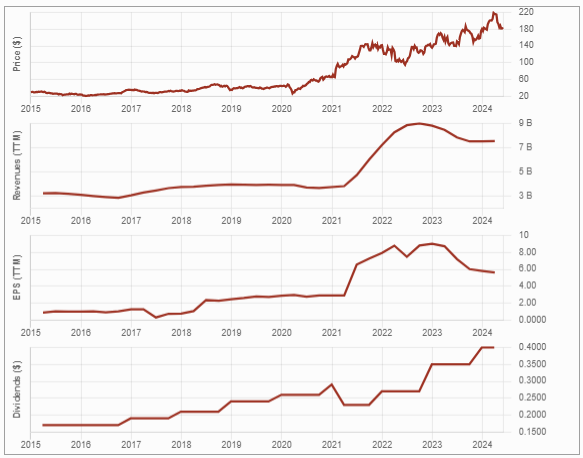

But CNR is more than railway transport! Its services also include intermodal, trucking, and supply chain services. CNR’s rail services offer equipment, customs brokerage services, transloading and distribution, private car storage, and more. Intermodal container services help shippers expand their door-to-door market reach with ~23 strategically placed intermodal terminals. These services include temperature-controlled cargo, port partnerships, logistics parks, moving grain in containers, custom brokerage, transloading and distribution, and others. Trucking services include door-to-door service, import and export dray, interline services, and specialized services.

But CNR is more than railway transport! Its services also include intermodal, trucking, and supply chain services. CNR’s rail services offer equipment, customs brokerage services, transloading and distribution, private car storage, and more. Intermodal container services help shippers expand their door-to-door market reach with ~23 strategically placed intermodal terminals. These services include temperature-controlled cargo, port partnerships, logistics parks, moving grain in containers, custom brokerage, transloading and distribution, and others. Trucking services include door-to-door service, import and export dray, interline services, and specialized services.

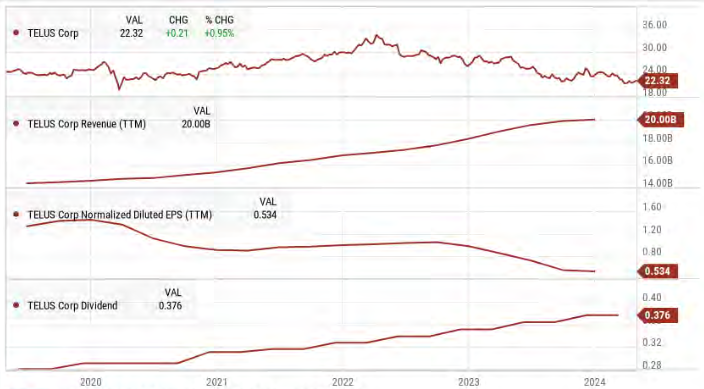

Telus has grown its revenues, earnings, and dividend payouts very consistently. Very strong in the wireless industry, the company is now tackling other growth vectors such as internet and television services. Telus has the best customer service in the wireless industry as shown by its low customer loss rate. It uses its core business to cross-sell its wireline services. The company is particularly strong in Western Canada. Telus is well-positioned to surf the 5G technology tailwind.

Telus has grown its revenues, earnings, and dividend payouts very consistently. Very strong in the wireless industry, the company is now tackling other growth vectors such as internet and television services. Telus has the best customer service in the wireless industry as shown by its low customer loss rate. It uses its core business to cross-sell its wireline services. The company is particularly strong in Western Canada. Telus is well-positioned to surf the 5G technology tailwind.

success internationally but had to close its Italian division and continues to struggle in India. However, after closing its Italian business, the company focused on what’s working for it in North America.

success internationally but had to close its Italian division and continues to struggle in India. However, after closing its Italian business, the company focused on what’s working for it in North America.

Its projects under construction include over 140 MW of renewable generation capacity and 512 MW of incremental natural gas combined cycle capacity from the repowering of Genesee 1 and 2 in Alberta. It has over 350 MW of natural gas and battery energy storage systems in Ontario and approximately 70 MW of solar capacity in North Carolina in advanced development. Its La Paloma facility is in Kern County, California. The Company also has a natural gas generation facility in the Harquahala region of Arizona.

Its projects under construction include over 140 MW of renewable generation capacity and 512 MW of incremental natural gas combined cycle capacity from the repowering of Genesee 1 and 2 in Alberta. It has over 350 MW of natural gas and battery energy storage systems in Ontario and approximately 70 MW of solar capacity in North Carolina in advanced development. Its La Paloma facility is in Kern County, California. The Company also has a natural gas generation facility in the Harquahala region of Arizona.