One of the biggest challenges when planning for retirement is creating a dependable income stream that balances safety, flexibility, and long-term growth.

Fortunately, Canadian investors have access to a variety of income-generating strategies. This post explores two proven approaches: Laddered Bond ETFs & GIC Ladders and Dividend Stocks.

Each serves a distinct role in a well-diversified retirement portfolio.

Remember, they are just two of 20 retirement income products I analyzed in a comprehensive guide. The guide categorizes each option by complexity and suitability for retirees.

Whether you’re in the Go-Go, Slow-Go, or No-Go phase, this guide can help you find the right income solution.

Download the Guide Now to Get a Review of 20 Income Products

Laddered Bond ETFs & GIC Ladders

What Are They?

A laddered bond ETF is a fund that invests in a series of bonds with staggered maturity dates, typically across 1 to 5 years. As bonds mature, proceeds are reinvested automatically, maintaining a balanced maturity ladder.

Similarly, a GIC ladder involves purchasing Guaranteed Investment Certificates with staggered maturities—often one yearly from 1 to 5 years. As each GIC matures, the capital and interest are rolled into a new 5-year term, preserving the ladder structure.

How do They Generate Income?

Both products earn income through regular interest payments. The principal can be reinvested or withdrawn upon maturity, depending on your needs. Bond ETFs offer more liquidity, as they can be sold anytime, while GICs are typically locked in unless you choose redeemable options.

Pros

-

Balance between income and capital preservation.

-

Laddering smooths out interest rate risk.

-

GICs are CDIC-insured (within limits) for added protection.

Cons

-

GICs may be locked in and non-redeemable.

-

Bond ETFs are exposed to market risk and may lose value if rates rise.

-

Interest income is tax-inefficient in non-registered accounts.

Tax Considerations

Interest income is fully taxable. To minimize the tax impact, it is best held within tax-sheltered accounts such as TFSAs or RRSPs.

Who Is It Best For?

This strategy is ideal for retirees in the Slow-Go or No-Go phase who prioritize predictable income and capital protection. GICs appeal to those seeking safety, while bond ETFs offer liquidity and flexibility for those following a systematic withdrawal plan.

Common Mistakes to Avoid

-

Choosing long-term GICs without understanding redemption terms.

-

Assuming bond ETFs are “risk-free” like GICs.

-

Failing to reinvest matured capital, weakening the laddering effect.

From GICs to REITs: A Complete Guide to Retirement Income in Canada

This free guide reviews 20 income-focused products. In the one-page summaries, we highlight the pros and cons, common mistakes to avoid, and who should use them.

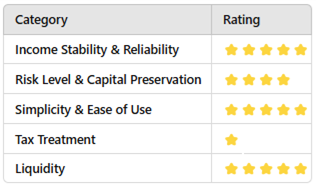

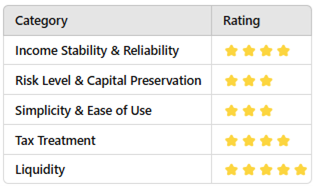

We also created a rating system to highlight the difference between each product. The idea is to provide you with as much information as possible so you can make the right choice for your situation.

While there is no free lunch in finance, there are multiple ways to reach your retirement goals.

Download the Complete Guide to Retirement Income Products to discover which fits your retirement phase best.

Dividend Stocks

What Are They?

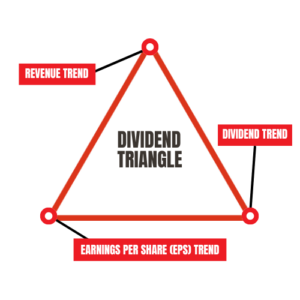

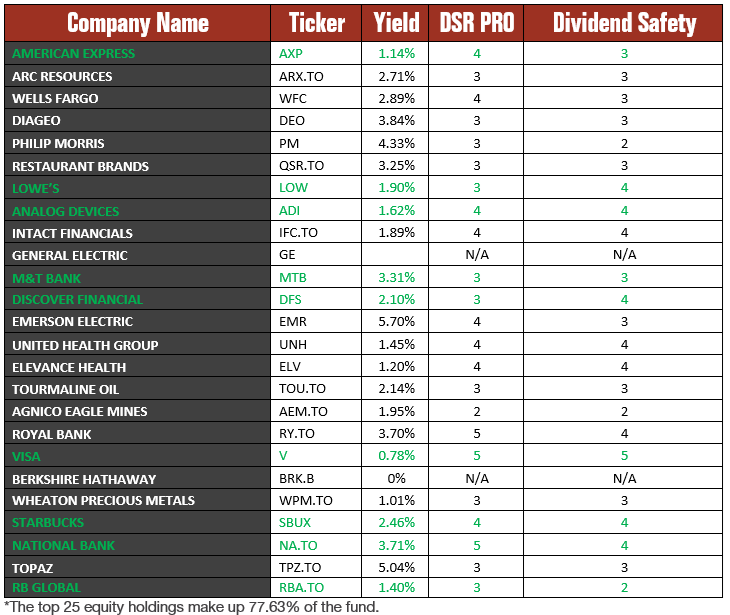

Dividend stocks are shares of companies that distribute part of their profits as dividends—often quarterly or monthly. Canadian dividend-paying stocks with consistent dividend increases signal strong fundamentals, reliable cash flow, and prudent management.

Understand how to find the most reliable dividend stocks by reading about the dividend triangle.

How do They Generate Income?

Dividend payments offer a recurring source of income. Investors may take the dividends in cash or reinvest them for compounding growth. A well-constructed dividend portfolio can deliver monthly or quarterly income with potential for annual increases.

Pros

-

Tax-efficient income thanks to the Canadian dividend tax credit.

-

Potential for dividend and capital growth over time.

-

Helps offset inflation through dividend increases.

Cons

-

Dividends are not guaranteed—cuts can occur in downturns.

-

Subject to market volatility.

-

Requires time, interest, and some financial knowledge to manage effectively.

Tax Considerations

Eligible Canadian dividends are taxed at a lower rate than interest income in non-registered accounts, making dividend stocks a strong candidate for taxable portfolios.

Who Is It Best For?

Dividend stocks are best suited for retirees in the Go-Go or Slow-Go phases who are comfortable with market exposure. This approach rewards those seeking rising income and portfolio growth. Even novice investors can manage this strategy effectively with tools, newsletters, or professional support.

Common Mistakes to Avoid

-

Chasing high yields without assessing dividend safety.

-

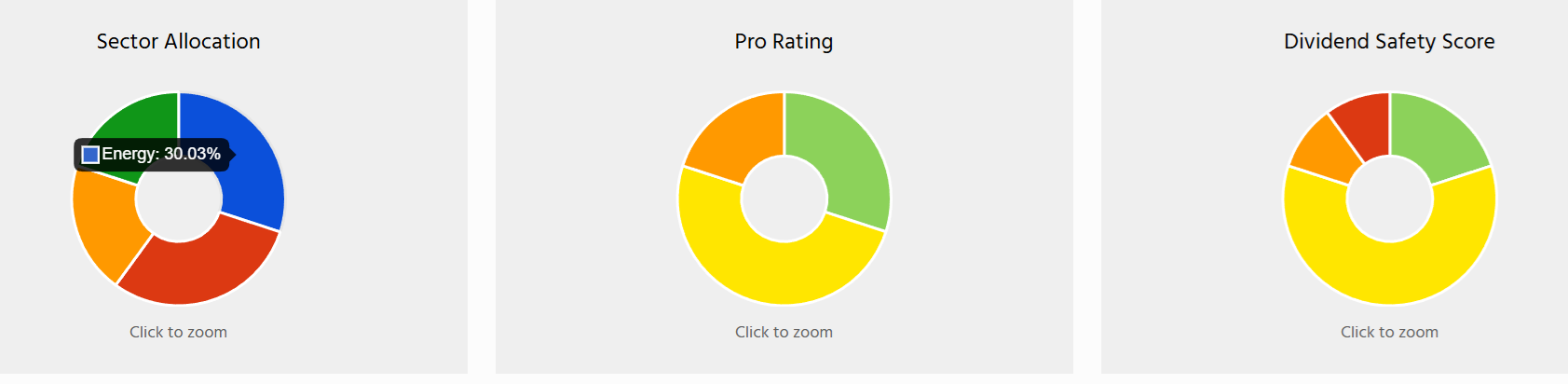

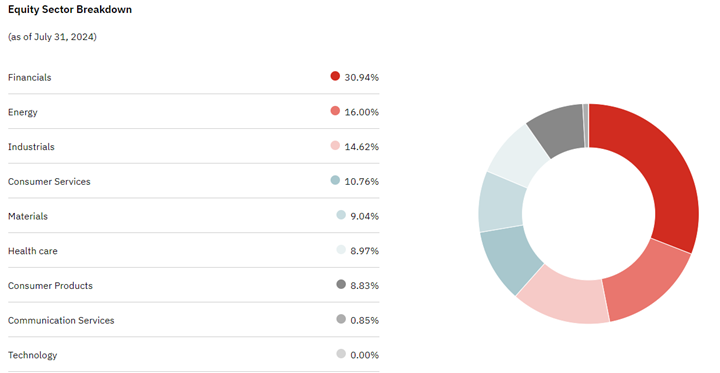

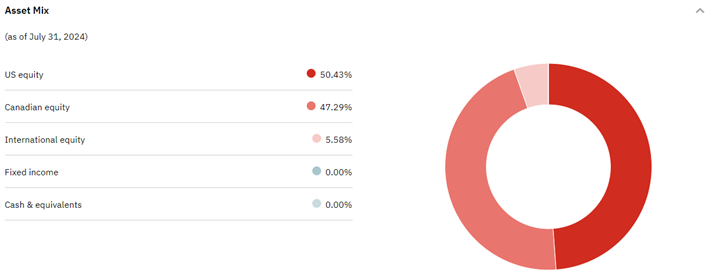

Overconcentration in one sector (e.g., banks, energy).

-

Ignoring stock valuation when buying.

We have covered some other income products in the Dividend Guy Blog podcast episode below.

Final Thoughts: A Solution for All Retirement Seasons

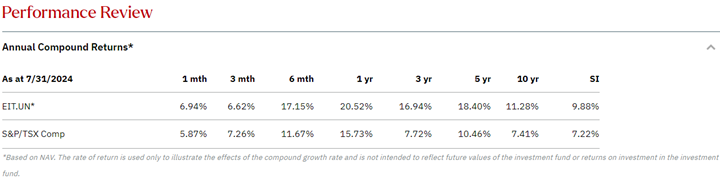

Both laddered bond strategies and dividend stocks can play an essential role in your retirement plan.

Bond ladders provide stability and predictable cash flow, while dividend stocks offer growth potential and tax advantages. Choosing between them—or using a mix of both—depends on your comfort with risk, need for liquidity, and long-term income goals.

By understanding the trade-offs and aligning them with your retirement phase, you can build a resilient portfolio that supports your lifestyle—through all seasons of retirement.

Ready to build a retirement income plan that fits your lifestyle?

From simple GIC ladders to advanced income strategies, the Canadian Retirees’ Guide to Income-Producing Investments covers 20 income-generating products with pros, cons, and tax insights for each.

👉 Get your free copy of the complete guide now and take the guesswork out of retirement planning.

Not at all. You must invest in sectors that fit with your goals, i.e., stability vs growth, and that you understand.

Not at all. You must invest in sectors that fit with your goals, i.e., stability vs growth, and that you understand. #1 List the TSX 60 index by dividends.

#1 List the TSX 60 index by dividends. #2 Select the top 10 yielding stocks from the TSX 60

#2 Select the top 10 yielding stocks from the TSX 60 #3 Buy the top 10 yielding stocks in equal weight.

#3 Buy the top 10 yielding stocks in equal weight. #4 Each January, review the new Dogs of the TSX and trade accordingly.

#4 Each January, review the new Dogs of the TSX and trade accordingly.

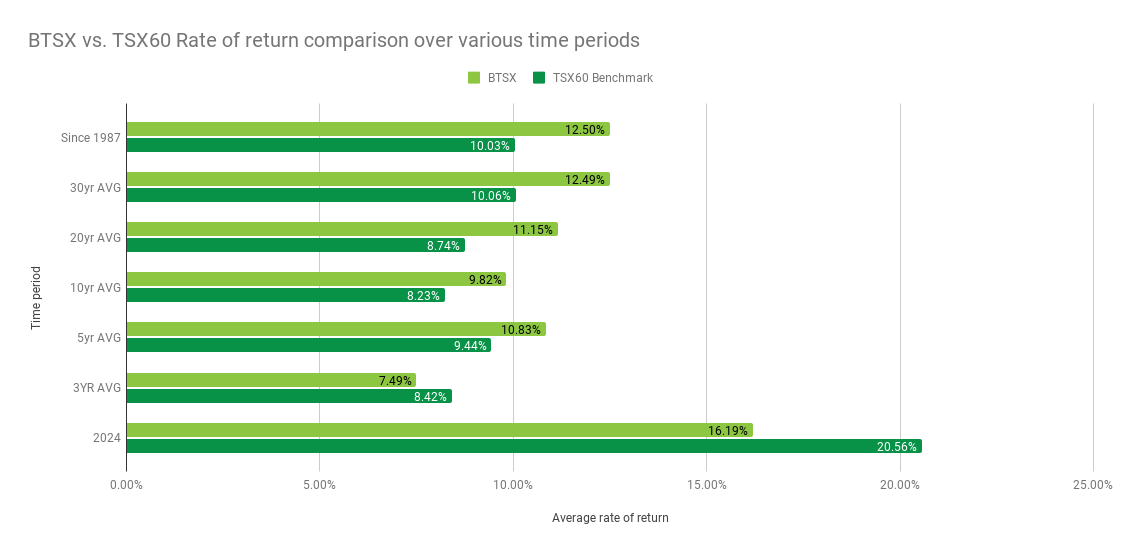

Actually, you could beat the TSX using a list of well-diversified dividend growers that are leaders in their industry. I have built a list of them for you to download for free using this strategy and the tools at

Actually, you could beat the TSX using a list of well-diversified dividend growers that are leaders in their industry. I have built a list of them for you to download for free using this strategy and the tools at

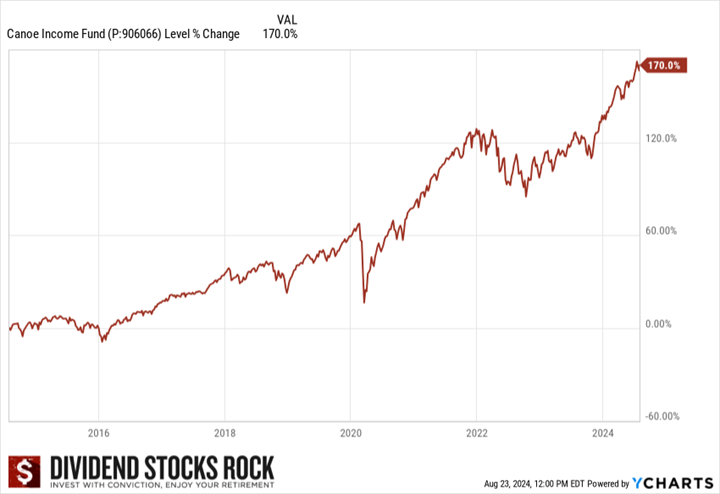

I prefer to let my winners run so I don’t set rules like this to protect my profit. Over the past 20 years, I found that it’s worth holding on to your great picks—those companies that you were so right about buying. Letting them run 5, 10, 15 years, can create so much profit…300%, 400% sometimes even over 1000%!

I prefer to let my winners run so I don’t set rules like this to protect my profit. Over the past 20 years, I found that it’s worth holding on to your great picks—those companies that you were so right about buying. Letting them run 5, 10, 15 years, can create so much profit…300%, 400% sometimes even over 1000%! Something else that I do that relates to profit protection is to trim winning positions that are weighing too much in my portfolio.

Something else that I do that relates to profit protection is to trim winning positions that are weighing too much in my portfolio.