Among common investing mistakes is waiting for market pullback hoping to buy stocks at a cheap price. Another is holding on to loser stocks hoping their price goes back up. These mistakes put your retirement at risk and keep you from sleeping well at night. Learn what you can do about it.

Learn about the other three frequent mistakes investors make here.

Download our Recession-Proof Portfolio Workbook to learn more about building a resilient portfolio.

Waiting for a Pullback

Buy low, sell high, basic and sound investing advice for anyone starting their investing journey. So, what do you do when the stock market keeps climbing higher? You’re not going to buy high, are you? When the market’s trading close to an all-time high, it’s very tempting to wait for the next crash before investing

Why you do this

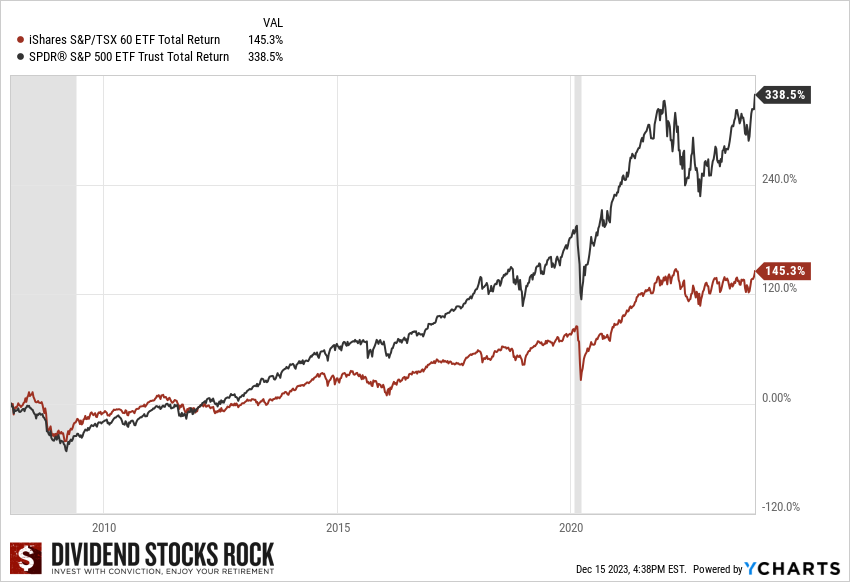

History is full of investing horror stories. Over the last 25 years alone, we’ve seen the tech bubble, the Twin Towers terrorist attack, the 2008 financial crisis, the oil bust in 2015, the 2018 quick bear market, and the 2020 pandemic crash. Inexplicably, many investors think of the events of went up 145% while the U.S. market tripled!

Hoarding cash until the next crash seemingly makes sense; you’ll buy shares at an incredibly low price and enjoy strong returns when they go back up. Why buy now if you can get it cheaper later? And, while you wait, you won’t lose any money on the chunk you hold in cash. A win-win situation; earn interest on your cash now and bargains in the market later. Wrong!

How it hurts your portfolio

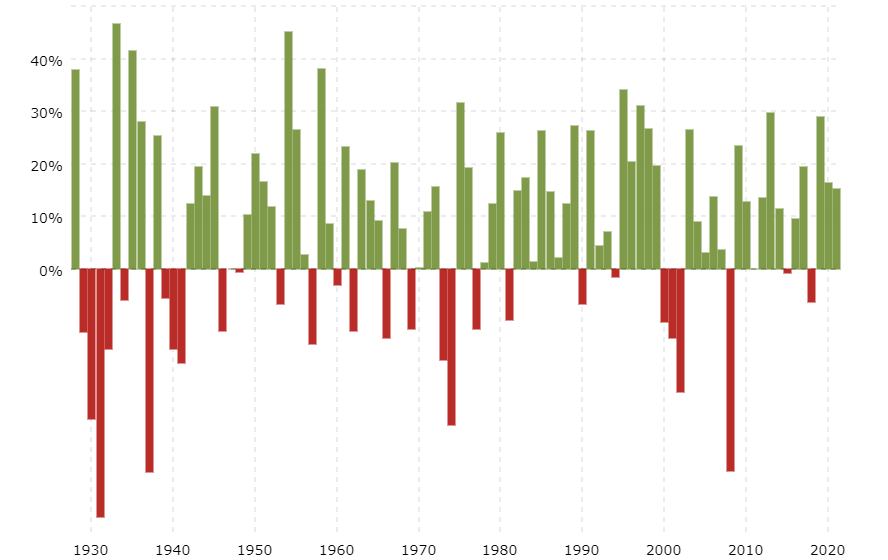

It’s true that investors who invested in 2009 show impressive results today. If the events of 2009 occurred every 5 or even every 10 years, waiting for a major pullback would be a defendable strategy. The opportunity to invest after a major stock market correction is quite rare. Since 1970, there have only been three pullbacks that would’ve been worth the wait (1973-74, 2000-01-02 and 2008-09).

Most often, you’d wait nine years for the next major crash. Who can afford to wait a decade to invest? An insidious effect of waiting is that it makes you doubt your investing plan. Case in point: on December 26th, 2018, both markets had just decreased double-digit from their peak levels. Did you invest all your available money then? This was a major pullback. You probably didn’t invest more money in December 2018 because you were thinking about the possibility of another 2008 or 2000-2002. None of us knew it was the start of yet another bullish segment. Nobody waives a flag to tell us it’s time to buy.

Fixing it

In 2013-2014, most financial analysts and the media said the market was overvalued, be it Forbes, Goldman Sachs, or Motley fool. Everybody agreed the market was way overvalued again in 2017, and again in 2022.

In 2017, I didn’t care where the market was from a valuation standpoint. Selecting from the finest dividend growers at that time, I built my portfolio. Even if a pullback happened 3 months after I invested, I knew my dividend payments would continue to increase during the correction. Sooner or later, share values would go back up… because this is what happens, repeatedly.

Despite 2018, a terrible year, I was better off fully invested during that time than if I had kept 30% to 50% of my portfolio in cash to invest on boxing day. The capital appreciation from early fall 2017 to summer of 2018 combined with the dividends paid exceeded temporary losses incurred during the rest of 2018. None of the calculations I made showed that waiting would have been better.

So, when you think you shouldn’t invest money, focus on your dividend growth plan instead of the stock value. To add in some protection, you can plan to invest at intervals over a 6- to 9- month period. See How to invest a lump sum.

Investing with confidence prevents waiting for a pullback. Our DSR portfolio returns show that even during the market correction of 2018, the focus on dividend growing stocks minimized losses. The best protection against a market crash is a solid portfolio, holding robust dividend growth.

Download our Recession-Proof Portfolio Workbook to learn more about building a resilient portfolio.

Thinking it’ll Bounce Back

Many people invest in the wrong companies. Making poor investment decisions happens to all of us. My positions in Lassonde (LAS.A.TO) and Andrew Peller (ADW.A.TO) were in the red, about 30 months after I bought them. For a while, I waited, but eventually sold my shares of both as they didn’t fit my investment thesis.

Why you do this

None of us want to buy high and sell low. We’ll justify the first 10-20% loss as a temporary setback, the market doesn’t get it, or investors will realize it’s a good company. It’s hard to admit mistakes. It hurts our ego, and our brain does all it can to protect that ego. So, we patiently wait for our losers to come back on track and prove us right.

We also tell ourselves that selling at a loss is acting on fear, and we don’t let our emotions drive our transactions. It’s good reflex to have, but we must analyze our losers to decide to keep or sell them.

How it hurts your portfolio

Investors keep their losers because they focus on the money lost. After making a bad investment that’s trading 40% lower than what you paid, not much else can go wrong. How can you possibly lose more? So, you keep your shares thinking one day it’ll bounce back, and you could recover your money.

In doing so, you leave a lot on the table; there’s an opportunity cost when keeping your money invested in a bad place. What if you cut your losses and bought shares of a strong dividend grower instead? Worried you’ll make another mistake? It could happen, but since you already made one, you learned from it and will make better choices.

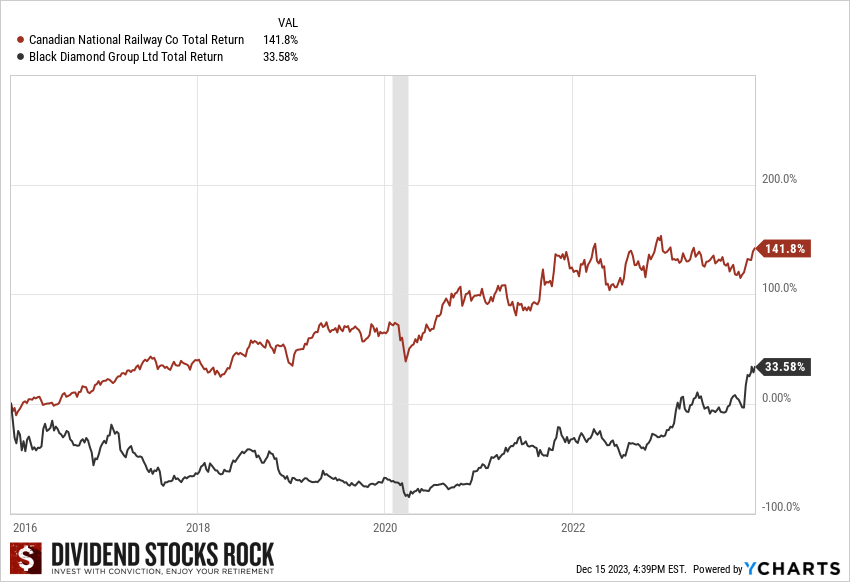

Some years ago, I held shares of Black Diamond Group (BDI.TO). The company faced challenges after the oil bust of 2014-2016 and cut its dividend. Sticking with my investing principles, I sold my shares right away and took the loss. I wasn’t happy to lose money and felt a bit dumb for having bought it in the first place. I was wrong with my investment thesis, and I wasn’t fast enough to see the dividend cut coming. Instead of whining about my bad investment, I moved on. With the proceeds, I bought shares of Canadian National Railway (CNR.TO / CNI). The rest is history:

Had I waited for better days with Black Diamond, I’d have suffered a second dividend cut and lost even more money. Meanwhile, my new shares of CNR appreciated in value substantially and the dividend kept increasing.

Fixing it

Investigate why your loser stocks are losers; perhaps they suffered a one-time event or temporary setback? Or perhaps metrics over 5 years show more serious problems with the company, like lack of growth, absence of dividend increase, a dividend cut, ballooning debt, etc. To avoid future mistakes, find where you went wrong; were you blinded by the company narrative, seduced by a high yield, in denial about the risks the company faced? See 7 Reasons we end up With Loser Stocks, What to do About it.

Build a list of replacement stocks; those you’ve researched and would like to own. The best way to get over selling a loser at a loss is to get a shiny new thing!

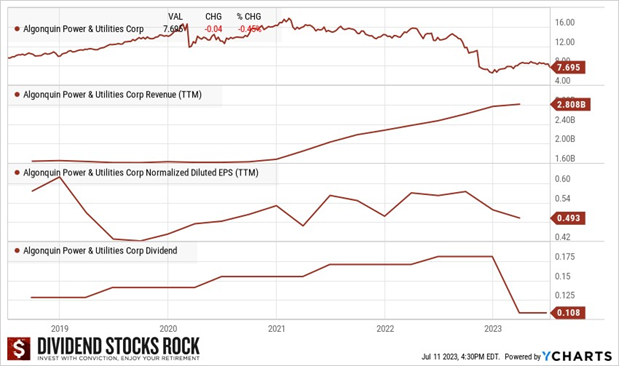

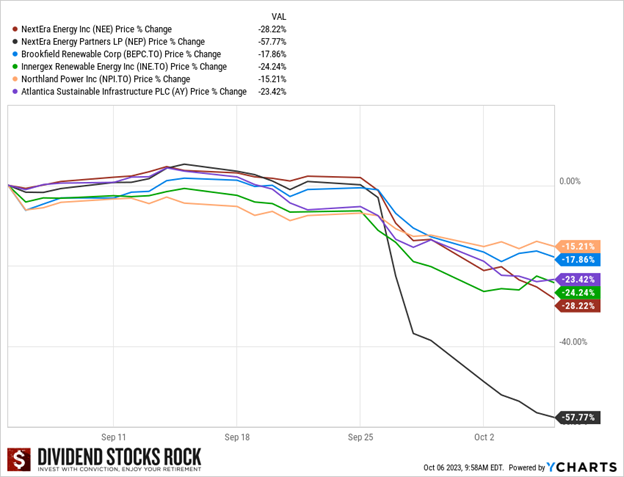

Look for investors’ presentations and quarterly earnings reports on the company website. Doing that reveals that another renewable, Brookfield Renewable (BEPC/BEPC.TO), hosted its investors day in September. Contrary to NEP, BEPC reaffirmed its growth expectations and distribution growth targets…business as usual for BEPC.

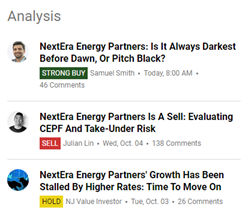

Look for investors’ presentations and quarterly earnings reports on the company website. Doing that reveals that another renewable, Brookfield Renewable (BEPC/BEPC.TO), hosted its investors day in September. Contrary to NEP, BEPC reaffirmed its growth expectations and distribution growth targets…business as usual for BEPC. First, ignore the noise, or you’ll get lost in a myriad of conflicting information. Here are three articles on Seeking Alpha for October 6 (Strong Buy, Sell, and Hold ratings).

First, ignore the noise, or you’ll get lost in a myriad of conflicting information. Here are three articles on Seeking Alpha for October 6 (Strong Buy, Sell, and Hold ratings). Preferred Shares: usually offer regular dividends, have a set redemption value, and take precedence over other shares if the company is dissolved.

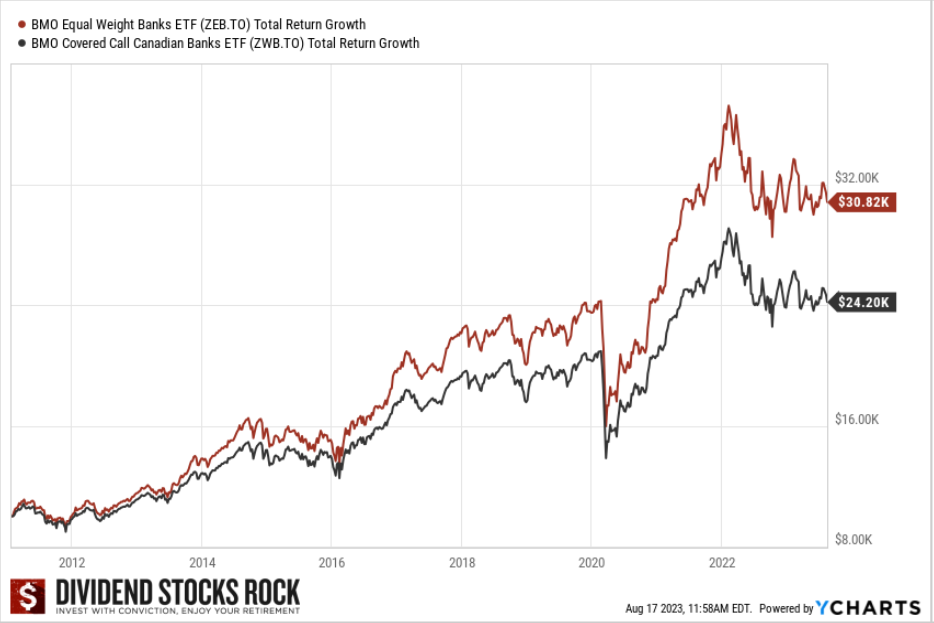

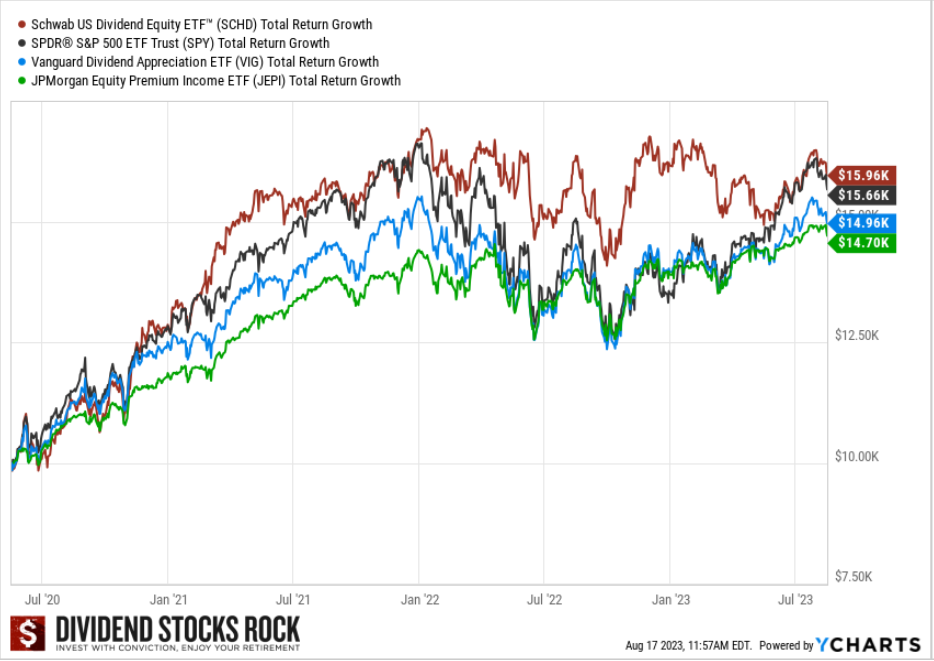

Preferred Shares: usually offer regular dividends, have a set redemption value, and take precedence over other shares if the company is dissolved. Let’s say DSR trades at $100 with a dividend of $1 quarterly, a 4% yield. You hold shares bought at $100 per share. You write a call option on those shares, granting the buyer the right to buy 100 shares at $110. The buyer of pays you $200 for the option.

Let’s say DSR trades at $100 with a dividend of $1 quarterly, a 4% yield. You hold shares bought at $100 per share. You write a call option on those shares, granting the buyer the right to buy 100 shares at $110. The buyer of pays you $200 for the option.

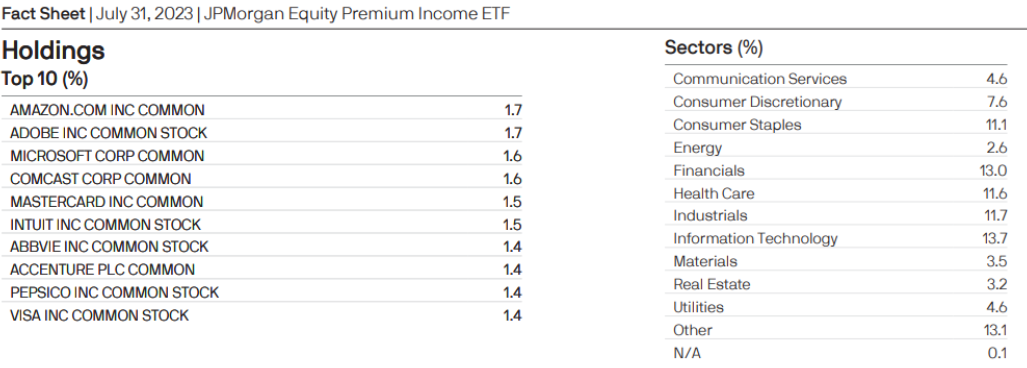

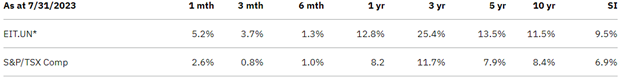

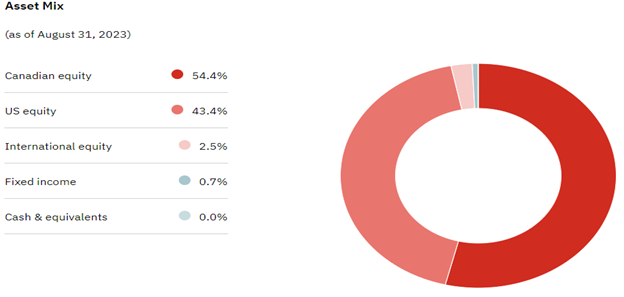

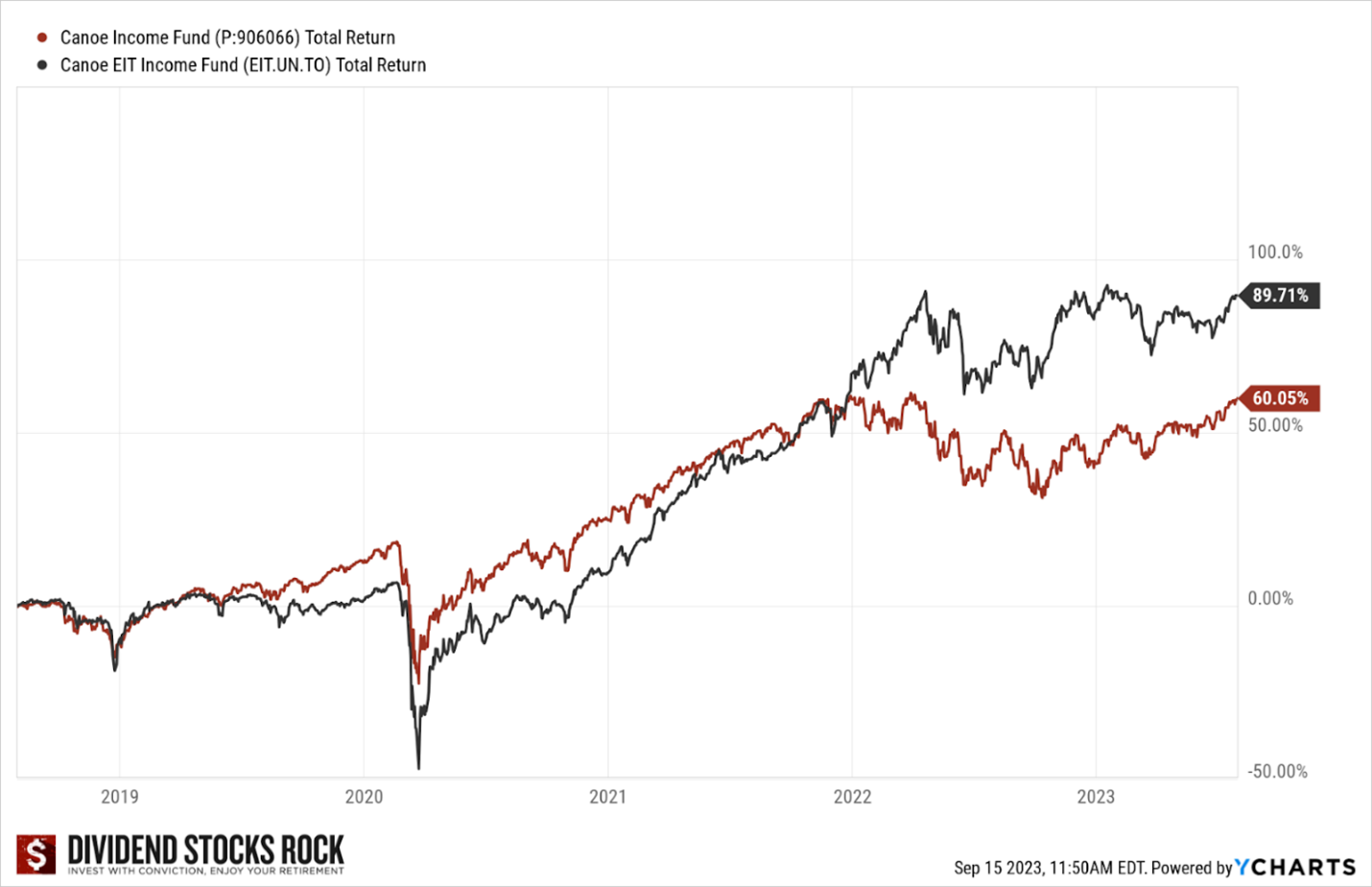

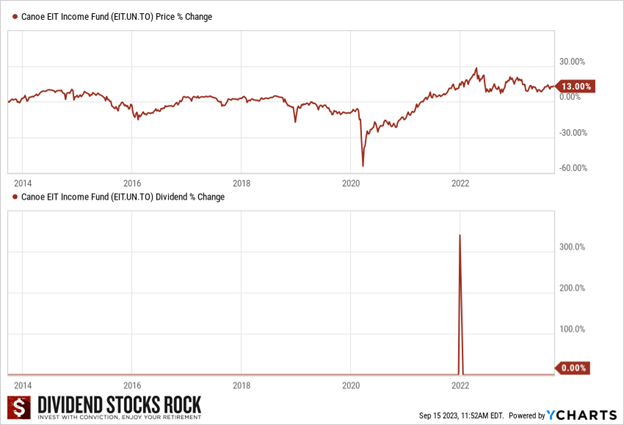

Financial companies, like asset managers, make fees based on the amount of Assets Under their Management (AUM). The higher the AUM, the higher the revenue and profit. Retirees are very profitable customers for these companies because of their sizeable savings, often in the hundred of thousands, that make growing AUM a lot easier than millennials investing much less. What do retirees want? Income!

Financial companies, like asset managers, make fees based on the amount of Assets Under their Management (AUM). The higher the AUM, the higher the revenue and profit. Retirees are very profitable customers for these companies because of their sizeable savings, often in the hundred of thousands, that make growing AUM a lot easier than millennials investing much less. What do retirees want? Income! Financial companies often use a mix of options strategies to create income; you must understand what you’re investing in. You’ll have to read pages of boring stuff, and don’t stop at the description either!

Financial companies often use a mix of options strategies to create income; you must understand what you’re investing in. You’ll have to read pages of boring stuff, and don’t stop at the description either!

Throughout your retirement, you’ll go through bull and bear markets. During a bear market, selling shares to generate your homemade dividend could hurt your retirement plan.

Throughout your retirement, you’ll go through bull and bear markets. During a bear market, selling shares to generate your homemade dividend could hurt your retirement plan.

$20,000 for 1 year at 3%

$20,000 for 1 year at 3%