Want exposure to real estate without the hassle of fixing leaky faucets or chasing tenants for rent? That’s where Canadian REITs come in. These high-yield investments offer steady income, inflation protection, and real estate exposure — minus the landlord stress.

Thanks to their unique tax structure, REITs are designed to return most of their income to shareholders, making them ideal for income-seeking investors.

What Are REITs & Why They Matter?

REITs are not only popular because they distribute generous dividends, but also because they’re easy to understand. Investors can picture an apartment building or an office tower and tenants paying their rent monthly. Investors are willing to purchase units of those businesses in exchange for the income and peace of mind.

The concept of being a landlord and having tenants is comparatively simple to understand. The company owns and manages real estate and receives rental income from properties such as apartment complexes, hospitals, office buildings, timber land, warehouses, hotels, and shopping malls.

Most REITs are equity REITs. They must invest most of their assets (75%) into real estate (properties) or cash equivalents. In other words, they cannot produce goods or provide services with their assets. They must generate 75% of their income from those real estate assets in the form of rent, interest on mortgages, or sales of properties.

REITs must also pay a minimum of 90% of their taxable income as dividends to shareholders each year. Therefore, the classic earnings per share (EPS) and dividend payout ratios don’t gauge an REIT’s health.

3 Types of REITs: Equity, Mortgage, and Hybrid

Equity REITs

Equity REITs own and invest in property. They may own a diversified set of properties, and they generate income primarily in rent payments from leasing their properties.

Mortgage REITs

Mortgage REITs, or mREITs for short, finance property. They generate income from interest on loans they make to finance property.

Hybrid REITs

Hybrid REITs do a bit of both, as they own property and finance property.

In general, REITs offer great investment opportunities by their nature. A growing economy leads to growing needs for properties. REITs can grow organically as the population requires more industrial facilities, healthcare centers, offices, and apartments.

Sub-Sector (Industry)

| REIT – Diversified | REIT – Mortgage | REIT – Specialty |

| REIT – Healthcare Facilities | REIT – Office | Real Estate – Development |

| REIT – Hotel & Motel | REIT – Residential | Real Estate – Diversified |

| REIT – Industrial | REIT – Retail | Real Estate Services |

The Hidden Strengths of REITs

REITs are unique as they distribute most of their income. In fact, they exist to pay generous distributions. This makes them one of the retirees’ favorite sectors!

Therefore, it’s easy to understand how most offer a relatively high dividend income. This is one of the rare sectors where you can find “relatively safe” stocks paying 5%, 6%, or even 7%+. Investors must be careful not to get too greedy, though. We have seen several REITs cut their dividends due to poor management or economic downturns.

REITs usually bring stability to a portfolio. It’s a great sector to start with if you want additional income. Real estate brings significant diversification to your portfolio. Research has proved that REITs are not directly correlated to stock market movements over the longer term.

Finally, since most of them operate with escalator contracts, they offer great protection against inflation. Many income trusts include yearly rent increases in their leases to ensure rental income matches inflation. Some REITs also use Triple-Net leases, where the tenants is responsible for insurance, taxes, and maintenance costs, thus reducing the REITs’ expenses (and risk of unexpected charges!).

REITs: The Risks You Need to Know

One of the REIT sectors’ favorite ways to finance their new projects is to issue more units. Therefore, if a company purchases a property generating $20M per year but needs to issue more units to finance the purchase, you must look at the net outcome for unitholders. If the FFO per share drops, this is not necessarily good for you as it will affect the REIT’s ability to increase its dividend in the future.

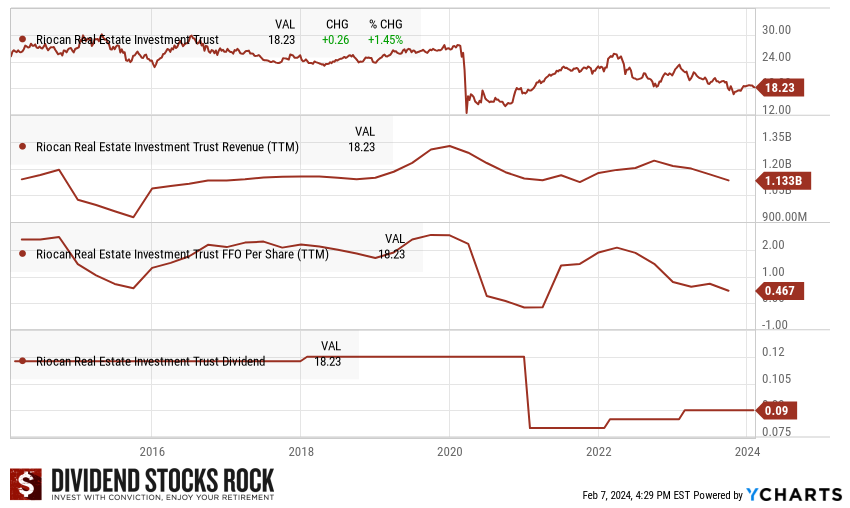

Another downside related to their business model is their lack of flexibility. We have often seen REITs try to shift their focus from one industry to another. In most cases (H&R, RioCan, Boardwalk, and Cominar, to name a few), the trajectory change comes with a dividend cut and a loss in value for unit holders. A REIT wishing to get rid of its shopping malls to buy more industrial properties will likely have to sell properties at a lower price and pay a hefty price to buy more appealing assets.

Finally, don’t make the mistake of thinking REITs are safer than other sectors. They are companies facing challenges while benefiting from tailwinds. While you may argue that an apartment building can’t go anywhere, I would answer that if you have one hundred empty apartments due to an oversupply in a neighborhood, your money will also go nowhere.

The REIT sector is best for income investors.

Target sector weight: For income-seeking investors, you can aim at 15% to 30% (if you invest in various industries). For growth investors, REITs could represent a 5%-15% portion of your portfolio.

Protect Your Portfolio: Canadian Rock Stars List

REITs can provide good income, but they are all part of the same sector. You need more diversification for your portfolio to be fully protected of market events.

I have created a list showing about 300 companies with growing revenue, earnings per share (EPS), and dividend growth trends. Focusing on trends rather than numbers gives you a better perspective on past, present, and future growth.

The Dividend Rock Stars List is the best place to start your stock research. Get it for free by entering your name and email below.

How to Analyze a REIT (The 3 Must-Know Metrics)

While REITs are among a short list of sectors that are perfect for retirees or other income-seeking investors, it is important to understand that they cannot be analyzed using the same metrics as other sectors.

Funds From Operations (FFO/AFFO)

The Funds from Operations (FFO) and Adjusted Funds from Operations (AFFO) are probably the most valuable tools for analyzing a REIT’s financial performance. Those two metrics replace the earnings and adjusted earnings for a regular stock. While those are different metrics, it’s all about cash flow and the REITs’ ability to sustain their dividend payments.

Fortunately, we can find those metrics inside each REIT’s quarterly report and subsequent press release. It’s important to follow not only the total FFO/AFFO, but also the FFO/AFFO per share (or unit of ownership) rather than earnings per share (EPS) or adjusted earnings per share.

FFO = Earnings + Depreciation (Amortization) – Proceeds from Property Sales

AFFO = Earnings + Depreciation (Amortization) – Proceeds from Property Sales – Capital Expenditures

Loan to Value Ratio (LTV)

The loan-to-value ratio (LTV) is a great tool for analyzing the REIT’s future ability to raise low-cost capital. The LTV is easy to calculate from the financial statement, as you only need 2 measures of data:

LTV = Mortgage Amount / FMV of properties

You don’t want to invest in a REIT showing a high LTV. This means that their credit rating may be at risk and the price for future debt will be higher. In other words, it could mean less money for future dividends.

Net Asset Value (NAV)

The last metric to follow for REITs is Net Asset Value (NAV), which (usually shown in units) is equivalent to a price-to-book ratio.

NAV = Total Property Fair Market Value – Liabilities

The idea is to compare a few REITs from your list against one another. This is how you should be able to find the ones with the best metrics. A lower than industry NAV is either a riskier play or a value play. The AFFO and LTV will tell you which one it is.

Avoid This Common REIT Mistake

REITs are required to distribute at least 90% of their taxable income to investors, which makes traditional payout ratios less useful. The metrics you’re looking for is the Funds From Operations (FFO) and the Adjusted Funds From Operations (AFFO) payout ratios.

Funds from Operations Payout Ratio

Formula: DIVIDEND PER SHARE (DPS) / (ADJUSTED) FUNDS FROM OPERATIONS (FFO) PER SHARE

Because of REITs’ tax structure, adjusted funds from operations (AFFO or FFO) is a more precise metric. Like the payout and cash payout ratio, it’s always preferable to look at a long-term trend of the metrics over several years.

Pros: Similar to the cash payout ratio, this ratio clearly shows how much cash the company has to pay dividends.

Cons: In most cases, you can’t calculate the FFO payout ratio yourself or find it on general finance websites. You must rely on the company’s information found in their quarterly earnings reports. It requires additional time to establish a trend over several years.

How to Value a REIT Like a Pro

Valuing a REIT is like valuing any stock.

I generally use the Dividend Discount Model (DDM) to value them. However, some of the other REIT-specific metrics we’ve seen are also very valuable when valuing REITs.

Net Asset Value (NAV) is another estimate of intrinsic value. It’s the estimated market value of the portfolio of properties. One way to evaluate this value is to divide the current net income from the properties by a capitalization rate that’s fair for those types of properties. NAV can potentially understate the value of the properties because it might not capture value appreciation of properties during strong growth periods in the market. Compare the NAV to the price of the REIT.

We’ve seen that Funds from Operations (FFO) are far more important than net income for a REIT. Due to the tax structure of REITs, earnings mean almost nothing; instead, it’s all about cash flow. When calculating net income, depreciation is subtracted from revenues; depreciation is a non-cash item and might not represent a true change in the value of the company’s assets. FFO adds depreciation back to net income, providing a better idea of the cash income for a REIT.

Adjusted Funds from Operation (AFFO) is arguably the most accurate income measurement metric for REITs. AFFO takes FFO but then subtracts recurring capital expenditures on maintenance and improvements. It’s a non-GAAP measure but a very good gauge of the actual profitability and amount of cash flow available to pay out in dividends.

Overall, it’s good to look for REITs that have diversified properties, strong FFO and AFFO, and a good history of consistent dividend growth.

REIT advantages and disadvantages

Before presenting some of our picks for Canadian REITs, let’s sum up the advantages and disadvantages of REITs.

Advantages:

- Usually have above-average dividend yields.

- Are good protectors from inflation. Property values and rents increase over time if inflation occurs, but fixed-interest on the debt that finances the properties doesn’t.

- Real estate, if managed conservatively, can be a reliable investment for income and in times of recession, assuming tenants pay their rent.

Disadvantages:

- Often have lower dividend growth than companies in other sectors.

- Generally use debt to add to their property portfolio, but their larger debt loads is used for conservative, appreciating assets.

- Since they have to pay most of their income as dividends, they have little downside protection from recessions. They might have to trim the dividend if their cash flow dips below their distribution levels. There are, however, some REITs that have good track records of consistent dividend growth, despite market downturns.

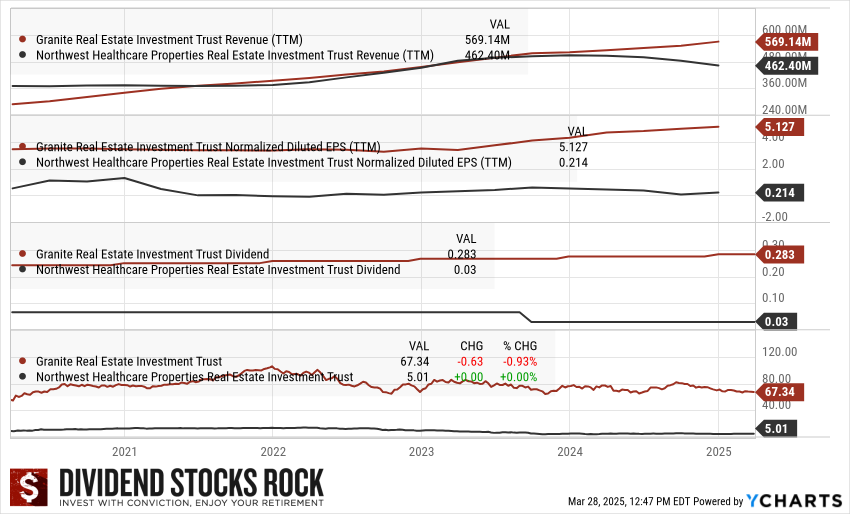

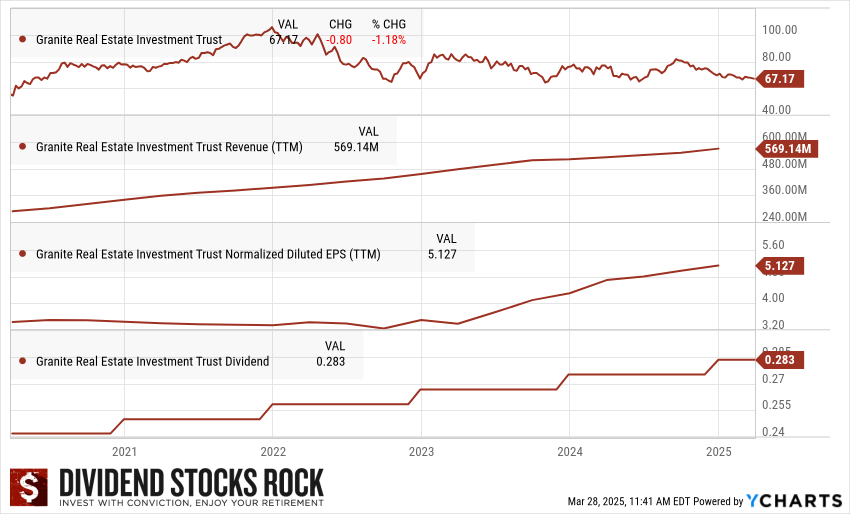

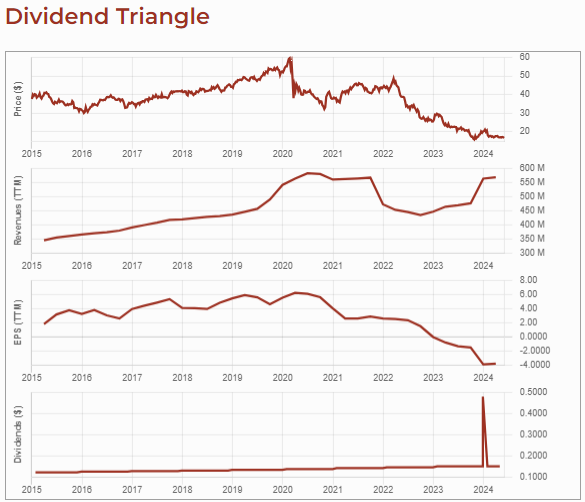

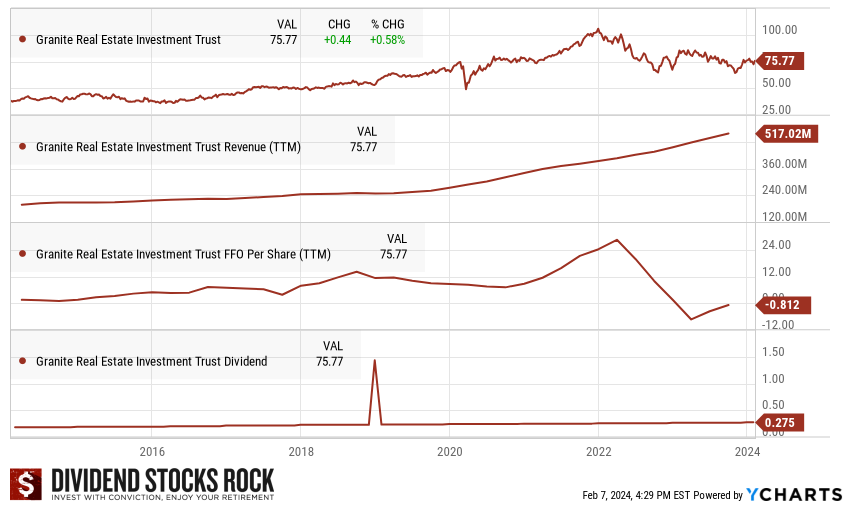

For example, Granite REIT has consistently used conservative debt and escalator leases to grow dividends. Conversely, Northwest Healthcare REIT stumbled due to poor balance sheet management, overreliance on floating rate debt, and deteriorating cash flow, leading to a dividend cut in 2023.

REIT Summary or Quick Reference Table

✅ REIT Cheat Sheet

Best For: Income-focused investors, retirees.

Top Metrics: FFO/AFFO, NAV, LTV.

Risks: Overconcentration, debt levels, and tenant health.

Watch For: Dividend sustainability and inflation-adjusted leases.

Top REIT Picks

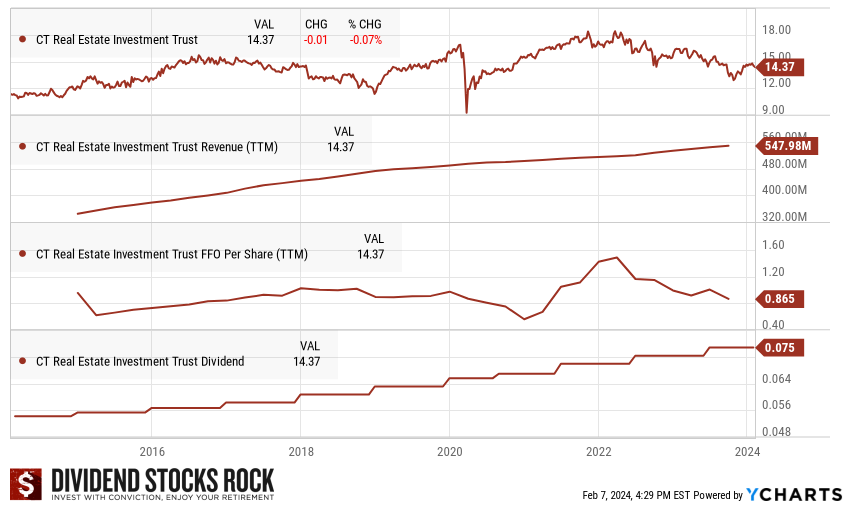

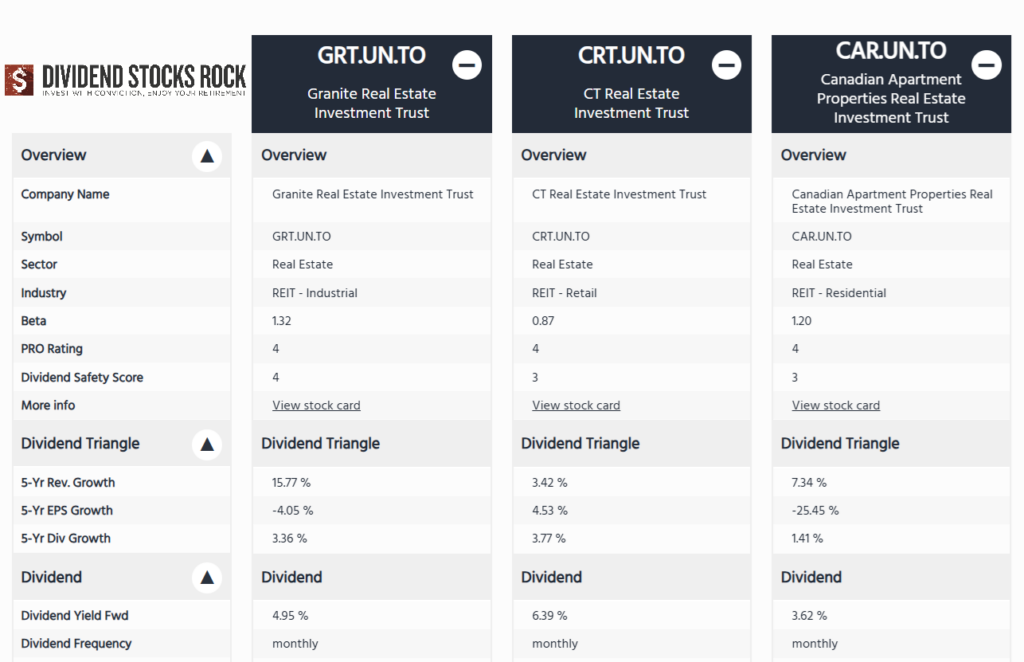

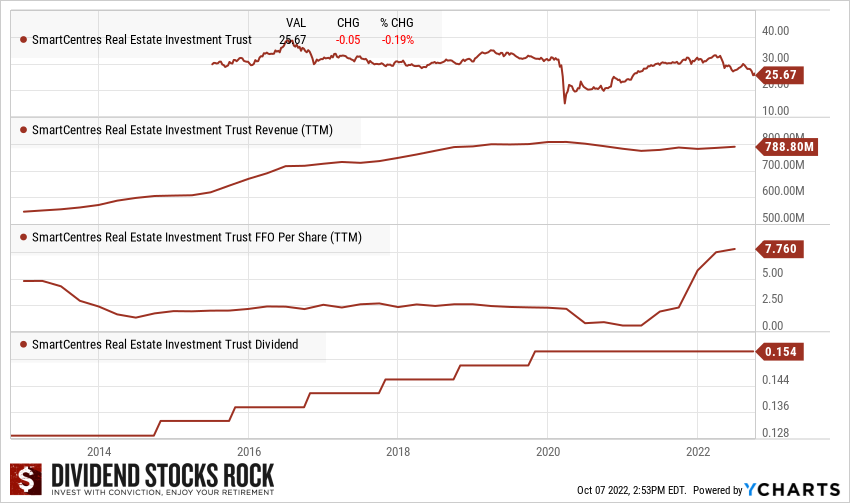

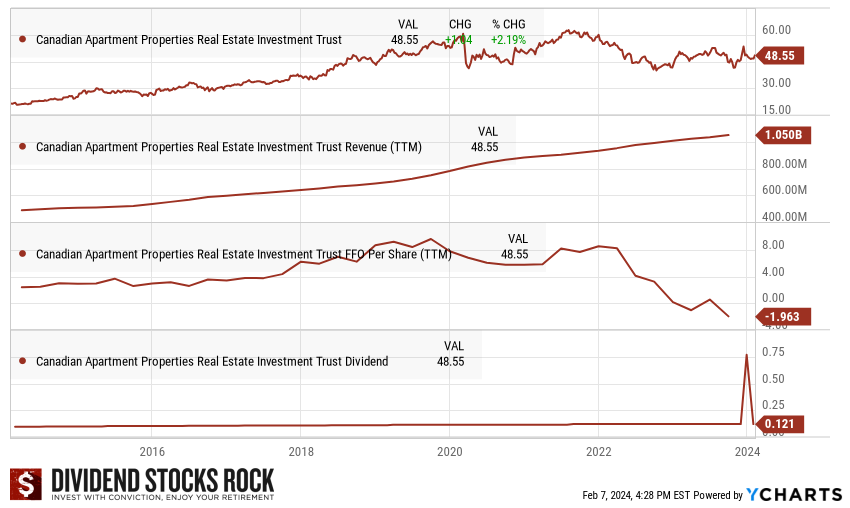

Below are some of my favorite REITs in Canada, side-by-side. You can also find a complete description for each in this article.

Get More Stock Ideas: The Canadian Rock Stars List

REITs can anchor your income portfolio — but they’re just one piece of the puzzle.

Explore our Canadian Rock Stars List to discover 300 dividend-growing stocks showing a positive dividend triangle (5-year revenue, earnings per share (EPS), and dividend growth trends) with filters.

Start your stock research on the right foot with the best Dividend Stocks List. Enter your name and email below.

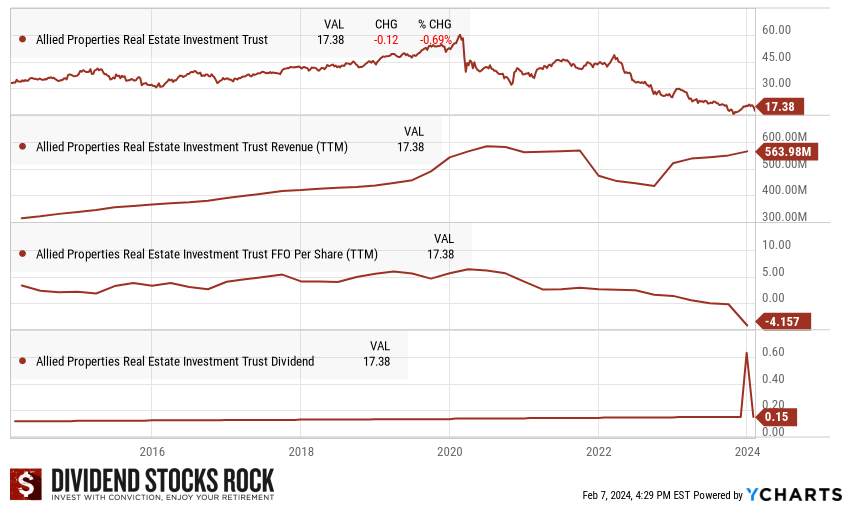

AP.UN.TO maintains its unique expertise in managing and developing prime heritage locations, which will continue to be in high demand in the coming years. The REIT also counts on many technology clients, which represent a growing sector in Canada.

AP.UN.TO maintains its unique expertise in managing and developing prime heritage locations, which will continue to be in high demand in the coming years. The REIT also counts on many technology clients, which represent a growing sector in Canada.

Allied Properties REIT (AP.UN.TO)

Allied Properties REIT (AP.UN.TO)

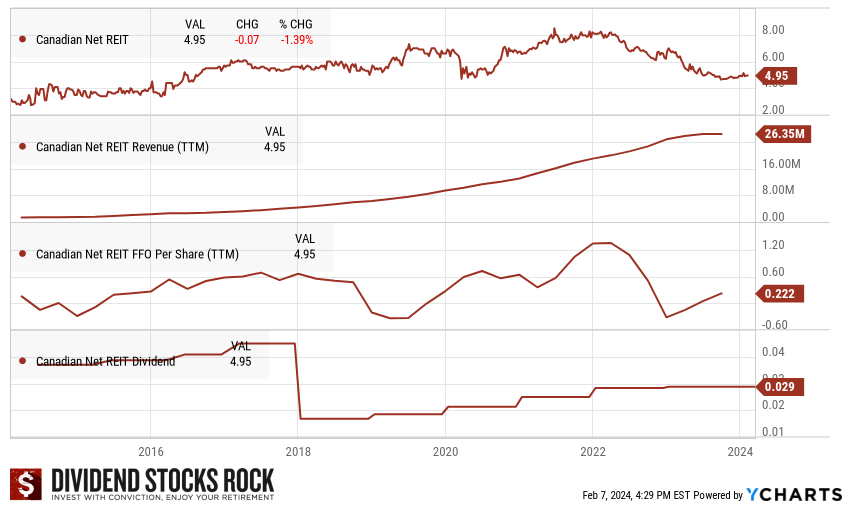

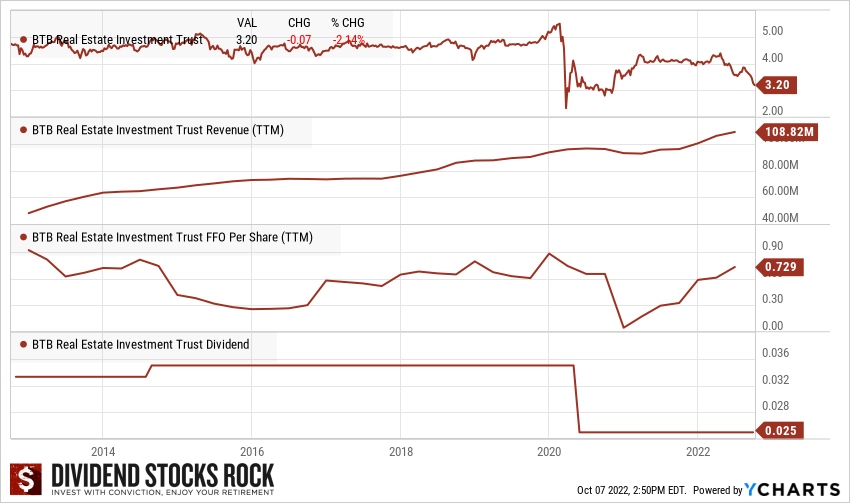

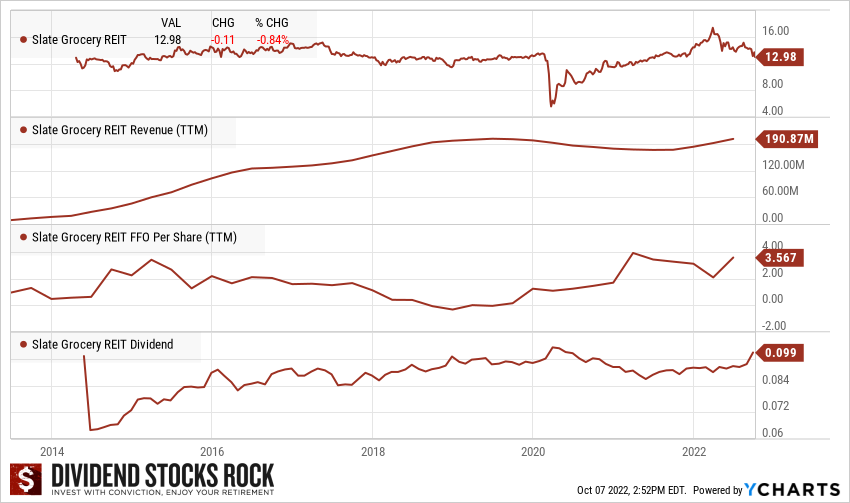

Canadian Net REIT (NET.UN.V)

Canadian Net REIT (NET.UN.V)