In a tech world obsessed with disruption, some firms win by delivering mission-critical services with precision and consistency. This company has built one of the most dependable consulting and IT infrastructures supporting governments and enterprises across the globe — and its latest results show it’s still gaining ground.

Business Model: The Backbone of Digital Bureaucracy

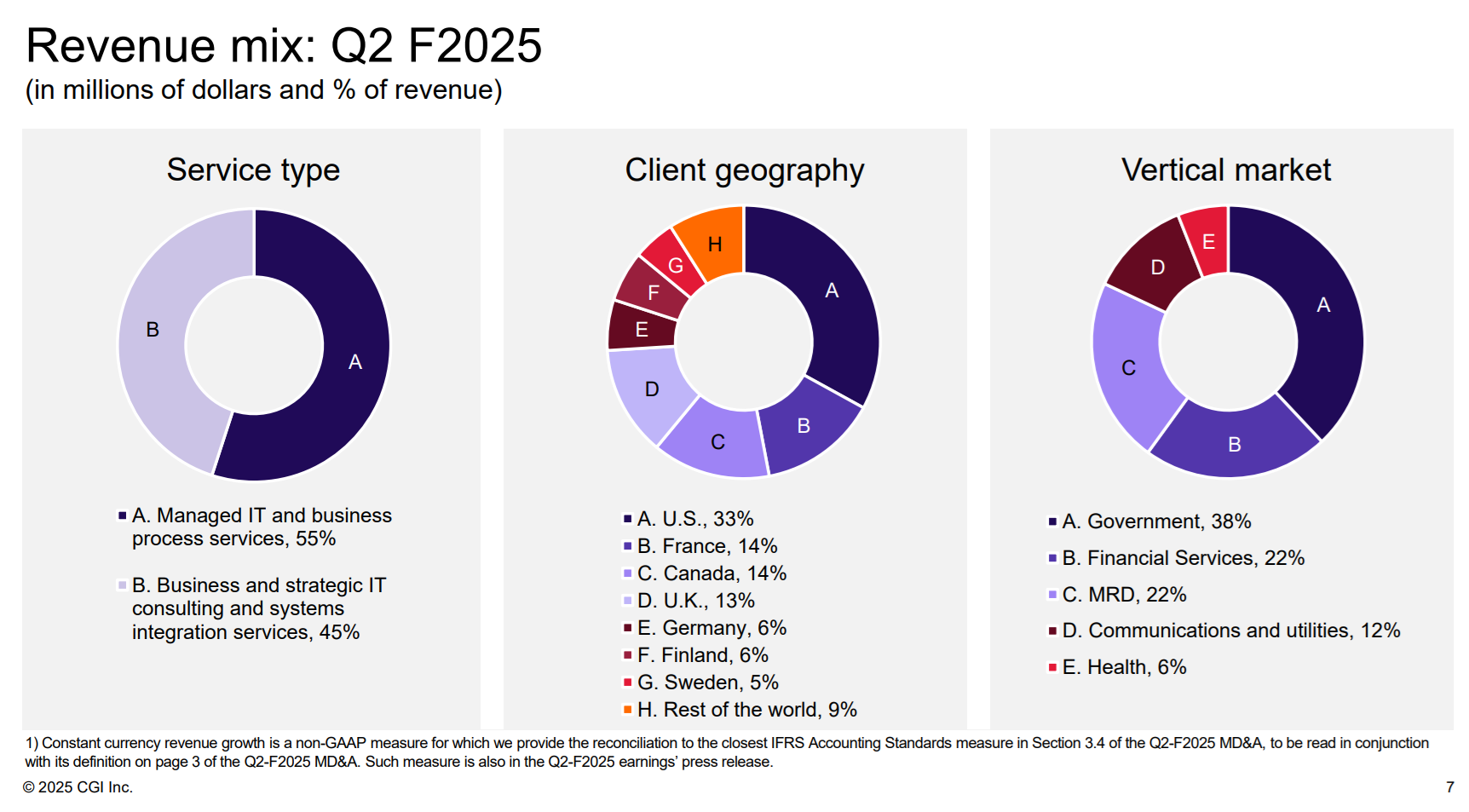

CGI Inc. (GIB.A.TO) is a global consulting and IT services company that thrives on long-term contracts, particularly in the public sector. With operations in over 40 countries and more than 90,000 employees, its core strategy is simple: being close to the client.

The firm deploys a proximity-based model, which places offices near its customers — especially effective for sensitive government work where data sovereignty, security, and compliance are paramount. Its comprehensive service suite spans:

-

IT and business consulting

-

Managed IT and business process services

-

System integration

-

Proprietary software solutions

Its client-first approach is underscored by a 95% contract renewal rate, proving the strength of its long-term relationships.

Investment Thesis: Built for Resilience, Positioned for Growth

This company stands out not through flash, but through stability and execution. Serving governments and large enterprises with critical infrastructure, it builds high-retention, multi-year recurring revenue. Its book-to-bill ratio of 110% signals sustained demand, while public sector work — nearly 40% of total revenue — provides a defensive core.

In a world accelerating toward digital transformation and automation, this firm is well-positioned with capabilities in AI, cybersecurity, and data analytics. As governments modernize and enterprises automate, this company is the quiet engine behind the upgrade.

For an even more detailed investment thesis, watch my video on CGI below.

Want More Stocks Like This One?

The Dividend Rock Star List is our hand-picked collection of quality dividend stocks.

Here’s what you’ll find inside:

-

🔍 Over 300 U.S. and Canadian dividend-paying stocks

-

✅ Screened using our Dividend Triangle: Revenue growth, EPS growth, and dividend growth

-

🚨 Updated monthly with the latest data

-

📊 Filter by yield, sector, payout ratio, dividend growth rate, and more

-

💡 Discover reliable growers that can power your portfolio through bull and bear markets

Start browsing the Dividend Rock Star List now and find your next winner before everyone else does.

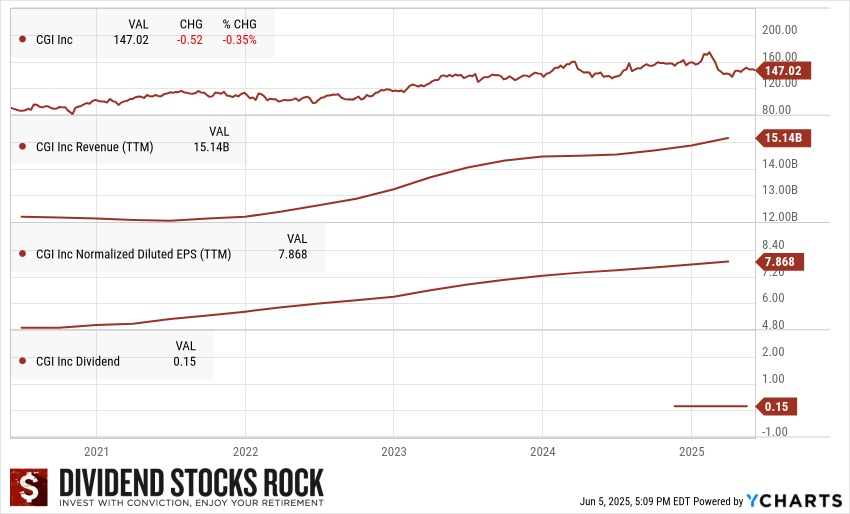

The Dividend Triangle in Action: Growth, Growth and… Not Much Yield

Let’s look at the company through the lens that matters: the Dividend Triangle.

1. Revenue Growth: Revenue sits at C$15.14B, up steadily over the past three years. That’s what you want to see — clients are spending, and the firm is landing new contracts.

2. Earnings Growth: EPS climbed to $7.87, tracking right alongside top-line growth. This shows substantial operating leverage and margin discipline.

3. Dividend Growth: The dividend is symbolic: $0.15 per share. This isn’t an income stock. Management prefers to reinvest capital into growth and acquisitions. And frankly? With these returns on equity, that’s not a bad call.

Bull Case: A Backlog that Buys Time and Growth

Investors bullish on this name point to several strengths:

-

A backlog of C$30.99B, equivalent to 2x annual revenue

-

Strong public sector exposure — offering resilience during economic downturns

-

A scalable global model with recent acquisitions driving margin improvements

-

Expanding into AI-driven solutions, where demand is surging

-

Financial discipline with rising EPS and a history of effective capital allocation

This is a stock built for compounders who value visibility, execution, and sticky client relationships.

Bear Case: Acquisition Risks and Margin Ceilings

While its recurring revenue model is attractive, bears flag a few key risks:

-

Its growth strategy leans heavily on acquisitions, raising concerns about integration execution and potential overpayment

-

Government contracts, while stable, tend to come with lower margins

-

The company’s low dividend payout (currently $0.15) and slow dividend growth may turn off income-seeking investors

-

In a talent-driven industry, maintaining headcount and quality amid global wage inflation could become a drag

Any stumble in acquiring, integrating, or retaining key staff could pressure performance.

Latest News: Booking Big, Growing Steady

The most recent quarterly report was strong across the board:

-

Revenue and EPS up 8% YoY

-

U.S. Commercial & State Government segment up 24.6% in EBIT

-

Scandinavia, Northwest & Central-East Europe EBIT up 21.7%

-

Book-to-bill ratio: 111.5%, with solid new contract momentum

These results reinforce the strength of the firm’s international footprint and its ability to scale contracts profitably.

Final Word: A Low-Yield, High-Confidence Compounder

This company may miss the spotlight like tech giants, but it compounds value through consistency, thoughtful acquisitions, and long-term client relationships. For dividend growth investors, the fundamentals are in the right place.

With its deep backlog, public sector strength, and push into AI and digital transformation, this is a stock worth watching — and potentially owning.

Build a Smarter, Safer Dividend Portfolio

Whether you’re looking for income today or wealth tomorrow, you need stocks that deliver on all three parts of the Dividend Triangle.

That’s exactly what the Dividend Rock Star List is built for:

-

No fluff — just fundamentally strong dividend stocks

Includes both Canadian and U.S. dividend payers

-

Easily sort by dividend growth rate, payout ratio, and more

-

Updated every month — no stale picks, no guesswork

Use it to build your watchlist, strengthen your portfolio, or start fresh with confidence.

Explore the Dividend Rock Star List now: