When a company builds its fortunes around one powerful partner, it can either look like a risk or a source of stability. For dividend investors, the key question is whether that dependence translates into predictable, but also growing, dividends. In the case of CT REIT, its close relationship with Canadian Tire provides both an anchor and a growth engine. While it may not offer explosive expansion, it delivers the kind of steady, reliable income stream many dividend investors value.

Anchored in Retail Real Estate

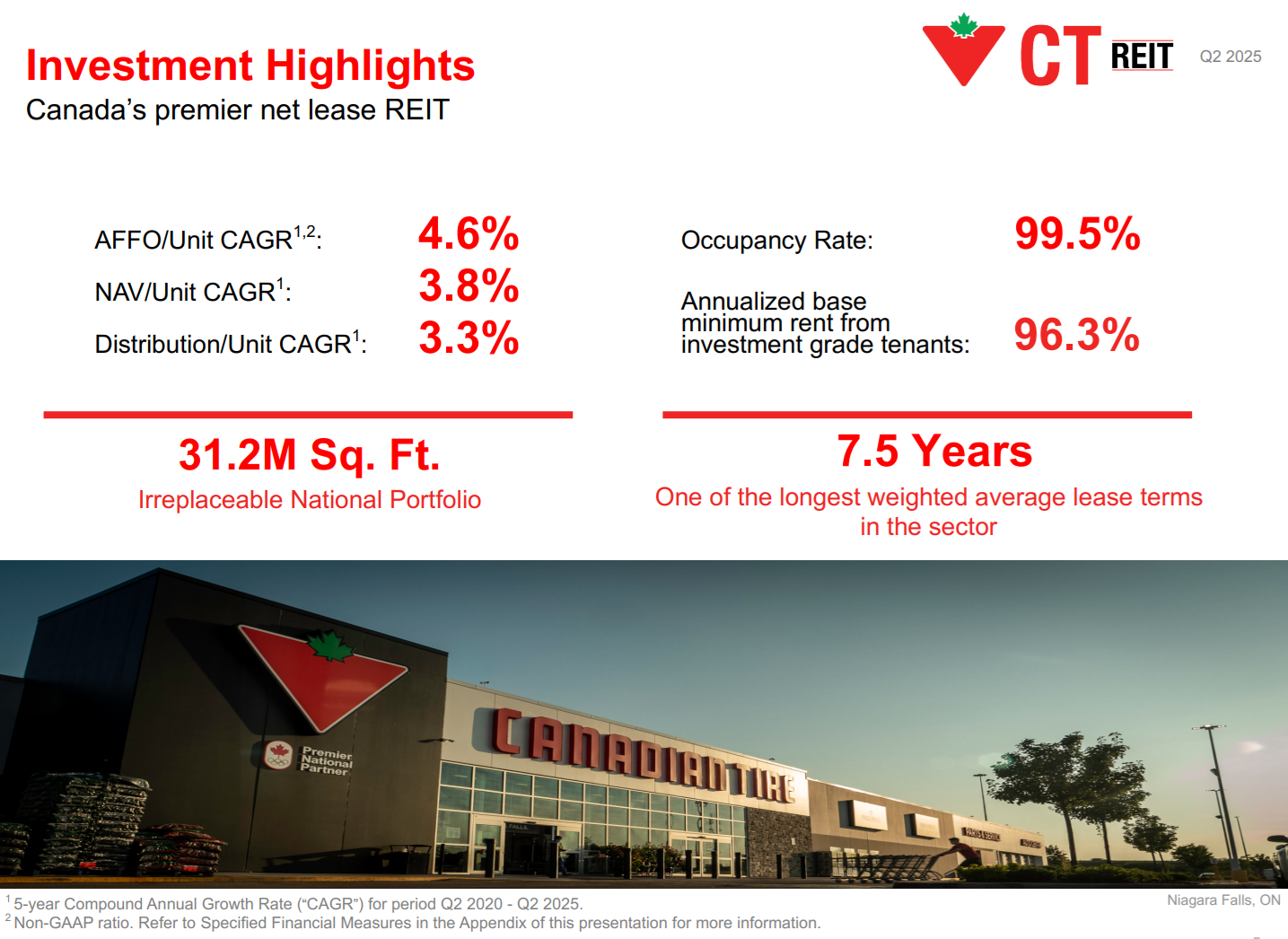

CT Real Estate Investment Trust (CRT.UN.TO) is a Canadian REIT that owns, manages, and develops commercial properties across the country. Its portfolio includes more than 375 properties totaling over 31 million square feet of gross leasable area (GLA), primarily single-tenant net lease retail properties.

The trust’s defining feature is its close relationship with Canadian Tire Corporation (CTC), which accounts for about 92% of GLA. These properties are mission-critical for CTC’s retail network, ensuring a highly stable occupancy base. CT REIT generates income through long-term triple-net leases, where tenants pay property taxes, insurance, and maintenance, providing the REIT with predictable and durable cash flows.

Management supplements this core business with property intensification projects, acquisitions, and occasional multi-tenant developments to diversify revenue.

When Dependence Feels (Mostly) Like Strength

Bull Case – Why Investors Like It

-

Predictable Income Stream: With Canadian Tire as its anchor tenant, CT REIT enjoys exceptionally stable occupancy and renewal rates. Weighted average lease terms are 7.9 years, providing strong visibility on future cash flow.

-

Sustainable Dividends: The REIT pays a 6.3% yield, backed by a conservative ~72% AFFO payout ratio, leaving room for future increases.

-

Growth Levers:

-

Acquisitions of Canadian Tire properties (2 stores added in Q4 2024).

-

Intensification projects in Quebec, Saskatchewan, and a development pipeline in Kelowna, BC.

-

Lease renewals with strong pricing power (+10.3% third-party rent increase in Q4 2024).

-

-

Solid Balance Sheet: Management has kept debt levels manageable, supporting both dividend stability and growth initiatives.

Bear Case – Risks You Can’t Ignore

-

Tenant Concentration: With over 90% of space leased to Canadian Tire, CT REIT’s fortunes are tightly linked to a single retailer. If Canadian Tire faces operational or strategic challenges, the REIT’s revenue would feel it immediately.

-

Limited Diversification: Unlike larger diversified REITs (e.g., retail + industrial + residential), CT REIT remains focused on one category, leaving little cushion if retail traffic declines.

-

Slow Growth Profile: NOI growth is modest (1.5%–2.0% annually). Investors looking for high growth will find this REIT more of a “bond proxy” than a growth story.

Free Webinar Invite: Avoid Price Confusion and Act with Conviction

When a stock dives or spikes, most investors focus on the price. That’s the wrong move. In this live session, I’ll show you how to ignore the noise and interrogate the business—so you can decide with confidence whether to sell, hold, or buy more.

Thursday, September 18th at 1:00 p.m. ET

~50 minutes + 1-hour Q&A

Replay available for all registrants

Seats are limited to the first 500

You’ll discover:

-

A simple framework to know when to ignore headlines and when to act

-

A quick business-model check that surfaces real risks (fast)

-

How to use the Dividend Triangle to separate bargains from traps

Save your spot (or get the replay)

What’s New: Expansion Keeps the Wheels Turning

CT REIT’s latest quarter showed steady progress:

-

Revenue: +4% YoY.

-

FFO per unit: +2%.

-

NOI: $118.9M (+3.4% YoY).

-

Payout Ratio: 72% (comfortably sustainable).

-

Key drivers:

-

Completed property acquisitions and intensifications in 2024–2025 (+$3.1M).

-

Rent escalations from Canadian Tire leases (+$1.7M).

-

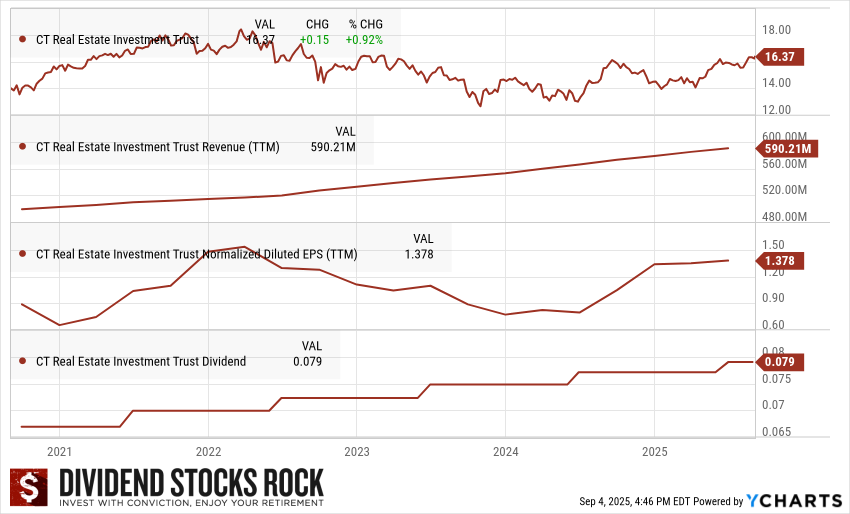

The Dividend Triangle in Action: Slow & Steady Growth

When we look at CT REIT through the lens of the Dividend Triangle, the picture is clear: this is a story of income stability rather than rapid growth.

-

Revenue: Gradually rising, supported by acquisitions and annual lease escalations.

-

EPS/FFO: Consistent, with minor fluctuations tied to timing of developments.

-

Dividend: Modest but reliable, growing in step with AFFO and maintaining a sustainable payout ratio.

CT REIT isn’t here to deliver explosive growth. Instead, it delivers the kind of slow, predictable compounding that income-focused investors prize.

Final Thoughts: Built to Last, Not for Excitement

CT REIT is less about chasing growth and more about locking in dependable monthly income. With Canadian Tire as its anchor and a disciplined payout strategy, the trust is positioned as a steady, income-first REIT. The trade-off? Limited diversification and modest long-term growth.

For dividend investors who prioritize stability and cash flow visibility, CT REIT remains a compelling option.

Free Webinar: Avoid Price Confusion

Stocks often jump or drop 10% on earnings day. How do you know if it’s time to buy, sell, or simply hold?

Join me on Thursday, September 18th, at 1:00 p.m. ET for a free session where I’ll share how to cut through the noise, check the business fast, and use the Dividend Triangle to spot real opportunities.