What if you could beat the Canadian market by selecting ten stocks each year? The Dogs of the TSX strategy gets its name from the Dogs of the Dow, an investing technique well-known in the U.S. for selecting the “dogs” (paying a higher dividend yield) of an index.

The Dogs of the TSX, or Beat the TSX (BTSX) strategy, was developed by a professor named David Stanley. He suggested that you could beat the index by selecting the highest dividend yielders of the TSX each year.

If you are tired of losing money on bad stocks, this strategy could help you quickly build a solid core portfolio.

The Dogs of the TSX in a Nutshell

One of the BTSX’s main advantages is its easy implementation. You can start trading with four simple steps:

#1 List the TSX 60 index by dividends. The TSX 60 is the index of the 60 largest Canadian companies. Most of them are blue chips like banks or telecoms and pay dividends.

#1 List the TSX 60 index by dividends. The TSX 60 is the index of the 60 largest Canadian companies. Most of them are blue chips like banks or telecoms and pay dividends.

#2 Select the top 10 yielding stocks from the TSX 60. The ten most generous stocks are called the dogs of the TSX. As they offer the largest yields, they haven’t performed well the year before. Therefore, their yield is higher, and you buy them at a relatively low price.

#2 Select the top 10 yielding stocks from the TSX 60. The ten most generous stocks are called the dogs of the TSX. As they offer the largest yields, they haven’t performed well the year before. Therefore, their yield is higher, and you buy them at a relatively low price.

#3 Buy the top 10 yielding stocks in equal weight. Boom! You build your core portfolio for the year! The strategy is based on buying the dogs in January.

#3 Buy the top 10 yielding stocks in equal weight. Boom! You build your core portfolio for the year! The strategy is based on buying the dogs in January.

#4 Each January, review the new Dogs of the TSX and trade accordingly. Each year, you must do steps from #1 to #3 to ensure you always have the highest Canadian yield stocks.

#4 Each January, review the new Dogs of the TSX and trade accordingly. Each year, you must do steps from #1 to #3 to ensure you always have the highest Canadian yield stocks.

The Dogs of the TSX (BTSX) Stocks List 2025

Here’s the list of the top 10 yielding stocks from the TSX 60 for this year. All you have to do is invest an equal amount of money in each dividend stock to build your portfolio.

| COMPANY | SYMBOL | PRICE | DIVIDEND | YIELD | |

| 1 | Bell | BCE.TO | $34.07 | $3.99 | 11.71% |

| 2 | Telus | T.TO | $20.56 | $1.61 | 7.83% |

| 3 | Enbridge | ENB.TO | $63.88 | $3.77 | 5.90% |

| 4 | Algonquin Power | AQN.TO | $6.32 | $0.36 | 5.70% |

| 5 | Bank of Nova Scotia | BNS.TO | $74.53 | $4.24 | 5.69% |

| 6 | Emera | EMA.TO | $54.36 | $2.90 | 5.33% |

| 7 | Pembina | PPL.TO | $52.55 | $2.76 | 5.25% |

| 8 | Power Corp | POW.TO | $43.31 | $2.25 | 5.20% |

| 9 | Canadian Natural Resources | CNQ.TO | $44.43 | $2.25 | 5.06% |

| 10 | TD Bank | TD.TO | $66.14 | $3.28 | 4.96% |

30 Years of Outperformance for BTSX

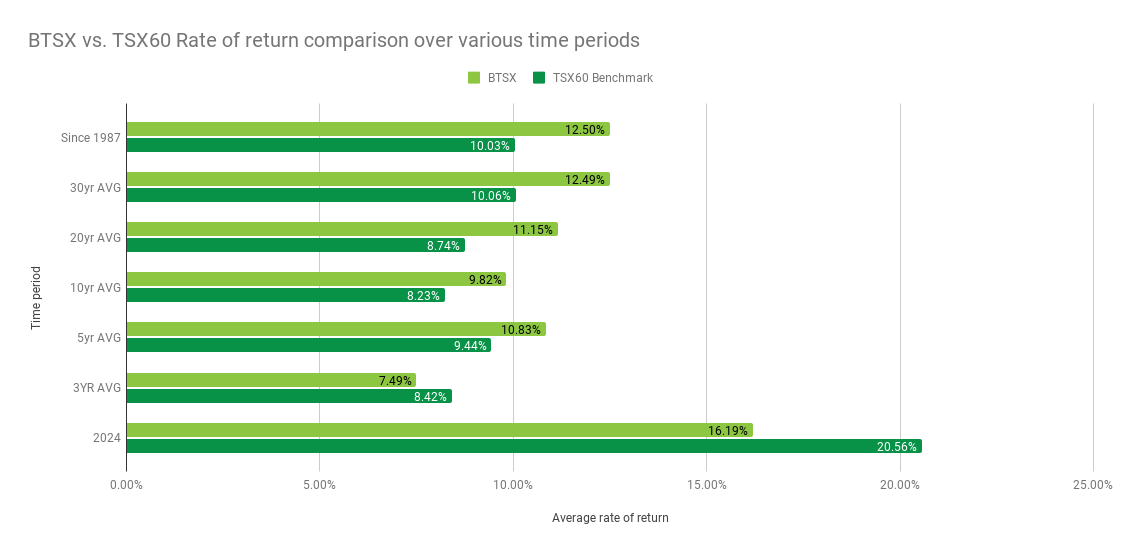

Matt from Dividend Strategy is doing a monk’s work to keep track of this strategy. Shockingly, The Dogs of the TSX has outperformed the market for 30+ years!

I must add that it did not beat the market in 2023 and 2024. While the results were just 1% apart in 2023, we can see a difference of 4% in favor of the market in 2024. The narrowed sector allocation of this strategy can explain this. I have given more thought to BTSX’s recent performance in the episode below.

As shown below, the average for five years and more still exceeds the market. In 2024, pipelines in the BTSX portfolio highly compensated for other losers.

Why the BTSX Portfolio Works so Well?

I was a bit skeptical when I heard of this strategy at first. It’s unlikely that such a simple strategy would outperform the market consistently. I’ve done my research to understand the success rate behind the BTSX strategy.

#1 Buying blue-chips quality stock. The TSX 60 refers to the 60 largest stocks in Canada. Chances are, those companies will be around for a while.

#2 Canadian stocks have a great history of paying and increasing dividends. There are many dividend aristocrats among the TSX 60. Dividend growers tend to outperform the market over a long period.

#3 Buy low, sell high. The Dogs of the TSX is based on a classic investment principle: buy when stocks are low and sell them at a higher price. By rotating your portfolio each year with the new “dogs”, you ensure to buy the best stocks at the lowest price while selling those with a great return over the past 12 months.

#4 It’s relatively easy to beat the Canadian market. The fact that the BTSX is working isn’t necessarily an achievement. The Canadian market is heavily concentrated in two sectors: Financials and Energy. By investing in other sectors, you can easily beat the TSX.

Use This List Instead

Actually, you could beat the TSX using a list of well-diversified dividend growers that are leaders in their industry. I have built a list of them for you to download for free using this strategy and the tools at Dividend Stocks Rock. Enter your name and email below to get your spreadsheet with filters.

Actually, you could beat the TSX using a list of well-diversified dividend growers that are leaders in their industry. I have built a list of them for you to download for free using this strategy and the tools at Dividend Stocks Rock. Enter your name and email below to get your spreadsheet with filters.

Why I Don’t Use the Dogs of the TSX Strategy

Investors can beat the TSX with an easy-to-use and straightforward strategy. Why am I not using the Dogs of the TSX for my portfolio?

#1 Know what you hold and why you hold it. It is one of the foundations of my investment model. I prefer researching and understanding a company’s business model before I add it to my portfolio. Buying stocks based on an index and a dividend yield seems too simplistic. It won’t hold very well during market crashes.

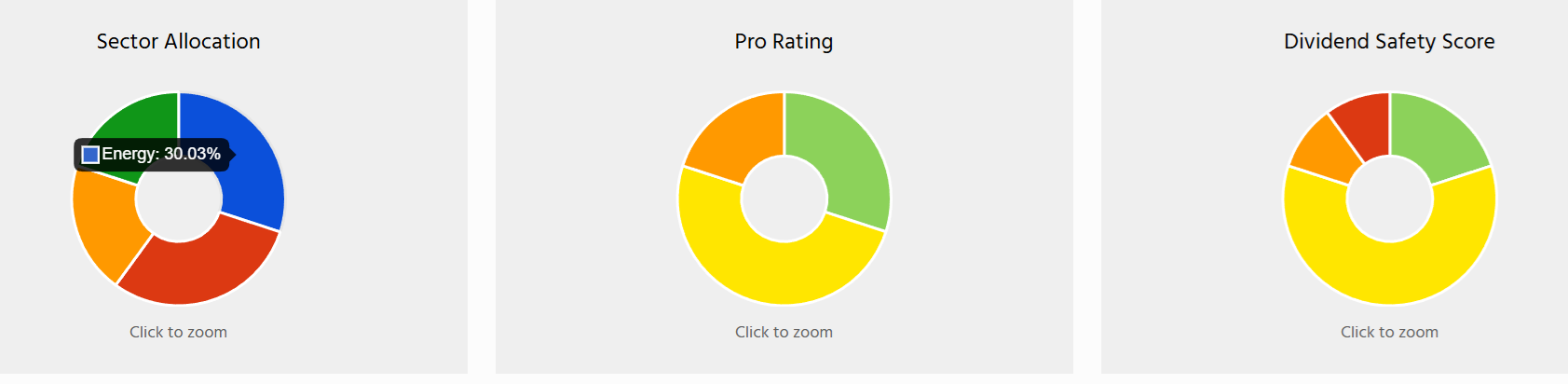

#2 Sector concentration. The BTSX forces you to buy only ten stocks based on the dividend yield regardless of the sector. The Dogs of the TSX 2022 shows 30% of financial companies and 30% of energy stocks. With 2/3 of your money invested in two industries, your portfolio is subject to intense volatility.

#3 Transaction costs and taxes. Rotating your stocks each year could trigger several transactions and prevent you from deferring tax on capital gains. This will have a severe impact on your returns in a non-registered account. Investing in the Dogs of the TSX in an RRSP or a TFSA account is best.

#4 I already beat the TSX. I’ve been a dividend growth investor since 2010. My years of experience in the financial industry and research helped me build a proven investing strategy. My results are not only better than the TSX, but they are also better than the BTSX strategy. Therefore, I don’t see any reason to change something that already works.

I have created a mock portfolio of the 2025 BTSX using the Dividend Stocks Rock PRO Dashboard just to see how it would look. Not only is it highly concentrated, but it includes many companies with poor ratings, such as Bell (BCE.TO) with a PRO Rating of two and a Dividend Safety Score of one, and Algonquin (AQN.TO) with two for both ratings.

If you’d like to have more details on my investment thesis for the companies part of the Dogs of the TSX, I have reviewed them in this episode.

Exclusive List of Dividend Growers with More Potential

There is another way to beat the TSX with more conviction. It is to invest in companies that show revenue growth, earnings per share (EPS) growth, and dividend growth. Selecting well-diversified holdings with growth metrics ensures your portfolio will beat the market for decades!

To help you build a solid portfolio, I have created the Canadian Rock Stars List, showing over 300 companies with growing trends.

To help you build a solid portfolio, I have created the Canadian Rock Stars List, showing over 300 companies with growing trends.

Enter your name and email below to get the instant download in your mailbox.