I’ve had my eye on this one for a while — first adding it to my Smith Manoeuvre portfolio as a defensive play in case of a recession. Funny enough, the recession never came… but the stock still delivered.

What drew me in wasn’t just its resilience — it was the consistency. Quarter after quarter, this company executes. It’s not flashy, and the dividend won’t knock your socks off, but the fundamentals? Rock solid.

With a perfect dividend triangle and more room to grow through its Latin American expansion (and now Australia!), I’ve decided it’s time to go all in. I’m using all available cash in my pension account this month to build it into a full position.

Let me be clear: I don’t want small, forgettable holdings. If I take the time to research and monitor a stock, it needs to matter in my portfolio. This one earns that spot.

Business Model: Discount Done Right

This isn’t just a dollar store chain — it’s a value-focused retail machine.

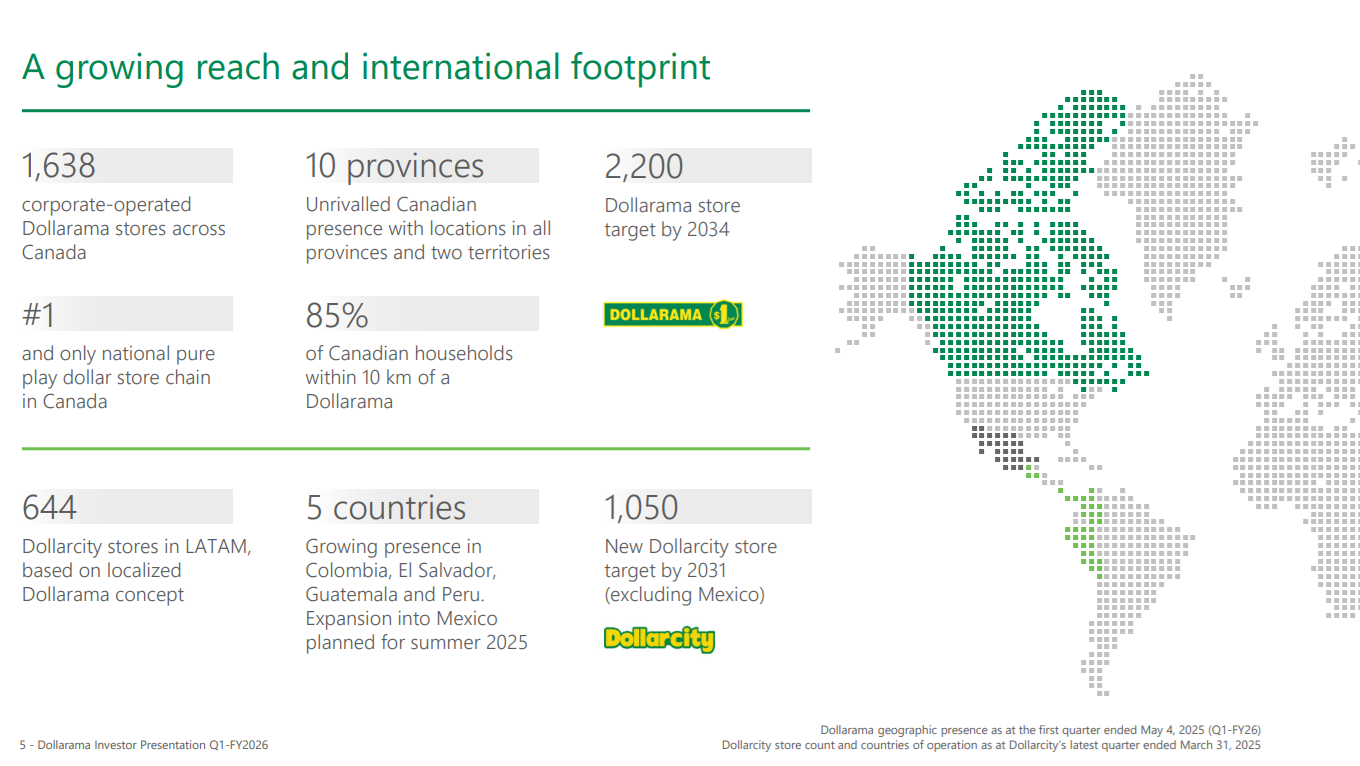

With 1,600+ stores across Canada, Dollarama (DOL.TO) sells low-cost, high-turnover merchandise across general goods, food, and seasonal items. Most products are under $5 (soon going up to $6), and nearly 60% are private label, giving it better margins and pricing control.

It also owns a majority stake in Dollarcity, a fast-growing Latin American chain with 600+ stores across Colombia, Guatemala, El Salvador, and Peru. Together, they deliver value to cost-conscious shoppers — and strong returns to investors.

Investment Thesis: Consistency that Compounds

This company thrives because it keeps things simple: offer everyday essentials at fixed low prices, run tight operations, and grow methodically. That formula has worked across Canada — and now it’s gaining traction internationally through Dollarcity and its pending acquisition of The Reject Shop in Australia.

What makes it a standout is the consistency. It continues to grow revenue and earnings through store openings, disciplined cost control, and steady foot traffic — even in a tough economic environment. At the same time, its high private-label mix and fixed pricing model help maintain healthy margins while giving shoppers predictability.

It’s also preparing for long-term growth. With a new distribution center in Calgary, expansion plans into Mexico, and higher price tiers on the horizon, the company is building the foundation for even more scale. Combine that with its performance during inflationary periods and its strong execution quarter after quarter, and you have a business built for both offense and defense.

This may not be the flashiest stock — but it’s the kind of compounder you’ll be glad you held onto.

The Dividend Triangle in Action: Steady as it Goes

Let’s break it down by the three Dividend Triangle pillars:

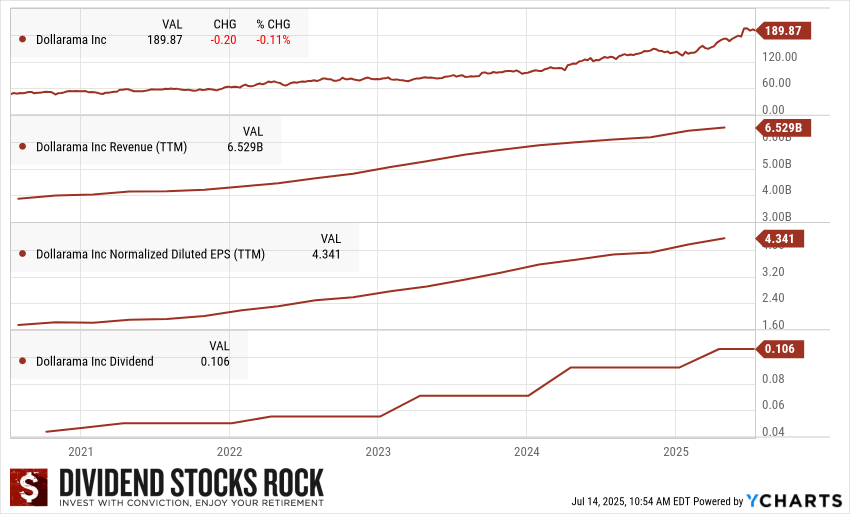

1. Revenue Growth: Revenue hit $6.53B, up 8% year-over-year, driven by 69 net new stores and strong same-store sales.

2. Earnings Growth: EPS climbed to $4.34, up 27% — a result of stronger margins and increased customer transactions.

3. Dividend Growth: The dividend has grown slowly to $0.106, reflecting a conservative payout strategy. It’s not an income play today, but the consistent growth signals stability.

Summary: Dollarama nails the dividend triangle with smooth, upward trends across revenue, earnings, and dividends.

Bull Case: Defensive, Disciplined and Growing Globally

There’s a lot to like for long-term investors:

-

Dominant position in Canadian value retail

-

60%+ of sales from private-label = strong margins

-

International growth through Dollarcity and upcoming expansion into Mexico and Australia

-

$450M investment in Western Canadian distribution = future scale

-

Resilient even in inflationary or recessionary environments

Bear Case: Margins Could Be Pressured as It Grows

Even with a strong moat, there are some risks:

-

High exposure to imports = FX, tariffs, and shipping disruption risks

-

Canadian market could approach saturation

-

Competitive pressure from Walmart, Amazon, and e-commerce

-

International expansion adds political/economic risk (especially in Latin America)

Still, DOL’s execution track record has been solid — and the moat is wider than most think.

Latest News: New Markets, Bigger Margins

Dollarama’s most recent quarter was another beat:

-

Revenue +8% | EPS +27%

-

69 new stores (now at 1,638)

-

Comparable sales +4.9%

-

Plans to enter Mexico soon

-

Acquisition of The Reject Shop in Australia expected to close in July

Management reaffirmed its full-year targets and continues to deliver quarter after quarter.

Want More Stocks Like This?

We track more than yield. The Dividend Rock Star List includes Canadian and U.S. stocks that hit all the right metrics — even when yield is low.

Here’s what’s inside:

-

Filter by revenue, EPS, and dividend growth

-

Screen for quality with payout ratio, sector, and more

-

Updated monthly so you’re always working with fresh data

-

Great for building long-term portfolios focused on dividend resilience

Start browsing the Dividend Rock Star List now and find your next winner before everyone else does.

Final Word: Make Every Holding Count

This isn’t just about filling space in a portfolio — it’s about owning companies that matter.

Dollarama continues to perform across all fronts: growth, margins, international expansion, and shareholder returns. While the dividend is small, the compounding machine behind it is strong.

There aren’t many names on the TSX that combine operational discipline, international growth, and defensive qualities like this one.

Dollarama remains one of the best Canadian stocks on the market — and building a full position just makes sense for me.