Summary

- Enbridge offers a generous yield (6%), is it safe?

- ENB is responsible for about 25% of crude oil and 22% of all-natural gas transportation in North America.

- ENB generates substantial cash flow, and management is usually on target with its guidance.

- Finally, regulators may not be as enthusiastic as Enbridge is regarding new pipeline projects.

My Investing Thesis

ENB’s customers enter 20-25-year transportation take or pay contracts. This means that ENB profits regardless of what is happening with commodity prices. ENB is also well positioned to benefit from the Canadian Oil Sands as its Mainline covers 70% of Canada’s pipeline network. As production grows, the need for ENB’s pipelines remains strong. Following the merger with Spectra, about a third of its business model will come from natural gas transportation. Enbridge has a handful of projects on the table or in development. It must deal with regulators, notably for their Line 3 and Line 5 projects. Both projects are slowly but surely developing. The cancellation of the Keystone XL pipeline (TC Energy) secures more business for ENB for its liquid pipelines. ENB now has a “greener” focus with its investments in renewable energy.

Business Model Explained to a 12 Years Old

What is nice about pipelines is that they are like a toll roads. The only difference is that you have no choice to take that road and pay the toll if you want to travel. The best part is that most Enbridge clients enter in 20-25 years transportation contracts. Therefore, no matter what happens, there are always people paying the toll. The cash flow is easy to predict in the future which leads to steady dividend growth.

Enbridge operates the longest pipeline in North America. The company recently merged with Spectra in order to create an energy infrastructure company. About 2/3 of ENB earnings is generated through oil sand (liquid pipelines) distribution while the other 1/3 is coming from natural gas transmission.

Source: Enbridge

Potential Risks

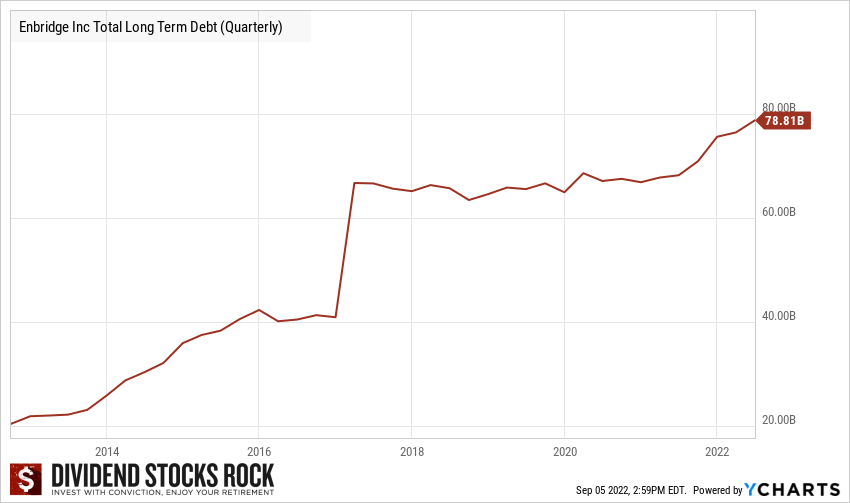

Stocks do not pay a high yield for no reason. ENB raised its debt and number of shares during the merger with Spectra and the integration of its partners a few years ago. The total long-term debt stands at around $76B (up from $67B in 2017) with no sign of being reduced. It’s time that investors see some debt repayment. As pipelines require significant amounts of capital to build and maintain, ENB may find itself in a position where cash is short. After all, management has plenty of projects to fund, a double-digit dividend growth promise to keep, and larger debts to repay. This could seriously jeopardize ENB’s growth plans. Many pipeline projects have been revised or paused by regulators over the past few years.

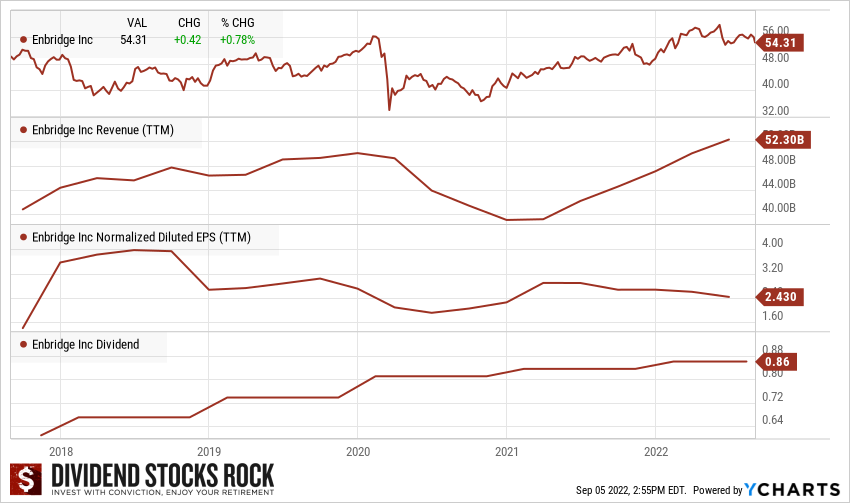

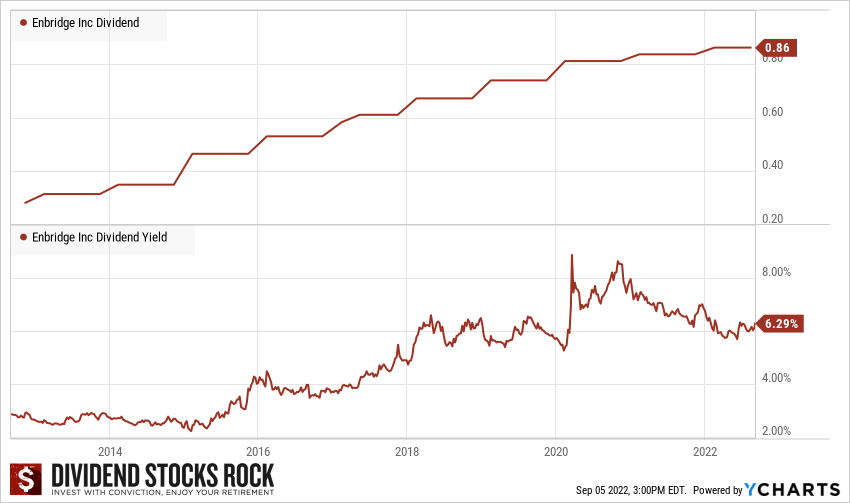

Dividend Growth Perspective

The company has been paying dividends for the past 65 years and has 27 consecutive years with an increase. Further dividend growth shouldn’t be as generous as compared to the past 3 years (10%/year). Management aims at distributing 65% of its distributable cash flow, leaving enough room for CAPEX. Look to their latest quarterly presentation for their payout ratio calculation. Management expects distributable cash flow growth of 5-7% annually. Therefore, you can expect a similar dividend growth rate. We have used more conservative numbers in our DDM calculation that are more in line with the 2021 and 2020 dividend increases of 3%.

An exclusive list of dividend growers with more potential…

Moose Markets presents the Canadian Dividend Rock Stars list: a selection of Canadian companies showing income and growth. You guessed it; we prefer a combination of dividend growth and dividend yield. The Canadian Rock Stars List is a selection of the safest dividend stocks in Canada.

Disclaimer: I am long ENB in my Dividend Stocks Rock portfolios.