If there’s one thing retirement should bring, it’s simplicity.

You’ve worked hard, saved diligently, and now it’s time to put your money to work—with minimal hassle and maximum peace of mind.

For Canadians investing for retirement, ETFs are one of the best-kept secrets in plain sight.

In this article, we’ll explore:

-

What ETFs are

-

How to use them in retirement

-

Why ETFs belong in your toolbox—but not your core plan

-

And how to avoid the #1 trap

Why ETFs Are the “Easy Button” for Retirees

Let’s be honest: once you retire, the last thing you want is to babysit a complex, high-maintenance portfolio. You don’t want to track 45 stocks or time the market. You want income, simplicity, and peace of mind.

That’s where ETFs (Exchange-Traded Funds) come in.

These low-cost, diversified bundles of investments are perfect for Canadians who want a hands-off strategy that still delivers results—and they’re especially powerful in retirement.

What Is an ETF?

An ETF is a basket of stocks, bonds, or both you buy on the stock exchange. Think of it like buying a package of investments in one easy trade.

You’ll find ETFs for nearly everything:

-

🇨🇦 Canadian dividend payers

-

🇺🇸 U.S. market leaders (e.g., S&P 500)

-

🌎 Global tech and emerging markets

-

💵 Bonds and fixed income

-

🧊 Even Cash ETFs (we’ll get to these soon)

Why retirees love them:

ETFs offer instant diversification, low fees, and fewer decisions to make. You can build a complete retirement portfolio with just one or two ETFs.

Looking for Retirement Income? Here’s Your Guide!

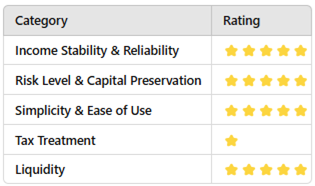

This free guide reviews 20 income-focused products. In the one-page summaries, we highlight the pros and cons, common mistakes to avoid, and who should use them.

We also created a rating system to highlight the difference between each product. The idea is to provide you with as much information as possible so you can make the right choice for your situation.

While there is no free lunch in finance, there are multiple ways to reach your retirement goals.

Download The Canadian Retiree’s Guide to Income-Producing Investments Now!

How Would I Invest $1M Using ETFs?

Let’s say I’m retired today with $1 million and want to keep it simple. Here’s how I’d break it down:

Option 1: Balanced & Reliable (60/40 mix)

-

60% equity ETFs for growth and dividends

-

40% bond ETFs for stability

📈 Goal: Generate $30K–$40K in annual income and preserve capital.

Example ETFs:

-

XEI.TO (Canadian dividends)

-

ZAG.TO (Canadian aggregate bonds)

Option 2: Growth-Focused (80/20 mix)

-

80% equities for long-term compounding

-

20% fixed income for cushion

Example ETFs:

-

VFV.TO (S&P 500)

-

XIU.TO (TSX 60)

-

ZAG.TO (bonds)

Option 3: All-in-One Simplicity

If I didn’t want to deal with asset allocation at all? I’d go with a single all-in-one ETF that already includes everything.

Top all-in-one picks:

-

VBAL (60/40)

-

VGRO (80/20)

-

XEQT (100% equity)

-

XGRO / ZGRO – Canadian alternatives

📌 Why I like them:

-

Global diversification

-

Automatic rebalancing

-

Extremely low MER (~0.25%)

-

Perfect for monthly withdrawals

Honestly, this is the strategy I’d hand to my spouse if she had to manage our finances solo.

To give you an idea of the returns an all-in-one ETF can offer, I have analyzed XEQT in the video below.

Where Do Cash ETFs Fit In?

Cash ETFs are like a high-interest savings account inside your brokerage account. They hold short-term government securities or T-bills and pay interest monthly.

🔍 When to use them:

-

Emergency fund

-

Cash reserve for the next 1–3 years of expenses

-

Temporary “parking spot” for your money

✅ Pros:

-

Very low risk

-

Highly liquid (sell anytime)

-

Monthly income

❌ Cons:

-

Modest returns that won’t keep up with inflation

-

Fully taxable as interest income (unless held in a TFSA/RRSP)

-

Not a growth tool—just a buffer

💡 Pro tip: Use Cash ETFs in a bucket strategy to smooth out withdrawals and avoid selling equities during downturns.

Don’t Overdo It: Avoid ETF Overload

One of the most common ETF investing mistakes? Buying too many. Here’s what happens:

“I’ll buy one Canadian dividend ETF… oh, and a U.S. dividend ETF… and maybe a global growth one… and a few sector ETFs… and—wait, why do I own 1,200 companies now?”

Here’s the truth: most ETFs already own hundreds (or thousands) of holdings. Buying more means duplication, higher fees, and decision fatigue.

🎯 Keep it tight:

-

1 ETF → All-in-one solution

-

2–3 ETFs → Perfectly fine for a balanced strategy

-

4+ → You better have a solid reason

Mike’s Simple ETF Selection Checklist

Whether you’re building a brand-new ETF portfolio or fine-tuning an existing one, this no-nonsense checklist will keep you on track:

✅ Start with your goal – Income, growth, or balanced?

✅ Stick with trusted providers – Vanguard, iShares, BMO, Horizons

✅ Compare MERs – Under 0.30% is ideal

✅ Check top holdings – Avoid overlap

✅ Currency exposure – Hedged or not? Know what you’re buying

✅ Assets Under Management (AUM) – Larger = more liquidity

Why All-In-One ETFs Are My Favourite Option for Retirees

I’ve said it before, and I’ll say it again: if I ever stop picking stocks, I’m going all-in on all-in-one ETFs.

They’re simple, cost-effective, globally diversified, and handle rebalancing for you. No spreadsheets, no second-guessing, no stress.

Imagine having just one line on your investment statement… and knowing it includes thousands of companies worldwide. That’s not just convenience—it’s smart portfolio design.

If you’re a retiree looking to draw income each month, all-in-one ETFs make it ridiculously easy. Just sell a few units when needed. Done.

Final Thoughts: Build a Retirement Portfolio That Works for You

Here’s what I’ve learned after more than a decade of working with dividend and ETF investors:

👉 You don’t need to make it complicated to be successful.

👉 The best portfolio is one you understand—and can stick with.

👉 ETFs give you instant access to diversification, low fees, and income.

👉 All-in-one ETFs are perfect for Canadians who want a hands-off solution.

👉 Cash ETFs aren’t the main dish, but they’re a great side.

And above all, remember: your plan only works if you actually follow it.

Don’t let perfectionism delay progress. Whether you build a 3-ETF mix or go with a single all-in-one fund, the key is to stay invested and consistent.

Learn More about 20 Income-Focused Products

With that in mind, remember to grab your free copy of The Canadian Retiree’s Guide to Income-Producing Investments! You’ll be well-aware of the pros and cons of each to make the best decision for your situation and goals.