REITs are companies primarily engaged in Real Estate and source most of their income from rents. To qualify as REITS (tax purposes) they need to distribute more than 90% of their net income to shareholders. This amongst other factors makes REITs a great option for income seekers looking for stable and decent dividends. At DSR we track 47 Canadian REITS! From that list, today we will be covering some of the higher-yielding companies (over 5% dividend yield). Although this might sound very appetizing make sure you do your due diligence because high yield is not always the same thing as high quality.

- Make sure you find a healthy dividend growth rate in the last few years (at least 5 years). If the company is increasing dividends at a rate lower than inflation, it means every single year you are getting a smaller paycheck.

- Some of these higher-yielding companies could also be dividend traps just looking to attract investors and their dividend is not sustainable, that is why you need to make sure you take a close look at the payout ratio (remember with REITs you use funds from operations (FFO) and not net income).

- Last but not least take a look at their track history, have they cut dividends in economic downturns? If they have how fast did they recover? This could give you an idea of what to expect next time things get rough for these companies.

For more REIT investing guidelines, please refer to the Canadian REITs Beginner’s Guide.

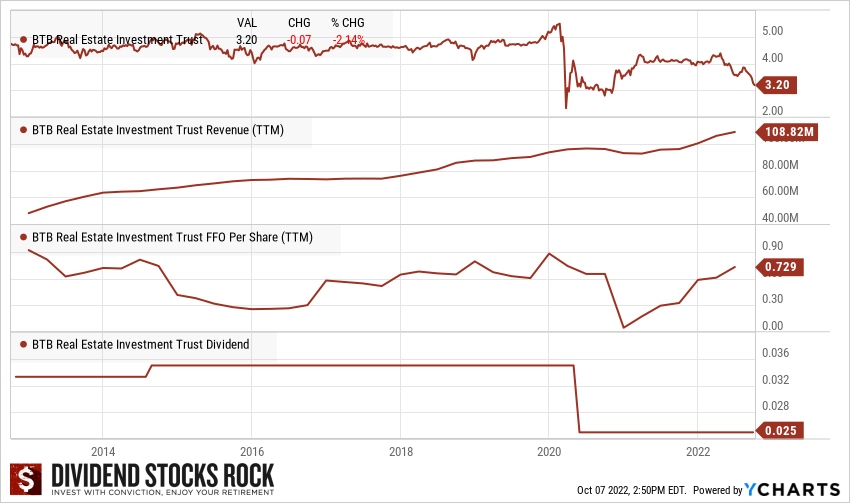

BTB REIT (BTB.UN.TO)

Market Cap: $271M

Dividend Yield: 9.14%

Subsector: Diversified (Retail, Office, and Industrial)

BTB Real Estate Investment Trust (the Trust) is a Canada-based real estate investment trust (REIT). The objective of the REIT is to generate stable and growing cash distributions on a tax-efficient basis from investments in a diverse portfolio of income-producing properties, with a primary focus in Quebec; to expand the real estate asset base of the REIT and increase its income available for distribution through an accretive acquisition program, and to enhance the value of the REIT’s assets and maximize long-term Unit value through the active management of its assets. The Trust owns approximately 75 properties, representing a total leasable area of approximately 5.9 million (M) square feet. It is an owner of properties in eastern and western Canada. It also offers a distribution reinvestment plan to unitholders. The Company operates through three segments, namely Industrial, Off downtown core office, and Necessity-based retail.

In September, BTB REIT reported strong revenue growth (+11%), but failed to reflect this performance in its AFFO per unit (-7%). Revenue growth was driven by strong rental activity and recent accretive acquisitions. Furthermore, BTB’s net operating income increased by 13% and its leasing efforts improved the occupancy rate of the properties by 1.6% compared to the same quarter of 2021. AFFO per unit was down due to a one-time additional recovery of $2.6M and an indemnity collection thereby increasing the revenues for that period last year. The dividend is safe with an AFFO payout ratio of 65.5% for the quarter and 67.8% for the first six months of the year.

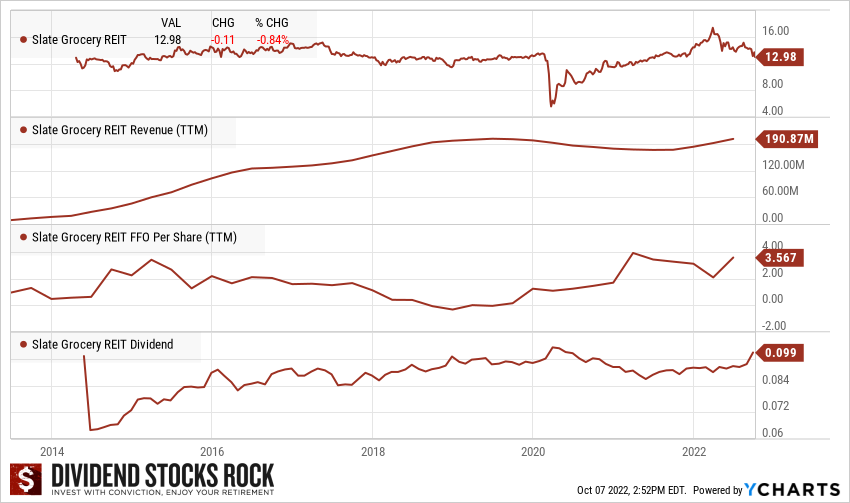

Slate Grocery REIT (SGR.UN.TO)

Market Cap: $783M

Dividend Yield: 9.20%

Subsector: Retail (Grocery)

It is known that we are not fans of brick-and-mortar REITs at DSR. However, Slate Grocery REIT focuses solely on grocery-anchored commercial properties, which are generally buffered against the competition from e-commerce. The REIT counts Walmart (6.2% of base rent) and Kroger (8.1%) as its top tenants. We also like SGR’s geographic diversification across Florida (15.5%), North Carolina (14.1%) and Pennsylvania (10.4%). This combination of strong tenants and good geographic diversification has led to a high rent collection rate in 2020. Slate Grocery boasts a defensive portfolio of tenants including 64% of its base rents linked to groceries (38%), essential services (14%), or medical and personal services (13%). Despite its strengths, this REIT still has a weak dividend growth policy.

In August, Slate Grocery REIT reported good growth this quarter (revenue up 18%, AFFO per unit up 5%). This brought the AFFO payout ratio from 100% last year to 98%. On July 15, 2022, the REIT completed the acquisition of 14 properties for $425 million, which represents a low acquisition basis of $174 per square foot with below-market rents. The Portfolio increases the REIT’s exposure to the rapidly growing Sunbelt Region of the U.S. and includes a wide range of high-performing grocers, including Publix, Ahold Delhaize, Albertsons, and Walmart Occupancy has increased by 20 basis points since the most recent quarter to 93.4%.

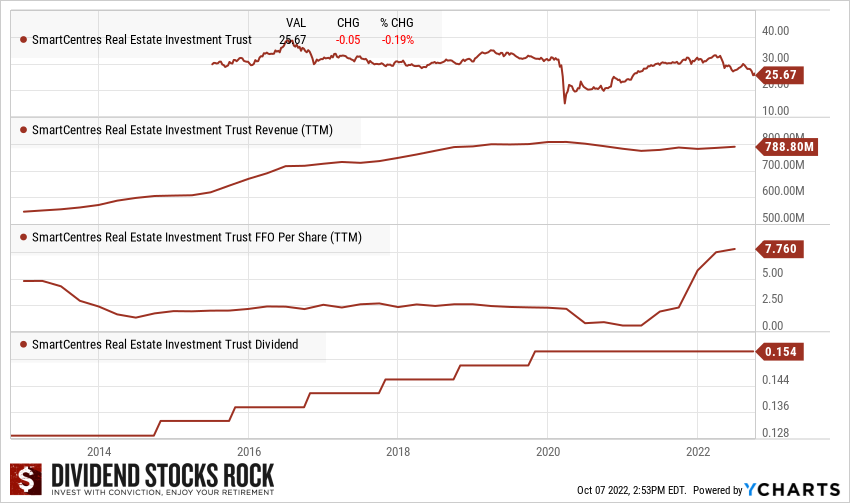

Smart REIT (SRU.UN.TO)

Market Cap: $4.37B

Dividend Yield: 7.20%

Subsector: Diversified (Retail, Multifamily, Office, and Self-Storage)

SmartCentres’ strengths lie in its long-term partnerships with retail giants such as Walmart, Canadian Tire, TJX and Loblaws. We like how SRU has integrated drugstores and grocery stores into each mall. This ensures a constant flow of customers for all the other retailers. SRU doesn’t just count on its strong relationships with stellar tenants to ensure growth. Management has recently increased its focus on 5G towers, EV charging stations, and pickup services (to compete against e-commerce). SRU also has an “intensification plan,” where it will develop various property types (residential, hotels, office buildings, etc.) in fast-growing cities. SRU is in the midst of an ambitious expansion and diversification project where a total of $15B will be invested. This is a great way to ensure diversification away from large retailers going forward. SmartCentres’ intensification program is expected to produce an additional 58.6 million square feet of space.

In September, SmartCentres reported a good quarter with revenue up 2% and FFO up 6%. The payout ratio for the quarter is at 90%, down from 99% last year. If the REIT continues on this track, we could talk about a distribution increase next year. Shopping centre leasing activity continues to improve with occupancy levels, inclusive of committed deals, increasing to 97.6% in Q2 2022, representing a 40 basis points increase from Q1 2022. SRU received zoning approvals for over 3.8 million square feet of residential development in the second quarter on 3 projects in the Greater Toronto Area.

Truth about REITs

As you can tell, finding the perfect REITs for your portfolio is not an easy task. Especially when looking for high-yield REITs, there are a lot of factors that you need to consider in order to be able to sleep well at night. You want to add to your portfolio a stable business with enough growth to at least beat inflation. If you get down to the weeds, looking at the actual portfolio and its growth might be a good resource to look into the future. At DSR we give you the tools to make sure you put your money to work with stable and growing companies so you can enjoy your passive income on the things that matter most!

Those REITs are great, but there is more!

We are now in market correction territory, and the fear of losing more money is growing. What will happen if we keep up with continuous high inflation?

If you look at past performances, Real Estate Income Trust is one of the best performing classes during high inflation periods since the 70s. Unfortunately, not all REITs are created equal and you must do adequate research to make sure you buy the right ones.

In this webinar, I will answer questions like:

- How about REITs paying a 10% yield

- How to make sure the REIT’s distribution is safe

- Which metrics to consider during my analysis?

- Should I consider mortgage REITs?