You did it—you’re officially retired!

Your bucket list is ready, your calendar is wide open, and your dreams are finally within reach. You’ve saved and planned like a pro. Now it’s time to enjoy what you’ve built.

But then… the real questions start to pop up.

-

Where do I withdraw money from first?

-

What if there’s a market crash?

-

How do I manage taxes across my accounts?

-

How do I make my investments last?

This is when your retirement income plan becomes just as important as your retirement savings plan.

Let’s set the basics for building a simple, flexible income plan—including how to protect your portfolio from market downturns and withdrawal mistakes. Plus, we’ll walk through the concept of a cash reserve and why it could be your most underrated retirement tool.

Why You Need an Income Plan

Knowing you have “enough to retire” is only half the equation. The other half is understanding how to turn that nest egg into a paycheck.

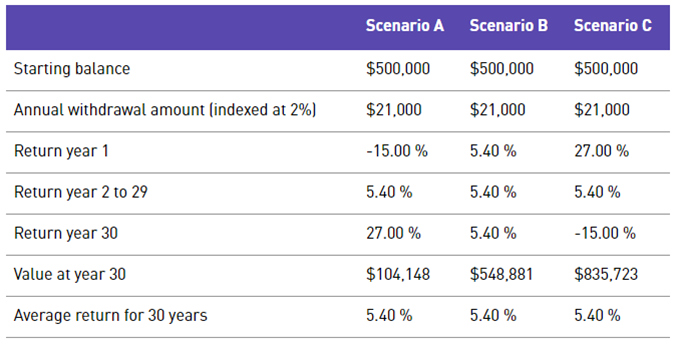

One of the biggest risks retirees face is the withdrawal sequence risk—the possibility of selling investments at a loss during a market downturn. If the first few years of retirement coincide with a bear market, this can significantly reduce the long-term sustainability of their portfolio.

It’s why even well-prepared retirees feel overwhelmed when they look at 10+ accounts and multiple income sources.

Imagine this: you retire at the top of a bull market, start drawing income, and the market drops 20% in your first year. Now you’re forced to sell lower-priced shares to meet your income needs—locking in losses early and potentially throwing your entire plan off course.

Retirees with dividend-only or high-yield portfolios hope to avoid selling shares. But we know high yield often comes with higher risks, so this isn’t always a better strategy.

So what’s the solution?

The Cash Reserve Strategy: Your Retirement Shock Absorber

One of the most effective ways to manage withdrawal risk is using a cash reserve—a buffer of liquid, low-risk funds outside the market.

What is it?

A cash reserve is money you set aside in a high-interest savings account, money market fund, or short-term GICs—not in the market.

Why use it?

If your portfolio doesn’t generate enough dividends to cover your retirement spending needs, the difference (the “gap”) typically comes from selling shares. But during a bear market, you can instead draw from your cash reserve—giving your investments time to recover.

Example:

-

Retirement income needed: $50,000/year

-

Dividends generated: $20,000/year

-

Gap to cover: $30,000/year

If markets are down, you draw that $30,000 from the reserve instead of selling at a loss.

How Much Cash Reserve is Enough?

There’s no one-size-fits-all answer. It depends on two key factors:

-

How big your income gap is

-

How much volatility you’re comfortable with

As a general rule:

-

1–2 years’ worth of gap = moderate protection

-

3+ years’ worth = maximum protection (especially for conservative investors)

Keep in mind: while a large reserve offers security, it also limits your exposure to long-term market growth.

6 Retirement Upgrades—Save Your Spot to My Next Webinar!

Planning for retirement is both complex and essential for enjoying this phase of life. Understanding strategies, tax optimization, and withdrawal methods can feel overwhelming.

But how do you know if you’re making the right decisions?

You weren’t trained as a financial planner. Yet when seeking professional help, many advisors focus more on selling investments than addressing your concerns.

It’s time to put you in control of your retirement plan.

As a financial planner for 10 years before leaving the corporate world, I’ve helped many people like you, and I took great pride in answering their retirement questions.

On May 22nd at 1 pm ET, I’ll host a free webinar addressing six crucial retirement questions:

- Do I have enough to retire?

- How to pay less fees?

- How to pay less taxes?

- How to spend more, and still have enough?

- What if the market crashes?

- How do I know I’m doing the right thing?

👉 Reserve your free spot here »

A Simple Framework to Build Your Income Plan

There are many variations, but the foundational steps are consistent:

- Run Your Retirement Projections: Estimate your needs, withdrawal rates, and growth assumptions to see if you’re on track.

- Identify All Sources of Income: Include CPP, OAS, pensions, dividends, and any part-time work or rental income.

- Calculate the Gap: Subtract total income from your spending needs. That’s the gap you must fill each year.

- Build the Cash Reserve: Set aside 1–3 years of your gap in liquid, low-risk assets.

- Invest the Rest: Focus on dividend growth equities to protect against inflation and grow your income. Add fixed income if volatility keeps you up at night.

Keep it Simple (and Flexible)

Managing multiple accounts doesn’t have to be complicated. Whether you use managed solutions or self-directed portfolios, a clear set of 3–4 rules can guide when and what to sell.

For example:

-

Only sell from accounts with the lowest tax impact

-

Prioritize capital gains over income in non-registered accounts

-

Rebalance once per year to refill your reserve and stay diversified

And remember: selling isn’t a mistake—it’s part of the plan.

Revisit Your Plan Every Year

Markets change. Life changes. So should your income plan.

Rerun your retirement projections each year and adjust your withdrawal strategy accordingly. The goal is to spend more time enjoying retirement rather than constantly recalculating it.

Let’s Talk Retirement—Live!

You’ve worked hard to get to retirement. Don’t let uncertainty about withdrawals derail the freedom you’ve earned.

By building a thoughtful income plan—with a cash reserve as your buffer—you’ll give your retirement more flexibility, stability, and peace of mind.

I’m hosting a free webinar in which we’ll explore real-life retirement income strategies, including how to handle taxes, cash reserves, and withdrawal timing.

- The webinar is on Thursday, May 22nd at 1 pm ET.

- The content is 100% Canadian.

- If you can’t attend, register and you will receive the replay for free.

- It is 100% free, no strings attached.

- The presentation is about 50 minutes.

- I will stay one hour after the presentation to answer all your questions.

- I will also provide handouts and other resources to all live attendees.

- Live places are limited to the first 500.