The best way to improve your financial situation and retire stress-free is to invest. But how do you buy Canadian Stocks? Which one should you be buying? Do you need a financial advisor or can you simply buy stocks on your own?

I’ve asked myself all those questions before I made my first trade on the market. At first, I felt overwhelmed by the information about the stock market. I didn’t know where to start, which type to account to choose, and which investing strategy (do you need one?) to pick. Fifteen years after I first bought my first shares of Power Corporation (POW.TO), I take a look back at what I’ve learned to help you start today (and avoid some of the mistakes I’ve made!).

I remember the very first thing I did once I got my first stable job was open an investment account. I was fortunate enough to meet with the right people telling me at a young age that the best way to build wealth was through investing. At the age of 23, I didn’t have much financial responsibility, and this was the perfect timing to start saving and investing. However, before opening a brokerage account and buying stocks of the first company that comes to my mind, I should have take the time to build a real plan.

Here are the steps I should have followed before making my first investment. This is a complete article that will be updated as I add more content to each section. You don’t need to read it in one shot (just bookmark it!). Just take one step at a time and you will learn how to buy stocks.

Step #1 Know yourself and know where you are going

Before you even think to buy stocks, you must first draw the picture of your financial situation and write down why you invest. Do you….

- Wish to retire early or comfortably?

- Fund your children education?

- Buy a rental property or vacation property by the lake?

- Or you just want to save money “just in case”?

Answering those questions, looking at your current financial situation and determining your risk tolerance will tell you a lot about the type of investing strategy you should pick (we will cover that later down the road).

The “classic and boring” investor profile questionnaire meets this purpose. Why is it so important to complete such questionnaire before you start investing? Because once you invest and the storm gets in and you lose money, it will be too late to know if you were able to handle it or not. It’s better to know if you are able to look down the cliff before you jump right?

The best questionnaire I found so far isn’t coming from a bank or an investing firm (that adds to the credibility!). In fact, it’s coming from the Financial Market Authority of Quebec (L’autorité des Marchés Financiers). You can give it a try here:

Investor profile questionnaire

Step #2 You need a brokerage account

Now that you know why you invest, it’s time to know how you can buy stocks on the market. Forget about movies where you call some shady brokers at their desk, you can do everything on your own!

A brokerage account is basically a platform enabling you to buy and sell stocks on the market. You can have multiple different accounts (RRSP, TFSA, RESP, etc.) with the same online broker. The money is being transferred from your bank account to your brokerage account as any other electronic fund transfer. Then, you can start buying stocks.

You can open an online brokerage account at your bank or you can go the savvy route and opt for Questrade. Questrade is a safe online broker offering the lowest fees. While most banks will charge you around $9.99 each time you buy or sell stocks, Questrade will do it for a starting price of $4.95. After that, shares are .01 each, to a maximum of $9.95.

For example, if you buy 100 shares of Royal Bank (RY.TO), you will pay $4.95 + $0.01*100 = $5.95. That’s 40% discount vs any other bank. Plus, if you want to buy ETFs (Exchange Traded Funds), you do it for free!

Here’s how I opened a Questrade account in less than 15 minutes:

You can open an account with Questrade today and start with $50 in free trades.

Step #3 Canadians can choose among plenty of account types

When you open a brokerage account, you have the choice of opening multiple types of accounts. Each account is getting taxed differently and has different purposes. In general, all stocks and ETFs can be bought through any account types. Here are the choices will have:

Cash & margin accounts

The cash account is the most straightforward of them. You can trade any type of investments in this account. However, there are no tax deductions when you invest money. Profit, interest or dividend are also subject to taxes.

This type of account can be managed individually (by yourself) or joint (with your spouse for example).

RRSP (Registered Retirement Savings Plan)

This is probably the most classic account type if you plan to retire. The RRSP is well-known by Canadians for its tax advantages. Whenever you invest money in your RRSP, the “contribution” is being deducted from your declared income on that year. Also, all profit, revenue or dividend made inside a RRSP is tax sheltered (you don’t pay taxes on them). On the other side, when you withdraw money from your RRSP account, the amount withdrawn will be added as a revenue in your tax report.

TFSA (Tax Free Savings Account)

Here’s the most flexible and tax optimized investing account for Canadian! The TFSA has been designed to shelter your investment from taxes. When you buy stocks in your TFSA, the “contribution” will not be deducted from your income. In other words; there is no tax return on your contributions. All profit, revenue or dividend made inside the TFSA is tax sheltered (no more taxes!).

The good news is you can withdraw money from this account at any year and never pay taxes on your withdrawals. Even better, you can put that money back the following year without any penalty (or obligations!).

RESP (Registered Education Savings Plan)

This is probably the most complicated account as it is not designed for you, but for your children tuitions. I will cover this account later down the road with a complete article on it. In the meantime, what you need to know is that both Federal and Provincial Governments will grant subsidies according to the amount you invest. Plus, all profit, revenue or dividends earned in this account is tax sheltered. The purpose of the RESP is to help you pay for tuitions.

TFSA or RRSP?

As you can see, chances are you will have to make the decision between having a TFSA or a RRSP. Most investors will end-up with both. If you are starting in the investing world, I think the TFSA would allow you more flexibility than the RRSP.

Step #4 Which type of investment is offered to Canadians?

Now that you have opened a brokerage account and you have selected the right account type, we are now one step closer in learning how to buy stocks. This section covers the type of investment you can buy.

While there are hundred of ways to buy stocks, we’ll focus on a few products that are simple to understand and will get you started. Because time is money and time in the market is everything.

Robo-Advisor

If you are completely new to investing and you don’t want to get your feet too wet at first, Robo-Advisors are probably the best solution. A Robo-Advisor is a proven recipe that has been cooked and assembled for you. All you need to do is to pick your asset allocation according to your taste (risk tolerance) and you invest your money in this “recipe”.

Fees are relatively low for a complete “packaged and managed” solutions and you don’t have to worry about anything. Robo-Advisors create portfolios using specific ETFs to cover all assets classes. In a single transaction, you buy hundred of stocks and get a fully diversified portfolio instantly.

ETF (don’t even think of mutual funds)

We are not going to cover mutual funds here because A) they are expensive and B) they don’t do better than ETFs in most cases.

Exchange Traded Funds (ETFs) are packaged investment products replicating a market, a sector or a strategy. For example, one of the largest Canadian ETFs is the ISHARES S&P TSX 60 INDEX ETF (XIU.TO). This ETFs will mimic a portfolio that would include the 60 stocks included in the … TSX 60 (the 60 largest companies trading on the Toronto Stock Exchange). Therefore, instead of buying individually 60 stocks and make sure that each of them shows the same weight in your portfolio, a single transaction give you access to this “bundle”. If the TSX 60 goes up by 4%, the ETF will follow very close behind (as there is still small fees to pay). In the specific case of the XIU, its management fees are 0.18%. Therefore, the XIU would show a return of 3.82%. Not bad for not having to manage 60 stocks portfolio, huh?

There are plenty of ETFs combinations and strategies possible and we will cover them in the future.

Stocks

If you don’t trust someone else to manage your money because nobody cares more about your portfolio than you do, buying individual stocks is the strategy you must follow. Buying stocks isn’t as overwhelming as it seems. What you need is a clear strategy determining where you will put your focus. There are several thousand stocks on the market, you can’t (and don’t want) to buy them all. Focusing on specific stock market areas will help you saving time and make the right investments for you.

Then, through a straightforward process, you will identify which stocks to buy and how much to invest in each position. I’m sharing key metrics I look at before buying any shares in step 8 of this article. In the upcoming sections, you will learn how to buy stocks and build a strong portfolio.

Other investment products

There are obviously a lot more to cover when you consider investing. If you are reading this article, this means you are at the beginning of your investing journey. You don’t necessarily need to know and master all type of investments. My most important advice at this point is to keep your portfolio simple. You don’t need the latest investment strategy combining options, preferred shares and leveraged ETFs. You just need to learn how to buy stocks and build a solid portfolio. Now let’s get started.

Step #5 Transfer money in [this is exciting]

At the time to open your brokerage account in step #2, you already linked your investment account with your bank account. This is how you will transfer money into your investment account in the first place. You can either transfer a lump sum of money or start by periodic payment plan.

The lump sum transfer will allow you to buy larger amount of stocks in one transaction. However, it could take time to save before you can start investing. If you have a large amount coming from an heritage, the sale of a property or a pension plan transfer, you should transfer it directly to your brokerage account and start investing.

You can start with as low as $25/month

Depending on your brokerage account, you can start a periodic payment plan for as low as $25/month. Now, there is no excuse preventing you to start buying stocks! If you start with less than $100/month, you are better off looking at ETFs instead of stocks. You will gain immediate diversification and you can buy ETFs for free through Questrade.

Periodic payment plan can be done weekly, bi-weekly (to time with your paycheck!) or monthly. It’s a great way to automate your saving habit and not thinking about it anymore. You will learn to live without this amount in your budget. This is another version of “pay yourself first” strategy.

Dollar Cost Averaging (DCA)

Periodic payments also enable you to use a strategy called dollar cost averaging. Since you will be buying more stocks or ETFs periodically, your cost of purchase (the price you pay per share) will be average up when the market is doing well and average down during challenging period.

Throughout time, you will have money invested at peaks, but also at bottom levels. When you buy during down markets, you get more shares for your bucks. When markets rise, you get to enjoy the ride and buy at each level.

The key in both strategy (buying stock with a lump sum vs DCA) is to stick with your strategy and not wait. Time in the market will be the greatest source of your return. Don’t ruin it by waiting.

Step #6 A few key definitions before you start

Now that you have money ready to buy stocks, it’s time to get a few key definitions before you place your first order. Some of them are basic terms, but some may surprise you. Let’s do a quick tour of some common terms used in the financial world.

Common Shares/stock

This is what we refer as a “stock”. When you buy stocks, you buy common shares of a company. This is a small (tiny winy) portion of a business. Holdings common share entitled you to have rights on your part of the company’s value, receive dividend (if any) and go to shareholder meetings.

Preferred Shares

Similar to common shares, preferred shares will usually pay a higher dividend and will entitle shareholders to first right on the company’s assets in case of bankruptcies. Dividends are not only higher, but they are paid first (before common shares dividend). Preferred shares are halfway between common shares and bonds. Shareholders do not have voting rights. They are usually less volatile and less liquid (less stocks bought or sold each day) than common shares. If you start investing, you want to stick with common shares.

Symbol/Ticker

When you place a market order in your brokerage account, you will need the symbol or the ticker of the company. For example, Royal Bank’s ticker is RY. If a website covers both US and Canadian stocks, chances are “RY” will become “RY.TO” or “RY-TO” to identify on which market common shares can be purchased. You can search for the ticker inside your brokerage account or via a free investing site by looking for a “quote” or “stock quote”.

Quote/Stock Quote

In your broker screen, you will read “quote” or “stock quote”. This is where you will get the latest information on the stock you want to purchase. It will give you information such as the ticker, the full company’s name, the latest transaction price, the “bid and ask price” and “bid and ask size” and general information on the stock such as the PE ratio, the dividend yield, market capitalization, etc.

Bid and Ask Price

Remember the stock exchange (the Toronto Stocks Exchange (TSE) or the New-York Stock Exchange (NYSE), etc) is a place to buy or sell stocks. The bid price will refer to the latest order placed from a buyer (an investor is willing to pay $23.66 per company ABC shares) and the ask price refers to the latest order placed from a seller (an investor willing to sell shares of company ABC at $23.74). The transaction will happen once a buyer will meet a seller’s price.

If there is a huge difference between the bid and the ask price, this means there isn’t many buyers and sellers and the stock price will be subject to higher fluctuations. Penny stocks are a good example of this situation.

Bid and Ask Size

Similar to the bid and ask price, the size refers to the amount of shares an investor is willing to purchase or sell. This tells you how “liquid” the stock is. By liquid, I mean how many shares will be exchanged (bought and sold) in the upcoming transactions. The more liquid, the “smoother” the stock price will fluctuate. This is more important when you trade, again, penny stocks and other small capitalization (low value) stocks. Big guys of the TSX 60 don’t have this problem.

Market Order

A market order happens when you enter the number of shares you want to purchase, but you are willing to buy them at market price (the lowest ask price). That’s usually not a problem when there are lots of transaction (liquidity) going on because you will pay a price very close to the latest price shown in your stock quote.

Stop Order

The stop order is when you put a number of shares and a specific price you want to buy or sell. The transaction can be placed for several days until the desired price is reached. The transaction will only trigger if the price is reached.

Investors use that to buy stocks at a better price or to protect their gains. If a stock surged from $22.34 to $37.09, an investor may want to protect his profit by setting a stop sell at $35.00. If shares ever go down to this price, the online broker will automatically sell your shares starting at $35. This means that if shares keep going down, you will continue to sell until you have sold all your shares. Your average price sold will likely be lower than $35.

This doesn’t mean that you will sell the stock at $35/share, just that the market order will be triggered at $35. Same rationale applies for buy stop order.

Limit Order

A limit order is similar to a stop order only that the former will only happens at a specific price. For example, if you put a limit order to buy 400 shares at $56.75 and only 200 are available at that price, you will end-up with 200 shares in your account and a pending order for 200 more at $56.75.

Step #7 Where do you get your information to buy stocks?

Now that you are all set and ready to start investing, it’s time to do some stock research! Unfortunately for us, Canadians, the offer is quite limited when you look for free information on Canadians companies.

The best free stock screener you can find is probably over at the TMX or Yahoo Finance where you can do research on both Canadian and US stocks. This is a good place to start building your watch list.

Then, general sites such as Reuters, Motley Fool, , and Morningstar will provide you with some useful information and quick analysis.

Then, one of the best places to find reliable information is the company’s investor relations site. Simply type “Royal Bank investor relations” and you will get directly to where you can read quarterly reports, investors presentations and annual reports. I’ve listed other free financial resources here.

Step #8 Key metrics to find the best stocks to buy

What is the most important when I look at the company is not the number, but my investment thesis. Before I get there, I must screen stocks with a very specific, yet simple stock screener. I’m looking for company with revenue growth, earnings growth and dividend growth. This is what I call the “Dividend Triangle”.

Growing revenue

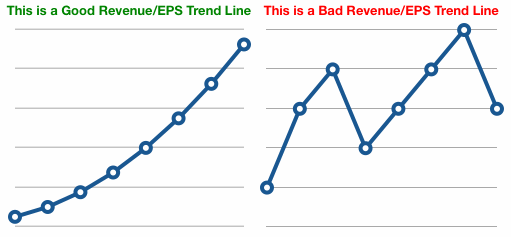

My criteria for a positive revenue analysis is:

- An increasing revenue trend line for at least the last 5 years;

- A revenue growth trend line that is steeper than the company’s closest competitor;

- Do I expect that the company has a better than reasonable chance of continuing with the steep revenue trend line in the next five years.

If the company cannot meet these requirements, then my analysis usually stops. However, there may be some cyclical stocks that see up and down periods in revenue growth. If this is a consistent pattern, then that is ok. Another thing I keep in mind is that very large companies (i.e. Royal Bank or Canadian National Railway) can have difficulty growing revenues year after year. I don’t necessarily look for a high revenue growth trend line, only a trend line that is up and growing faster than the competition.

Growing Earnings Per Share (EPS)

Earnings per share (EPS) is a much tougher thing to decipher for a company. Revenue is revenue and is hard for a company to lie about, other than recognizing sales before the product actually ships or something like that. EPS on the other hand can be easily manipulated by a company, and not just in illegal ways. There are a number of very legitimate methods a company can present earnings. During my analysis of earnings, I don’t necessarily concern myself with the exact EPS number, but more importantly the trend line. Just as I do with revenue, I require the following criteria be met:

- An increasing EPS trend line for at least the last 5 years;

- An EPS trend line that is steeper than the company’s closest competitor;

- Do I expect that the company has a better than reasonable chance of continuing with the steep EPS trend line in the next five years?

The last point can be tricky, but further analysis of items such as ROE later on will help to determine how well management is performing in their ability to earn money for the company. I always keep in the back of mind that earnings can be manipulated. Again, I am looking at the trend.

The next step I take when analyzing EPS is to estimate what the EPS number will be 5 years out. This is obviously a very tricky thing to do, but it will be important later on when I start to value the stock. I look at the past 10 years of EPS history and earnings estimates from services such as Value Line to determine a number I am comfortable with. My approach is to be very conservative in my number to help build in a safety net if things get bad. This will ultimately give me a buy price for the stock that I believe has some safety built into it.

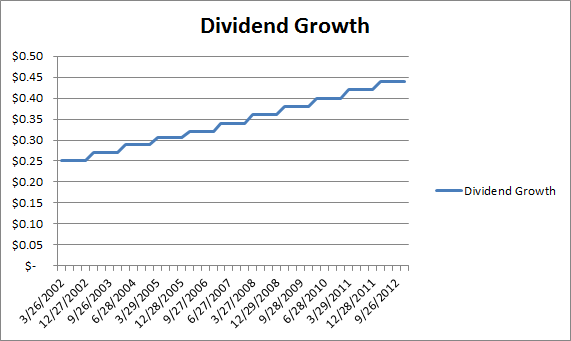

Dividend Growth

Once you’ve selected a company from your screener, the next step is to download their financial statements. If you are lucky, you will find an “Investor Fact Sheet” or “Recap” giving you some key ratios such as Earnings per Shares, Sales, Profit, and Dividend Payouts throughout the past years.

If you can’t get a hold of a one pager giving you the information right away, you’ll have to dig inside the financial statements. Take the annual reports as you will have more than one year and the info might have been calculated for you already.

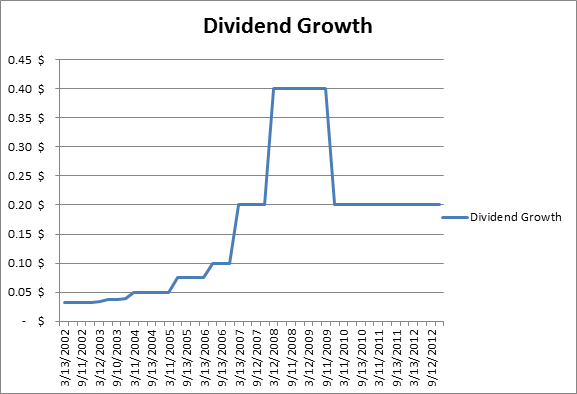

When you look at the dividend growth history, it is preferable to look at the past five years. Instead of simply calculating the dividend growth annualized rate, I suggest you make a quick graph of the past 5 years dividend payout. It will give you a clear idea of which stocks have a strong dividend payout strategy compared to another. The graph can be as simple as the following:

Which looks a lot better than the following:

The first graph is a good indication of a solid company that is looking to increase its dividend year after year. For the record, the first graph is TRP dividend growth and the second graph is Encana dividend growth.

Looking at past dividend history is a good start to know if the company intends to boost its dividend in the future. But there is always a will and a way, right? So the company might have a strong dividend growth history over the past 5 years, it doesn’t mean that it is sustainable.

The relation between sales evolution and earning per shares will tell you 3 things:

- How is the company’s main market doing (if sales are growing or not)

- If are the company’s profits growing (are they making more profit or not)

- How are the company’s margins doing (if the sales and EPS graph don’t head in the same direction, that’s a red flag or very nice news for the companies’ margin)

To ensure stable dividend growth over time, it’s obvious that you need stable sales and earnings growth. Sales growth will ensure future cash flow and earnings growth will ensure that the company makes more money as sales climb. If these two metrics are negative or growing erratically, you will need to dig deeper into the financial statements to explain it or simply pick another stock to analyze.

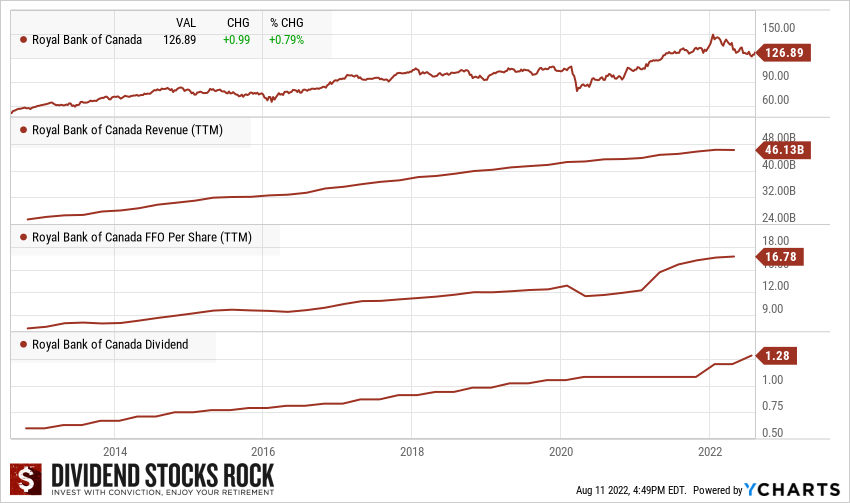

Royal Bank Example

Royal Bank is as close as a “perfect dividend triangle” you can find:

Source: Ycharts

In an ideal world, RY’s revenue and earnings would grow faster than its dividend, but you can see a steady trend for all three metrics. This is the kind of stock you want to buy for your retirement.

Step #9 Get your plan in motion; how to buy stocks summary

Before you start your investing journey and buy your first shares, remind yourself of the following key points:

#1 Keep things simple; overcomplicated will not necessarily improve your returns.

#2 Know yourself and know where you are going; having a financial plan and an investing strategy will come handy when the market goes crazy. Just stay focused on your plan when this happens.

#3 Write down why you buy stocks; elaborating your investment thesis for each purchase is crucial to build a solid portfolio.

#4 Don’t expect fast results; investing is all about playing the long game. After your purchase some shares, don’t refresh your account every hour. Don’t even look at it daily. Let time works is magic. Patient investors make good investors.

#5 Download this free ebook:

DOWNLOAD the WORKBOOK

DOWNLOAD the WORKBOOK

I wrote an entire workbook to give you confidence and guide you through the first steps of your investing journey.