Fast food is no longer just about convenience—it’s about brand power, menu innovation, and the ability to adapt to changing consumer tastes across diverse geographies. The company we’re looking at today commands some of the most recognized quick-service brands in the world, each with its own loyal following. With a franchise-heavy model, it thrives on scale, efficiency, and international growth opportunities, while still contending with industry-wide pressures like labor costs and price-sensitive consumers.

Behind the Counter: How the Business Works

Restaurant Brands International (QSR.TO) operates a portfolio of well-known quick-service restaurant chains: Tim Hortons (coffee and baked goods), Burger King (flame-grilled hamburgers), Popeyes Louisiana Kitchen (fried chicken and seafood), and Firehouse Subs (hot subs). It runs through a predominantly franchise-based model, generating revenue from royalties, lease income, and sales at company-owned locations.

-

Tim Hortons remains the market leader in Canada, offering beverages, baked goods, and all-day food menus.

-

Burger King drives scale globally, with operations in over 100 countries, though it faces challenges in North America.

-

Popeyes delivers strong unit-level economics with its Louisiana-style menu and growing global presence.

-

Firehouse Subs is expanding in the U.S. and selectively internationally, targeting the premium sandwich market.

The franchise-heavy approach limits capital expenditures while providing steady cash flow, but it also means that brand execution relies heavily on franchisee performance.

Opportunity on the Menu: The Bull Case

Restaurant Brands International ranks as the third-largest quick-service restaurant operator in the world, a scale that gives it bargaining power, brand leverage, and global expansion capacity.

Strengths driving the bull case:

-

Global Scale & Brand Recognition – The company operates across more than 120 countries, with iconic brands recognized for decades.

-

Franchise Model Efficiency – With over 100% of net new openings driven by franchisees, capital intensity stays low, allowing the company to reinvest in marketing and menu development.

-

Growth Through Expansion & M&A – Management is targeting 40,000 restaurants by 2029, with both organic openings and acquisitions (e.g., Carrols Restaurant Group, Popeyes China) feeding the pipeline.

-

Turnaround Potential at Burger King – The “Reclaim the Flame” strategy is refreshing stores, improving operations, and boosting franchisee profitability.

-

Menu Innovation & Digital Expansion – Tim Hortons’ new product launches and loyalty programs, plus Popeyes’ global chicken sandwich success, demonstrate the ability to capture new demand.

While Tim Hortons has reasserted its leadership in Canada, the most dynamic growth story is in international markets, where Burger King and Popeyes are achieving high-single-digit unit growth annually. This geographic diversification helps smooth performance when one brand or region faces headwinds.

Risks to Chew On: The Bear Case

Even with its scale and iconic brands, Restaurant Brands International faces meaningful risks that could hinder its expansion and earnings trajectory.

Key vulnerabilities and threats:

-

Franchisee Profitability Pressures – Rising wages, food inflation, and operational costs can squeeze franchisee margins, leading to slower store expansion or reduced reinvestment.

-

Debt Load Limits Flexibility – With a net debt-to-EBITDA ratio of 4.6x at the end of 2024, high leverage could restrict strategic acquisitions or marketing investments if interest rates rise further.

-

Mixed Brand Performance – While Tim Hortons and Popeyes post healthy sales growth, Burger King North America continues to lag peers like McDonald’s and Wendy’s in traffic.

-

Global Economic Sensitivity – As a discretionary spending category, quick-service dining is vulnerable to economic slowdowns, which can trigger more discounting and hurt margins.

-

Competitive Heat – McDonald’s and Yum Brands have global dominance, scale advantages, and deep digital ecosystems, forcing QSR to maintain constant innovation to keep market share.

The heavy reliance on franchisees means brand quality is only as strong as local execution—something that’s difficult to maintain perfectly across thousands of locations and dozens of countries.

The Ultimate Safe List to Get Dividend Growth Stock Ideas

To help you build a solid portfolio with dividend growth stocks, I have created the Canadian Rock Stars List, showing about 300 companies with growing trends.

You can read on to understand how it is built and why it’s the ultimate list for Canadian dividend investors, or you can skip to the good stuff and enter your name and email below to get the instant download in your mailbox.

What’s New: Recent Performance Highlights

In its 2025 Q2 results (May 29, 2025), Restaurant Brands International reported:

-

Revenue up 21%, driven largely by acquisitions (Carrols Restaurant Group and Popeyes China).

-

EPS up only 3%, as higher costs and integration expenses weighed on profitability.

-

System-wide sales grew 2.8%, with international markets delivering 8.6% growth.

-

Comparable sales flat at 0.1% globally, or just over 1% adjusted for Leap Day.

-

Burger King North America saw a 1.3% decline in comparable sales, reflecting softer consumer demand.

-

Tim Hortons and Popeyes posted positive comps, benefiting from menu innovation and marketing.

The Dividend Triangle in Action: QSR’s Growth Profile

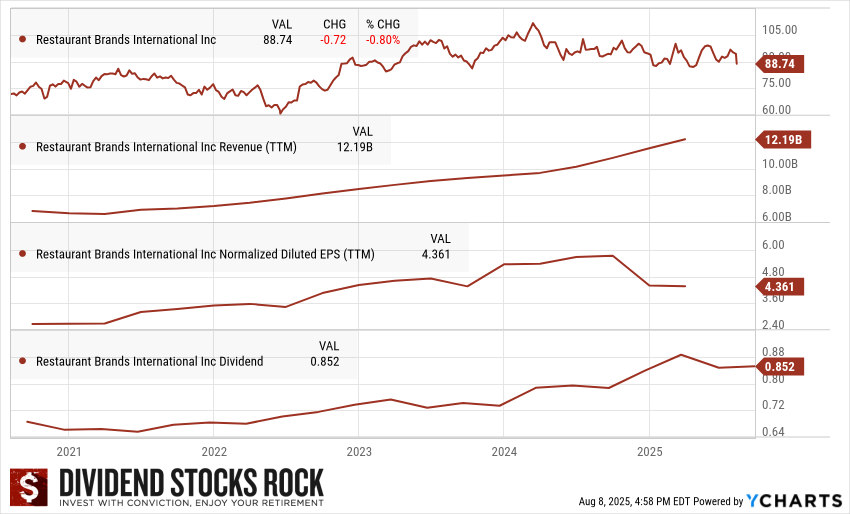

Looking at the Dividend Triangle—revenue, EPS, and dividend growth—Restaurant Brands International shows a consistent uptrend in the top line and dividends, but EPS volatility is a watch point.

-

Revenue has risen steadily to $12.19B over the past three years, fueled by expansion and acquisitions.

-

EPS has grown over time but faced a dip in 2025 due to cost pressures and integration expenses.

-

Dividend has increased consistently, now at $0.852 per quarter, showing management’s commitment to rewarding shareholders.

The dividend growth case here leans on long-term expansion and scale efficiencies rather than near-term earnings acceleration.

The Dividend Rock Stars List: The ONLY List Using the Dividend Triangle

The dividend triangle is an exclusive concept developed at Dividend Stocks Rock (DSR).

The dividend triangle is an exclusive concept developed at Dividend Stocks Rock (DSR).

While many seasoned investors use these metrics in their analysis, no one has created a list based on them before.

Don’t waste any more time with complex strategies and dozens of metrics duplicating each other: focus on quality and download the list with filters now.

Final Bite: A Brand Empire Built for the Long Term

Restaurant Brands International combines brand power, a scalable franchise model, and aggressive global expansion ambitions. While short-term headwinds—particularly in Burger King North America and from higher operating costs—are real, its multi-brand, multi-market portfolio offers resilience and multiple growth levers. For dividend growth investors, the appeal lies in a management team committed to steady dividend hikes, backed by a cash-generating model that doesn’t require heavy capital investment.