How is it possible that I keep talking about this store… but never shared a full, public analysis of it?

If you’ve followed me for a while, you already know I’m a big fan of this one. Some companies make headlines. Others make results. Couche-Tard (ATD.TO) does both. Whether it’s Circle K on a road trip or a late-night Couche-Tard pit stop, this company is everywhere — and still expanding.

Between fuel, snacks, coffee, and now EV charging, this business is evolving fast. It’s not a high-yielder, but it’s consistent, resilient, and cash flow rich. So yes — it’s about time we break it down properly.

Business Model: Fuel, Coffee, and Convenience at Global Scale

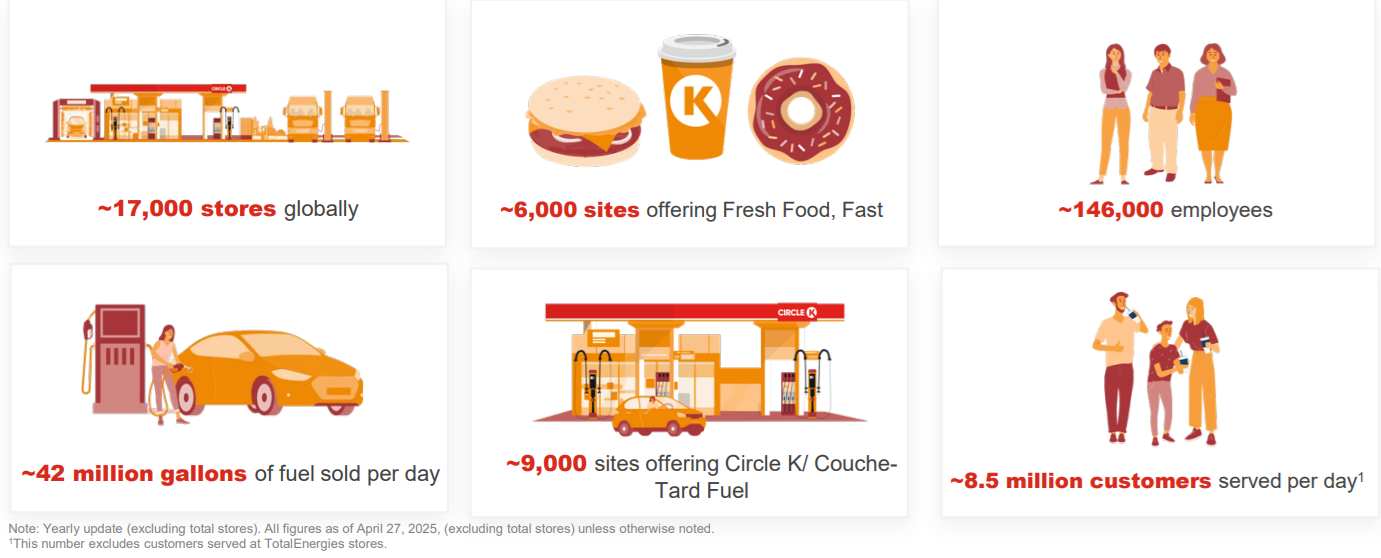

ATD is one of the largest convenience store operators in the world. With more than 17,000 stores across 29 countries, it operates primarily under the Couche-Tard and Circle K banners. Roughly 13,000 of those stores also sell road transportation fuel.

The company generates revenue from:

-

Fuel sales (still the most significant slice)

-

In-store merchandise (snacks, drinks, convenience goods)

-

Food service (prepared foods, coffee, fresh grab-and-go)

-

Service offerings like car washes, ATM fees, and mobile payment partnerships

Its North American operations are structured into 17 business units and it has deep market penetration in Canada, the U.S., and Northern Europe. The company is currently focused on strengthening its margins and customer experience through its 10 for the Win strategic plan, aiming to exceed $10 billion in EBITDA by 2028.

Investment Thesis: The Steady Compounder that Never Stops Moving

Couche-Tard is one of those businesses that feels boring… until you look at the numbers.

The company has built a long-term track record of revenue, EPS, and dividend growth through steady execution and smart acquisitions. It’s rare to find a company that consistently integrates new stores and finds ways to unlock margin — but ATD has done it for years.

While the market worries about declining fuel consumption and cigarette sales, Couche-Tard is already pivoting — expanding fresh food offerings, testing EV charging stations, and rolling out smart loyalty programs to drive in-store traffic.

Its scale advantage allows for pricing power, while its operational playbook enables new acquisitions to become accretive faster than most peers. The company generates serious free cash flow and operates with discipline — which is why it has quietly become one of the most efficient operators in retail.

It’s not immune to headwinds, but it adapts. And in a recession? This business gets even more interesting.

The Dividend Triangle in Action

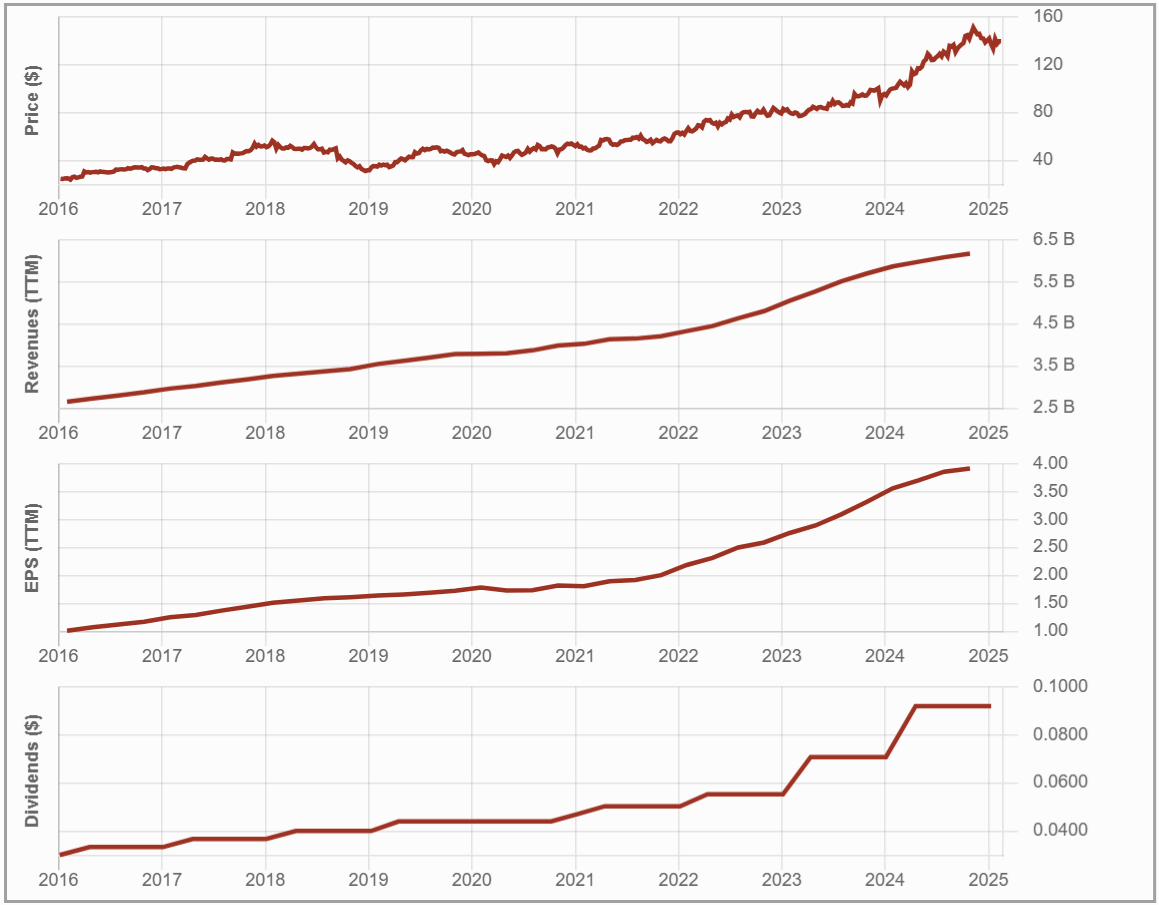

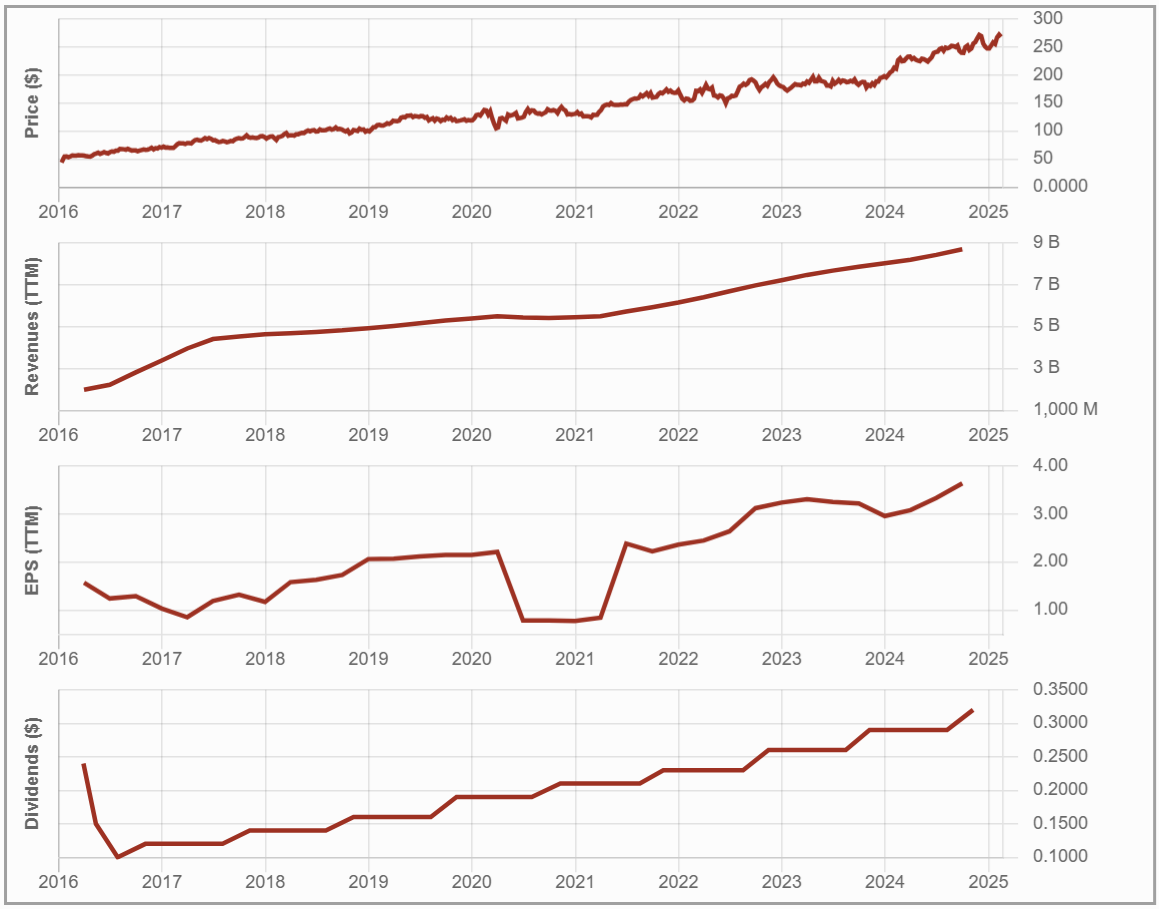

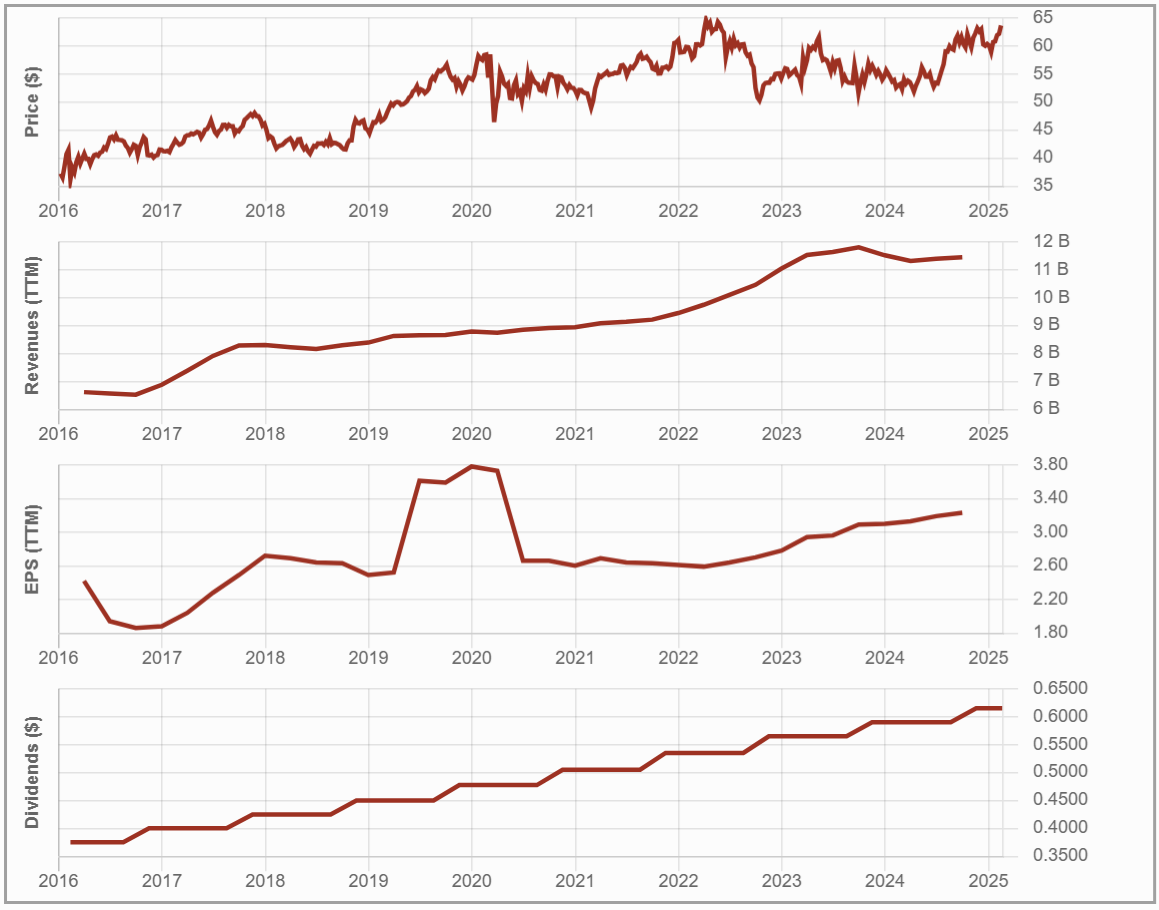

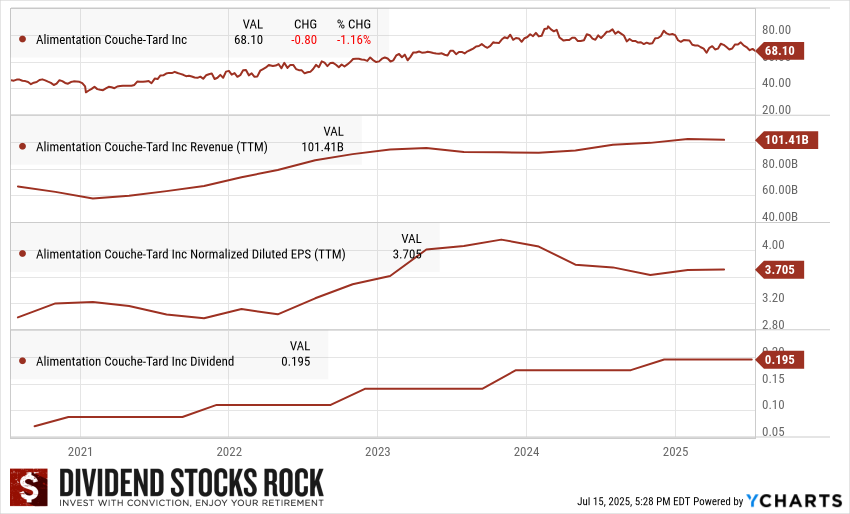

Let’s put Couche-Tard through the Dividend Triangle:

-

Revenue Growth: Over $100B in trailing twelve-month revenue, up from ~$85B just a few years ago. The business continues to expand both organically and through acquisitions.

-

EPS Growth: Normalized EPS is hovering near all-time highs ($3.70 TTM), showing the business continues to scale and manage costs effectively — even as fuel margins fluctuate.

-

Dividend Growth: Still a very low yield (under 0.3%), but the company has increased its dividend annually with a solid CAGR. Payout ratio remains extremely low (~5%), leaving plenty of room for future hikes.

This is a classic low-yield, high-growth name and fits the long-term compounding strategy like a glove.

Bull Case: Built to Scale, and Still Growing

Couche-Tard has proven over the decades that it can scale, integrate, and execute across borders. Its dominance in the convenience store space is the result of:

-

Smart, disciplined M&A

-

Margin expansion through cost synergies

-

Adapting to consumer trends (e.g., food, loyalty, digital)

It has the balance sheet and operational know-how to weather changing trends (EVs, tobacco decline) and shift its model accordingly. And with its 10 for the Win plan in place, management has a clear roadmap to create shareholder value.

Bear Case: Fuel Reliance & Acquisition Risk

Despite its strengths, Couche-Tard isn’t without risks:

-

Fuel remains a key profit driver — any long-term demand drop will pressure margins

-

Cigarette sales, a high-margin category, are in secular decline

-

The company’s reliance on acquisitions means missteps (like the failed Carrefour deal) could be costly

-

Food service expansion brings Couche-Tard into competition with grocery chains and QSRs — not easy battlegrounds

In short, execution must remain tight. This isn’t the time for acquisition blunders or weak integration.

Latest Results: A Slower Quarter(s), but Strategy Intact

Q1 FY2026 Earnings (June 26, 2025)

-

Revenue: Down 7.5% (fuel price/demand weakness)

-

EPS: Down 4.2%

-

Merchandise Revenue: Up 2.4% (led by Canada & Europe)

-

Operating Expenses: Up, due to strategic investments

-

Fuel Gross Margin: Improved, softening the impact of the revenue drop

-

M&A Activity: No update on the potential 7-Eleven acquisition

While the numbers were soft, the long-term thesis remains. The company is investing to reposition its business — and short-term pain may unlock future gain.

Final Word: Simple. Strong. Still Compounding.

Couche‑Tard just posted a softer quarter: revenue fell 7.5%, EPS dipped 4%, and growth in fuel sales took a breather. But dig deeper, and you’ll see why it still matters.

Merchandise and service revenue is growing. They’re investing intentionally — stepping up fresh food, EV charging, and loyalty tools. The business is evolving, not collapsing.

Look, I’m not here for flash. I’m here for resiliency, adaptability, and cash flow. And despite a bump in the road, Couche‑Tard remains all three. That’s exactly why I’m comfortable rolling the cash into this full position: it’s a compounder, even when it’s slow.

Remember to review all of your holdings quarterly, though.

Want a Step-by-Step Approach to Dividend Investing?

If you’re serious about building a portfolio of resilient, high-performing stocks like Couche-Tard, don’t wing it.

The DSR Investment Roadmap walks you through the exact process I use — from screening and analyzing stocks to managing positions over time.

✅ Ground rules templates to define your strategy and stock count

✅ Stock screener filters that actually work

✅ Sector-by-sector research tips so you don’t waste time

✅ Stock analysis breakdowns for consistent decision-making

✅ Position sizing guidelines to balance growth and risk

✅ Portfolio builder worksheet to test before you invest

Whether you’re starting from scratch or cleaning up a messy portfolio, this is the framework to help you build something strong, clear, and personalized.

👉 Download the free roadmap here » and take your first confident step today.

What if you could invest once and never worry again?

What if you could invest once and never worry again?