What if you could invest once and never worry again?

What if you could invest once and never worry again?

That’s the power of forever stocks—companies so strong and reliable that you can buy them, hold them for decades, and sleep soundly at night.

Let’s be clear, my selections aren’t based on timing; I’m not saying that they are great buys right now, but rather that I’d buy any of them and that, if I couldn’t monitor them quarterly as I do (and you should too), I wouldn’t worry much.

Forever stocks share several of these qualities:

- Diversification

- Forever stocks are companies that diversify to reduce risk by not relying solely on one market or product for revenue.

- Market leaders

- Forever stock companies often dominate their industry or market segment, enjoying a significant market share and strong competitive advantages.

- Economies of scale

- The average cost per unit decreases as a company produces more products or services.

- Predictable cash flow

- Being able to anticipate consistent and steady incoming cash over time reasonably is crucial for a company’s financial health and sustainability.

- Stable or sticky business model

- A stable business operates consistently and predictably; it found a formula for generating revenue and maintaining profitability.

- A sticky business, on the other hand, aims for customer loyalty and retention, and repeat business.

- Essential products or services

- Selling essentials—food, medical supplies, energy, communication services, transportation, etc.— produces relatively stable demand and revenue stream, as well as repeat business due to customer loyalty and resilience.

- Multiple growth vectors

- Growth vectors are paths to expand business, increase revenue, and enhance market presence.

- Long dividend growth history

- Yearly increases over decades mean the company ticks the boxes for many of the qualities described earlier.

This list is partial; clearly, other contenders could be on it. I have covered this part more in-depth on The Dividend Guy Blog.

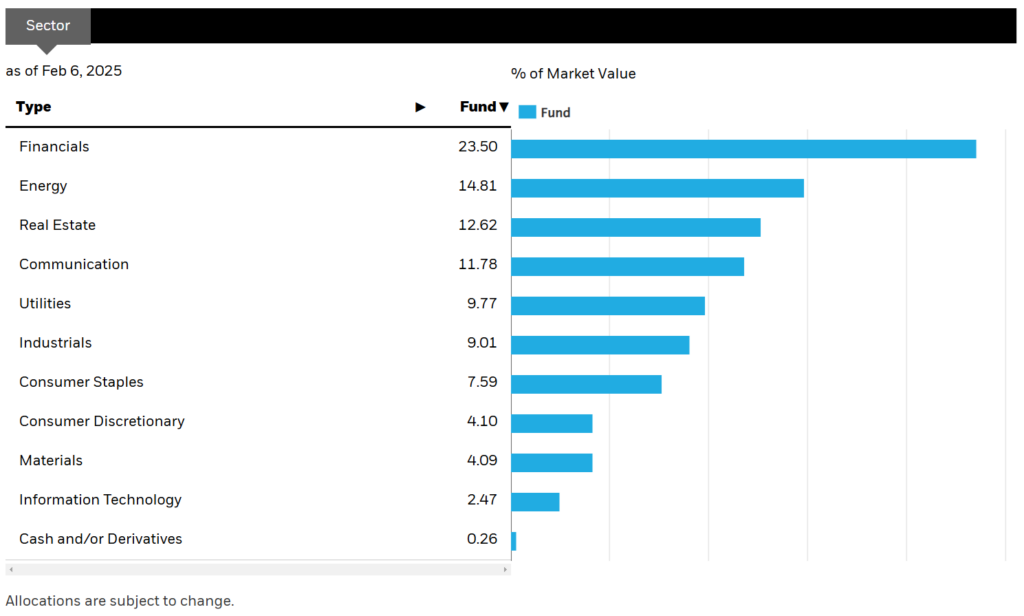

Brookfield Corporation (BN.TO) – Financials

Brookfield skyrocketed with more than 50% return in 2024. I think there is more to come!

Brookfield is amongst the most prominent players in alternative asset management. As the stock market looks overvalued, many investors will turn toward alternative assets to generate profits and hedge their bets. Those long-term assets require patient capital and a high level of expertise. Brookfield is in a perfect position to provide this service to investors.

Even better, BN invests its capital in its many projects. Therefore, it can double-dip by charging a fee on managed capital and making capital gains when selling assets.

The ONLY List Using the Dividend Triangle

After this first example, you may wonder how I find such high-quality dividend stocks.

I handpick companies with a strong dividend triangle (revenue, earnings, and dividend growth trends) and make sure I understand their business model. While this may seem too simple, two decades of investing have shown me it is reliable.

While many seasoned investors also use these metrics in their analysis, no one has created a list based on them before. This is exactly why I created The Dividend Rock Stars List.

The Rock Stars List isn’t just about yield—it’s built using a multi-step screening process to ensure the highest-quality dividend stocks. You can read more about it or enter your name and email below to get the instant download in your mailbox.

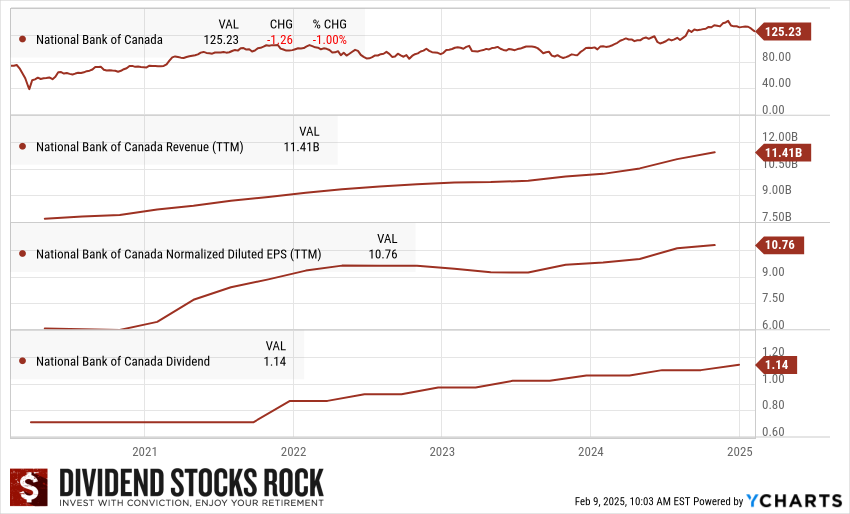

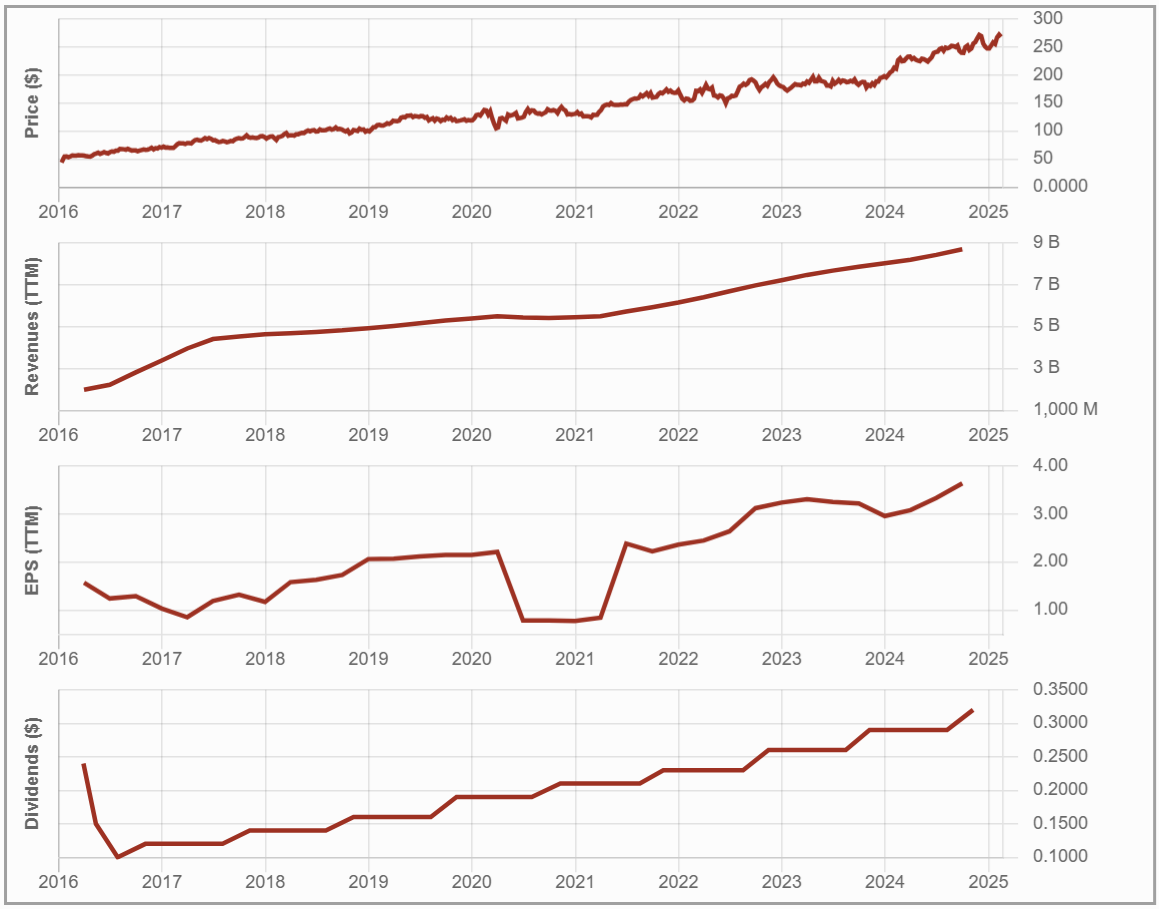

National Bank (NA.TO) – Financials

The bank seems to have done everything right over the past 15 years.

This significant transformation converted a small provincial bank into a serious player in capital markets and the private wealth industries.

The Bank is expected to complete a key acquisition of Canadian Western Bank in 2025, which will bring more capital onto its balance sheet (supporting capital market lucrative operations), more synergies (high cross-selling opportunities between CWB’s commercial clients and private wealth management), and a good presence in Western Canada.

NA is also doing very well in Cambodia (Aba Bank) and through its door into the U.S. (Credigy).

Note that National Bank (NA.TO) is also a Canadian Dividend Aristocrat.

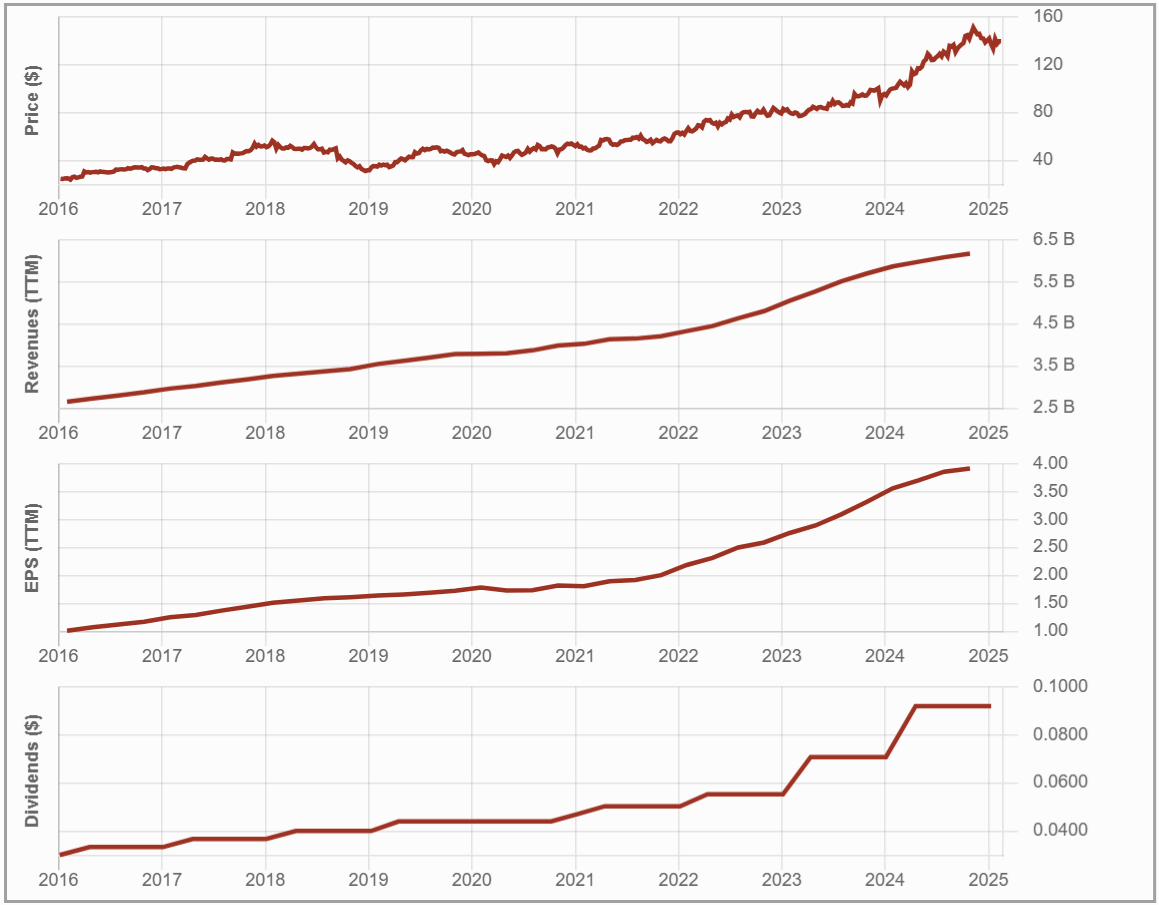

Dollarama (DOL.TO) – Consumer Discretionary

DOL has built a strong brand, and its business model (aimed at low-value items) is an excellent defensive play against the e-commerce threat over the retail business.

As consumers’ budgets are tight, DOL appears to be a fantastic alternative for many goods. Dollarama has consistently increased same-store sales and opened new stores.

Introducing many products under its “home brand” increases the company’s margin. DOL introduced a new price point of $5 for many items, adding flexibility and pricing power.

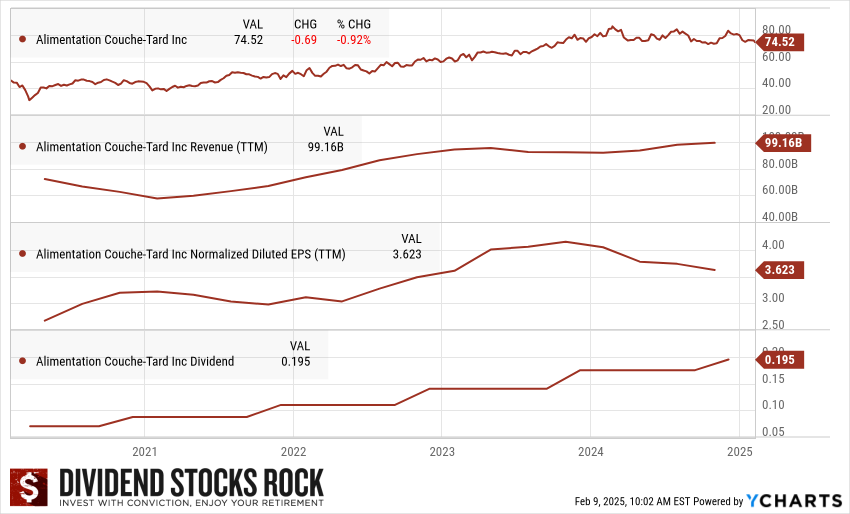

Alimentation Couche-Tard (ATD.TO) – Consumer Staples

I’ve looked at grocery stores, but they don’t seem to offer many growth opportunities. Don’t get me wrong, they are great companies, but I think ATD will do better.

Things are changing quickly around the 7-Eleven deal. ATD has tried to get to the negotiation table to acquire 7-Eleven for a few months. The Japanese company is trying all means to stay Japanese. The latest chatter was that the son’s founder would repurchase it and make it private. The market liked the idea, and the ATD share price rose again. This story isn’t over yet, one way or another.

For 2025, I see ATD striking another acquisition.

After all, it’s in its DNA. If it’s not 7-Eleven, it will be another chain (maybe Casey’s?… it tried to acquire CASY in 2010). ATD must gain more expertise in growing organically through the sale of ready-to-eat and fresh produce. This is how they can mitigate the impact of slowing fuel and tobacco sales over the next 10-20 years.

Alimentation Couche-Tard (ATD.TO) is another Canadian Dividend Aristocrat part of this list.

Canadian Natural Resources (CNQ.TO) – Energy

CNQ is a rare beast in its environment that has increased dividends for 25 consecutive years. Yes, it even increased its payouts while everybody was on hold or cutting distributions in 2020.

This raises the question: Why is CNQ “oil price resistant”?

The company is sitting on a large reserve of cheap oil. According to management, CNQ is profitable, with an oil price per barrel of around $35-$40. This enables the company to manage production and capex with greater flexibility. They can then slow down CAPEX when the oil price is low and produce less. When we are in “full oil bull mode”, CNQ bolsters CAPEX and boosts production generating maximum cash flow. This is precisely what just happened when CNQ dropped its debt and now focuses on rewarding shareholders with share buybacks and dividend increases.

To be clear, I don’t see CNQ as a super-powered growth stock for the future. However, with a yield above 4% and a resilient business model, that’s the type of business that will either be very good in your portfolio or will go back into hibernation mode, paying a secure dividend. In both scenarios, you can be a winner in the long run.

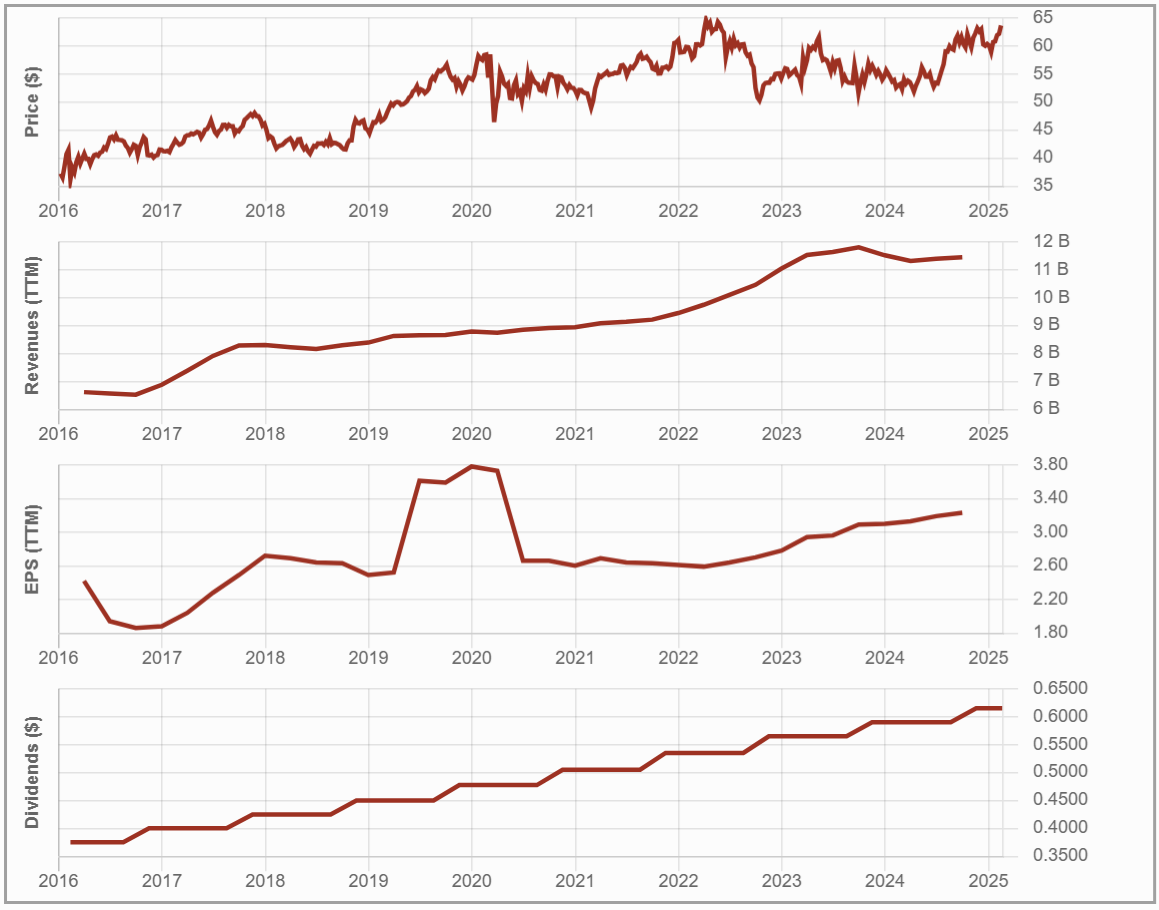

Waste Connections (WCN.TO) – Industrials

If you are looking for a beast in the industrial sector, you should probably look toward the waste management industry.

Waste Connections has refined its expertise in acquiring and integrating smaller players in the same industry. Its business model is recession-proof, as solid waste is a given regardless of the economic cycle.

I also like the fact that WCN offers a recurring service and is fully integrated. Management has been adept at integrating their acquired companies. Therefore, the business is not only growing but also becoming more profitable.

The company has the size to enjoy the resulting economies of scale. Its dividend payment is low, but its dividend growth is strong.

CCL Industries (CCL.B.TO) – Materials

Finding an international leader with a well-diversified business based in Canada is rare.

Through the significant acquisition of business units from Avery (the world’s largest supplier of labels) in 2013, the company has set the tone for several years of growth. Bolstered by its previous successes, CCL also bought Checkpoint, a leading developer of RF and RFID, and Innovia in the past few years and announced more acquisitions in 2021.

The company can still generate organic growth (roughly 4-5%) on top of its growth through acquisitions.

Granite (GRT.UN.TO) – Real Estate

Granite is a very frustrating REIT to hold.

I love the investment thesis, which includes the strong need for industrial properties, GRT’s ability to grow its business while growing FFO per unit and distribution increases intact, and the high occupancy rate. The financial metrics back this investment thesis, such as revenue, funds from operations, FFO per unit, payout ratio, and occupancy rate, all look good.

Why is GRT frustrating to hold?

Because it simply doesn’t get any love from the market. Despite its good numbers, GRT lags the market and fails to generate positive returns. This is among the rare REITs exhibiting AFFO per unit growth while issuing more units to finance growth.

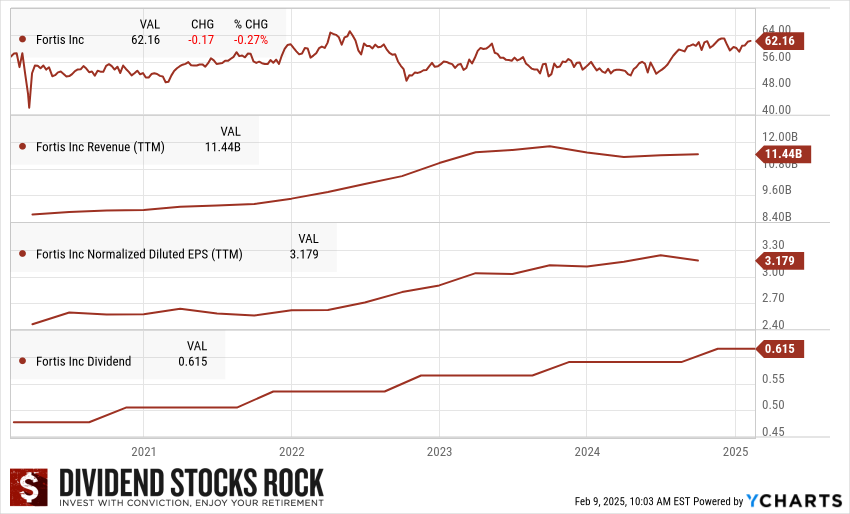

Fortis (FTS.TO) – Utilities

Fortis invested aggressively over the past few years, resulting in solid growth from its core business.

Investors can expect FTS’ revenues to grow as it expands. Bolstered by its Canadian-based businesses, the company has generated sustainable cash flows, leading to four decades of dividend payments.

The company’s five-year capital investment plan is approximately $25 billion between 2024 and 2028, $2.7 billion higher than the previous five-year plan. The increase is driven by organic growth, reflecting regional transmission projects for several business segments. Only 33% of its CAPEX plan will be financed through debt, while 61% will come from cash from operations. Chances are that most of its acquisitions will happen in the U.S.

We also like the company’s goal of increasing its exposure to renewable energy from 2% of its assets in 2019 to 7% in 2035.

Find Other Buy and Hold Forever Stocks: Download the Dividend Rock Stars List

This dividend stock list is updated monthly. You will receive the updated version every month by subscribing to our newsletter. You can download the list by entering your email below.

This isn’t just a list of high-yield stocks—it’s a handpicked selection of Canada’s best dividend growth stocks backed by detailed financial analysis.

✅ Monthly updates

✅ Full dividend safety ratings

✅ 10+ Metrics with filters

Enter your email to get the latest Canadian Dividend Rock Stars List now!