Most of the best Canadian stocks pay a dividend. Known for their stability when markets are rough, they also provide income to investors quarterly. Companies in sectors such as utilities, REITs, and banks can protect you against market fluctuations and severe losses.

Yet, not all dividend-paying companies are good investments. Investing in dividend stocks can lead to painful losses and income cuts. The risk of falling for dividend traps or seeing your retirement income plummet due to the wrong stock selection is too frequent.

The market creates bubbles and hurts your portfolio. You worked hard to invest money, and you shouldn’t lose it to the wolves of Bay Street. There is a way you can invest safely in Canadian dividend stocks. We have selected some high-quality stocks to make your life easier.

Best Canadian Dividend Stocks for 2025

When I built my retirement portfolio, I focused on companies showing a combination of safe income and steady growth. My choices include Canadian Dividend Aristocrats (companies showing several years of consecutive dividend increases). I added a few more metrics and used the DSR stock screener to refine my research.

Here are some of the best Canadian Dividend Stocks for 2025:

#6 Canadian Natural Resources (CNQ.TO)

#3 Brookfield Renewables (BEPC.TO)

#1 Alimentation Couche-Tard (ATD.TO)

More Stock Ideas and Sectors’ Insights

Unlock More Dividend Growth Picks

If you want more hand-picked dividend growers across industries, grab our Dividend Rock Star List.

If you want more hand-picked dividend growers across industries, grab our Dividend Rock Star List.

It features around 300 stocks with complete Dividend Safety Scores, growth projections, and buy lists tailored for retirement portfolios.

Most importantly, it is the ONLY list using the Dividend Triangle as its foundation.

#10 Telus (T.TO)

About a year ago, Telus was upgraded to a PRO rating of 5. I thought the company would bounce back faster, but it wasn’t the case. My long-term view of Telus hasn’t changed, though.

While the company reported modest revenue growth throughout the year, its cash flow metrics (cash flow from operations, free cash flow and capital expenditure) have improved significantly. The company is covering their dividend from free cash flow and interest charges are under control.

It took longer than expected, but I believe Telus will get out of this rut and make investors happy. It’s only a matter of time.

#9 Granite REIT (GRT.UN.TO)

Granite is a very frustrating REIT to hold. I love the investment thesis which includes the strong need for industrial properties, GRT’s ability to grow its business while growing FFO per unit and distribution increases intact and the high occupancy rate. The financial metrics back this investment thesis as revenue, Funds from operations, FFO per units, payout ratio and occupancy rate are all looking good. Why is GRT frustrating to hold? Because it simply doesn’t get any love from the market. Despite its good numbers, GRT lags the market and fails to generate positive returns.

With a low FFO payout ratio (68% for the first 9 months of 2024), shareholders can enjoy a 4.5% yield that should grow and match (or beat) the inflation rate. This is among the rare REITs exhibiting AFFO per unit growth while issuing more units to finance growth.

#8 Hydro One (H.TO)

From time to time, I hear that Hydro-Quebec should go public and unlock tons of value. However, I understand the government’s provincial point of view of keeping this amazing asset for themselves. Do you know why? Because Hydro-Quebec pays a generous dividend to the government each year!

Well, Hydro One is in a similar situation but you have the possibility of getting a piece of the cake as the Ontario Government decided to sell a part of its stake in this beauty. With 99% of its operations being regulated and 98% of its electric lines being in Ontario, an investment in Hydro One is a pure play on Ontario’s power development. This is the pure definition of a sleep-well-at-night investment. The company expects to invest $1.3B to $1.6B in CAPEX yearly until 2027 which will support their EPS growth guidance of 4-7% and dividend growth of about 5%. The province enjoys a strong and diversified economy and Hydro One will continue to grow by walking in the province’s path.

#7 Dollarama (DOL.TO)

I’m kicking myself for not having Dollarama in my portfolio. Maybe in another life!

DOL has built a strong brand, and its business model (aimed at low-value items) is an excellent defensive play against the e-commerce threat over the retail business. As consumers’ budgets are tight, DOL appears to be an amazing alternative for many goods. Dollarama has been able to increase same store sales along with opening new stores consistently. The introduction of many products under its “home brand” increases the company’s margin. DOL introduced a new price point of $5 for many items, which lends additional flexibility and pricing power.

#6 Canadian Natural Resources (CNQ.TO)

CNQ is a rare beast in its environment that has increased dividends for 25 consecutive years. Yes, it even increased its payouts while everybody was on hold or cutting distributions in 2020. It brings the question: why is CNQ “oil price resistant”?

The company is sitting on a large reserve of cheap oil. According to management, CNQ is profitable with an oil price per barrel of around $35-$40. This enables the company to manage production and capex with greater flexibility. They can then slowdown CAPEX when the oil price is low and produce less. When we are in “full oil bull mode”, CNQ bolsters CAPEX and boosts production generating maximum cash flow. This is exactly what just happened where CNQ dropped its debt and now focuses on rewarding shareholders with share buybacks and dividend increases.

To be clear, I don’t see CNQ as a super powered growth stock for the future. However, with a yield above 4% and a resilient business model, that’s the type of business that will either be very good in your portfolio, or it will go back into hibernation mode paying a secure dividend. In both scenarios, you can be a winner over the long run.

#5 CCL Industries (CCL.B.TO)

Finding an international leader with a well-diversified business based in Canada is rare. Through the major acquisition of business units from Avery (world’s largest supplier of labels) in 2013, the company has set the tone for several years of growth. Bolstered by its previous successes, CCL also bought Checkpoint, a leading developer of RF and RFID, and Innovia in the past few years and announced more acquisitions in 2021. The company is still able to generate organic growth (roughly 4-5%) on top of its growth through acquisitions.

#4 Brookfield Corporation (BN.TO)

I’m keeping BN among my top picks for a third year in a row. The 2024 selection paid off as Brookfield skyrocketed with more than 50% return. I think there is much more to come! Brookfield is amongst the largest players in alternative asset management. As the stock market looks overvalued, many investors will turn toward alternative assets as a way to generate profits and hedge their bets. Those long-term assets require patient capital and a high level of expertise. Brookfield is in a perfect position to provide this service to investors. Even better, BN invests its own capital in many projects. Therefore, it can double-dip by charging a fee on managed capital and making capital gains when selling assets.

#3 Brookfield Renewables (BEPC.TO)

BEP enjoys large-scale capital resources and has the expertise to manage its projects across the world. Management aims for a 5-9% annual distribution increase, backed by double-digit guidance that includes a mix of organic and M&A growth. Investors gravitate toward clean energy, and BEP is well-positioned to attract them.

Following an impressive stock price surge through 2020, the stock has been trending down for the past two years, although there is nothing to worry about. The rise of interest rates on bonds combined with the incredible ride BEP has had is responsible for this correction. In late 2023, management reaffirmed its strong position and ability to generate strong returns over the long haul. The latest results in early 2024 confirmed that BEP is still focused on growth opportunities. In Q2 of 2024, management highlighted the important contract signed with Microsoft to supply 10.5GW to support MSFT’s AI and cloud business energy needs. This could open the doors to more deals with corporations in the future.

#2 National Bank (NA.TO)

There is no secret here as I’m a National Bank fan. It seems that the bank has done everything right over the past 15 years. This big transformation converted a small provincial bank into a serious player in capital markets and the private wealth industries. The Bank is expected to complete a key acquisition of Canadian Western Bank in 2025 which will bring more capital onto its balance sheet (supporting capital market lucrative operations), more synergies (high cross-selling opportunities between CWB’s commercial clients and private wealth management) and a good presence in Western Canada. NA is also doing very well in Cambodia (Aba Bank) and through its door into the U.S. (Credigy).

#1 Alimentation Couche-Tard (ATD.TO)

I might never have another choice for Canadian than Couche-Tard. I’ve looked at grocery stores, but Metro (MRU.TO) and Loblaws (L.TO) don’t offer many growth opportunities. Don’t get me wrong, they are great companies, but I think ATD will do better.

Things are changing quickly around the 7-Eleven deal. ATD has tried to get to the negotiation table to acquire 7-Eleven for a few months now. The Japanese company is trying all means to stay Japanese. The latest chatter was that the son’s founder would buy it back and make it private. The market liked the idea, and the ATD share price rose again. This story isn’t over yet one way or another.

For 2025, I see ATD striking another acquisition. After all, it’s in its DNA. If it’s not 7-Eleven, it will be another chain (maybe Casey’s?… it tried to acquire CASY in 2010). ATD must gain more expertise in growing organically through the sale of read-to-eat and fresh produce. This is how they can mitigate the impact of slowing fuel and tobacco sales over the next 10-20 years.

Unlock More Dividend Growth Picks

If you want more hand-picked dividend growers across industries, grab our Dividend Rock Star List.

If you want more hand-picked dividend growers across industries, grab our Dividend Rock Star List.

It features around 300 stocks with complete Dividend Safety Scores, growth projections, and buy lists tailored for retirement portfolios.

Most importantly, it is the ONLY list using the Dividend Triangle as its foundation.

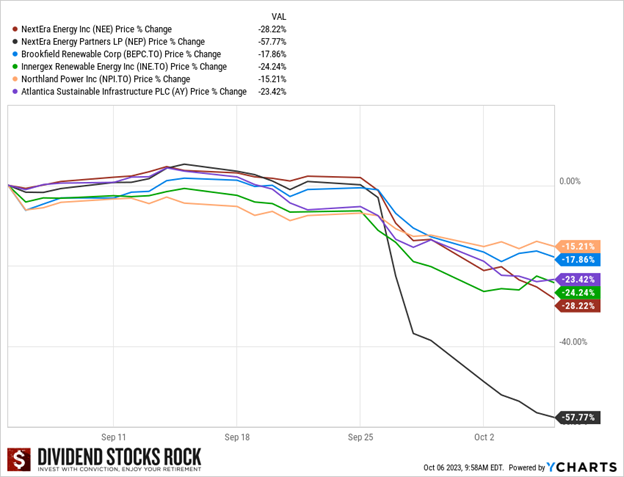

Look for investors’ presentations and quarterly earnings reports on the company website. Doing that reveals that another renewable, Brookfield Renewable (BEPC/BEPC.TO), hosted its investors day in September. Contrary to NEP, BEPC reaffirmed its growth expectations and distribution growth targets…business as usual for BEPC.

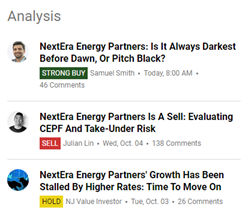

Look for investors’ presentations and quarterly earnings reports on the company website. Doing that reveals that another renewable, Brookfield Renewable (BEPC/BEPC.TO), hosted its investors day in September. Contrary to NEP, BEPC reaffirmed its growth expectations and distribution growth targets…business as usual for BEPC. First, ignore the noise, or you’ll get lost in a myriad of conflicting information. Here are three articles on Seeking Alpha for October 6 (Strong Buy, Sell, and Hold ratings).

First, ignore the noise, or you’ll get lost in a myriad of conflicting information. Here are three articles on Seeking Alpha for October 6 (Strong Buy, Sell, and Hold ratings).