The transportation sector is notoriously cyclical, but some businesses learn to make volatility work in their favor. This is one of the rare freight operators that consistently comes out of downturns stronger than it went in. It expands when others retreat, improves margins when competitors are scrambling, and uses every cycle—good or bad—to upgrade its network and strengthen its long-term positioning.

For dividend investors willing to stomach short-term turbulence, this is one of the most compelling ways to gain exposure to North American logistics. It’s not smooth, and it’s not gentle—but over a full market cycle, the results tend to reward those who stay on board.

How the Business Works

TFI International (TFII.TO) operates across three major segments:

- Less-Than-Truckload (LTL) — Pickup, consolidation, and delivery of small shipments.

- Truckload (TL) — Full-load direct transport using vans, flatbeds, tank containers, and dedicated fleets.

- Logistics — Asset-light brokerage, freight forwarding, and transportation management.

The company runs an extensive network across Canada, the U.S., and Mexico, serving industrial, retail, construction, and e-commerce customers. TFI uses a hybrid model—owning assets where it provides an advantage and keeping things asset-light in brokerage and logistics—to maintain flexibility during economic swings.

The Investment Thesis: Built to Scale, Built to Survive

TFI International has proven itself as one of the most disciplined operators in North American transportation. Over 70% of revenue now comes from the U.S., giving the company exposure to the largest trucking market in the world and to industries like manufacturing, construction, and e-commerce.

TFI’s strength lies in acquisition mastery. The 2021 purchase of UPS Freight was transformational—TFI cut operational waste, improved pricing discipline, and significantly expanded margins. The more recent acquisition of Daseke strengthened its presence in flatbed trucking, a segment tightly linked to industrial and infrastructure activity.

TFI’s network density, cost discipline, and ability to pivot during downturns give it a durable competitive advantage. Even though trucking is cyclical, TFI continuously emerges stronger from each downturn—a rare quality in the transportation sector.

Bull Case Summary

- A North American Leader With Real Scale

TFI has grown into one of the largest trucking operators on the continent, with a deep footprint in Canada and the U.S. The company benefits from diversified end markets and a broad customer base, which helps soften the impact of industry cycles.

2. Acquisition Machine With a Proven Playbook

TFI’s greatest strength is its ability to take underperforming assets, streamline operations, and expand margins. The successful absorption of UPS Freight, and now Daseke, demonstrates that the company knows exactly how to extract value.

3. Margin Expansion Through Efficiency

Cost-cutting, fleet optimization, and asset-light operations in logistics allow TFI to maintain strong profitability even when freight volumes weaken. When markets recover, the margin leverage becomes even more compelling.

The Bear Case: Volatility Comes With the Territory

While TFI is a long-term winner, investors must be prepared for sharp short-term swings, especially during freight recessions.

The trucking industry is heavily tied to economic activity, and TFI’s results reflect that cyclicality. Higher fuel costs, labor shortages, and freight downturns can all pressure margins. The company’s rapid acquisition pace also creates integration risk—missteps could hurt returns.

In tougher quarters, TFI’s stock often reacts aggressively. When earnings disappoint, double-digit declines are not unusual. Investors need a strong stomach to stay the course.

- Highly Cyclical and Volatile

TFI is sensitive to industrial production, retail demand, and freight rates. When the economy slows, volumes fall quickly—and so does the stock price.

- Cost Pressures and Regulatory Risks

Fuel price spikes, driver shortages, and regulatory changes across North America can challenge profitability. Cross-border operations also add tariff and policy uncertainty.

- Acquisition-Driven Growth Can Create Integration Risk

TFI’s strategy requires constant deal-making. If the company overpays or struggles to integrate a major asset, it could disrupt margins and cash flow.

Latest News: Freight Recession Still Hitting Hard

TFI International delivered another difficult quarter as industry weakness continues.

Q3 Highlights:

- Revenue: down 10%

- EPS: down 24%

- LTL revenue: $687M (-11%)

- TL revenue: $684.1M (-7%)

- Logistics revenue: $367.8M (-14%)

- Margin pressure across all segments

Management expects Q4 EPS of $0.80–$0.90, citing lower truck-manufacturer deliveries and ongoing freight softness.

TFI remains focused on cost discipline, customer retention, and preparing for the next upcycle.

The Dividend Triangle in Action: Reliable — but Not Perfect

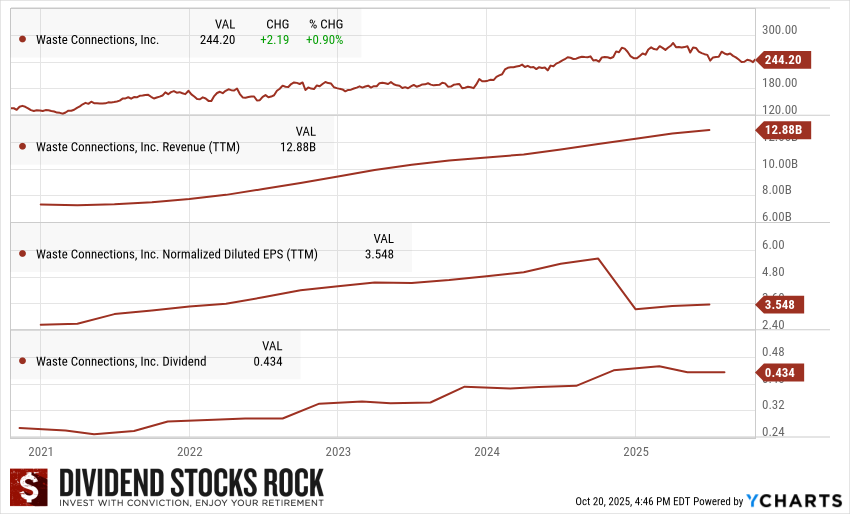

Revenue:

TFI’s revenue has grown meaningfully over the past five years, although it moves in cycles, reflecting the ebb and flow of North American freight demand.

Earnings per Share:

EPS has been more volatile than revenue, but over a full economic cycle it trends upward thanks to strong cost discipline, smart acquisitions, and margin improvements during recovery periods.

Dividend:

The dividend continues to climb steadily, supported by healthy free cash flow generation and a payout ratio that gives management room to keep raising the distribution even during slower freight years.

TFI is not a classic smooth dividend grower, but it is a high-performing compounder over time.

The ONLY List Using the Dividend Triangle

You may wonder how I find such high-quality dividend stocks.

I handpick companies with a strong dividend triangle (revenue, earnings, and dividend growth trends) and make sure I understand their business model. While this may seem too simple, two decades of investing have shown me it is reliable.

While many seasoned investors also use these metrics in their analysis, no one has created a list based on them before. This is exactly why I created The Dividend Rock Stars List.

The Rock Stars List isn’t just about yield—it’s built using a multi-step screening process to ensure the highest-quality dividend stocks. You can read more about it or enter your name and email below to get the instant download in your mailbox.