Waste might not be glamorous, but it’s one of the most reliable businesses out there. In good times or bad, people still generate garbage — and someone has to collect it. That simple reality has made the waste management industry a quietly powerful source of recurring revenue and growing dividends. Among the sector’s leaders, one company stands out for its disciplined growth, smart acquisitions, and focus on steady returns.

A Fortress Built from Waste

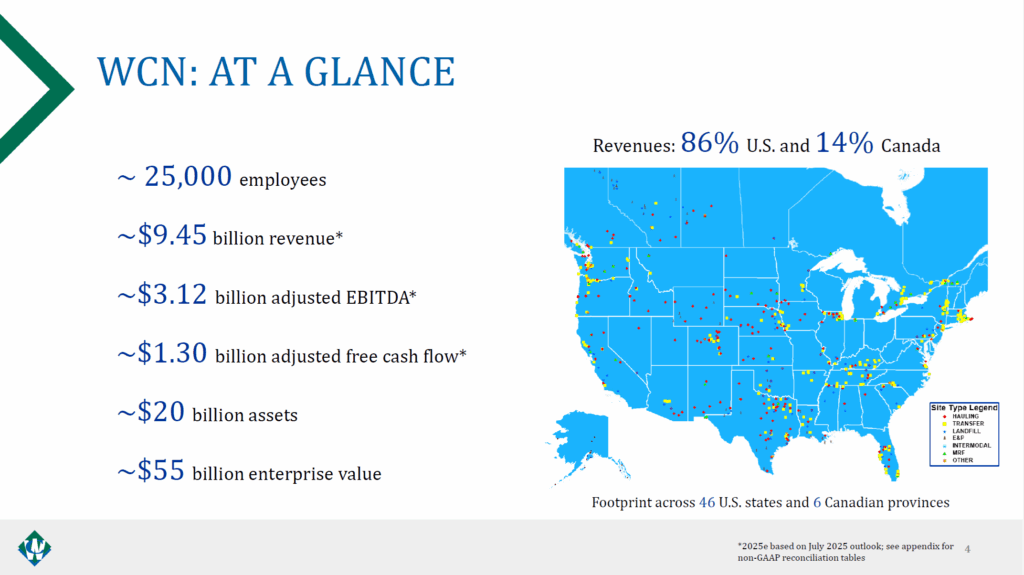

Waste Connections (WCN.TO) operates a vast network of landfills, transfer stations, and collection routes across the U.S. and Canada, serving roughly nine million residential, commercial, and industrial customers. It collects, transports, and disposes of non-hazardous solid waste while also managing recycling and renewable fuel recovery programs.

What makes the company unique is where it operates — primarily in secondary and rural markets. These regions face less competition and lower regulatory friction than dense urban areas, allowing for superior pricing flexibility and stronger margins.

Its integrated model — from curbside pickup to landfill disposal — provides both efficiency and pricing control. Add to that long-term municipal and industrial contracts, and you get a business that hums along through economic ups and downs.

Investment Thesis: Built to Withstand the Cycle

Bull Case — Consistency You Can Count On

This is the kind of company dividend investors love: predictable, cash-generative, and built to last. Waste Connections benefits from steady demand, high switching costs, and barriers to entry that few industries can match.

Playbook:

The company generates most of its revenue from recurring waste collection and disposal services. Its strategy is to expand organically while acquiring smaller operators, integrating them into its efficient network. By controlling every step of the waste stream, it captures value others miss — from landfill tipping fees to recycling recovery.

Growth Vectors:

- Acquisitions remain the backbone of growth. The purchase of Secure Energy Services’ Canadian disposal assets boosted both revenue and margin potential.

- Core pricing power is another strength — solid waste pricing rose 6.6% year-over-year in the latest quarter.

- Recycling and environmental services are emerging growth levers as the company expands into renewable fuels and materials recovery.

- Strong cash generation supports continued investment and dividend increases, with adjusted free cash flow projected near $1.3 billion this year.

Economic Moat:

The moat here is real and durable. Landfill scarcity and regulatory hurdles make it extremely difficult for new competitors to enter. Once contracts and routes are established, customer churn is minimal. Waste Connections can raise prices above inflation without losing volume — a rare feat in any industry.

Bear Case — Even Strong Businesses Have Limits

Despite its resilience, this isn’t a risk-free story. The waste management sector carries its own operational and environmental challenges.

Business Vulnerabilities:

The company’s acquisition-heavy model demands constant integration. As industry consolidation continues, finding attractively priced targets will get tougher. Rising labor and equipment costs could also erode margin gains over time.

Industry & Market Threats:

- Recycling volatility remains a headwind — commodity price swings can cause sharp revenue fluctuations.

- Regulatory pressure is increasing, particularly as cities push for reduced landfill usage.

- A slowdown in commercial and industrial activity could weigh on waste volumes if the economy softens.

Competitive Landscape:

While the company enjoys a strong position in smaller markets, larger peers like Waste Management (WM) and Republic Services (RSG) dominate urban centers and are expanding their sustainability initiatives. If governments tighten environmental standards or encourage municipal recycling, the competitive gap could narrow.

The ONLY List Using the Dividend Triangle

You may wonder how I find such high-quality dividend stocks.

I handpick companies with a strong dividend triangle (revenue, earnings, and dividend growth trends) and make sure I understand their business model. While this may seem too simple, two decades of investing have shown me it is reliable.

While many seasoned investors also use these metrics in their analysis, no one has created a list based on them before. This is exactly why I created The Dividend Rock Stars List.

The Rock Stars List isn’t just about yield—it’s built using a multi-step screening process to ensure the highest-quality dividend stocks. You can read more about it or enter your name and email below to get the instant download in your mailbox.

Latest News — Another Quarter of Steady Gains

August 8, 2025: The company reported another solid performance, with revenue up 7% and EPS up 4.7%. Core pricing in solid waste services increased 6.6%, leading to roughly 70 basis points of margin expansion.

Management reaffirmed full-year 2025 guidance:

- Revenue: ~$9.45 billion

- Adjusted EBITDA: ~$3.12 billion (≈33% margin)

- Adjusted Free Cash Flow: ~$1.30 billion

- CapEx: $1.2–$1.25 billion

Those numbers highlight the beauty of the model — dependable growth, disciplined spending, and resilient profitability even amid inflation and volatile commodity trends.

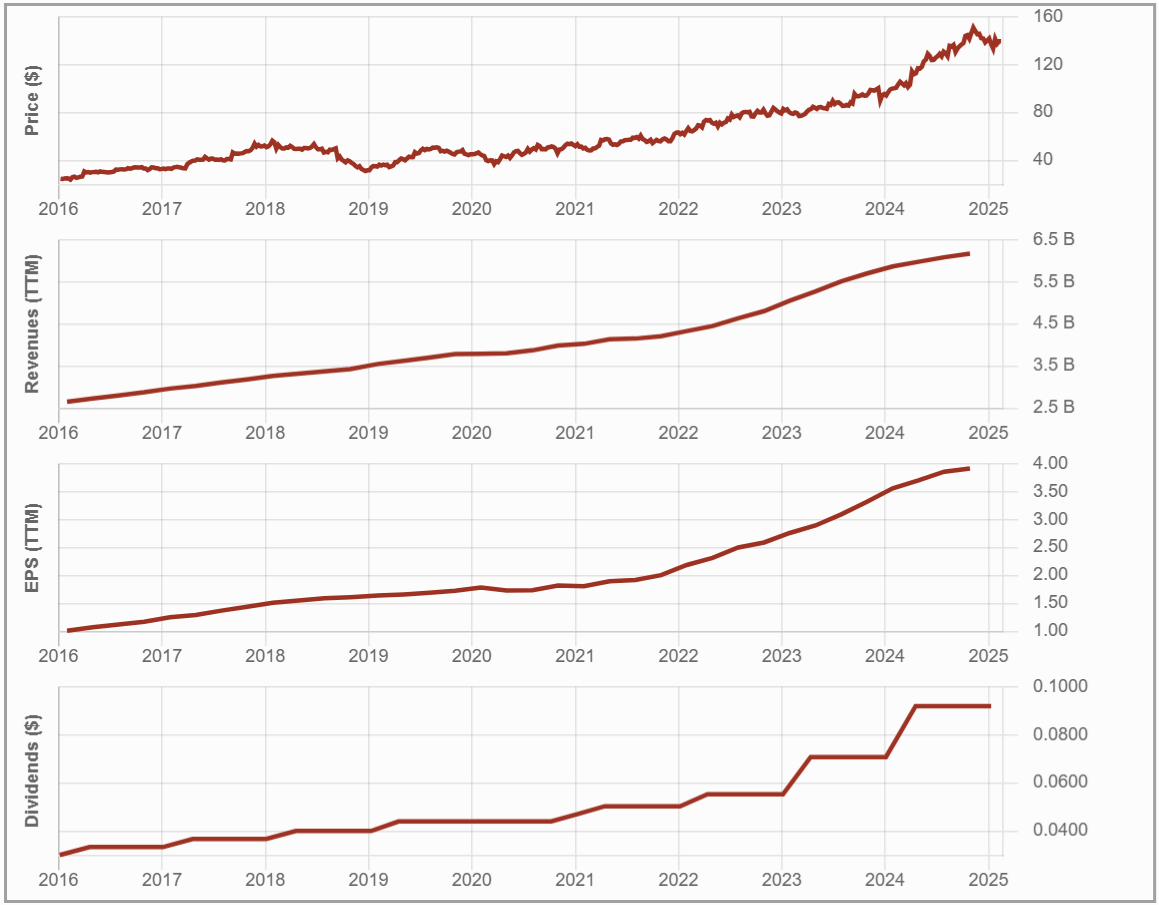

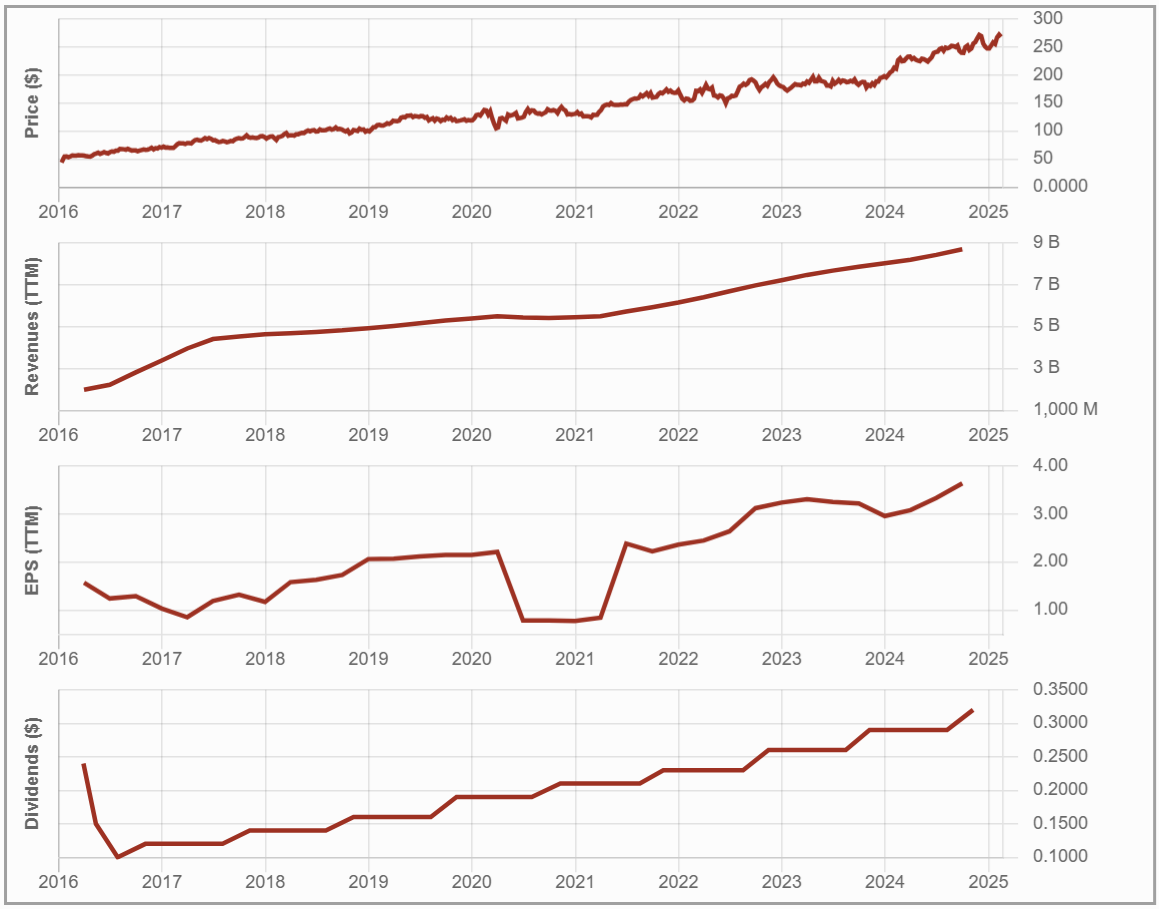

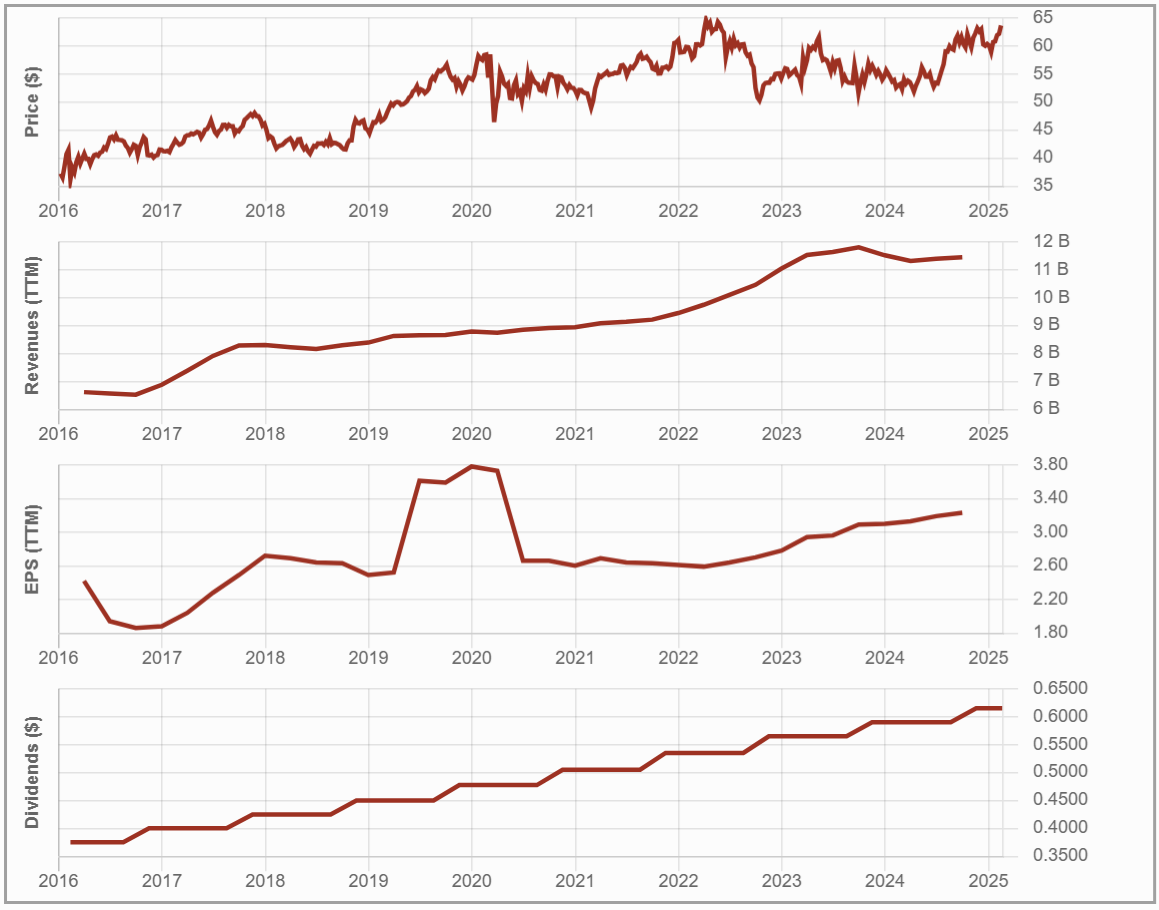

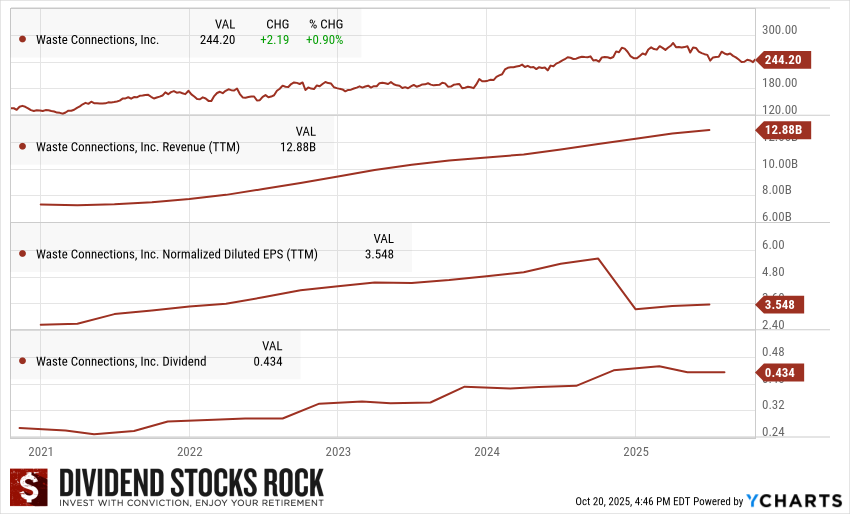

The Dividend Triangle in Motion

Waste Connections may not boast the highest yield, but it’s a classic dividend grower. Its consistent pricing gains and cash flow discipline translate into sustainable, long-term dividend growth.

- Revenue: $12.9 billion (TTM), rising steadily year after year.

- Earnings per Share (EPS): $3.55 TTM, rebounding from recent acquisition-related costs.

- Dividend: $0.434 per share, continuing its climb with a payout ratio comfortably below 25%.

The company’s dividend may look modest, but its growth record is strong, with double-digit hikes common in recent years. Investors can expect more of the same as earnings and cash flow expand.

Final Take — The Steady Hand in a Messy World

In an unpredictable market, it’s refreshing to find a company where performance isn’t tied to consumer confidence or economic cycles. Waste Connections turns necessity into opportunity, combining a recession-resistant business with disciplined management and reliable dividend growth.

Its focus on smaller markets, strong pricing power, and steady free cash flow give it a long runway for shareholder returns. This isn’t a flashy story — it’s a dependable one. And sometimes, that’s exactly what a dividend growth portfolio needs.

Find Other Buy and Hold Forever Stocks: Download the Dividend Rock Stars List

This dividend stock list is updated monthly. You will receive the updated version every month by subscribing to our newsletter. You can download the list by entering your email below.

This isn’t just a list of high-yield stocks—it’s a handpicked selection of Canada’s best dividend growth stocks backed by detailed financial analysis.

- Monthly updates

- Full dividend safety ratings

- 10+ Metrics with filters

Enter your email to get the latest Canadian Dividend Rock Stars List now!

What if you could invest once and never worry again?

What if you could invest once and never worry again?