Investors often overlook smaller software firms because they lack the scale of global tech giants. Yet, some carve out profitable niches by focusing on where complexity and mission-critical operations create durable client relationships. That’s exactly the case here: a Canadian software provider turning supply chain headaches into sticky, recurring revenue streams.

A Software Specialist with Global Reach

Tecsys Inc. (TCS.TO) is a Canadian small-cap software company that develops and markets enterprise-wide supply chain management solutions. Its offerings cover warehouse management, transportation logistics, point-of-use distribution, and order management.

The company’s solutions are delivered through its Elite Enterprise, Elite Healthcare, Omni Retail, and Streamline platforms, supported by its Itopia infrastructure. Tecsys also provides consulting, training, cloud services, and customer support.

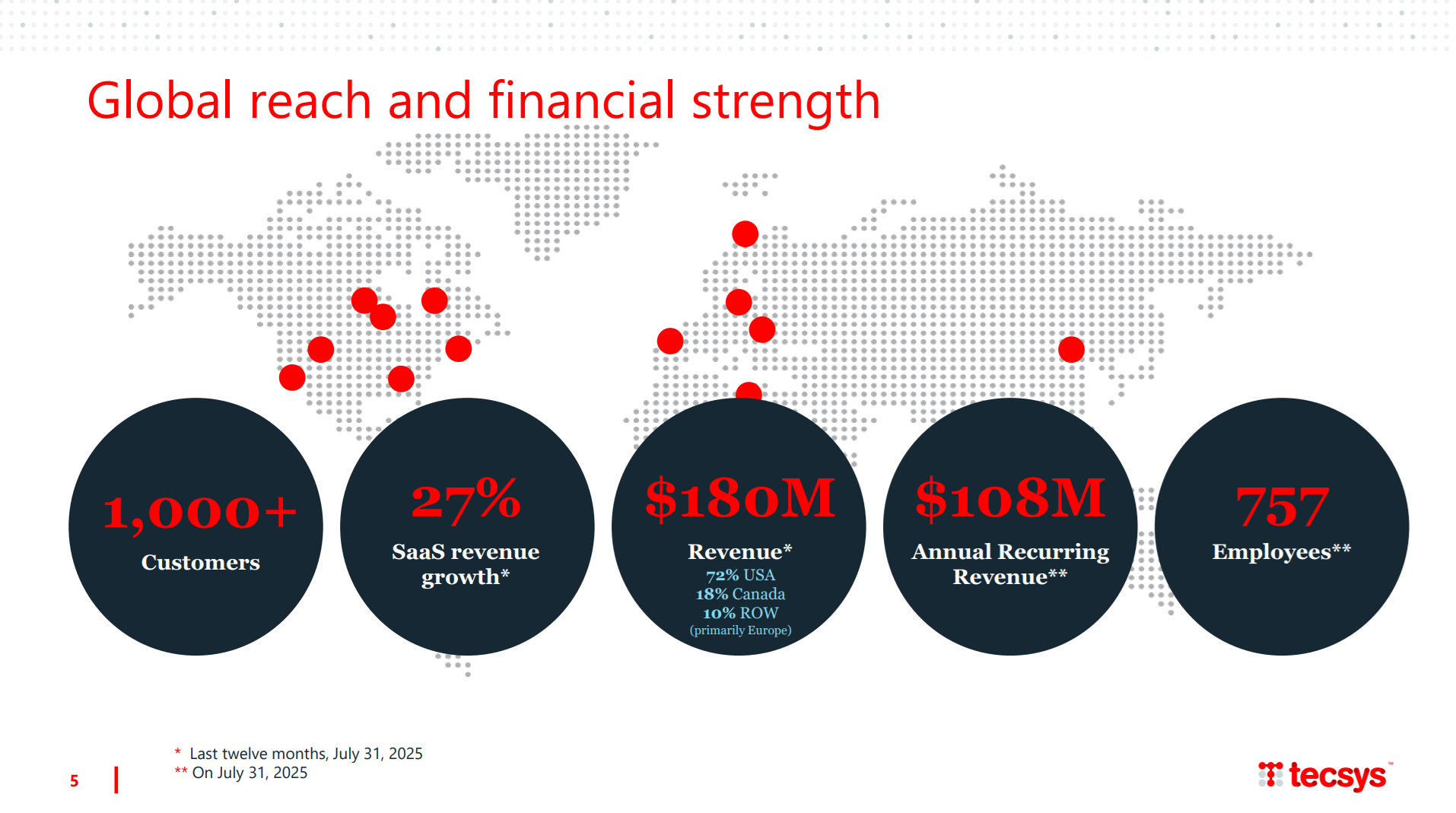

With more than 1,000 clients worldwide, Tecsys has built particular strength in healthcare, retail, and distribution verticals—industries where managing complexity can’t be left to generic systems. Over 50% of revenue now comes from recurring contracts, underscoring the resilience of its model.

Also, keep in mind that TCS revenues are generated in the U.S. (72%), Canada (18%), and the rest of the world (10%), primarily in Europe.

Why Investors Should Pay Attention

Bull Case – Growth Through Healthcare and SaaS

Tecsys operates in a lucrative niche. Its software helps hospitals, retail chains, and industrial firms manage complex distribution networks. These systems are mission-critical, making customer churn rare once the software is in place.

-

Recurring revenue strength: SaaS and maintenance now represent nearly 60% of total revenue, creating visibility for investors.

-

Healthcare pipeline: Healthcare remains the standout vertical, with a 20% YoY pipeline increase and multiple new Integrated Delivery Networks (IDNs) signed. Hospitals are notoriously sticky clients due to long implementation cycles.

-

SaaS migration: Cloud transitions are accelerating. Management expects SaaS revenue to grow by 30% in fiscal 2025, with total revenue climbing toward $196.7M by 2026.

-

Financial flexibility: Tecsys has no long-term debt and holds a net cash position of about $21M, giving it room to reinvest in growth or acquisitions.

This combination of recurring income, industry focus, and conservative balance sheet makes Tecsys an appealing small-cap growth play.

Bear Case – Small Fish in a Big Pond

As promising as the growth story is, Tecsys faces challenges tied to its size and market positioning.

-

Execution risk: With a small market cap, earnings and cash flow can swing quarter-to-quarter depending on project timing. EPS has been volatile, as the dividend triangle shows.

-

Expense pressures: Inflation and tight labor markets have increased compensation costs. Talent retention in particular is critical for keeping service delivery on track.

-

Competition: Global giants like Oracle and SAP bundle supply chain solutions into their enterprise packages, undercutting Tecsys on pricing. The company must keep innovating to defend its niche.

-

Macro exposure: While healthcare demand is resilient, clients in retail or industrial sectors may cut IT budgets during slowdowns, delaying or canceling projects.

In short, Tecsys must execute flawlessly and remain innovative to compete with larger players while preserving its small-company agility.

Unlock More Dividend Growth Picks

Tecsys is just one example of a company quietly laying the groundwork for growth and steady shareholder returns. If you want more hand-picked dividend growers across industries, grab our Dividend Rock Star List.

Tecsys is just one example of a company quietly laying the groundwork for growth and steady shareholder returns. If you want more hand-picked dividend growers across industries, grab our Dividend Rock Star List.

It features 350+ stocks with complete Dividend Safety Scores, growth projections, and buy lists tailored for retirement portfolios.

Most importantly, it is the ONLY list using the Dividend Triangle as its foundation.

Latest News: A Quarter of Shifts

On September 10, 2025, Tecsys reported a mixed quarter:

-

Revenue: Up 9% year-over-year.

-

EPS: Flat, reflecting expense pressures.

-

By segment:

-

SaaS revenue +25% to $19.14M

-

Professional services +20% to $16M

-

Maintenance & Support -10% to $7.86M

-

License revenue -90% to $0.09M

-

Hardware -29% to $2.84M

-

The story is clear: Tecsys is steadily transitioning away from on-premise licenses and hardware toward SaaS and services. This transition temporarily flattens margins but is expected to drive stronger recurring cash flows in the long run.

The Dividend Triangle in Action: Consistent Increases

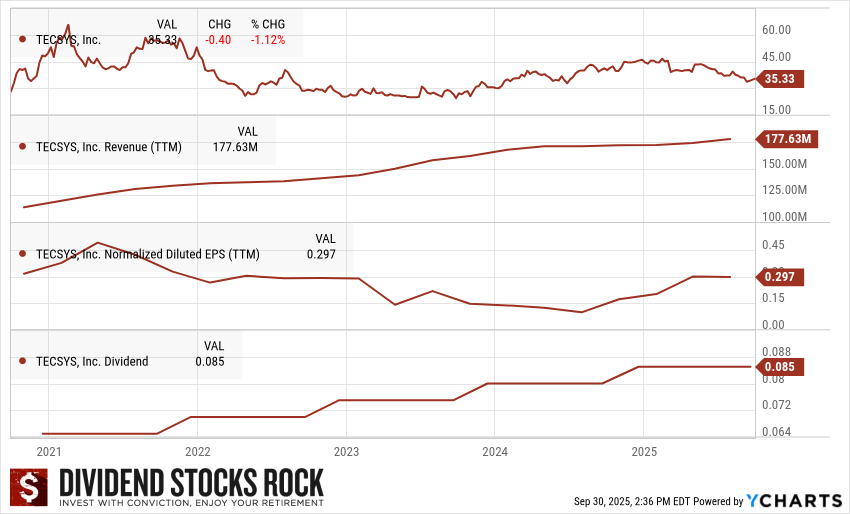

Dividend growth investors need to understand that Tecsys is not a high-yield play. The yield is modest, but the company has built a habit of consistent—if cautious—dividend increases. Here’s how the dividend triangle looks:

-

Revenue: Solid upward trend, now at $177.6M, reflecting SaaS migration and customer growth.

-

Earnings per Share (EPS): Volatile, sitting at $0.30 TTM. Lumpy results come with the territory for small-cap tech.

-

Dividend: Steady growth from $0.07 to $0.085, showing management’s willingness to reward shareholders even as the company reinvests in growth.

For income investors, Tecsys’s dividend won’t pay the bills, but it does send a clear message: management is confident in long-term cash generation.

Final Take: Small but Mighty in Its Niche

Tecsys isn’t about blockbuster growth or outsized dividends. Instead, it’s a story of a focused software firm with sticky customers, a clean balance sheet, and a strong pipeline in healthcare—a sector where reliability trumps cost-cutting.

The risks are real: small size, lumpy earnings, and heavyweight competitors. Yet the company’s recurring revenue base, SaaS migration, and deep industry expertise make it a worthwhile watchlist candidate for dividend growth investors seeking diversification into Canadian tech.

Don’t leave without your freebie! Download the ONLY list focusing on the Dividend Triangle.

The Dividend Rock Star List is updated monthly with over 350 screened dividend stocks, complete with safety scores and valuations.