Do you have holdings showing a weak dividend triangle? Revenue or EPS is stagnating or falling, dividend growth is slowing down, or worse there is no dividend growth. Do you sell right away? Not so fast. First, interpret the weak dividend triangle to know what’s really happening and make the correct decision.

What’s the dividend triangle again?

The dividend triangle is a tool I’ve been working with for over ten years, successfully and it forms the basis of my investment process. The dividend triangle includes three metrics: revenue, earnings per share (EPS), and dividend.

- The key to my investment strategy is to find companies that are capable of growing their revenue, either organically or by acquisition, but that constantly find ways to grow their sales. As investors, we want to invest in thriving companies. A company that found a way to grow its sales year after year is the first thing I look for.

- Next on my list that, as an investor, I want to see in a company is more and more profit. Earnings per share track that. Every year, I want to see a company with more sales and higher earnings per share.

- After finding this magical Unicorn—well, truthfully, many companies show strong revenue and earnings growth—the next factor I want is for the company to reward its shareholders with yearly dividend increases.

Get great stock ideas from our Rock Stars list, updated monthly!

Why these three metrics?

Since I focus mostly on dividend growers, I want to see constant and often increasing dividend growth. Good and constant revenue and EPS growth are preconditions to a growing and sustainable dividend. The combination of these three metrics often leads to companies that have positive cash flow, repetitive and predictable income, a robust balance sheet, and a business model that has plenty of growth vectors.

Since I focus mostly on dividend growers, I want to see constant and often increasing dividend growth. Good and constant revenue and EPS growth are preconditions to a growing and sustainable dividend. The combination of these three metrics often leads to companies that have positive cash flow, repetitive and predictable income, a robust balance sheet, and a business model that has plenty of growth vectors.

A company with a strong dividend triangle also comes with another bunch of great metrics. As an investor, that’s the type of business you want; a thriving business able to go through a recession without too many worries and that’ll honor its promise to increase its dividend year after year.

Learn more about the dividend triangle here.

What does a weak dividend triangle mean?

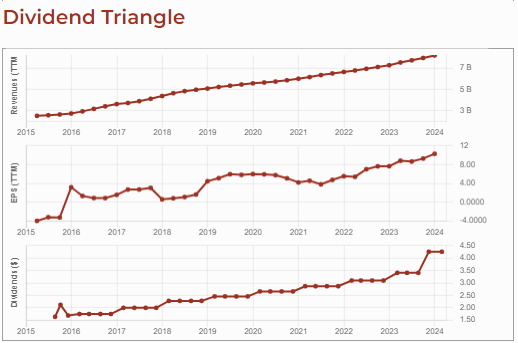

Look at Equinix’s dividend triangle. It’s easy to understand a positive dividend triangle, right? Revenue keeps growing as does the earnings per share. The dividend growth is steady and even increasing.

How do we explain a weak one? What do we do when a good company’s dividend triangle is weakening? What if one metric goes down? After a bad quarter or even a few bad quarters, don’t instinctively click the Sell button. Just like our energy level and our weight, numbers fluctuate, it’s normal.

It’s all about interpreting these deteriorating numbers to see what’s happening and whether things will get better soon. As I like to say, the trend is your friend. You must look at the triangle metrics over time, 5 years is a good duration, to see whether the poor results are a hiccup or part of a downward trend over a long time.

Along with the trend, it’s important to put the results in context, i.e., understand what is going on with the company, or around the company, that is making one metric, or the entire triangle go down, or up for that matter. Monitoring your stocks every quarter will help you to quickly spot trends and put results in context.

Get great stock ideas from our Rock Stars list, updated monthly!

When revenue is going down

Whether revenue is fluctuating down or up, you can often find the context for the change in the quarterly results press release or the investors’ presentation. They usually explain the factors that affected the revenue positively and negatively. Revenue could be down for a pretty good reason in which case you shouldn’t worry too much. Here are some examples:

- Currency fluctuation. Take Coca-Cola; it makes many sales outside of the U.S. and generates a lot of revenue in other currencies. Revenue reported in U.S. currency is affected by the exchange rate. A U.S. dollar getting stronger will affect its revenue downward. To see if there was revenue growth or not, it’s important to also look at the numbers on a currency-neutral basis, which is stated in the press release.

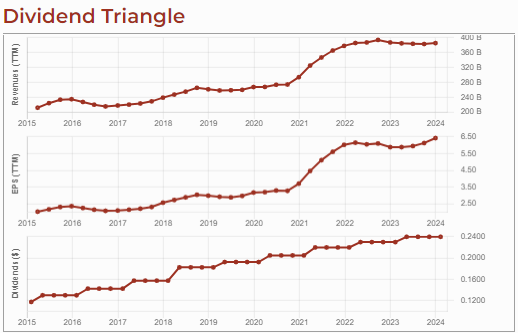

- Cycle of innovation or product cycle. Look at Apple’s dividend triangle below. There’s no frenzy around iPhones, nor is the company launching many products. As a result, over the last five or six quarters, sales and earnings haven’t grown as fast as they used to. This is normal if you look at Apple’s history. It goes through product innovation cycles and occasionally there’s a pause in growth before starting another upcycle.

- Industry-wide cycle. We can think about basic materials and the energy sector for example. If you look at the 2015-2020 period versus 2021-2026, when we get there, we’ll have a completely different picture of the energy sector; the whole sector goes through cycles.

- Sometimes it’s just the economy. Recent reports from Home Depot, Canadian Tire, and railroad companies reveal there are slowdowns. We cannot expect huge revenue or earnings per share growth for 2024, and possibly 2025. This isn’t limited to a specific company, but entire cyclical industries getting hit by consumers spending less.

Putting the revenue slowdown in context helps you to differentiate between a temporary cause, such as a cycle fluctuation or a negative currency impact, or a permanent situation. By permanent situation, I mean things that are specific to the company and not resolved by time alone, if at all. This could be a company losing market share as it cannot adapt to increased competition (think Blackberry), or a business that isn’t relevant anymore because it’s in a dying industry and fails to innovate or diversify; remember printed media and video stores?

What about falling EPS and slowing dividend growth?

Yes, the triangle isn’t just about revenue. EPS and dividends are also key metrics that can show signs of weakness. We’ll explore that in next week’s article, along with a few other metrics.

In the meantime, it’s important to understand that you must look at more than one metric to assess the state of a company’s performance, good or bad. Also, remember that putting things in context is a must and the trend is your friend!