When markets get choppy, insurance companies often do their best work — quietly stabilizing your portfolio while the rest of the market swings from optimism to panic. These stocks may not lead rallies, but they help investors stay invested when volatility hits.

Canadian insurers bring a unique kind of strength to a dividend growth portfolio. Their business models thrive on risk management, consistent cash flows, and disciplined capital allocation. When well-managed, they deliver the trifecta every long-term investor wants: steady earnings, sustainable dividend growth, and resilience across economic cycles.

Today, we’re looking at four of the strongest Canadian insurance companies — each with its own mix of stability, growth potential, and dividend power.

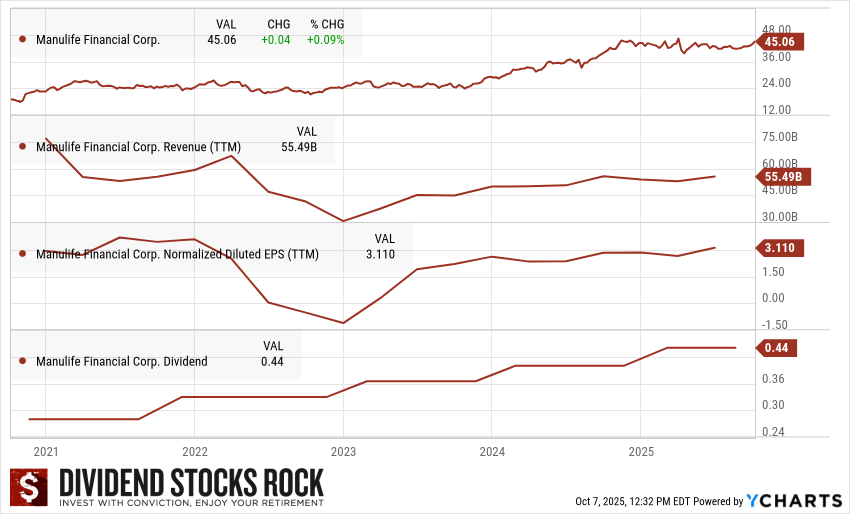

4. Manulife Financial (MFC.TO)

Investment Thesis

Manulife Financial has rebuilt its reputation since the financial crisis and now stands as a well-diversified global insurance and wealth management powerhouse. With operations in Canada, the U.S., and Asia, it benefits from both mature and high-growth markets. The company’s asset management arm oversees over CAD 1 trillion in assets, generating a steady stream of fee-based income.

Its Asian segment—now roughly 30% of total earnings—is the key growth engine. Rising middle-class populations and underpenetrated insurance markets in countries like China, Japan, and Hong Kong make this region a massive opportunity. The company’s pivot toward behavioral insurance and investment management also supports long-term profitability.

Manulife may not have a strong moat in a commoditized industry, but it has evolved into a leaner, more efficient, and more globally balanced insurer than it was a decade ago.

Potential Risks

Manulife’s reliance on capital markets makes it more volatile than some of its peers. A downturn or sharp interest rate decline could compress investment income and returns. Its U.S. operations under John Hancock remain a weak link, with thin margins and fierce competition.

In Asia, while the long-term growth story remains intact, the company faces local competitors with deep roots and faster product innovation. The insurance business is price-driven, limiting differentiation and putting pressure on returns.

Unlock More Dividend Growth Picks

If you want more hand-picked dividend growers across industries, grab our Dividend Rock Star List.

It features around 300 stocks with complete Dividend Safety Scores, growth projections, and buy lists tailored for retirement portfolios.

Most importantly, it is the ONLY list using the Dividend Triangle as its foundation.

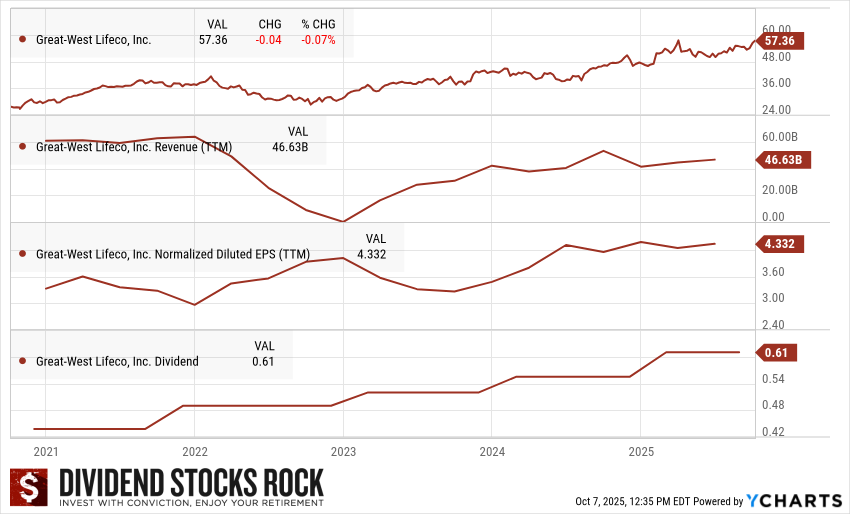

3. Great-West Lifeco (GWO.TO)

Investment Thesis

Great-West Lifeco is the definition of a steady compounder. With roots in life insurance, pension management, and asset management, it generates highly predictable cash flows. Its Empower Retirement division is now the #2 U.S. retirement services provider, expanding GWO’s reach into one of the world’s largest pension markets.

The company’s strategy emphasizes fee-based revenue and cost discipline. Recent acquisitions in the U.S. and Japan add diversification, while higher interest rates boost returns on investment portfolios. Its strong connection to Power Corporation provides both stability and a deep distribution network.

While not a fast grower, Great-West Lifeco offers stability and consistent dividend growth—an ideal fit for conservative dividend investors.

Potential Risks

The flip side of GWO’s stability is limited growth potential. With only 20% of revenue outside North America and Europe, it lacks exposure to high-growth emerging markets. Fee compression in asset management and regulatory capital requirements could also weigh on margins.

Insurance products are largely commoditized, and GWO competes in mature markets with intense pricing pressure. While its cost structure is efficient, sustaining above-average ROE will require continued discipline and favorable market conditions.

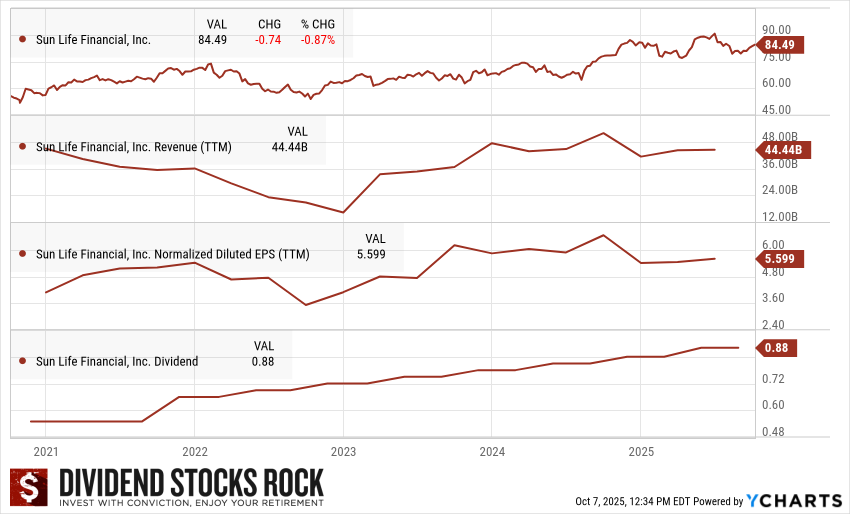

2. Sun Life Financial (SLF.TO)

Investment Thesis

Sun Life combines traditional insurance with a powerful asset management and group benefits platform. With over CAD 1 trillion in assets under management, it earns nearly half its profits from wealth and asset management—a steady, fee-based source of income that cushions against insurance volatility.

Its group benefits and dental insurance operations give it scale and recurring cash flow, particularly after acquiring DentaQuest, making it the #2 dental benefits provider in the U.S. Sun Life’s strength lies in diversification: Canada provides steady profits, Asia offers long-term growth potential, and its U.S. business adds scale.

The company has positioned itself as a balanced player in an unpredictable industry, with strong capital discipline and an eye toward gradual, sustainable growth.

Potential Risks

Sun Life’s results are highly tied to interest rate movements and financial markets. A sustained decline in rates would pressure margins and profitability. In addition, its international operations—especially in Asia—remain smaller than Manulife’s, limiting its global growth potential.

The company also operates in an increasingly commoditized industry where pricing remains a key battleground. Asset management, while profitable, faces fee compression from low-cost giants like BlackRock and Vanguard.

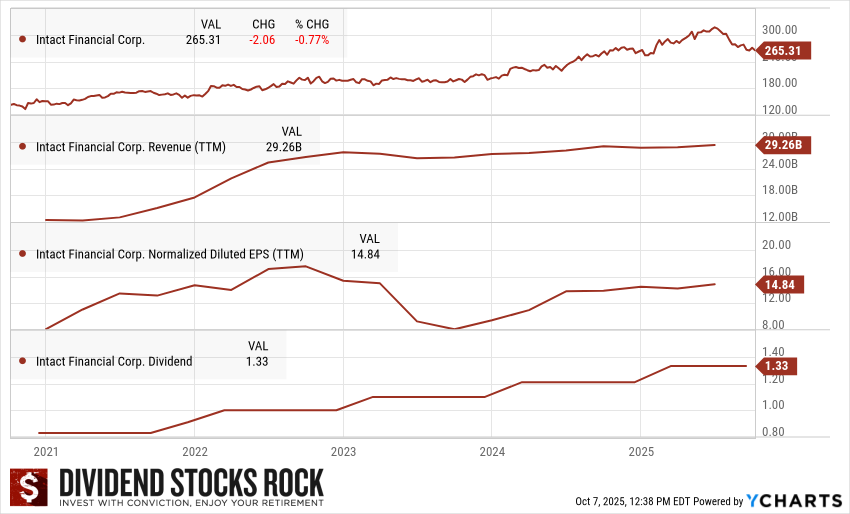

1. Intact Financial (IFC.TO)

Investment Thesis

Intact Financial is the heavyweight of Canada’s property and casualty (P&C) insurance industry. Unlike its life insurance peers, Intact’s strength lies in underwriting excellence and data-driven pricing. Through acquisitions like RSA Insurance (U.K./Canada) and OneBeacon (U.S.), Intact has become a diversified, international P&C leader.

It continues to grow organically, targeting 10%+ annual growth in net operating income per share (NOIPS). The company’s multichannel approach—through BrokerLink, Belairdirect, and commercial lines—spreads risk and enhances resilience.

Intact’s profitability metrics remain best-in-class, supported by AI-based risk modeling and cost efficiency. Even as catastrophic losses rise, its underwriting discipline ensures steady returns.

Potential Risks

The biggest threat to Intact comes from nature itself. Catastrophe losses from floods and wildfires reached $1.5 billion in 2024, and the trend isn’t slowing. These unpredictable events make quarterly results volatile.

Additionally, insurance regulation—especially in auto insurance markets like Ontario—can cap pricing flexibility. In the U.S. and U.K., Intact faces fierce competition and integration challenges, especially as it scales its commercial footprint.

Despite these challenges, Intact’s data advantage and risk management culture keep it a step ahead of its peers.

Final Thoughts – The Pillars of Dividend Stability

Canadian insurance companies won’t be the most exciting holdings in your portfolio—but they might be among the most dependable. They bring balance when growth stocks stumble, and they keep cash flow rising even through recessions and market noise.

Here’s how they stack up:

- Intact Financial – Best-in-class underwriting and risk management.

- Sun Life – Diversified with strong asset management exposure.

- Great-West Lifeco – A defensive dividend compounder.

- Manulife – Global reach with a powerful growth engine in Asia.

Each of these insurers plays a different role, but together they demonstrate a straightforward truth: dividend growth thrives on financial discipline—and few sectors embody that better than Canadian insurance.

Find More Dividend Rock Stars

Want to discover more high-quality dividend growers like these?

Grab your copy of our Dividend Rock Star List, featuring around 300 stocks screened for dividend safety, growth potential, and long-term reliability.

Download your free Dividend Rock Star List here