Want to make your portfolio more resilient to economic downturns or worse, recessions? Look to consumer staples stocks. There’s a reason for consumer staples stocks to also be called consumer defensive stocks; they defend your portfolio from the assault of market crashes.

When we describe consumer staples, we often say they are all the products you can find in your house. Products you must buy no matter what happens in your life. Companies in this sector have built stellar brand portfolios that support repeat purchases from their customers. Repetitive purchases lead to constant and predictable cash flows. Therefore, food, beverage, and household products are a great foundation for building a dividend growth portfolio.

When we describe consumer staples, we often say they are all the products you can find in your house. Products you must buy no matter what happens in your life. Companies in this sector have built stellar brand portfolios that support repeat purchases from their customers. Repetitive purchases lead to constant and predictable cash flows. Therefore, food, beverage, and household products are a great foundation for building a dividend growth portfolio.

If you are concerned about the current state of the economy, add some consumer defensive stocks to your portfolio.

Also interested in growth stocks? Explore the Consumer Discretionary sector.

Consumer staples industries

The consumer staples sector includes companies in different industries:

- Beverages – Brewers

- Beverages – Non-Alcoholic

- Beverages – Wineries & Distilleries

- Confectioners

- Discount Stores

- Education & Training Services

- Farm Products

- Food Distribution

- Grocery Stores

- Household & Personal Products

- Packaged Foods

- Tobacco

Listen to our recent webinar “All-Time-High Markets: Should You Buy?” here.

Greatest strengths

If you’re looking for a place to stash your cash during tough times, forget about your mattress. Consumer staples stocks are defensive. When the market goes into panic mode, this part of the equity markets isn’t normally a source of worry. We saw how well grocery and discount stores performed during the pandemic in 2020. They were the first to be deemed “essential businesses” along with healthcare companies.

On top of selling “essential goods” (we could discuss how alcoholic and tobacco products are considered essential, but that’s for another time), this sector also shows another great characteristic. Most industries in this sector have built their business model around repetitive sales. What’s better for a dividend investor than to find a business that keeps selling the same products to the same consumers every week? This is what we call a cash cow.

Since consumers rely on many of these products, they’ll likely cut their expenses for consumer discretionary products, such as restaurant meals, non-essential clothing, travel, and entertainment, to prioritize consumer staples products. Keep in mind that while stocks in this sector offers great protection when the market goes sideways, you must have them before market sentiment shifts downward to benefit from their protection. When the market panics, consumer staples usually trade at higher valuations, i.e., their PE ratios increase.

Since consumers rely on many of these products, they’ll likely cut their expenses for consumer discretionary products, such as restaurant meals, non-essential clothing, travel, and entertainment, to prioritize consumer staples products. Keep in mind that while stocks in this sector offers great protection when the market goes sideways, you must have them before market sentiment shifts downward to benefit from their protection. When the market panics, consumer staples usually trade at higher valuations, i.e., their PE ratios increase.

Throughout the years, many consumer staple companies have built iconic brands. Some companies even manage portfolios of multibillion-dollar brands. Such large brands come with economies of scale and a wide distribution network, making it very difficult for potential competitors to enter the market. This also gives investors a sentiment of calm because they can count on them paying their dividends no matter what happens. Even when people lose their jobs, they’ll probably keep buying many of these brands!

Greatest weaknesses

Lack of growth is often a matter of concern for this sector. When emerging markets came into play, they all rode the wave and discovered new playgrounds.

As those markets grew many local competitors also came on the scene. While smaller players can’t compete on price and scale, they’re more flexible and know their customers better than those “gringos” coming from North America. Buy American and buy local are not just concepts that we have here in North America. It’s a movement trending around the world.

Speaking of competition, it now comes from everywhere in the staples sector. Beverage companies go after the snacks and packaged foods industries; discount stores that first introduced limited packaged foods are transforming into full grocery stores. Such competition first led to a shelf war where products were competing against each other for top space in stores. This has moved to the online world as online shopping has reached all industries. Margins are getting squeezed and inflation has done nothing to help those industries.

Those “old” staple companies must adapt to e-commerce. They face similar challenges to consumer discretionary companies when it comes to dealing with digital sales. Even groceries must invest massively in their online platform to let consumers order their food and pick it up at the store or have it delivered.

Listen to the replay of our recent”All-Time-High Markets: Should You Buy?” here.

How to get the best of consumer staple stocks

It’s hard to identify a good time to buy consumer staples stocks because they’re rarely “on sale”. When everybody is making money in the market and growth stocks get most of the love, you have a shot at buying lesser-loved consumer staples. This is the type of investment that you almost regret having made during a bullish year because they often lag, showing minimal growth during boom times. On the other hand, when panic spreads, these companies hold the fort and ensure your portfolio doesn’t go bust.

It’s hard to identify a good time to buy consumer staples stocks because they’re rarely “on sale”. When everybody is making money in the market and growth stocks get most of the love, you have a shot at buying lesser-loved consumer staples. This is the type of investment that you almost regret having made during a bullish year because they often lag, showing minimal growth during boom times. On the other hand, when panic spreads, these companies hold the fort and ensure your portfolio doesn’t go bust.

Most consumer staple industries are investments best suited to income investors. Not for their average yield, but rather for the stability they bring to one’s portfolio.

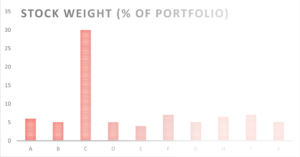

Income investors, you can get some of these “safe stocks” for up to 10% to 20% of your portfolio. You won’t generate a maximum of dividend payments from this sector, but you’ll reduce value volatility.

For growth investors, anything between 3% to 10% would work well. Too much money invested in this sector would impact your total return potential during a bull market.

Favorite Picks

Some of my favorite picks in this sector at the time of writing are the following:

- Canada stocks: Alimentation Couche-Tard (ATD.TO), Jamieson Wellness (JWEL.TO), Premium Brands Holdings (PBH.TO), Metro (MRU.TO).

- U.S. stocks: Costco (COST), Procter & Gamble (PG), Coca-Cola (KO), PepsiCo (PEP), McCormick & Company (MKC), Hershey (HSY).

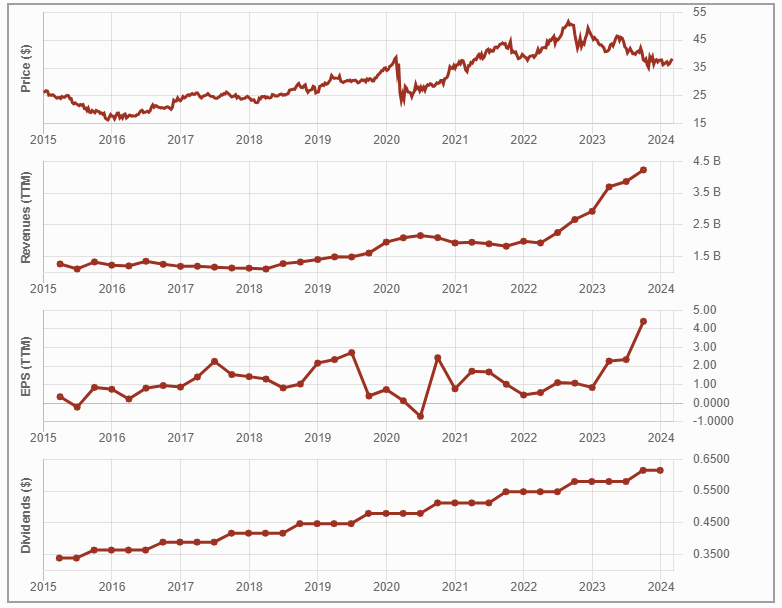

Its projects under construction include over 140 MW of renewable generation capacity and 512 MW of incremental natural gas combined cycle capacity from the repowering of Genesee 1 and 2 in Alberta. It has over 350 MW of natural gas and battery energy storage systems in Ontario and approximately 70 MW of solar capacity in North Carolina in advanced development. Its La Paloma facility is in Kern County, California. The Company also has a natural gas generation facility in the Harquahala region of Arizona.

Its projects under construction include over 140 MW of renewable generation capacity and 512 MW of incremental natural gas combined cycle capacity from the repowering of Genesee 1 and 2 in Alberta. It has over 350 MW of natural gas and battery energy storage systems in Ontario and approximately 70 MW of solar capacity in North Carolina in advanced development. Its La Paloma facility is in Kern County, California. The Company also has a natural gas generation facility in the Harquahala region of Arizona.

Dividend reinvestment plans (DRIPs) are an investment tool that allows shareholders to reinvest cash dividends received from a company’s stock into more

Dividend reinvestment plans (DRIPs) are an investment tool that allows shareholders to reinvest cash dividends received from a company’s stock into more Participating in a DRIP increases investors’ positions in some stocks automatically without them having to lift a finger. Over time, you could end up with overweight positions for these stocks if you don’t monitor your portfolio.

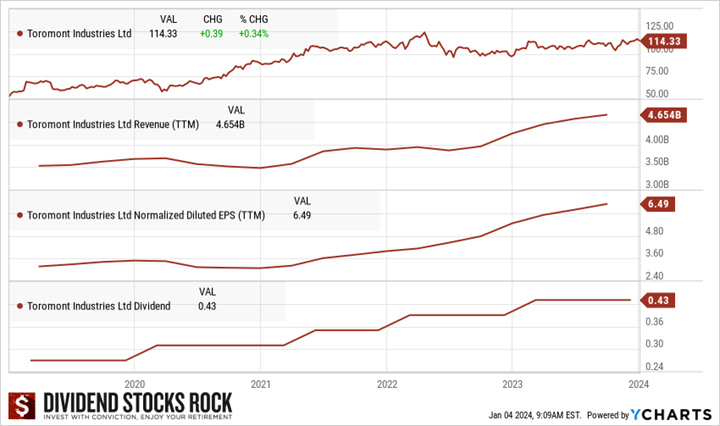

Participating in a DRIP increases investors’ positions in some stocks automatically without them having to lift a finger. Over time, you could end up with overweight positions for these stocks if you don’t monitor your portfolio. Toromont Industries is a Canada-based company serving the specialized equipment and lifetime product support needs of thousands of customers in diverse industries from roadbuilding to mining, and telecommunications to food and beverage processing. It operates the Equipment Group and CIMCO segments.

Toromont Industries is a Canada-based company serving the specialized equipment and lifetime product support needs of thousands of customers in diverse industries from roadbuilding to mining, and telecommunications to food and beverage processing. It operates the Equipment Group and CIMCO segments.

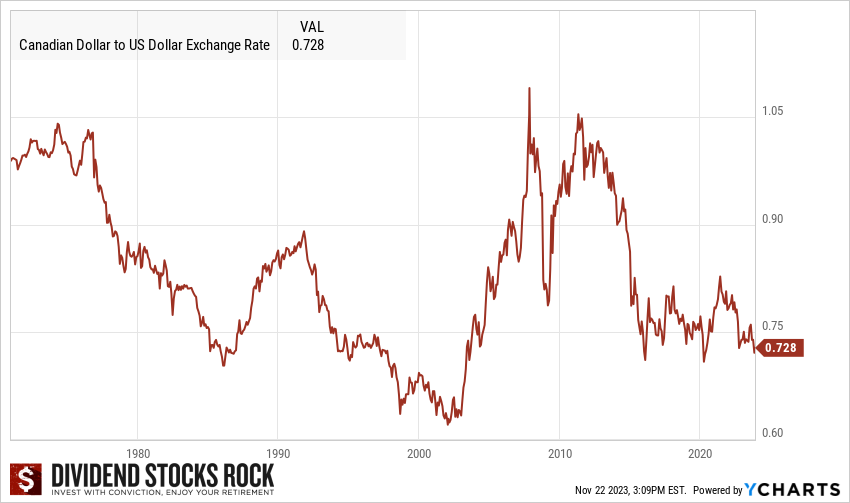

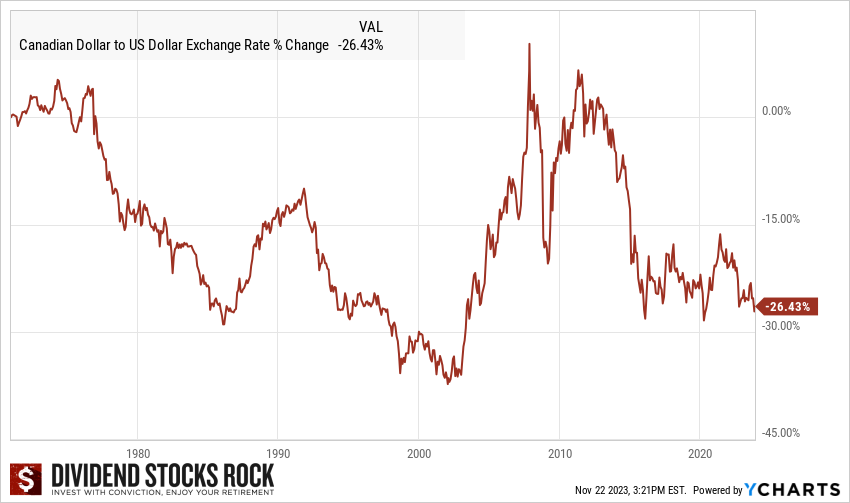

Canadian stocks paying USD dividends or trading on an U.S. market (either the NYSE or NASDAQ), or both. Why? Canadian dividend stocks are fascinating. Many of them operate in small niches and pay handsome dividends.

Canadian stocks paying USD dividends or trading on an U.S. market (either the NYSE or NASDAQ), or both. Why? Canadian dividend stocks are fascinating. Many of them operate in small niches and pay handsome dividends.

(BCE, TU, RCI, ): Like Canadian banks, telecoms operate in a small oligopoly where 90% of the wireless market is controlled by BCE, TU and RCI. BCE and TU are long-time dividend growers.

(BCE, TU, RCI, ): Like Canadian banks, telecoms operate in a small oligopoly where 90% of the wireless market is controlled by BCE, TU and RCI. BCE and TU are long-time dividend growers.  (TFII, CNI, CP,

(TFII, CNI, CP,  In general, the advantage of Canadian stocks paying a USD dividend is more for the company, because it generates most of its revenues in USD as explained earlier. For investors, it could be a source of headaches or frustrations (you don’t want your broker making a sweet 2% conversion rate fee on your dividend, right?). However, if you plan a vacation or retirement in the U.S., having Canadian stocks paying their dividend in Uncle Sam’s dollar is a natural hedge against currency fluctuation. You can build a part of your portfolio with those Canadian stocks along with other US stocks and you’ll be set to never have to worry about converting your money “at a bad rate” in the future.

In general, the advantage of Canadian stocks paying a USD dividend is more for the company, because it generates most of its revenues in USD as explained earlier. For investors, it could be a source of headaches or frustrations (you don’t want your broker making a sweet 2% conversion rate fee on your dividend, right?). However, if you plan a vacation or retirement in the U.S., having Canadian stocks paying their dividend in Uncle Sam’s dollar is a natural hedge against currency fluctuation. You can build a part of your portfolio with those Canadian stocks along with other US stocks and you’ll be set to never have to worry about converting your money “at a bad rate” in the future.