I just published my top 5 Canadian Dividend Stocks for 2024 on the Moose on the Loose for Canada Day!

Since 10 minutes is not much to explore those 5 business models, I thought of giving you more details on each of them.

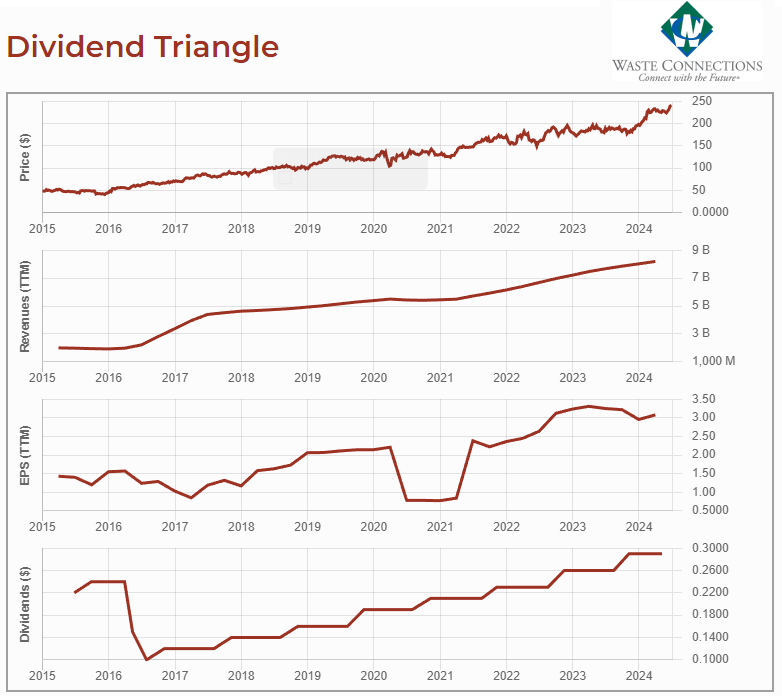

Waste Connections (WCN.TO)

| 5-Yr Revenue Growth | 11.15 % |

| 5-Yr EPS Growth | 8.20 % |

| 5-Yr Div Growth | 13.50 % |

Waste Connections has refined its expertise in acquiring and integrating smaller players in the same industry. Its business model is recession-proof as solid waste is a given regardless of the economic cycle. We also like the fact that WCN offers a recurring service and is fully integrated. Management has been adept in integrating their acquired companies. Therefore, the business is not only growing but also becoming more profitable. The company has the size to enjoy the resulting economies of scale. Its dividend payment is low, but its dividend growth is strong. Unfortunately, lower-yielding stocks are usually not a good match for the dividend discount model. Unfortunately, you must pay a steep price for quality, considering a PE of 57 and a forward PE of 63. Remember that WCN 5-year average PE is also in that range (65). Therefore, you will not get a good deal anytime soon for this amazing Canadian dividend grower.

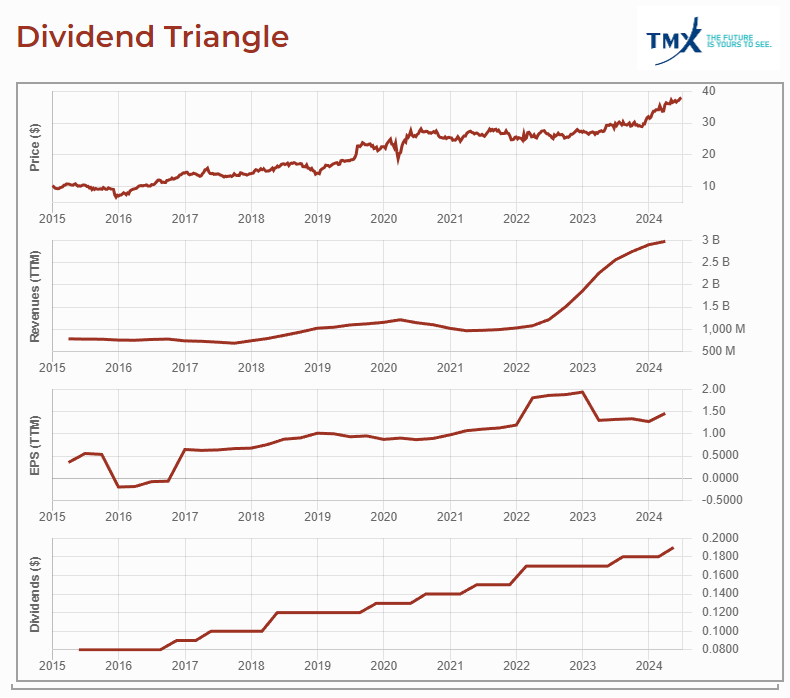

TMX Group (X.TO)

| 5-Yr Revenue Growth | 7.80 % |

| 5-Yr EPS Growth | 4.65 % |

| 5-Yr Dividend Growth | 9.60 % |

TMX has worked very hard to diversify its business through derivatives, technology, and data analytics over the past few years. TMX enjoys strong barriers to entry with regulations to generate cash flow while investing its surplus in growth vectors. It disposed of many of its non-core businesses during 2016 and 2017 and, from a regional infrastructure provider, transformed itself into a global technology solutions provider. Recurring revenue now accounts for more than half of total revenues, growing from 40% five years ago. As an exchange, TMX gathers information on the market. Many institutions are prepared to pay good prices to subscribe to such a data feed. This will be a great way to generate recurring revenues going forward. We can see interesting trends from revenue and earnings, which strengthen the dividend triangle.

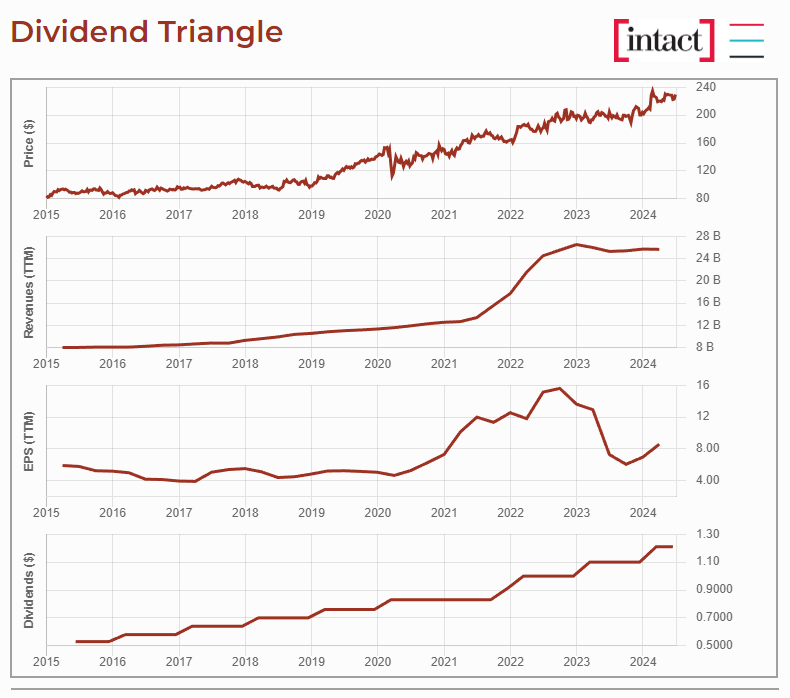

Intact Financial (IFC.TO)

| 5-Yr Rev. Growth | 15.85 % |

| 5-Yr EPS Growth | 7.85 % |

| 5-Yr Dividend Growth | 9.45 % |

IFC is one of the best managed P&C insurance companies in Canada. Through a strict underwriting process and careful portfolio management, IFC has proven its value to investors over time. Due to its size, IFC benefits from ample amounts of data to improve its underwriting. This also allows IFC to enter smaller niche insurance markets that are usually more profitable. Since the insurance market in Canada is quite fragmented, there are plenty of opportunities for growth in the coming years without any real threats to the IFC business model. The acquisition of OneBeacon opened the door to U.S. business and reinforces IFC’s ability to underwrite insurance for smaller businesses. Intact did it again with the acquisition of RSA insurance for $1.25B in late 2020. In 2023, IFC and RSA acquired Direct Line Insurance Group plc’s brokered commercial lines operations to expand its business in the UK.

Intact Financial expects to continue capturing growth opportunities, aiming for a 10% net operating income per share growth over time and to consistently outperform the industry ROE by at least 500 basis points annually. Intact Financial is focusing on expanding its digital capabilities to enhance customer experience and operational efficiency. The company is also investing in data analytics and artificial intelligence to improve risk assessment and underwriting processes.

Have you noticed something?

If you look at those three Canadian dividend growers, you will notice they have three things in common:

- They all offer a low yield and a high dividend growth policy.

- They all show a strong dividend triangle. Those Canadian companies are thriving.

- They all show great total return performance in the past 10 years.

The future looks bright for those companies as they operate sound businesses with robust financial metrics. We wish they were in our portfolio to enjoy the past ten years of growth. You may feel like you missed a great opportunities, but there are several companies showing a similar profile.

Do you want to find more companies like this?

My investment strategy has been built around low yield, high dividend growth companies showing strong dividend triangles. I wrote this guide to help you find those and build a stronger and safer portfolio for your retirement. You can download it here:

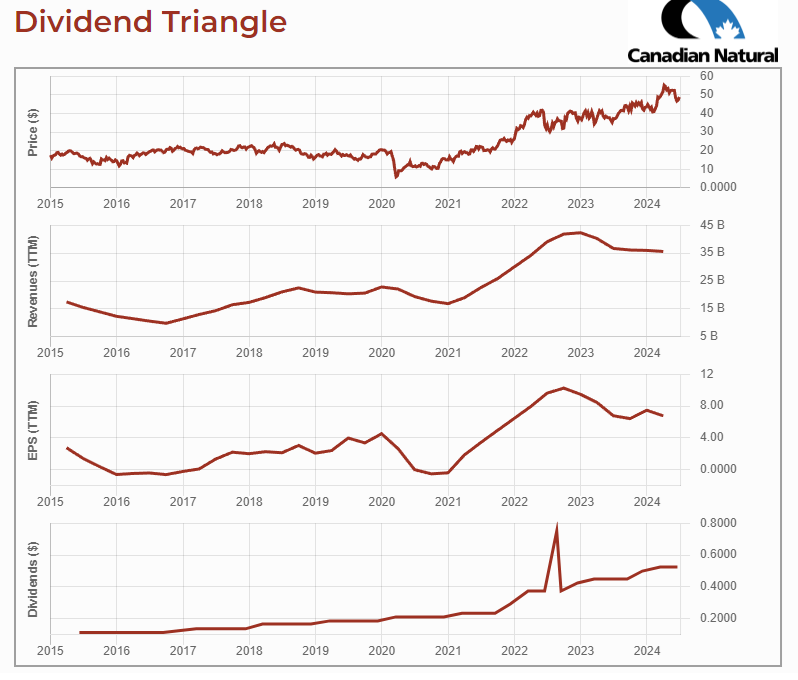

Canadian Natural Resources (CNQ.TO)

| 5-Yr Revenue Growth | 12.90 % |

| 5-Yr EPS Growth | 28.65 % |

| 5-Yr Dividend Growth | 22.50 % |

In a world where the West Texas Intermediate (WTI) would always trade at $75+ per barrel, CNQ would be a terrific investment. It is sitting on a large asset of non-exploited oilsands and reaches its breakeven point at a WTI of $35. What cools our enthusiasm is the strange direction oil has taken along with the fact that oilsands are not exactly environmentally friendly. Many countries are looking at producing greener energy and electric cars. This could slow CNQ’s ambitions. However, CNQ is very well positioned to surf any oil booms. The stock price has more than doubled in value since the fall of 2020. It has previously invested very heavily, and it is now generating higher free cash flow because of past capital spending. CNQ exhibited resilience in 2020, and this merits a star in their book! If you are looking for a long-term play in the oil & gas industry, CNQ appears at the top of our list at DSR. We also appreciate CNQ’s shareholder-friendly approach, as it will return 100% of free cash flow to shareholders after hitting $10B in net debt.

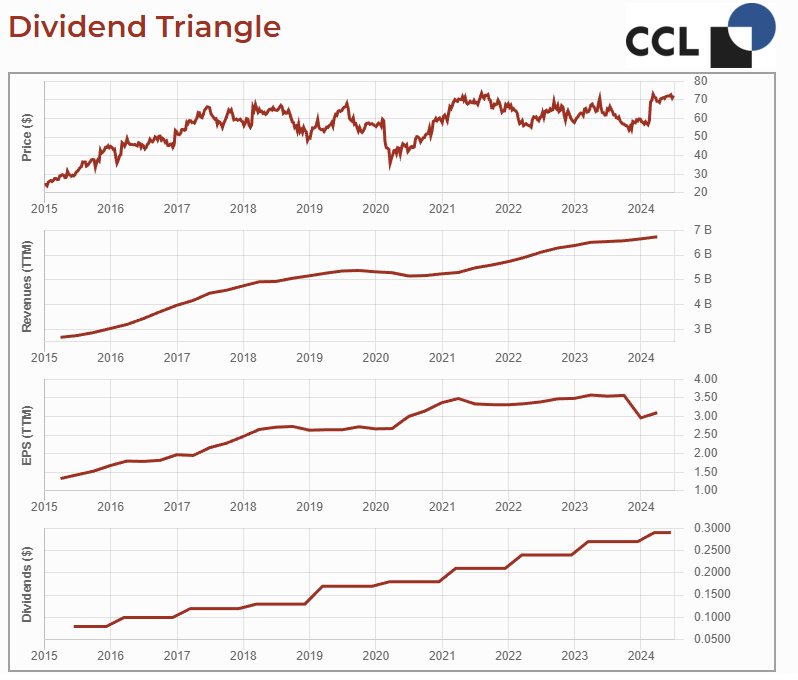

CCL Industries (CCL.B.TO)

| 5-Yr Revenue Growth | 5.20 % |

| 5-Yr EPS Growth | 2.50 % |

| 5-Yr Dividend Growth | 15.30 % |

It is quite rare to find an international leader with a well-diversified business based in Canada. Through the major acquisition of business units from Avery (world’s largest supplier of labels) in 2013, the company has set the tone for several years of growth. Bolstered by its previous successes, CCL also bought Checkpoint, a leading developer of RF and RFID, and Innovia in the past few years and announced more acquisitions in 2021. The company is still able to generate organic growth (roughly 4-5%) on top of its growth through acquisitions. You can also rest assured that management’s interests are aligned with yours since the Lang family still owns 95% of CCL’s A shares with voting rights. We appreciate CCL’s capital allocation that includes a mix of dividend, share buybacks, acquisitions and CAPEX. Now that the stock price has returned to normal levels, the company exhibits an attractive PE ratio and can still generate more growth through acquisitions

Low yield, high dividend growth stocks are safer

Focusing on companies with strong financial metrics will help build a more sustainable income for retirement. Once you identify the key elements that made that business thrive, you will be in a better position to determine if the story will continue.

Start seeing your portfolio as your “big” holding corporation like Warren Buffet. Create your own dividend and keep a cash reserve for the bad days. This is how you create a dividend income for life.

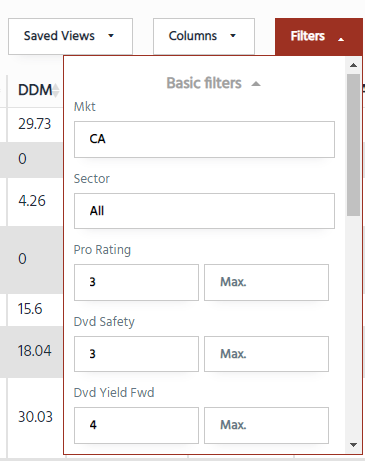

The first step in finding interesting stocks is to go to the Canadian Retirement portfolio and the 100% Canadian portfolio models’ pages and select companies with a minimum rating of 3 for both the DSR PRO rating and the Dividend Safety Score. I also added a minimum dividend yield of 4% as I want to make sure I can use the full 5%+ interest rate that will be charged on my loan by the end of the year. Right now, I’m at 5.4% on a variable rate. That helped me to select a few stocks, but it wasn’t enough to build a complete portfolio. I wanted to double-check across our entire stock library.

The first step in finding interesting stocks is to go to the Canadian Retirement portfolio and the 100% Canadian portfolio models’ pages and select companies with a minimum rating of 3 for both the DSR PRO rating and the Dividend Safety Score. I also added a minimum dividend yield of 4% as I want to make sure I can use the full 5%+ interest rate that will be charged on my loan by the end of the year. Right now, I’m at 5.4% on a variable rate. That helped me to select a few stocks, but it wasn’t enough to build a complete portfolio. I wanted to double-check across our entire stock library.

While I love our stock screener, when you look at 30 financial metrics, it’s not that easy to see them and sort them as you want. Excel is a better software to use to make an additional triage among the list of your potential stocks. Then, I can read each stock card and start building my portfolio! Will I go ahead and buy the 22 stocks? Let’s build a fake portfolio to see what it looks like, shall we?

While I love our stock screener, when you look at 30 financial metrics, it’s not that easy to see them and sort them as you want. Excel is a better software to use to make an additional triage among the list of your potential stocks. Then, I can read each stock card and start building my portfolio! Will I go ahead and buy the 22 stocks? Let’s build a fake portfolio to see what it looks like, shall we?